Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 02, 2020

Daily Global Market Summary - November 2, 2020

Equity markets closed higher across most of the globe today, with European markets having a particularly strong performance after last week's significant sell-off. iTraxx and CDX closed tighter across IG and high yield, with Europe outperforming North America. US and most benchmark European government bonds closed higher on the day. The US dollar closed flat, while gold, silver, and oil closed higher on the day. Tomorrow's US election will be one of the main focuses of the market alongside the growing number of COVID-19 cases and restrictions, with potentially more pressure weighing on the markets and an uptick in volatility if some of the closer election contests take days or even weeks to determine the winner.

Americas

- US equity markets closed higher, with the Nasdaq closing +0.4% despite being in negative territory for most of the afternoon; Russell 2000 +2.0%, DJIA +1.6%, and S&P 500 +1.2%.

- The CBOE VIX US equity volatility index closed -2.3%/37.17 and remains at its highest level since mid-June.

- According to FactSet, energy minerals was one of the top performing major sectors in the S&P 500 today at +4.2%, followed by industrial services at +3.9% (note: companies with their sector being 'undefined' were +4.4% on the day).

- 10yr US govt bonds closed -2bps/0.86% yield and 30yr bonds -4bps/1.62% yield.

- CDX-NAIG closed -2bps/63bps and CDX-NAHY -3bps/418bps.

- DXY US dollar index closed flat/94.02.

- Gold closed +0.7%/$1,893 per ounce and silver +1.6%/$24.03 per ounce.

- Crude oil closed +2.8%/$36.81 per barrel.

- A group of business leaders and public policy experts is launching a new organization called the Commission on the Future of Mobility. The commission aims to strengthen current transportation policies, and it will propose a new regulatory framework to address questions surrounding the future of transportation. The commission will be co-chaired by Jared Cohon, president emeritus of Carnegie Mellon University; Jim Hackett, former CEO of Ford; Thierry Mallet, CEO of Transdev Group; Richard Kramer, Goodyear CEO; Fred Smith, FedEx CEO; José Muñoz, Hyundai Motor CEO; and Steven Mollenkopf, Qualcomm CEO. Significance: The global transportation sector is transforming as it is driven by shared, connected, autonomous, and electric technologies. The commission aims to "leverage the synergy created by an interconnected transportation system to reshape transportation policy". The commission is housed within SAFE, a nonpartisan organization focusing on energy security issues, and this is its first global initiative. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Securities and Exchange Commission adopted a rule Monday to help companies raise capital without going public, the latest in a series of measures likely to further bolster private markets. Commissioners voted 3-2 on Monday to expand several exemptions to federal securities laws that require issuers to register with the SEC and publish financial statements and other key information before accepting investors' money. Companies also will be allowed to make such exempt offerings, as they are known, within as little as 30 days of one another, rather than six months currently. The vote marks the regulator's latest move to help small and medium-size companies raise money in private markets, following an August rule that expanded the pool of so-called accredited investors deemed able to "fend for themselves" without the SEC's protections. (WSJ)

- Corporate insiders, whose buying correctly signaled the bottom in March, have refrained from bargain hunting this time. Fewer than 380 corporate executives and officers snapped up shares of their own firms last month, the second-lowest showing in at least two years, according to data compiled by the Washington Service. While sellers also retreated, they did so at a slower rate than buyers. As a result, insider purchases trailed sales by the most since January. (Bloomberg)

- The seasonally adjusted IHS Markit final U.S. Manufacturing

Purchasing Managers' Index (PMI) posted 53.4 at the start of the

fourth quarter, up slightly from 53.2 in September and broadly in

line with the earlier released 'flash' estimate of 53.3. The latest

improvement in operating conditions was solid overall and the

fastest since January 2019, marking a further move away from

April's nadir. (IHS Markit Economist Chris Williamson)

- Contributing to the rise in the headline figure was a quicker upturn in production in October. The rate of output growth accelerated to the sharpest since November 2019. Companies often stated that greater output was driven by stronger client demand and higher new order inflows.

- The rate of new order growth picked up once again in October, following a slight slowdown in September. The increase in total sales was attributed to more robust client demand, with some firms noting larger orders being placed.

- Meanwhile, average cost burdens increased at an accelerated pace that was the steepest since January 2019 in October. Higher input prices were often linked to greater raw material costs and supplier shortages.

- Goods producers were able to partially pass on higher costs to clients through a rise in selling prices, though the rate of charge inflation eased at the start of the fourth quarter.

- The mild increase in output charges was the slowest for three months as some companies used discounting and offers to entice clients.

- Business expectations remained positive in October, improving on September's four-month low, as firms foresee a rise in output over the coming year. The degree of confidence was historically muted, however, as fears regarding the pandemic weighed on optimism.

- Finally, manufacturers registered further delays to suppliers' delivery times in October, with lead times lengthening markedly.

- Total US construction spending rose 0.3% in September,

considerably below both our assumption and the consensus

expectation. This followed materially faster growth over the prior

three months. (IHS Markit Economists Ben Herzon and Lawrence

Nelson)

- Core construction spending, which directly enters our GDP tracking, rose 0.5% in September, well below our assumption and a step down from increases averaging 1.0% per month over the prior two months.

- A bright spot in the report was solid growth of private residential construction spending through September, which, after reaching a low in May, has risen at an average monthly rate of 3.2% per month. The level of private residential construction spending has surged past the pre-pandemic high, as low mortgage rates and some pent-up demand have driven housing activity higher.

- Private nonresidential construction is not faring as well, and the recent trend toward working from home will present a challenge to this sector in the coming year or so.

- Since February, private nonresidential construction spending has trended lower, declining at an average monthly rate of 0.9% per month.

- State-and-local construction spending declined 1.2% in September and has been trending lower since reaching a peak in March. Over this period, the decline in state-and-local construction spending has been nearly fully accounted for by highway and street construction.

- The level of highway and street construction is now back in line with averages seen from 2016 to 2018, prior to surges in the level of activity over the winters and springs of 2019 and 2020.

- Soybean futures weakened Monday with the November contract down 5 3/4 cents at $10.50 3/4. Soybean futures declined along with crush products. Much of the pressure stemmed from weakness in global vegetable oil markets as long positions were liquidated amid concern over new coronavirus mitigation efforts. Losses came despite USDA soybean export inspections coming in at 2,082,741 tons for the week ended October 29. That was in line with expectations that inspections would be from 1.5 million to 2.5 million tons. USDA reported in its Fats and Oils report that 171 million bushels (5.13 million tons) of soybeans were crushed in September, down from 5.24 million tons in August and 4.87 million tons in September 2019. Traders also looked for USDA to report soybean harvest reached 91% as of November 1, up from 83% the prior week. Funds were reportedly net sellers of 4,500 soybean contracts, 3,000 soybean meal contacts, and 2,500 soybean oil contracts. (IHS Markit Food and Agricultural Commodities' Wes Petkau)

- Waymo reveals an in-depth report that details its autonomous car testing operations in Phoenix, Arizona (United States). The report mentioned that Waymo's autonomous cars have driven 6.1 million miles in the city, including 65,000 miles without a human behind the wheel, between January 2019 and September 2020. During this time, Waymo vehicles were involved in 18 minor accidents and 29 situations wherein the human driver was forced to take control to avoid potential collisions. Separately, the company released another document that describes its multilayered approach to safety. Through the release of these reports, Waymo aims to foster transparency and openness; it hopes this will increase public confidence in autonomous vehicle (AV) technology and will help regulators to devise industry-wide safety standards for AVs. This would also support Waymo's plan of opening its fully autonomous ride-hailing service to the public in Phoenix (see United States: 9 October 2020: Waymo begins offering fully autonomous rides to public in Phoenix). Waymo has conducted 20 million miles of AV testing on public roads in 25 cities and more than 10 billion miles of simulation. The company recently announced that a new funding round raised USD750 million, bringing its total external funding to USD3 billion. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Notogen is developing a regenerative therapy for what it considers to be a huge unmet need in animal health - spinal issues in dogs. The Canadian-headquartered start-up's NTG-101 is a single injection intradiscal molecular therapy comprised of two growth factors within an excipient solution. It targets degenerative disc disease (DDD) in both dogs and humans. DDD is the leading cause of chronic back and neck pain and disability in humans - a condition that is paralleled in companion animals and is a particularly prevalent issue in purebred dogs such as Dachshunds, Shih Tzus, beagles, cocker spaniels and German Shepherds. According to Notogen, in certain susceptible breeds, approximately one in three can suffer from DDD. The company claims the prevalence of this issue is only increasing, as the life expectancy of dogs increases. Gary Margolis - the company's chief executive - told IHS Markit Animal Health: "There's a lot of prevalence for DDD in dogs but there's no treatment out there at all. Veterinarians are not so attuned to looking for it in advance. Dogs will arrive at the veterinary practice and it might be too late for them because the vets are not proactively looking for this issue." Currently, the main option for dogs with DDD is highly invasive and costly fusion surgery, typically followed by eight or more weeks of emotionally challenging cage/crate rest. Notogen believes its therapeutic could fundamentally change the treatment paradigm for DDD. The start-up's pre-clinical published study demonstrated a single injection of NTG-101 can suppress inflammation in the disc, block the biochemical causes of pain in dogs, stop disc degeneration, preserve the biomechanical properties of the disc and induce a restorative effect in the disc. Mr Margolis said this can be achieved without any safety issues. NTG-101 is a protein-based biologic developed by Notogen's co-founder and chief scientific officer Mark Erwin. Notogen is based on Dr Erwin's work as assistant professor at the University of Toronto looking at why certain mixed breed dogs do not suffer from degenerative diseases whereas pure breed dogs frequently do. (IHS Markit Animal Health's Joseph Harvey)

- The Colombian government approved a USD81.7-billion budget for

2021 - the country's largest budget ever and an approximate 15.4%

increase from the budget approved in 2020. (IHS Markit Economists

Carlos Caicedo and Lindsay Jagla)

- The 2021 budget increases spending on government operations, investments, and debt service; debt service will increase by 31.5% to USD18.2 billion in 2021, and investment spending will be boosted by 22.1% to USD15.0 billion, the largest amount set aside for investment in Colombia's history. The revenues in the budget include a combination of tax income and new debt.

- The approved budget includes various economic assumptions from the government, notably that the economy will contract by 5.5% in 2020, followed by 6.6% growth in 2021. Additionally, the government expects an 8.2% deficit in 2020, followed by a 5.1% deficit in 2021 and has postponed fiscal adjustments to 2022, acknowledging an increase in the debt burden next year.

- The Colombian government's 2021 budget will come into effect amid a vulnerable economic situation because of the coronavirus disease 2019 (COVID-19)-virus pandemic. Despite growing fiscal weakness, the budget clearly prioritizes economic reactivation through additional public expenditure and, although debt service funds will increase from the 2020 budget, Congress still chose to redirect approximately USD1.4 billion from debt-service payments to the investment budget during the debates.

- Strong congressional support for the budget, which it passed by 134 votes to 15 in the Lower House and 66 votes to 11 in the Senate, gives President Iván Duque's government scope for maneuver and for increased borrowing if needed. It is most likely to tap the country's Flexible Credit Line granted by the International Monetary Fund, which was increased from USD6.2 billion to USD17.2 billion in late September.

- Republic of Colombia 5yr CDX closed +1bp/127bps today (Price

Viewer screenshot below shows historical CDS spreads since November

2015)

- The Central Bank of Costa Rica (Banco Central de Costa Rica:

BCCR) on October 28 voted to maintain the 0.75% policy rate because

of the continued need for countercyclical policies amid the

COVID-19-virus pandemic and subsequent economic downturn. (IHS

Markit Economist Lindsay Jagla)

- The BCCR has cut the policy rate twice during the COVID-19-virus crisis for a total of 150 basis points. The policy rate has been set at 0.75 since mid-June and is the lowest rate on record.

- The decision to maintain an expansive monetary policy stems largely from the disappointing recovery of Costa Rica's economy in recent months. Unemployment has remained high at 23.2% (a minimal drop from the record-high 24.4% at the height of the pandemic) compared with the 12.5% unemployment rate before the pandemic, while the monthly economic activity index has faced an uneven recovery and remains well-below 2019 levels.

- Notably, the central bank pointed out that much of Costa Rica's recovery thus far has stemmed from improvements in external demand as major trade partners, such as the United States exhibit faster growth. Thus, with internal demand still significantly constrained, inflation expectations remain well below the central bank's 2-4% target: in September, annual inflation was a mere 0.3%.

- Costa Rica is struggling to boost its economy following the significant downturn caused by the pandemic. In the context of slow economic recovery and very low inflation, IHS Markit expects that the BCCR will maintain its posture of expansive monetary policy, keeping rates low until mid-2021.

- Inflation will stay low amid dampened domestic demand, which will reduce pressure on prices. Furthermore, we expect oil prices to remain low with more significant recovery beginning in mid-2021; this will have a trickle-down effect on Costa Rican prices, as cheaper oil imports also reduce the cost of transportation and the cost of manufacturing certain goods.

Europe/Middle East/Africa

- European equity markets closed sharply higher; Italy +2.6%, France/Spain +2.1%, Germany +2.0%, and UK +1.4%.

- Most 10yr European govt bonds closed higher except for Italy flat; UK -4bps and German y/Spain/Italy -1bp.

- iTraxx-Europe closed -3bps/62bps and iTraxx-Xover -12bps/355bps.

- Brent crude closed +2.7%/$38.97 per barrel.

- The UK government has introduced fresh national lockdown

measures in England from 5 November to 2 December to tackle rising

COVID-19 cases. (IHS Markit Economist Raj Badiani)

- Prime Minister Boris Johnson said that the new lockdown measures are driven by the risk that deaths from the virus could be twice as high over the next month or two than it was during the first wave of the pandemic. Furthermore, scientists and health experts have warned that the National Health Service could be overwhelmed in the next few weeks, placing incredible stress on doctors and nurses treating both COVID-19 and non-COVID-19 patients.

- Chancellor of the Exchequer Rishi Sunak has brought back the furlough scheme after its expiry on 31 October. The scheme will subsidize 80% of wages for any hours that employees do not work and will expire on 2 December 2020. This will probably cost around GBP7.0 billion during November.

- Sunak also announced new grants for businesses that are required to shut, namely a further GBP1.1 billion for local authorities to offer one-off support to businesses. In addition, mortgage holidays will also be extended after expiring on 31 October.

- The government has yet to announce new support for the

self-employed, particularly those vulnerable to the closing of the

hospitality sector.

The new national lockdown in England is adding to the fiscal nightmare facing Sunak, with general government debt now at a record high of GBP2.06 trillion, equivalent to 103.5% of GDP. - The new lockdown measures in England could spell the end to the recovery after the UK economy shrunk by 21.8% in the first half of this year compared with the final quarter of 2019.

- Despite growth disappointing in August, the economy is estimated to have grown by a record 14.8% quarter on quarter (q/q) in the third quarter.

- The new national lockdown in England further supports our view that the Bank of England (BoE) will announce a further round of quantitative easing during its meeting on 5 November.

- Britvic has announced that it will hit plastics target three years earlier than scheduled. Notwithstanding the schedule, the original plan also called for a 50% rPET target. Britvic recently converted its Ballygowan 500ml bottles and Fruit Shoot Hydro to 100% rPET in Ireland. It signed an agreement with UK rPET converter Esterform Packaging in 2019. As a founding signatory of the UK Plastics Pact, Britivc claims to have removed more than 1,500 tons of primary plastics from its supply chain since 2017. All of its primary packaging is now fully recyclable. Sarah Webster, director of sustainable business at Britvic, commented: "We want to be a net positive contributor to the people and the world around us, and we're committed to minimizing waste and using resources in a sustainable way across our business. "Accelerating this move to 100% rPET is the right next step for Britvic to help reduce our impact on the planet. "It requires a suite of solutions, which is why we support the swift introduction of a well-designed GB-wide deposit return scheme, and reform of the current producer responsibility system, to create the required investment in UK recycling infrastructure." (IHS Markit Food and Agricultural Commodities' Neil Murray)

- Daimler and Tesla are taking contrasting approaches to the development of self-driving technology. Mercedes-Benz is looking at taking a more-staged approach to autonomous vehicle (AV) development than some rivals, notably, electric vehicle (EV) maker Tesla, as it prepares to debut new technology on the new S-Class, reports Reuters. According to the report, the Mercedes-Benz system on the S-Class technically will allow Level 3 autonomous operation but stops short of allowing the driver to use the system fully on urban roads. Daimler has always been at the forefront of developing advanced driver-assistance systems (ADAS), but it is taking a cautious approach in which the company's engineering team is in charge of validation. Meanwhile, Tesla launched the latest iteration of its Full-Self Driving (FSD) technology last week and has already extensively demonstrated it in publicity films. This system is designed to be used in inner-city environments, although Tesla has launched the system with the warning that its cars "May Do the Wrong Thing at the Worst Time". Tesla's launch of the FSD software is a typically attention-grabbing act and is in direct contract with Daimler's more-conservative approach, which is more aligned to its core brand values. However, the regulatory environment has still to catch up with the technology and, in most major markets, it would, in theory, be illegal to use fully autonomous driving technology in urban environments. (IHS Markit AutoIntelligence's Tim Urquhart)

- Daimler Trucks and Volvo Group have signed a binding agreement on their proposed fuel-cell joint venture (JV), according to a company press release. The two firms had already inked a memorandum of understanding (MoU) on the co-operative venture. The JV will be focused on developing, producing, and commercializing fuel-cell systems for use in heavy-duty trucks primarily, as well as other applications, such as industrial powerplants. Volvo Group will acquire 50% of the partnership interests in Daimler Truck Fuel Cell GmbH & Co KG for approximately EUR600 million (USD700 million) on a cash and debt-free basis. The closing of the transaction is expected during the first half of 2021 and will be subject to all usual regulatory approvals. Commenting on the establishment of the JV, Martin Daum, chairman of the board of management of Daimler Truck AG and member of the board of management of Daimler AG, said, "For us at Daimler Truck AG and our intended partner, the Volvo Group, the hydrogen-based fuel-cell is a key technology for enabling CO2-neutral transportation in the future. We are both fully committed to the Paris Climate Agreement for decarbonizing road transport and other areas, and to building a prosperous jointly held company that will deliver large volumes of fuel-cell systems." Commercializing fuel-cell technology is something of a holy grail for the automotive industry. Toyota is arguably the world leader in the field in terms of light-vehicle fuel-cell technology, with the company in the process of introducing its second-generation Mirai fuel-cell passenger car. However, the model is very expensive for what is effectively a normal family sedan and it is sold and leased in very limited numbers. However, the technology has more potential in the medium and heavy commercial vehicle (MHCV) space, if only because electric technology for the long-haul duty cycles of medium and heavy trucks will be difficult to make work. The joining forces of Daimler Truck and Volvo Group should decrease development costs for both companies and accelerate the market introduction of fuel-cell systems in products used for heavy-duty transport, and makes sense as a strategy for both businesses. (IHS Markit AutoIntelligence's Tim Urquhart)

- Daimler's trucks division has invested an undisclosed amount in LiDAR manufacturer Luminar Technologies to enable safe deployment of highly automated trucks. LiDAR sensors are necessary for autonomous vehicle (AV) operation as they measure distance via pulses of laser light and generate 3D maps of the world around them. The companies will jointly work towards enhancing LiDAR sensing, perception, and system-level performance for Daimler trucks, starting on highways. As part of this partnership, Daimler will integrate its subsidiary Torc Robotics' AV system along with Luminar's sensors into its trucks. Dr Peter Vaughan Schmidt, head of the Autonomous Technology Group at Daimler Trucks, said, "Luminar has pioneered a critical enabling technology for bringing automated vehicles to the road, and we're excited to work closely with them to drive this technology forward. Their company has proven visionary in its focus and unique ability to enable long-range sensing and high-speed driving on the highway." (IHS Markit Automotive Mobility's Surabhi Rajpal)

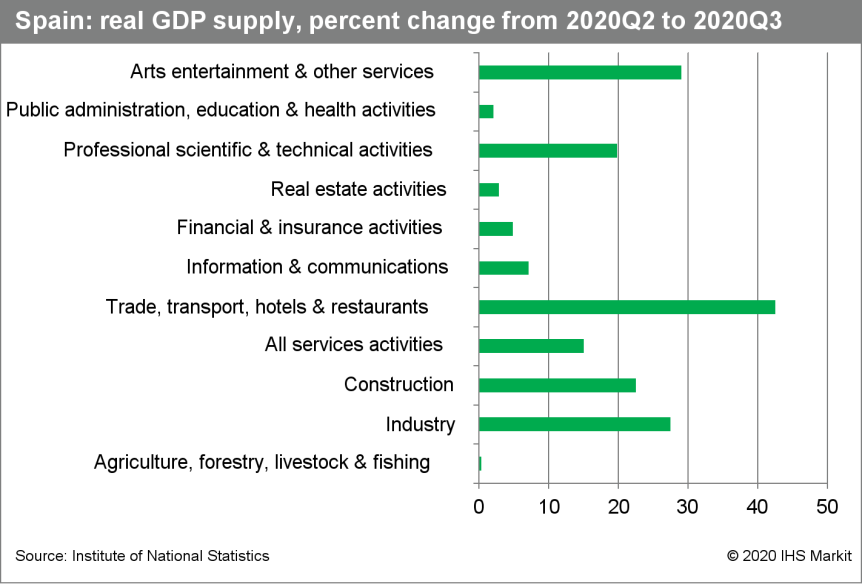

- According to the national statistical office (INE), Spain's

economy rebounded strongly during the third quarter of 2020,

pulling it out of its first recession since the third quarter of

2013. The economy therefore expanded by 16.7% quarter on quarter

(q/q) after falls of 17.8% q/q in the second quarter and 5.2% q/q

in the first. (IHS Markit Economist Raj Badiani)

- With the national lockdown measures lifted gradually from May, growth returned in the third quarter of 2020 with key parts of the economy reopening for business, namely restaurants, bars, and non-essential commercial establishments. This allowed some lost activity during the first two quarters of 2020 to occur, but it still represented a partial rebound with some cancelled spending on services lost permanently.

- IHS Markit had a less optimistic assessment for the third quarter, with growth estimated at 12.0% q/q

- Our conservative GDP estimate for the third quarter was due to the fact that service-sector activity appeared to return to contraction territory in August, with the downturn intensifying in September. Specifically, the headline index from the IHS Markit Purchasing Managers' Index (PMI) survey for services shows that the business activity index retreated to 47.7 in August and 42.4 in September, with a sub-50 score signifying contraction. This was down from 51.9 in July (see first chart below).

- Service providers reported that new business shrank for a third successive month in September, with a fresh outbreak of COVID-19 infections depressing tourist activity alongside still depressed demand from foreign clients. Job losses occurred in September as firms sought to minimise costs and activity remained well below the levels seen prior to the onset of the COVID-19 virus pandemic.

- Indeed, the tourist indicators revealed continued hardship in July and August. The number of overnight hotel stays and foreign visitors in July fell by 75% y/y and 86% y/y respectively. Meanwhile, other indicators suggest that tourism business continued to struggle in August, signaled by a high level of booking cancellations, even sharper y/y declines in the number of international passenger arrivals at Spanish airports, and weaker spending using bank or credit cards issued by non-residents.

- Our current forecast assumes that the economy will contract by

12.7% in 2020, indicating that Spain is one of the worst-affected

countries by the COVID-19 shock. However, this appears too

pessimistic after the stronger-than-expected GDP rebound in the

third quarter, and the 2020 projection is likely be raised to about

-11.5% in the November update.

- Kiadis (the Netherlands) announced on 2 November that it had received a takeover offer from Sanofi (France) valued at EUR308 million (USD359 million). This equity valuation is based on a definitive conditional agreement whereby Sanofi would agree to pay EUR5.45 per share. The takeover bid, subject to shareholder and regulatory approval, is expected to be completed in the first half of 2021. If approved, Sanofi would acquire rights to Kiadis's pipeline of next-generation allogeneic natural killer (K-NK) cell-based immune-therapeutics. The K-NK pipeline has potential applications in a broad range of tumor types - including for liquid and solid tumors and the treatment of patients undergoing hematopoietic stem cell transplant - and would potentially be a good fit in combination with Sanofi's existing and emerging immuno-oncology pipeline. The K-NK platform will also be developed as a potential first-in-class monotherapy immune-therapeutic. Kiadis's leading development program is currently a Phase II clinical trial of K-NK002 to prevent post-transplant relapse in patients with acute myeloid leukemia (AML) and myelodysplastic syndromes. In addition, once the takeover is completed, Sanofi would gain full licensing rights to Kiadis's pre-clinical K-NK004 program, which the French firm licensed as recently as July 2020 as a potential combination multiple myeloma treatment. Beyond the area of immune-therapeutics, the K-NK platform has potential secondary applications in infectious disease therapeutic area. As such, the Dutch biotech company is currently preparing a Phase I/IIa stage KNK-ID-101 to evaluate the technology in developing a post-exposure, pre-emptive treatment for COVID-19 in high-risk patient populations. (IHS Markit Life Sciences' Eóin Ryan)

- According to the Austrian Public Employment Service (AMS),

there were 358,396 unemployed people in Austria at the end of

October, up by 11,000 from September and by 70,000 (24.4%) versus

October 2019. (IHS Markit Economist Timo Klein)

- The annual gap is still narrowing, as it has been doing since May, but the unadjusted unemployment rate of 8.7% means that the gap with the rate a year ago (7.0%) was at 1.7 percentage points in October, only slightly below September's 1.8 points. This gap had peaked at 5.4 points in April.

- The impact of the opening up of the service sector and the recovering demand in the manufacturing sector had largely run its course by October, with some restrictions that limit capacity having had to be maintained for public health reasons all along.

- The unemployment rate on a harmonized, seasonally adjusted basis as calculated according to European Union and thus International Labour Organization (ILO) criteria, which is only available until September, rebounded slightly from 5.4% in August (revised up sharply from 5.0%) to 5.5% in October. This compares with an interim peak of 5.9% in June, caused by ramifications of the March-April lockdown, and a cyclical low-point of 4.2% in November-December 2019. The annual gap in September was 1.1 percentage points, smaller than the gap of its national counterpart in September (1.8 points) but is no longer that dramatically different. The ILO data are survey-based and therefore are much less volatile in reaction to changes in economic activity than the national numbers that reflect registrations for unemployment benefits.

- Vacancies, which had still exceeded their year-ago level until February, were down by 15.1 year on year (y/y) in October (absolute level: 64,666). Vacancies are still recovering, leading to a diminishing y/y decline. Momentum appears to be slowing, however, not least as firms want to restore full working hours for their existing workforce first.

- Finally, dependent employment declined by 43,000 y/y (or 1.1%) in October, representing a small setback following -35,000 y/y (or -0.9%) in September and a peak drop by 200,000 y/y in April. The dip by 43,000 in combination with the unemployment increase of 70,000 means that the labour force increased by 27,000 y/y (or roughly 0.7%), down again from 1.0% y/y in September and 2.0% y/y in April.

- In October, Switzerland's PMI for the manufacturing sector

(seasonally adjusted) - compiled by the Trade Association for

Purchasing and Supply Management procure.ch and published by Credit

Suisse - suffered a modest setback following its May-September

recovery. It slipped from a 19-month high of 53.1 to 52.3, thus

remaining below its long-term average of 53.7. (IHS Markit

Economist Timo Klein)

- In contrast, the PMI for the service sector more than unwound September's increase, falling from 55.1 to 50.4 in October. This was driven in roughly equal measure by the components for new orders, the current business, and the stock of orders, whereas a small increase of the employment index provided a partial offset.

- The worsening short-term outlook for consumer demand is underlined by a major downward correction for retail sales in September (-3.6% month on month [m/m] in both real and nominal terms). Notwithstanding the huge surge by 31% in May, which had temporarily lifted the year-on-year (y/) rate to 6.1%, the annual rate declined sharply again to 0.3% in price-adjusted terms and even -0.3% nominally. The latter is now a percentage point below Switzerland's long-term trend of 0.7% y/y.

- A closer look at the manufacturing sector reveals that October's headline PMI's decline contrasts with the further increase of its German counterpart, with Germany being Switzerland's main trading partner. This is particularly noteworthy in view of Switzerland's manufacturing PMI breakdown revealing that sharply lengthening supplier delivery times actually cushioned the fall that would have been seen owing to the four other components (see table). Longer delivery times may have been caused partly by renewed supply-chain disruptions, thus not indicative of higher demand. Finally, October's Swiss PMI level of 52.3 also underperformed the eurozone's 54.8 (up by 1.1 points), which may have to do with the recent reversion towards Swiss franc appreciation against the euro.

- The KOF Barometer slipped in October from September's 10-year high, but only from 110.1 to 106.6. This remained above its long-term (2009-18) average of 100.0 and compares with an all-time low of 52.3 in May (see chart). This is a level associated with annual GDP growth of about 3.3%, which roughly matches our very latest forecast for 2021.

- Switzerland's October leading indicators and September's retail sales data show that the short-term outlook has deteriorated again after a preceding phase of improvements lasting several months. The renewed rise in COVID-19 cases since late September has now caught up with the economy, as tightened restrictions are being implemented by authorities. Manufacturing is holding up better than services, but the former is still doing less well than the eurozone average, let alone Germany's manufacturing sector.

- Rival factions in Libya have reached a political compromise that could serve as a starting point for normalization after nine years of civil war. Key rivals including the Tripoli government, the Eastern government and its ally, the Libyan National Army, have signed up to what the United Nations has called a 'permanent ceasefire' deal that envisages a restart in political talks (with the aim of holding elections next year) and calls for the withdrawal of foreign forces from the country over the next three months. The deal also stipulates the need to demobilize Libya's myriad militias, some of which would be reintegrated into a national army. The ceasefire has paved the way for a restart in oil production from fields shut in by violence and the threat of theft, enabling the Libyan National Oil Corp (LNOC) to lift forces majeures at central terminals and southwest and central fields in recent days. Production has reached some 800,000 b/d from under 100,000 b/d at the lowest point this year, with significant upside ahead if Libya can regain the 1.25 million b/d achieved in 2019, a scenario that will depend heavily on the condition of infrastructure, field performance, and local political dynamics. Whether this breakthrough is decisive will take time to prove. A restart in oil and associated gas production is moving forward at pace - focused on fields the Sirte basin and the southwest Murzuq regions and supported by the reopening of oil-export terminals including es-Sider, Ras Lanuf, and Zawiya, as the LNOC lifts force majeures in response to the political settlement. (IHS Markit E&P Terms and Above-Ground Risk's Catherine Hunter)

Asia-Pacific

- APAC equity markets closed higher across the region; Hong Kong +1.5%, South Korea +1.5%, Japan +1.4%, Australia/India +0.4%, and Mainland China flat.

- Toyota Motor will invest JPY52.2 billion (USD500 million) in mobile carrier KDDI to deepen their partnership in developing telecommunications technologies to connect vehicles, reports Nikkei Asian Review. Toyota will purchase 18.3 million treasury shares from KDDI, representing a 13.74% stake in the latter. Under this partnership, the companies will jointly conduct research and development focused on telecommunication platforms that connect cars, homes, towns, and users. Communications technology is essential to enhance vehicle connectivity and Toyota has been increasing efforts in this space. KDDI and Toyota have been partnering since 2016 to create a global communications platform for vehicles and rolling out the technology by collaborating with local telecommunications companies. For instance, in the United States, KDDI has teamed up with AT&T to deploy LTE connectivity to Toyota and Lexus vehicles. In Australia, KDDI has teamed up with Telstra to offer connected car services to Toyota customers. This year, Toyota Connected and NTT Data have teamed up to form a new mobility service business that aims to increase the functions of the Mobility Service Platform (MSPF), Toyota's information infrastructure for connected vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Nissan Motor plans to switch all its models sold in China to either electric or hybrid vehicles, reports Nikkei News. According to the report, the automaker said nine models it plans to sell in China by 2025 will either be fully electric or hybrid vehicles. The first Nissan model powered by its e-Power hybrid technology system will arrive in the Chinese market in 2021, with up to six e-Power models planned in the next three years, including the Sylphy sedan. In addition, Nissan is expanding its production capacity in China under a partnership with Dongfeng Motor. The facility expansion will boost Nissan's production capacity in China by 30% to 1.8 million units per annum. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chongqing Changan Automobile (Changan) has reported revenue growth of 23.8% year on year (y/y) to CNY55.8 billion (USD8.3 billion) in the first three quarters of 2020. The company's net profit totalled CNY3.5 billion, up 231.0% y/y, in January-September. In the third quarter, the automaker's revenue increased by 51.3% y/y to CNY23.1 billion and its net profit surged 309.7% y/y to CNY883 million. Changan posted strong profit growth in the third quarter thanks to improved sales and proceeds from stock investment. The automaker sold nearly 540,000 vehicles from July to September, up 34% y/y. During the third quarter, Changan's two joint ventures, Changan Ford and Changan Mazda, both saw a rebound in vehicle sales. In January-September, sales of Changan Ford increased 30% y/y to 167,133 units, while sales of Changan Mazda fell 2% y/y to 94,332 units. Surging demand for commercial vehicles (CVs) in the Chinese market also enabled Changan to offset sales declines in the first quarter amid the COVID-19 virus outbreak. The automaker has a range of entry-level minivans and light trucks across the Changan, Kaicheng, and Ossan brands. Sales of Changan's CVs are forecast to contract by 6.3% to around 360,000 units in 2020. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Zhejiang Geely Holding Group Co (Geely) announced on 22 October that Lynk & Co, the company's premium brand, has sold more than 360,000 vehicles since the brand's launch in October 2016. Geely's expansion plans include launching deliveries of Lynk & Co vehicles in Europe next year. In our current forecast, IHS Markit expects Lynk & Co to reach the sales volume levels of the Ford brand in China by 2024 thanks to its expanding line-up, especially SUVs. The annual sales of Lynk & Co are forecast to hit over 300,000 units in 2024 in China, up from 128,000 units in 2019. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Coca-Cola and Mengniu's fresh dairy joint venture has been incorporated in Anhui's Bengbu City, is capitalized at USD68.86 million and its operations cover manufacturing and selling low temperature dairy (fresh dairy) products. The new venture is called Keniule, taking one character from each partner's Chinese name; the name means "bullish or competent". The legal representative is Venkata Vamsi Mohan Thati. President of Coca-Cola South Pacific, "he has extensive experience within the Coca-Cola system, with a strong track record of delivering results and building capabilities around customer management, market execution, digital technologies and people development," according to a Coca-Cola statement. China's low temperature milk/fresh milk sales were CNY83.3 billion (USD11.9 billion) in 2019, up by 15% over the previous year. Pasteurized milk was worth CNY34.3 billion, up by 7.2%. Fresh milk accounts for just over one-third of the Chinese milk market, compared with western Europe's 90%. Chilled yogurt still offers growth opportunities. Chinese consumers are expected to trade up to fresh dairy in response to the cold chain development. In Q3, Coca-Cola reported global net revenues of USD8.7 billion, down by 9%; organic sales fell by 6%, but demand is improving. Carbonated drinks volumes fell marginally, juice, dairy and plant-based drinks shrank, and tea and coffee were the hardest hit. The youth segment is the main consumers for Coca-Cola in China. Keniule should look to introduce products catering for this group, some analysts suggested. Additionally, development of both online and offline sales channels is crucial for a new brand building. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Daimler Mobility is strengthening its car rental business in South Korea. Mercedes-Benz Mobility Korea (MBMK), an affiliate of Daimler Mobility, has completed its acquisition of long-term car rental business provider Star-Rent-A-Car Korea. Through this acquisition, MBMK plans to offer mobility offerings across the entire country through its network of 59 dealerships. Guillaume Fritz, MBMK CEO, said, "I am pleased that this milestone will help us to respond to the demands of our customers in Korea. Over the past five years, the Korean car rental market has shown strong growth with high customer demand in car rental for premium vehicles and Mercedes-Benz enjoys a top position in this sector. This transaction will serve as a cornerstone in providing tailor-made mobility solutions that can meet the diverse needs of Korean customers with fast, easy, and digital experiences to access Mercedes-Benz vehicle." Last year, Daimler Mobility established MBMK, its mobility business unit in South Korea. The mobility business unit will focus on providing digitized customer services, as well as premium mobility products. On a global scale, Daimler Mobility division provides services such as financing, leasing, insurance, and fleet management; it is also an investor in mobility services such as FREE NOW, SHARE NOW, and Blacklane. (IHS Markit Automotive Mobility's Surabhi Rajpal)

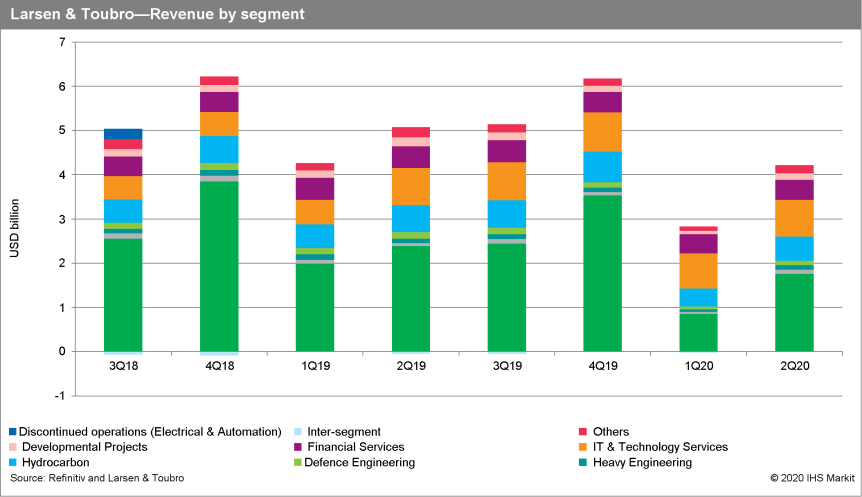

- Larsen & Toubro reported a 12% year on year (y/y) decrease

in revenue but an increase in net profit for the second quarter of

financial year 2020/21 (FY 2020/21) in Indian rupee terms. (IHS

Markit Upstream Costs and Technology's Amey Khanzode)

- The rise in reported net profit was mainly due to the conclusion of the sale of the Electrical & Automation business to Schneider Electric for USD1.9 billion (INR140 billion).

- For the second quarter period (July-September 2020), the company's revenue decreased to USD4.2 billion (INR310 billion), as compared with the revenue of USD5 billion (INR353 billion) in the second quarter of FY2019/20. Revenue growth was mainly driven by the Infrastructure, Services and Hydrocarbon segments.

- The net profit for the second quarter of FY2020/21 came in at USD743 million (INR55 billion), 107 % higher than the net profit of USD359 million (INR25 billion) for the same quarter last year.

- The second quarter included exceptional items worth USD527 million (INR39 billion) comprising of impairment of funded exposure in the heavy forgings facility joint venture and impairment of assets in the power development business. Excluding these, the net profit came in at USD190 million (INR14 billion).

- As a result of the exceptional items, the company reported an operating loss of USD239 million (INR17 billion) in the second quarter of FY 2020/21, compared with an operating profit of USD469 million (INR33 billion) a year ago.

- The Hydrocarbon segment recorded a revenue of USD545 million (INR40 billion) during the second quarter of FY 2020/21, down by 6% y/y. The contraction reflected the relatively subdued tendering activity caused by the decline in demand and low oil prices. The segment secured order inflows worth USD76 million (INR5.6 billion) during the reported quarter. The backlog for the segment stood at USD5.1 billion (INR377 billion) at the end of 30 September 2020.

- For the second quarter of FY2020/21, the infrastructure segment was the major contributor (42% contribution) to the overall company revenue. This segment's revenue decreased by 22% y/y to USD1.8 billion (INR131 billion). The Services segment reported a revenue of USD1.3 billion (INR94 billion) for the reported quarter.

- The total backlog for the company as of 30 September 2020 stood at USD40.6 billion (INR3,000 billion), down from USD43 billion (INR3,032 billion) on 30 September 2019. The new orders won by the company during the second quarter of FY2020/21 were worth USD3.8 billion (INR281 billion). The Infrastructure and Services segments were the major contributors to the order inflow during the quarter.

- Larsen & Toubro has noted that the economic conditions its

domestic market India are showing early signs of revival from the

sharp slowdown seen in the first quarter of FY 2020/21. Strong

emphasis by the government on infrastructure spending would augur

well for the company and the National Infrastructure Pipeline (NIP)

which laid out a detailed capex roadmap till 2025 would provide

visibility on the domestic infrastructure outlook.

- Thailand's industrial production rose by 3.7% from the previous

month in September, and the year-on-year (y/y) contraction

continued to narrow, reaching -4.0%. The sustained improvement

largely reflected an increase in production of computer and

electronic products and softer declines in production of motor

vehicles and food products. (IHS Markit Economist Harumi Taguchi)

- The improvement in industrial production was due to external and internal demand. The contraction of exports continued, easing to a 4.2% y/y drop in September from an 11.2% y/y fall in the previous month, largely because of rises in exports of food and machinery. In addition to exports to the US (up 21.7% y/y), exports to China (up 8.7% y/y), Malaysia (up 17.2% y/y), the European Union (up 1.2% y/y), and Australia (up 5.9% y/y) turned positive while the decline in exports to Japan (down 0.2% y/y) softened.

- The Bank of Thailand's private consumption index also continued to rise, moving up 2.3% from the previous month, and the y/y figure rose by 3.6% on a seasonally adjusted basis. While all spending indices for non-durable, semi-durable, and durable goods and services improved from the previous month, the y/y increases in the private consumption index reflected rises of non-durables (up 2.0% y/y) and durables (up 1.5% y/y). These increases were partially offset by continued weaknesses in other indices, particularly for services, because of sluggish recoveries in accommodations and food services and transportation despite the easing of containment measures. The Private Investment index (up 1.0% month on month [m/m] and down 3.7% y/y) signaled weak improvement in capital investment.

- The September results suggest that recoveries in private consumption and exports are likely to help narrow the contraction of real GDP for the third quarter of 2020. The resumption of economic activity will probably support industrial production and employment and underpin personal consumption. However, the upward momentum could ease because of lockdowns in Thailand's trade partners as well as persistent protests.

- A recovery in Thailand's economy is likely to remain a modest and patchy without a recovery of tourism. Although the Thai government has started to ease border controls, it is still difficult to project when the number of tourists could return to the pre-pandemic level, which could continue to weigh on a recovery of tourism-related industries.

- According to Vietnam's General Statistics Office, exports in

October are estimated to have risen by 9.9% y/y to USD26.7 billion,

while imports likely increased 10.1% y/y to USD24.5 billion,

resulting in a trade surplus of USD2.2 billion for the month of

October. (IHS Markit Economist Rajiv Biswas)

- Exports are estimated to have risen by 4.7% y/y over the first 10 months of 2020, while imports rose by 0.4%, resulting in a strong trade surplus for the first 10 months of the year amounting to USD18.7 billion.

- The United States has been Vietnam's largest export market during 2020 year-to-date, with Vietnam's exports to the United States up 24% y/y. Vietnam's trade surplus with the United States during the first 10 months of 2020 reached USD50.7 billion, compared with a trade surplus of USD55.8 billion for the full 2019 calendar year.

- Exports to China also showed strong growth of 14% y/y during the same period. However, exports to the European Union were down 3% y/y during the first 10 months of 2020.

- Industrial output rose by 5.4% y/y in October 2020, compared with a growth rate of 2.7% y/y for the first 10 months of 2020.

- The latest Consumer Price Index (CPI) inflation data show that the CPI in October grew by 0.09% month on month and was up 2.47% y/y. For the first 10 months of 2020, the CPI rose by 3.71% y/y.

- The Vietnamese economy has been one of the most resilient economies in the Asian region to the COVID-19 pandemic, having continued to record positive GDP growth on a y/y basis for each of the first three quarters of 2020.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-2-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-2-2020.html&text=Daily+Global+Market+Summary+-+November+2%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-2-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - November 2, 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-2-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+November+2%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-2-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}