Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 24, 2020

Daily Global Market Summary - November 24, 2020

Major equity markets closed higher across the globe today, with the exception of Mainland China which ended the day modestly lower. US government bonds closed lower and the curve steepened, while benchmark European bonds closed mixed. European iTraxx and CDX-NA indices were sharply tighter across IG and high yield. Oil and copper closed higher, while gold and silver closed lower for the second consecutive day.

Americas

- US equity markets closed higher, with the DJIA closing above 30,000 for the first time; Russell 2000 +1.9%, S&P 500 +1.6%, DJIA +1.5%, and Nasdaq +1.3%.

- 10yr US govt bonds closed +2bps/0.88% yield and 30yr bonds +6bps/1.61% yield.

- CDX-NAIG closed -2bps/52bps and CDX-NAHY -16bps/314bps.

- DXY US dollar index closed -0.4%/92.16.

- Copper closed +1.2%/$3.30 per pound, tying with the highest close since June 2018. The last time copper's price exceeded today's close was January 2014.

- Gold closed -1.8%/$1,805 per ounce and silver -1.4%/$23.30 per ounce.

- Crude oil closed +4.3%/$44.91 per barrel, which is the highest close since 5 March.

- Genentech (part of Roche, Switzerland) has garnered USD FDA expanded approval for Xofluza (baloxavir marboxil) as a treatment to prevent influenza in individuals aged 12 years and older following contact with someone who has influenza (post-exposure prophylaxis). The regulatory approval was based on data from the double-blind, multi-center, randomized, placebo-controlled Phase III BLOCKSTONE trial, which was conducted by Shionogi (Japan) in Japan. The percentage of household members (including adults and children 12 years and older) living with someone with influenza who themselves developed influenza was 1% in the Xofluza arm, compared with 13% in the placebo-treated group - thus demonstrating a statistically significant prophylactic effect from a single oral dose. Xofluza is the first single-dose influenza treatment to be approved by the FDA for post-exposure prophylaxis. Access to the treatment could be more critical than ever during the current flu seasons as the world battles with the COVID-19 virus pandemic. (IHS Markit Life Sciences' Margaret Labban)

- The global chemical-based crop protection market is predicted to have increased by 4.3% in 2020 to $62,429 million at the ex-manufacturer level, according to preliminary analysis by Phillips McDougall. Sales of all pesticides, including non-crop products will have grown slightly slower at 3.9% to $70,279 million. Growth was dimmer to almost flat for non-crop pesticide sales, which will have added only 0.6% at $7,850 million. A definitive survey of the market will be carried out in the new year, and reported early in 2021, Phillips McDougall notes. The report highlights that despite the major impact on the general economy from the Covid-19 pandemic, agriculture has been largely sheltered from the worst impacts. Agricultural input manufacturing and supply have largely been excluded from lockdown restrictions, with only some hurdles arising from reduced availability of migrant farm labour and issues surrounding delays of shipments in ports. Phillips McDougall has looked at financial reporting from the leading companies active in the crop protection sector, trade data, as well as crop acreage prospects and general economic factors in preparing the report. Phillips McDougall is cautiously predicting another low to mid-single digit market rise in 2021. It expects further withdrawals of older chemistries, driving adoption of newer ais and to a lesser extent biologicals. However, it stresses increasing adoption of biological products, particularly 'hybrid' conventional/biologicals products. Pressure from fall armyworms in South-East Asia is likely to remain, driving the use of the latest proprietary technologies, pyrethroid and organophosphate insecticides, as well as alternative technologies such as nucleopolyhedrovirus. (IHS Markit Crop Science's Robert Birkett)

- Ineos has agreed principle terms with Sasol for the $404-million acquisition of Sasol's 50% stake in the companies' Gemini high-density polyethylene (HDPE) manufacturing joint venture (JV) at La Porte, Texas. The target closing date for the acquisition is 31 December, the companies say. Ineos Olefins and Polymers (O&P) USA, a wholly-owned subsidiary of Ineos, will become the sole owner of the 470,000-metric tons/year HDPE unit. The company has been the operator of the Gemini plant, located within Ineos's Battleground manufacturing complex, since its start-up in 2017. The proposed purchase from Sasol subsidiary Sasol Chemicals North America will allow Ineos to "further expand its reach" in the rapidly growing specialty PE markets for pressure-pipe and high-molecular-weight film, it says. The deal will also "increase Ineos Group's global HDPE market share and strengthen its ability to service the rapidly-growing bimodal markets," it adds. The transaction is subject to financing and other customary adjustments. Sasol president and CEO Fleetwood Grobler says the divestment "continues the transformation of Sasol's chemicals business toward specialty chemicals markets." Proceeds from the transaction will be used to repay near-term debt obligations, the company says. The value of the net assets relevant to the sale was $176 million as at 30 June 2020, which is net of debt facilities, as disclosed in Sasol's financial statements, it says. The loss attributable to the net assets was $18 million for the fiscal year ended 30 June, with the proposed sale to be effective only on restructuring of the existing debt facilities, it adds. In early October, Sasol agreed to form an equally-owned JV with LyondellBasell, with LyondellBasell to pay $2 billion to acquire 50% of Sasol's new 1.5-million metric tons/year steam cracker, and low-density polyethylene (LDPE) and linear low-density polyethylene (LLDPE) plants at Lake Charles, Louisiana. That transaction is also expected to close by the end of the year. (IHS Markit Chemical Advisory)

- Autonomous truck startup TuSimple has reportedly raised USD350 million in a Series E funding round. The financing round is led by consulting and investment firm VectoIQ, headed by Steve Girsky, with participation from current partner Navistar and Volkswagen's (VW) Traton Group, a freight rail operator and grocery retailer, reports Forbes. With the latest capital, TuSimple has raised a total of USD600 million since its launch in 2015. TuSimple focuses on developing Level 4 autonomous solutions for the logistics industry. The company currently has about 40 vehicles in its test fleet and expects to achieve fully autonomous operations in 2021. Recently, Traton and TuSimple announced a global partnership on autonomous trucks, which will involve Scania testing the technology (see United States: 24 September 2020: Traton announces partnership with autonomous vehicle company TuSimple). In August 2019, UPS's venture capital arm, UPS Ventures, invested an undisclosed amount in TuSimple, after the companies conducted trials in May. TuSimple currently has 18 contracted customers and makes around 20 autonomous trips per day. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US government has awarded a federal transportation contract estimated to be worth up to USD810 million to Uber and Lyft, reports Reuters. This deal will enable both the companies to offer their ride-hailing services to public agencies in the United States, involving over 4 million employees of the government nationwide. The General Services Administration (GSA), the procurement arm of the federal government, has granted the five-year contract to Uber and Lyft. Previously, individual employees could use ride-sharing services, but the new contract allows the "companies to formally launch their services within agencies and directly work with officials to promote the service", the report states. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Pinellas Suncoast Transit Authority (PSTA) has partnered with Beep to launch a three-month autonomous shuttle trial program in St. Petersburg (Florida, US). The AVA autonomous shuttle, which is developed by French company NAVYA, will share the road with cars, busses and other vehicles, reports St. Pete Catalyst. The shuttle will take passengers between the Vinoy Hotel and the Dali Museum on Bayshore Drive. The shuttle operates without a steering wheel or pedals and travels on a pre-programmed route using technologies such as LiDAR sensors and GPS tracking for navigation. The AVA will operate at a maximum speed of 15 mph and will have an onboard shuttle attendant to intervene in case of emergency. To ensure safety, the program has implemented various COVID-19 virus-related safety measures; riders must wear face coverings and the shuttle capacity is limited to six passengers, down from the normal capacity of 15. Jeff Brandes, Florida Senator, said, "The world is getting more shared, it's getting more electric and it's getting more self-driving. Those three trends are represented in [AVA] and that will only grow over time. The fact that we have scooters in St. Pete, that we're seeing more and more electric vehicle charging stations, that Uber and Lyft are thriving here, and now we have a self-driving shuttle just highlights the world of shared, electric and self-driving to come." Beep is an autonomous mobility solution company that offers services to fleet operators in planned communities and low-speed environments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- CAOA Group has announced plans to invest BRL1.5 billion (USD277 million) over the next five years at its Anápolis plant in Goiás state, Brazil, reports Automotive Business. The automaker stated that the investment will result in the creation of 2,000 new direct jobs, on top of the current 1,600 jobs at the plant, the building of two new production lines, and powertrain electrification. The investment will also result in the manufacture of 10 models at the plant, including new and renewed models of CAOA Chery, Hyundai, and another brand that is in negotiations and the details of which will be reveled soon, the company stated. Further, the company plans to expand its dealership network from 104 to 151 centres. Mauro Correia, CEO of CAOA Group, said, "With the support of the government of Goiás and Governor Caiado, it was possible to extend federal benefits and this was fundamental to make this investment in Anápolis feasible. Without that, we would not be competitive here." He added that the automaker's objective of increasing production capacity from 86,000 units to 100,000 units per annum is likely to attract more suppliers and create 20,000 to 25,000 indirect jobs as well. According to IHS Markit's light-vehicle production data, CAOA's Anapolis plant produces three Chery sport utility vehicles (SUVs), the Tiggo 5x, 7, and 8, and three Hyundai vehicles, the ix35, Tucson, and HR. The plant is forecasted to produce the Exceed LX and VX SUV in 2021. The plant's production is forecasted to rise by 19% in 2021. (IHS Markit AutoIntelligence's Tarun Thakur)

- The governor of Argentina's province of Mendoza, Rodolfo Suárez, signed an agreement on 19 November with Brazilian firm Vale on the transfer of the Río Colorado potash mine to the province. Vale acquired the mine in Malargüe in 2009, planning a USD6-billion investment. However, the company left the project in 2013, citing increased costs and a deteriorating business environment in Argentina, with tight capital controls and high export taxes, and the project has been paralyzed since. The 19 November agreement includes the transfer of the totality of the mine's assets to Mendoza at no cost for the province, while Vale is exempted from penalties for abandoning the project. The revamped project is slated to be managed by a new provincial mining company and would be of much smaller scale than originally designed. It would require a USD200-million investment to produce 200,000 tons per year, down from the 4 million tonnes initially planned. Provincial authorities are looking for an external investor, and are reportedly holding conversations with Chinese, Swedish, Australian, Canadian, and British firms. The reactivation of the project does not signal an improving business environment in Mendoza for the wider development of other minerals, such as copper and gold, as bans against open-pit mining and the use of chemicals remain in place, despite the governor's efforts to reactivate mining activity. Repealing or amending the regulations that impose the restrictions on mining is very unlikely. In December 2019, social protests forced Suárez to repeal a controversial law that he had promoted himself, which would have allowed the use of chemicals in metal mining (see Argentina: 17 January 2020: Argentina's Mendoza and Chubut reject pro-mining proposals, signaling likely delays to government-sponsored framework to develop the sector). Since potash uses different extraction methods, new investors in Río Colorado would not be subject to the ban. The reactivation of Río Colorado could take up to six years, based on the timeframe agreed with Vale for it to continue paying for maintenance, costing a reported total of USD30 million. Statements against the deal with Vale by local opposition parliamentarians from the Justicialist Party (Partido Justicialista: PJ) would indicate likely hurdles to the approval of the bill in the provincial legislature, further delaying the reactivation of the project. (IHS Markit Country Risk's Carla Selman)

Europe/Middle East/Africa

- European equity markets closed higher across the region; Italy/Spain +2.0%, UK +1.6%, Germany +1.3%, and France +1.2%.

- 10yr European govt bonds closed mixed; Italy -1bp, Spain flat, France/UK +1bp, and Germany +2bps.

- iTraxx-Europe closed -3bps/49bps and iTraxx-Xover -11bps/264bps.

- Brent crude closed +3.8%/$47.78 per barrel, which is the highest close since 5 March.

- The U.K. recorded its lowest number of new coronavirus cases in nearly two months on Tuesday, the latest indication that infections are steadily declining. Restrictions in England are due to be eased next week to make way for a regional approach that will allow many businesses to reopen, and some socializing. (Bloomberg)

- The deterioration in PMIs, consumer sentiment, and national

business surveys has deepened as more stringent COVID-19 virus

containment measures take their toll. (IHS Markit Economist Ken

Wattret)

- "Hard" activity data for the eurozone are available only up to September and offer mixed signals of potential "carry over" effects for the fourth quarter's GDP.

- Survey data for November have been released and they paint a much more downbeat picture of short-term prospects.

- IHS Markit's 'flash' composite PMI dropped for the fourth successive month in November, with the decline (from 50.0 to 45.1) the biggest since April. While the decline was largely attributable to weakness in the service sector, inflows of new orders in manufacturing rose at their slowest rate for five months.

- The average reading of the eurozone composite PMI over the fourth quarter to date (of 47.6) is the lowest since the fourth quarter of 2012 in the latter stages of the eurozone crisis, excluding the two COVID-19 virus-blighted quarters in the first half of 2020.

- Eurostat's 'flash' estimate of November consumer sentiment in the eurozone also show its biggest decline since April, falling for the second month in a row, by just over two points.

- In the aftermath of the initial wave of the COVID-19 virus pandemic, consumer sentiment was less affected than the equivalent indices for services or industry (see chart below). However, consumer sentiment is below its long-run average, sliding and set to remain weak given deteriorating short-term growth and unemployment prospects.

- Business surveys across the eurozone's larger member states also show renewed downward momentum in November. This is evident in the drop in France's National Institute of Statistics and Economic Studies (INSEE) survey and the slippage in Germany's Ifo business climate index, although the manufacturing sector continued its recent spell of outperformance, echoing the signals from the PMIs.

- Final November releases for IHS Markit's PMIs and Eurostat's economic sentiment data could well show even bigger falls than their respective 'flash' estimates, as containment measures in many parts of the eurozone were only stepped up part way through the month.

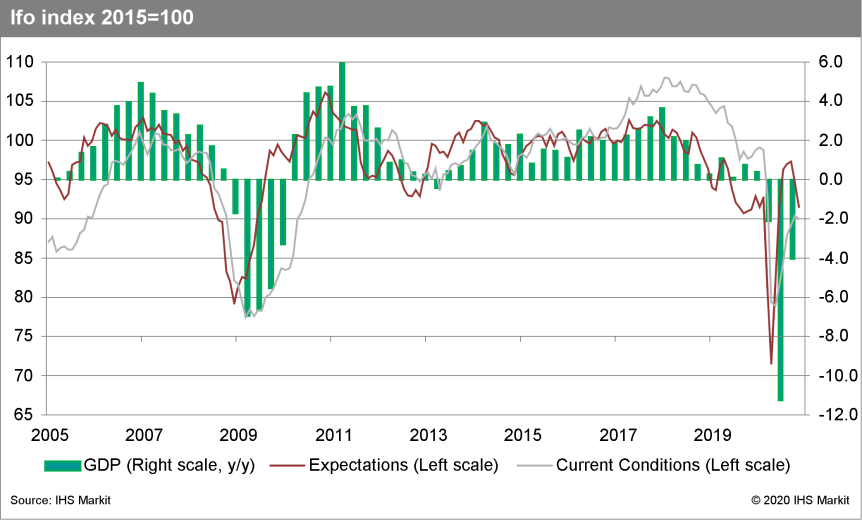

- Germany's headline Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

declined even more sharply in November than in October, confirming

a serious setback to the recovery observed since May. It fell from

92.5 in October (revised down from 92.7) to 90.7 in November. These

levels compare with February's pre-pandemic level of 95.7, the

all-time low of 75.4 in April, and the long-term average of 97.1.

The Ifo Institute attributes the setback to the fresh uncertainty

caused by the second wave of the COVID-19 virus pandemic and

November's tightened containment measures. (IHS Markit Economist

Timo Klein)

- In November, October's pattern of markedly deteriorating expectations (from 94.7 to 91.5, a setback to the sentiment in June) and greatly outperforming current conditions repeated (a modest dip from 90.4 to 90.0). Expectations worsened the least in construction and manufacturing, whereas the outlook for the service sector deteriorated sharply, driven by plunging confidence in the hospitality sector owing to the forced closures. Unsurprisingly, current conditions also fell markedly in the service sector and among retailers, in contrast with a small improvement in construction and quite a large one in manufacturing.

- The breakdown of overall indices by sector, which combines expectations and current conditions, reinforces the picture that the business climate in the service and retail sector is hurt the most by the renewed lockdown, whereas construction sentiment has hardly changed and manufacturing confidence posted a net gain because of major further improvements in current conditions. The manufacturing climate now outperforms that in all other sectors, following two-and-a-half years of in part severe underperformance.

- The Ifo graph portraying the cyclical position of the diffusion index of the headline measure - setting the current conditions and expectations balances against each other - signals that the economy is firmly in downswing territory now, having briefly touched booming territory in August-September. Although the assessment of current conditions slipped only slightly from 5.9 to 5.1, expectations fell quite sharply from -1.4 to -8.1. This accurately reflects the survey's participants' fear that the recent tightening of COVID-19 virus-related restrictions might last longer and thus deeply hurt their business prospects in the weeks and months ahead.

- Ifo's November survey results signal that Germany's economic

activity will be damaged by the renewed lockdown, but

manufacturing-sector resilience is providing significant support

that was missing during March and April.

- France's business sentiment index declined by 11 points to 79

in November. The magnitude of November's fall is similar to the

decline in the index between February and March 2020, when it

dropped from 105 to 95. However, it is substantially lower than

collapse of 41 points recorded between March and April (when the

index fell to just 54, its all-time low). (IHS Markit Economist

Diego Iscaro)

- Unexpectedly, given the nature of the new containment measures implemented at the start of the month, confidence in the retail sector fell particularly acutely in November (-23 points to 72), reaching its lowest level since May, when it had stood at 63.

- Confidence in the service sector also declined for the second successive month. The index waned from 89 in October to 77, a six-month low (the index had stood at 52 in April). The indices measuring expected activity, demand, and employment in the service sector plunged in November.

- Meanwhile, confidence in the manufacturing sector fell at a softer pace (2 points, to 92, a four-month low). The deterioration in the index was almost exclusively driven by a substantial fall in general and personal production expectations. On the other hand, the indices measuring overall and export order books improved modestly in November.

- Solvay says it has reached an agreement to sell its technical-grade barium and strontium business in Germany, Spain, and Mexico, as well as its sodium percarbonate business in Germany to Latour Capital (Paris, France), an independent private equity firm. The company says its joint venture (JV) with Chemical Products Corp. (Cartersville, Georgia) is included in the transaction as part of Solvay's barium and strontium business. The transaction—financial terms of which have not been disclosed—will be completed in the first quarter of 2021 and remains subject to the completion of information and consultation procedures with employee representatives and approval from the relevant regulatory authorities. Didier Gaudoux, partner at Latour Capital, says that under Solvay's umbrella, the businesses "have established leading competitive positions and proved to have very efficient production processes. We will support the management to deliver an ambitious and sustainable growth strategy, with the right investments in capacities and continuous improvements on ESG matters," he says. The agreement is a key step toward streamlining Solvay's portfolio while reducing the company's footprint by exiting its position in niche technical-grade chemical markets, the company says. The divestment also aligns with Solvay's G.R.O.W. strategy, announced last year, it says. (IHS Markit Chemical Advisory)

- Swedish truck-maker Scania has acquired Chinese truck company Nantong Gaokai to start making vehicles in the country, reports Reuters, citing information from Scania. The report has been confirmed by local media reports indicating that Scania plans to celebrate the opening of its new manufacturing base on 28 November in Rugao, Jiangsu province. However, production launch timing and planned capacity are not known at this stage. Scania has increased its investment in China with its first production plant there. The truck-maker is expected to expand its sales and service network across China over the next two years, as it prepares to launch locally built trucks. China's commercial vehicle (CV) market rallied during 2020 as new infrastructure projects backed by the central and local governments spurred demand for heavy trucks. In the first 10 months of 2020, sales of CVs in China have risen by 20.9% year on year (y/y) to 4.20 million units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The Hungarian government-funded project to create a test track for autonomous vehicles (AVs) is near completion, and the first phase of the project is now open for clients, according to a BNE IntelliNews report. Construction for the project, which is located in Zalaegerszeg, began in 2017 with the government funding the HUF45-billion (EUR138-million) facility, which will include a 2km handling course, 300m-diameter dynamic platform and multi-surface braking platform, five-hectare smart city, 2,000-square-meter garage and conference center. The Hungarian government has applied foresight to the construction of this facility, which will be the only bespoke AV testing site in Europe. It has been specifically designed for the testing of autonomous, connected and electric vehicles, including both passenger vehicles and larger commercial trucks up to 40 tons. Construction of the facility is now 70% complete, according to local media reports; Knorr-Bremse, Bosch, Continental, Porsche, and Volkswagen are already making use of it. (IHS Markit AutoIntelligence's Tim Urquhart)

- Israeli GDP bounced back 37.9% q/q SAAR in the third quarter

after the gradual lifting of the first shutdown. (IHS Markit

Economist Ana Melica)

- Israel's Central Bureau of Statistics (CBS) released on 16 November its first estimate of third quarter GDP. Real GDP surged at a 37.9% quarter-on-quarter (q/q) seasonally adjusted annualized rate (q/q SAAR). This followed a slightly downwardly revised contraction of 29.8% q/q SAAR in the second quarter of 2020.

- In non-annualised terms, real GDP recovered 8.4% q/q after -8.5% q/q in the second quarter. Third-quarter growth was the highest on record since at least the early 1980s.

- On an annual basis, real GDP was down only 1.4% year on year (y/y). Compared to the first quarter, it was down only 0.8%, or down 2.6% from the fourth quarter of 2019.

- Virtually all of the growth recovery came from private consumption, which contributed 4.6 percentage points (pps) of the 8.4% q/q growth, and exports, which contributed 4.3 pps. Private consumption expenditure on housing grew 1.1% q/q; spending on food grew 4.1% q/q; and spending on fuel, electricity, and water expanded 13.1% q/q.

- Fixed investment recovered only 7.3% q/q SAAR (1.8% q/q), as industries continued contracting while residential building saw a partial recovery.

- Government consumption growth slowed to 5.1% q/q SAAR (1.2% q/q) following a surge in healthcare and stimulus spending in the second quarter.

- Imports continued contracting, by 6.0% q/q SAAR (1.5% q/q). However, exports surged by 63.9% q/q SAAR (13.1% q/q) or by 7.0% y/y. Indeed, other than government consumption, exports were the only component that expanded from a year earlier. This resulted in the real trade surplus nearly tripling in size compared to the second quarter.

- Despite a strong recovery in the third quarter, real GDP is likely to contract or slow in the fourth quarter following a second nationwide lockdown from 18 September to 17 October and ongoing restrictions. Additionally, a third lockdown is being considered over the winter.

- Qatar General Electricity and Water Corporation (KAHRAMAA) has launched electric vehicle (EV) and charging infrastructure guidelines in Qatar, reports the Qatar Tribune. The guidelines are aimed at supporting the establishment of infrastructure regulations for EVs, promoting the sale of EVs, contributing towards the diversification of energy sources, and reducing carbon emissions in Qatar, according to the report. KAHRAMAA, in co-operation with the Ministry of Transportation and Communications (MoTC), issues approvals for installations of different capacities of charging stations according to their suitability in the locations. The guidelines aid in the installation of EV charging units for both the government and the private sector, and the selection of technical specifications for chargers and charging equipment. (IHS Markit AutoIntelligence's Tarun Thakur)

- Nigeria's GDP rebounded by 12.1% quarter on quarter (q/q)

during the third quarter, from a 5.0% q/q contraction during the

second quarter. The q/q rebound in economic activity in the third

quarter was not enough to offset the losses incurred during the

second quarter, when GDP also contracted by 6.1% y/y, and GDP

decreased 2.6% y/y during the first three quarters of 2020, as well

as declining 3.6% y/y in the third quarter. (IHS Markit Economist

Thea Fourie)

- Output in the oil sector fell by 13.9% y/y during the third quarter, while non-oil GDP - accounting for 91.3% of total real GDP - contracted by 2.5% y/y, from a contraction of 6.1% y/y during the second quarter. "The average daily oil production recorded in the third quarter of 2020 stood at 1.67 million barrels per day (mbpd), or 0.37 mbpd lower than the average production recorded in the same quarter of 2019 and 0.14 mbpd lower than the production volume recorded in the second quarter of 2020," the Nigeria National Bureau of Statistics (NBS) reported.

- Sectors that showed the strongest rebound during the third quarter included the agricultural sector (up 1.4% y/y), construction (up 2.8% y/y), information and communication (up 14.6% y/y), and finance and insurance (up 3.2% y/y). Public administration, health and social services, and water supply also recorded growth over the period.

- Sectors that recorded the biggest contractions during the third quarter included mining and quarrying (down 13.2% y/y), trade (down 12.1% y/y), accommodation and food (down 22.6% y/y), transport and storage (down 42.9% y/y), and education (down 20.7% y/y).

- The NBS reported that Nigeria's third-quarter GDP growth numbers continued to reflect the aftermath of the COVID-19 pandemic lockdown measures. In the third quarter, as COVID-19-pandemic-related restrictions on movement and economic activity were lifted, businesses across Nigeria slowly reopened, while international travel and trade activities resumed. The upward momentum is expected to be sustained in the fourth quarter.

Asia-Pacific

- Most APAC equity markets closed higher except for Mainland China -0.3%; Japan +2.5%, Australia +1.3%, India +1.0%, South Korea +0.6%, and Hong Kong +0.4%.

- On Nov. 12, President Trump signed an executive order barring Americans from investing in 31 Chinese companies that the U.S. says supply and otherwise support China's military, intelligence and security services. The blacklist sparked a selloff in stocks and bonds issued by some targeted companies or their units, though analysts said it wasn't clear if the prohibition extended beyond companies named directly by U.S. authorities to publicly traded subsidiaries of those companies. Adding to the uncertainty, the ban is due to start on Jan. 11, just days before President-elect Joe Biden is due to take office. Late last week, MSCI said it was consulting investors on the impact of the ban, including whether it needed to change existing stock indexes or introduce new ones. FTSE Russell said it was "seeking rapid feedback from clients and other stakeholders on the scope of the sanctions and the timing of the deletion of the affected securities from FTSE Russell indexes." Kenneth Ho, head of Asia credit strategy for Goldman Sachs, estimates that targeted companies and their subsidiaries have about $53.9 billion in offshore debt, or about 6% of all Chinese bonds issued in dollars, euros or yen. (WSJ)

- Billions of dollars in market value of Asian makers of protective and medical gear has been wiped out by the prospect of effective COVID-19 vaccines, denting a rally that was prompted by the pandemic. Shares in Kuala Lumpur-listed Top Glove, the world's largest maker of rubber gloves, have dropped almost 30 per cent from their October peak as of Tuesday, lopping about $5bn off its market capitalization as part of a sell-off that has hit PPE groups across the region. (FT)

- Fast-food giant KFC has deployed several 5G-based autonomous food trucks in China, reports Times Now News. This is a result of partnership between autonomous delivery company Neolix.ai and Yum! Brands, which owns KFC. These trucks aim to "minimize human contact and promote social distancing" and can travel 100 km on a single charge with a maximum speed of 50 km/hr. The trucks are integrated with special sensors to detect and avoid obstacles on the road. Users can select the food through a simple touchscreen and pay by scanning a QR code on the vehicle with a smartphone. Once the payment is successful, the food compartment door is unlocked, allowing customers to pick their food package. Delivery services are an attractive option as one of many potential autonomous-vehicle (AV) business use cases. The expectation is that, eventually, the ability to eliminate the cost of a human driver could make delivery services far more affordable for both the merchant and the consumer. Neolix was founded in 2014 and offers Level 4 autonomous delivery vehicles. The company has its own production plant and claims to operate the world's first production line for Level 4 vehicles. It has partnered with Baidu, Cainiao, and Meituan Dianping to commercialize its AVs. Its clients include JD.com, Alibaba, Meituan, and Huawei Technologies. Neolix's vehicles have been deployed in tourist attractions, campuses, and logistics parks across China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese automaker GAC Motor Group has launched its AION product series as a standalone brand with a focus on electric vehicles (EVs). The company made the announcement of the spin-off of AION from the GAC product line during the ongoing Guangzhou Motor Show 2020, at which the brand's fourth model, the AION Y, made its debut in China. The AION Y, a compact EV, has the same underpinnings as the AION V and the AION LX. The models are based on the GAC Electric Platform (GEP). GAC did not reveal the interior design and specifications of the AION Y at the auto show. According to the automaker, the AION brand will be managed by its wholly owned subsidiary GAC AION, which was previously known as GAC New Energy (GAC NE). (IHS Markit AutoIntelligence's Abby Chun Tu)

- ZNZ Pharma 2 Limited (UK), a newly incorporated biopharmaceutical company, has acquired a majority stake in the Hyderabad-based specialty generics company Celon Laboratories Private Ltd. (India). ZNZ Pharma, which is backed by the UK's publicly owned impact investor CDC Group plc, as well as private equity firm Development Partners International (DPI) and the European Bank for Reconstruction and Development (EBRD), has acquired a 74% stake in Celon Labs for around USD75 million, according to the Times of India. Middey Nagesh Kumar, Celon Labs' managing director, said, "The primary investment by our new shareholders will help Celon expand its capabilities and capacities to match market opportunities in both therapeutic segments on a much larger, global scale." The acquisition deal will see venture capital player Sequoia Capital (US), which had held a 55% stake in the Indian company since October 2010, divest its share. Through its acquisition of a majority stake in Celon Labs, ZNZ Pharma reportedly plans to establish a new oral and injectable manufacturing facility for critical care and oncology products in India. The investment will enable Celon to expand its manufacturing capabilities, its product portfolio and its global reach. (IHS Markit Life Sciences' Sacha Baggili)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-24-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-24-2020.html&text=Daily+Global+Market+Summary+-+November+24%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-24-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - November 24, 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-24-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+November+24%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-24-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}