Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 25, 2020

Daily Global Market Summary - November 25, 2020

Major equity markets closed mixed today, with the Nasdaq being the only major US index to close in positive territory. US government bonds closed slightly lower and benchmark European bonds were mixed. Investment grade credit indices were flat across iTraxx-Europe and CDX-NAIG, while the high yield indices iTraxx-Xover closed wider and CDX-NAHY tighter. The US dollar broke through a new 30 month low, while oil/silver were higher and gold flat was on the day. The US holiday shopping season officially begins on Friday after tomorrow's Thanksgiving holiday, with markets closely watching for any indications that the recent increase in COVID-19 cases is impacting brick and mortar and online sales during this critical time of the year for retailers.

Americas

- Most US equity markets closed lower except for Nasdaq +0.5%; Russell 2000 -0.5%, DJIA -0.6%, and S&P -0.2%.

- 10yr US govt bonds closed +1bp/0.89% yield and 30yr bonds +1bp/1.62% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY -3bps/311bps.

- DXY US dollar index closed -0.2%/92.00, being as low as 91.93 at 10:46pm EST. It is currently at its lowest level since April 2018.

- Gold closed flat/$1806 per ounce and silver +0.3%/$23.36 per ounce.

- Crude oil closed +1.8%/$45.71 per barrel.

- General Motors (GM) has said that it will offer Cadillac dealers up to USD500,000 in severance payments if they do not want to commit to investing in selling the company's planned range of new electric vehicles (EVs), according to an Automotive News report. GM has previously stated that dealers will have to invest in the region of USD200,000 in order to prepare their dealerships for the new generation of Cadillac battery electric vehicles (BEVs). However, a number of Cadillac dealers are unhappy with having to make the investment, as well as the overall strategy, and they now have until 30 November to accept the buyout. With Cadillac being such an iconic and traditional US brand, it is perhaps not surprising that some dealers are having a hard time accepting GM's strategy of an electric future. However, in terms of future-proofing the brand, it is the only decision that GM can make and Cadillac's traditional brand values of comfort, refinement, and luxury will be well aligned to what a BEV powertrain can offer from an engineering point of view. GM is being generous and fair by offering this settlement, which is the latest attempt to reduce its dealership footprint of 880 outlets. GM previously offered buyouts of between USD100,000 and USD180,000 to its 400 lowest-volume retailers in 2016. (IHS Markit AutoIntelligence's Tim Urquhart)

- US personal income decreased 0.7% in October as a 6.2% decline

in transfer receipts swamped moderate increases in employee

compensation (up 0.7%) and proprietors' income (up 1.2%). (IHS

Markit Economists James Bohnaker and David Deull)

- The decline in transfer receipts was primarily driven by decreases in "Lost Wages Supplemental Payments," federal money used for wage assistance to individuals impacted by the pandemic. These payments declined by more than 70% in October as most of the allocated funds had been used up in September.

- Farm proprietors' income was boosted by the Coronavirus Food Assistance Program intended to support farmers impacted by the pandemic. This income support increased from $7.6 billion (annualized) in September to $92.9 billion (annualized) in October.

- Real personal consumption expenditures (PCE) increased 0.5%, which was the slowest monthly growth rate since the recovery began in May, yet still above our expectation for a sharper slowdown. We revised up our forecast for fourth-quarter real PCE growth from 4.6% to 5.9%. Real PCE through October was 2.2% shy of its pre-pandemic February level.

- Spending on both goods and services slowed. Notably, real PCE for several services most at risk to virus spread such as food services and accommodations backtracked in their recoveries as COVID-19 cases skyrocketed in October.

- We remain guarded about consumer spending over the next several months given the recent wave of COVID-19 cases, waning fiscal support, and exhaustion of demand for durable goods.

- Seasonally adjusted (SA) US initial claims for unemployment

insurance rose by 30,000 to a five-week high of 778,000 in the week

ended 21 November. While claims are well below the spring high,

initial claims remain at historically high levels—the high

during the Great Recession was 665,000. The not seasonally adjusted

(NSA) tally of initial claims rose by 78,372 to 827,710. (IHS

Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 299,000 to 6,071,000 in the week ended 14 November. Prior to seasonal adjustment, continuing claims fell by 167,617 to 5,911,965. The insured unemployment rate in the week ended 14 November was down 0.2 percentage point to 4.1%.

- There were 311,675 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 21 November. In the week ended 7 November, continuing claims for PUA rose by 466,106 to 9,147,753.

- Pandemic Emergency Unemployment Compensation (PEUC) claims have been steadily rising as claimants are exhausting their regular program benefits. In the week ended 7 November, continuing claims for PEUC rose by 132,437 to 4,509,284.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 7 November, the unadjusted total rose by 135,297 to 20,452,223.

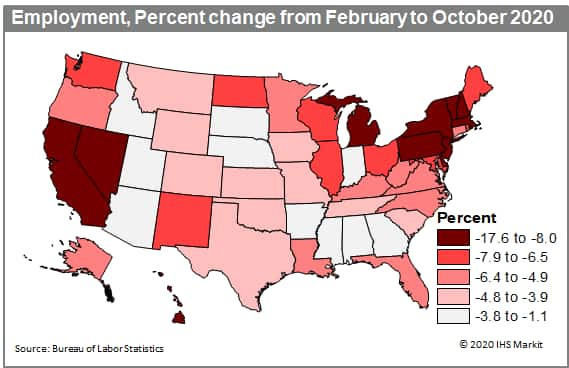

- Total nonfarm payroll employment increased in 45 states in

October 2020, gaining a net 763,000 jobs from the previous month on

a seasonally adjusted basis, according to the most recent report

from the US Bureau of Labor Statistics (BLS). This was down from

the gain of 887.5 million jobs in September 2020 and significantly

lower than July's increase of 1.6 million; however, the numbers

this month look better compared to September after factoring in the

winding down of temporary Census workers, which resulted in huge

losses in Federal government payrolls. Much like the previous

months, a large portion of the jobs added in October were in the

leisure and hospitality sector, specifically in food and

accommodation services, as restaurants and hotels around the

country cautiously re-opened for business. Professional and

business services also boosted payrolls, particularly in

administrative and accommodation services, as some employers either

allowed or started to prepare for office workers returning in a

limited capacity. Much like last month's report, many of the

largest states led the jobs rebound in absolute terms, including

California, Texas, Florida, Virginia, and Ohio. These states' job

gains resulted from the aforementioned hiring in the leisure and

hospitality sector, with the exception of Texas, which had a burst

of hiring in professional and business services. This was most

likely aided by Texas Governor Greg Abbott's loosening of

coronavirus restrictions for offices, increasing the amount of

office workers allowed to return from 50% to 75%. A look at the

percentage change of total jobs from February to October 2020 shows

which state economies have fared the best or worst since the

beginning of the pandemic. States in the Northeast, specifically

New York, New Jersey, Massachusetts, Vermont, and New Jersey,

suffered the biggest early employment impacts from the coronavirus

outbreak and efforts to contain it. Meanwhile, tourism and

travel-reliant states like Hawaii and Nevada, and heavily

goods-producing Midwestern states like Michigan, also sustained

heavy blows. (IHS Markit Economist Steven Frable)

- US manufacturers' orders for durable goods rose 1.3% in

October, beating consensus expectations by a few tenths. Orders for

September were revised higher. Shipments of durable goods rose 1.3%

and inventories of durable goods rose 0.3%. (IHS Markit Economists

Ben Herzon and Lawrence Nelson)

- The details of this report that inform our GDP tracking raised our forecast of fourth-quarter GDP growth by 0.4 percentage point. Separate reports out this morning (on trade, inventories, personal consumption expenditures, and new home sales) added another 1.1 percentage points to our forecast of fourth-quarter GDP growth, which now stands at 5.7%.

- With today's report on durable goods, both orders and shipments are back in line with pre-pandemic trends. This highlights that some sectors of the economy are doing well (goods-producing sectors) while others (notably services) remain weak.

- Both orders and shipments of nondefense capital goods excluding aircraft ("core" capital goods) rose more than we expected in October from September levels that were revised higher.

- This sets up fourth-quarter equipment spending for robust growth. We look for 17.6% annualized growth of equipment spending in the fourth quarter following 66.6% growth in the third quarter, a cumulative increase that would more than reverse the pandemic-induced declines over the first half of this year.

- The increase in durable-goods inventories was larger than we had assumed. Moreover, a separate report out this morning on October wholesale and retail inventories was also robust. All told, we raised our forecast of the change in fourth-quarter inventory investment by about $15 billion.

- The University of Michigan Consumer Sentiment Index fell 4.9

points (6.0%) to 76.9 in the final November reading, a three-month

low. (IHS Markit Economists David Deull and James Bohnaker)

- The index was 24.9 points beneath its pre-pandemic February high and just 5.1 points above its April trough. The absence of a meaningful rebound in consumer sentiment since the COVID-19 pandemic began is consistent with our expectation that consumer spending growth will continue to slow.

- The final November Consumer Sentiment reading was 0.1 point beneath the preliminary reading, suggesting that the impacts of skyrocketing COVID-19 cases and the November elections overwhelmed any positive effect from encouraging reports on the likely efficacy of several vaccines.

- The expectations index plunged 8.7 points to 70.5 even as the current conditions index rose 1.1 points to 87.0. Relative to the midmonth reading, expectations worsened and views on current conditions improved.

- In November, for the first time in four years, respondents self-identifying as Democrats expressed a more optimistic outlook than those identifying as Republicans. However, 59% of Democrats reported that the coronavirus had significantly changed their lives, versus just 36% of Republicans.

- Consumer sentiment fell 6.6 points to 73.6 among households earning less than $75,000 a year and fell 4.4 points to 79.5 among households with earnings above that threshold. The pandemic has disproportionately eliminated employment for lower-income workers, while equity markets are pushing record highs. According to the University of Michigan, 69% of households owned stocks in 2020, up from 61% in 2015.

- The expected one-year inflation rate rose 0.2 percentage point

to 2.8% and the expected five-year inflation rate rose 0.1

percentage point to 2.5%.

The index of buying conditions for large household durable goods rose 5 points to 114, while that for vehicles rose 2 points to 121. The index of buying conditions for homes fell 9 points to 132, the same as in September.

- US new home sales slipped 0.3% in October (±13.6%, not

statistically significant) to a seasonally adjusted annual rate of

999,000. The three-month moving average climbed above the 1.0

million threshold for the first time since September 2006 (note:

the three-month estimates are more informative than the monthly

estimates because averaging reduces statistical noise). Sales were

41.5% (±22.6%, statistically significant) higher than in October

2019. (IHS Markit Economist Patrick Newport)

- Sales are strong in four regions. Year-to-date sales are up 30% in both the Northeast and Midwest, 20% in the West, and 19% in the South.

- Sales of un-started homes increased for the sixth straight month to a 385,000 rate, its highest level since March 2006 (note: an un-started new home sale usually turns into a single-family housing start within a couple of months). Completed homes sold tumbled from 337,000 to 266,000.

- Sales for the prior three months were revised up a cumulative, whopping 64,000.

- The months' supply of unsold homes was unchanged at a record low 3.6 months.

- Despite strong demand, new home prices are hardly budging. The three-month average median and average price in October are both up about 1% from October 2018 and 2-3% from October 2017.

- Bottom line: Although sales were unchanged in October, this report was solid: it included large upward revisions; it pointed to further increases in single-family housing starts in the next two months; and it nearly guarantees that sales this year will be the highest since 2006.

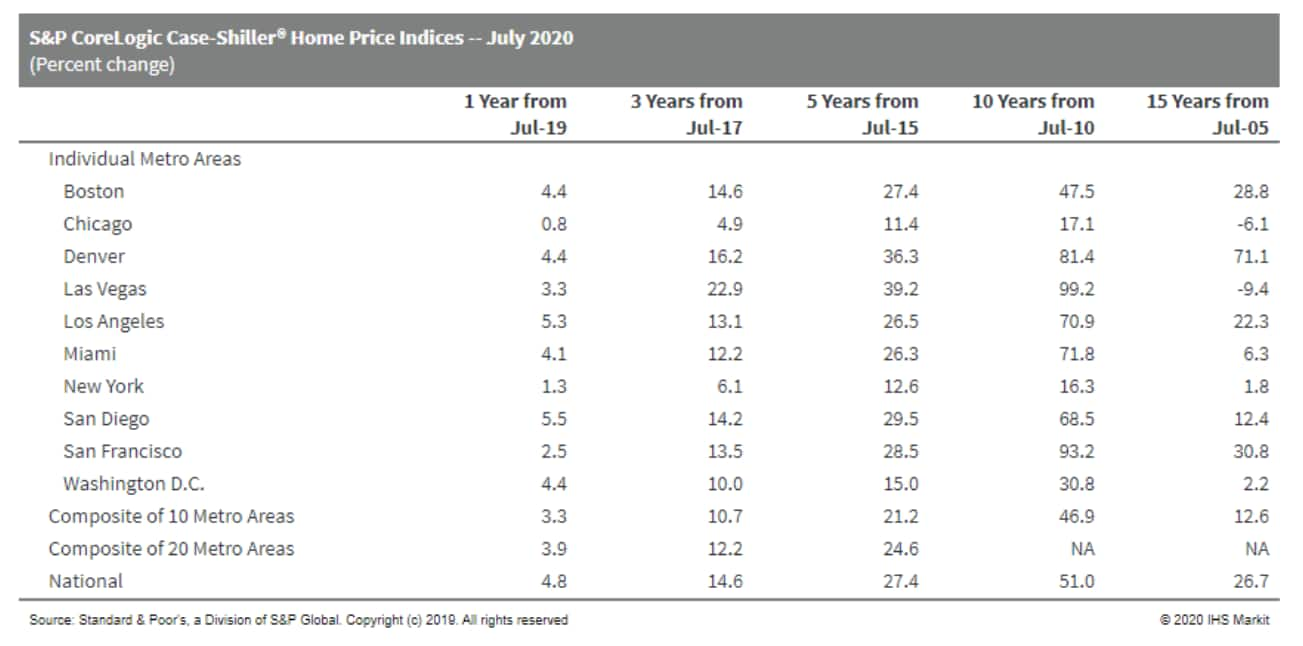

- The surge in US home price growth continued unabated in

September. Data for the three months ending in September show that

US home prices grew at the fastest pace in over six years, at 7.0%

y/y. (IHS Markit Economist Troy Walters)

- The 10-city index advanced 6.2%, its fastest pace since April 2018. The 20-city index gained 6.6%, its fastest pace since March 2018. This data release covers the June through September period and is the second to exclude the months during which the strictest initial shutdowns of nonessential business were in place.

- The summer months brought a surge of potential homebuyers who were largely shut out of the market from late March to mid-May. The resulting surge of delayed demand, combined with low mortgage rates and perhaps an additional sense of urgency due to fears of a resurgence in COVID-19 caseloads, brought about even faster price of appreciation.

- Limited supplies also continued to play a significant role. Data from the National Association of Realtors show that inventories of existing homes for sale, at 1.46 million in September, are near historic lows and falling rapidly at a double-digit y/y pace.

- Price growth accelerated across the country, with many cities again seeing faster appreciation.

- All 19 cities covered in this release saw home prices grow faster than in the previous month, a repeat of August's unprecedented performance.

- Phoenix remained in the top spot with an annual increase of 11.4% in September.

- Seattle, in second place, saw an increase of 10.1% y/y.

- San Diego jumped into the third spot in September with near double-digit gains as well at 9.5% y/y.

- Growth in Chicago and New York remained the slowest of the

cities covered, at 4.3% and 4.7%, respectively; nevertheless, both

saw significant acceleration in the late-summer months.

- The US goods deficit widened by $0.9 billion in October, in

line with the consensus expectation but less than we had assumed.

Furthermore, the combined inventories of wholesalers and retailers

rose 0.9% in October, also more than we had assumed. (IHS Markit

Economists Ben Herzon and Lawrence Nelson)

- In response to these developments, we raised our forecast of fourth-quarter GDP growth by 0.6 percentage point. Other reports out this morning added m

- Both exports and imports of goods posted healthy increases in October. Imports have already surpassed the pre-pandemic trend, and exports have now reversed about three-quarters of the pandemic-induced decline.

- Areas of relative strength within exports include food, feeds, and beverages; automotive vehicles, parts, and engines; and consumer goods excluding foods and autos.

- The increase in inventories (wholesale + retail) was the fourth consecutive monthly increase following steep declines earlier this year.

- The unexpected strength in October led us to add about $21 billion to our forecast of fourth-quarter inventory investment.

- Today's report rounds out the data we need to estimate real goods GDP through October, which we estimate slipped 0.8%. This would follow increases in prior months that have left the level of monthly goods GDP roughly in line with the pre-pandemic trend.

- The goods sector, by some measures (especially monthly goods GDP), has fully recovered from disruptions from COVID-19.

- Peru's National Institute of Statistics and Information

(Instituto Nacional de Estadística e Informática: INEI) reports

that the country's economy grew by 28.5% quarter on quarter (q/q)

on a seasonally adjusted basis in the third quarter of 2020. The

result slightly exceeded IHS Markit's expectations and set Peru on

a path towards recovery, although considerable momentum has already

been lost in recent months. (IHS Markit Economist Jeremy Smith)

- Even after the strong third-quarter performance, output remained 9.4% below levels recorded in the same quarter of 2019, a testament to the extent of the historic -26.6% q/q collapse in the second quarter that was brought about by the especially rigorous and protracted containment measures enacted to slow the spread of the coronavirus disease 2019 (COVID-19) virus.

- Large-scale loss of employment generated a 37.1% year-on-year (y/y) decline in real wages; this has weighed heavily on private consumption, which was down by 9.7% y/y despite a 16% q/q recovery. Consumption of durable goods and services has fallen substantially more than consumption of non-durables and food as households prioritize essential items.

- Government expenditure is the only component of aggregate demand to grow in y/y terms (3.5% y/y). The rise in spending, especially in the area of public health (up by 19.6% y/y), primarily results from the implementation of an ambitious economic stimulus package. The government has so far only partially executed the spending announced in March, worth 12% of GDP, leaving room for further stimulus.

- Fixed investment surged 125% q/q after grinding to a near-complete halt in the second quarter. Purchases of capital goods continue to suffer, but investment has been bolstered by resumption of previously stalled projects and new public infrastructure projects under the "Arranca Perú" program.

- The trade balance returned to surplus as export recovery outpaced imports. Copper prices, driven higher by mainland Chinese demand for construction materials, surpassed pre-crisis levels. However, mineral products, which amount to around 60% of total exports, recorded a 28% y/y decline by dollar value.

- The gradual relaxation of containment restrictions starting in May gave the Peruvian economy a boost, and the monthly production index rose by an average of 10.2% until June. Since that time, however, the recovery has lost considerable momentum, most recently slowing to a 1.5% month-on-month increase in September. The observed bounce-and-fade pattern is consistent with our expectation that the low-hanging fruit of economic reopening would be collected quickly but may soon be exhausted.

Europe/Middle East/Africa

- European equity markets closed mixed; Italy +0.7%, Spain +0.3%, France +0.2%, Germany flat, and UK -0.6%.

- 10yr European govt bonds closed mixed; UK/Germany -1bp, France/Spain flat, and Italy +1bp.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover +5bps/269bps.

- The United Kingdom's Society of Motor Manufacturers and Traders (SMMT) has issued its latest warning regarding the potential impact from a "no-deal" Brexit. According to a statement, the SMMT anticipates that World Trade Organization (WTO) tariff terms would cost the UK automotive industry GBP55.4 billion (USD73.8 billion) by 2025, as well as causing production to fall below 1 million units per annum consistently. The SMMT added that "even with a so-called 'bare-bones' trade deal agreed, the cost to industry would be some GBP14.1 billion". Separately, Nissan has denied a report in Automobilwoche that it is planning to close its Sunderland (UK) facility. The German trade publication cited a "Nissan manager familiar with the matter" as stating that "a decision has been made and it's not favorable for the UK". However, the Japanese automaker told The Telegraph Online, "These rumors are not true." When asked about the company's post-Brexit future, the representative added, "As a sudden change from the current arrangements to the rules of the WTO will have serious implications for British industry, we urge UK and EU negotiators to work collaboratively towards an orderly balanced Brexit that will continue to encourage mutually beneficial trade." The latest statement from the SMMT comes as the final deadline looms for the end of the transition period of the UK's departure from the European Union. With a little over one month to go, discussions on certain key topics, such as following EU standards and state aid, remain ongoing. (IHS Markit AutoIntelligence's Ian Fletcher)

- Specialty chemicals producer Elementis (London, UK) has rejected a second and improved possible takeover offer from Minerals Technologies (New York, New York) that values the company at £679 million ($905 million). Minerals made a second approach on 24 November regarding a possible all-cash offer to acquire Elementis, with the board of Elementis rejecting the revised proposal "after approximately two hours," Minerals says. The increased proposal comprised an offer of 117 pence per Elementis share, representing a rise of 9% on the initial proposal by Minerals of 107 pence per share. The increased proposal represents a premium of approximately 43% to Elementis's closing share price of 81.70 pence on 4 November, the date immediately prior to Minerals' initial approach, it says. It also represents a premium of 61% to Elementis's 90 trading-day volume weighted average share price of 72.66 pence on the same date, it adds. The original approach by Minerals on 5 November valued Elementis at £621 million, with the Elementis board rejecting the takeover offer saying it "significantly undervalued" the company. Elementis has more than 580 million issued shares. The board of Elementis has so far declined to enter into discussions, according to Minerals, which adds it has announced the details of the increased proposal so that Elementis's shareholders "have access to this information." Minerals is currently considering its position, and there is no certainty that any firm offer will be made, it says. Elementis manufactures additives for products in the consumer and industrial markets, including personal care, coatings, chromium, energy, and talc. (IHS Markit Chemical Advisory)

- EPCI contractor DEME has made good progress on the installation of the jacket foundations for the Moray East offshore wind farm project. Using heavy lift vessel Seajacks Scylla, 72 wind turbine jackets and three offshore transformer module (OTM) jackets have been installed since work started in July 2020. It is expected that the remaining 28 jackets will be completed by January 2021. The jackets were fabricated by Smulders, with 55 jackets awarded to it, and the remaining by Lamprell. The later also fabricated the jackets for the three OTMs. The 950 MW Moray East wind farm is expected to be commissioned in 2022 and comprises 100 MHI Vestas V164-9.5 MW wind turbines. Installation of the foundations was originally planned to be supported by DEME's newbuild installation vessel Orion. The project however suffered a setback in May when the vessel sustained damage to its deck and crane due to the catastrophic buckling of its 5,000 MT crane during load tests. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- In a high-profile visit to Berlin for the European Battery Conference, Elon Musk outlined plans to make the battery cell factory at Tesla's new Brandenburg site the biggest in the world, while also discussing plans for a potential C-segment car for Europe. Musk was in typical swashbuckling mood during his trip, no doubt fueled by the news that Tesla's share price has now climbed to such an extent that on paper he is now the second richest man on the planet after Amazon's Jeff Bezos. Tesla is well placed to achieve Musk's ambitions stated here. It is perhaps surprising that Musk had not so far realized that the Model X SUV-E is a very large car by European standards. A car like the Model X certainly makes more sense in the expansive wide open spaces of US cities, which have always been designed around car use, and the fact that the Model 3 has been such a success in Europe shows where most customers' preferences lie in the region. At the moment, IHS Markit forecasts that the Brandenburg plant will begin production of the new Model Y (effectively a higher riding Model 3) SUV in 2022, followed by the Model 3 in 2023. (IHS Markit AutoIntelligence's Tim Urquhart)

- Clariant says it plans to "rightsize" its regional organizations and service units, reducing their combined workforce by approximately 1,000, around 6% of the company's total workforce. The decision follows the divestments of the company's healthcare packaging business in October 2019 and masterbatches business in July 2020, as well as the anticipated divestment of the company's pigments business, it says. Approximately one-third of the reductions will be included in the divestment transfers, the company says. Clariant says it is transforming itself to focus more on its core business areas of care chemicals, catalysis, and natural resources. The company says that the timeline for the measures will extend over a maximum of two years and include departures attributable to natural fluctuation. It has also decided to make a provision of 70.0 million Swiss francs ($76.7 million) in discontinued operations in the fourth quarter of 2020 for the reorganizing program. Meanwhile, Clariant's previously announced efficiency program is in full implementation to cut approximately 600 jobs and realize SFr50 million of cost-base savings in the continuing business until the end of 2021, it says. (IHS Markit Chemical Advisory)

- An advocate general from the European Court of Justice will

next week issue an opinion - a non-binding preliminary ruling - on

the European Commission's appeal against a February 2019 judgement

by the General Court annulling the EU executive's 2016 decision

that Belgium's tax sweetener deals for domestic companies,

including brewing giant AB InBev, constituted illegal state aid.

(IHS Markit Food and Agricultural Policy's Sara Lewis)

- The Commission maintains that it was right to condemn the Belgian tax rulings that from 2004 to 2015 reduced the taxable profits of 55 domestic companies belonging to multinational groups, via a tax exemption on additional profits.

- The tax breaks were based on a provision of the Belgian Income Tax Code which, in accordance with the internationally accepted arm's length principle, allows profits to be adjusted between two affiliated companies if the conditions agreed between them were not the same as those that would apply to independent companies.

- The Commission contends that the Belgian tax authorities had not used the arm's length principle, as provided for in the Income Tax Code, to reassess charges for services between two associated companies, but rather compared the profits of the company forming part of a "cross-border group" with those of a non-affiliated company, irrespective of the services offered.

- More specifically, the Belgian tax authorities determined what these additional profits were by estimating the hypothetical average profit that an independent company carrying on a similar activity would have made in a comparable situation and deducting this amount from the actual profit made by the Belgian company concerned.

- To benefit from this special treatment, it was sufficient for the profits to be linked to a new situation, such as a reorganization leading to the resettlement of the main company in Belgium, the creation of jobs or additional investments. The Belgian authorities even advertised the possibility of an advance tax assessment, which would make a negative adjustment to profits - a tax exemption on additional profits.

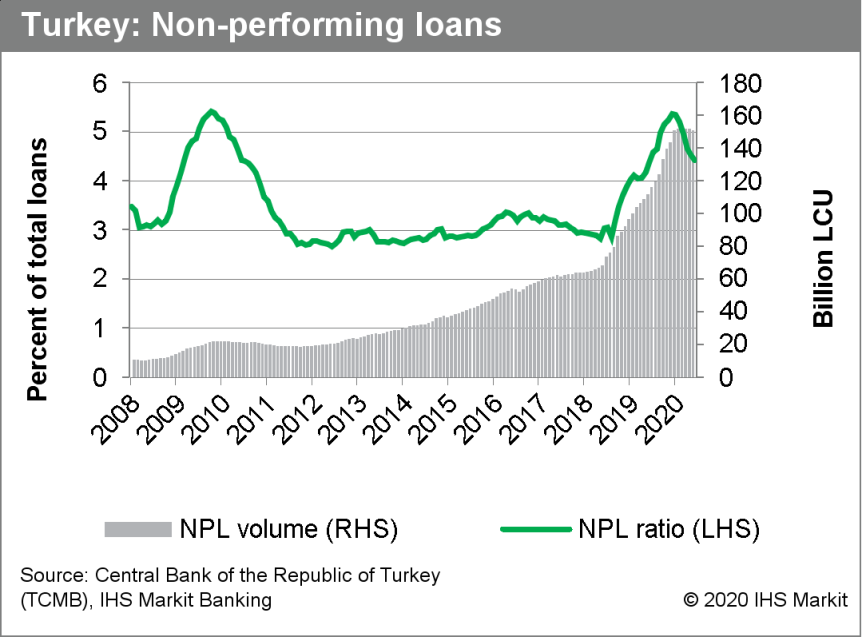

- Turkey's Banking Regulation and Supervision Agency (Bankacilik

Düzenleme ve Denetleme Kurulu: BDDK) has announced that it will

abolish the minimum asset ratio requirement for banks at the end of

2020. The requirement was announced in April and was designed to

boost credit growth and mitigate the economic fallout from the

COVID-19-virus shock. (IHS Markit Banking Risk's Gabrielle Ventura)

- The asset ratio was rolled back for the second time in September, requiring a minimum loan-to-funding ratio of 90% for commercial banks and 70% for Islamic banks (participating banks) (see Turkey: 29 September 2020: Turkey's banking regulator further reduces minimum asset ratio in second tightening measure of the month).

- In IHS Markit's view, the elimination of the loan-to-funding ratio requirement is credit positive for the Turkish banking sector. The requirement forces banks to loosen lending standards, driving up expected non-performing loans.

- The termination of the asset ratio should allow banks to further tighten lending standards in 2021 and prevent the accumulation of additional credit risks through rapid lending expansion, as seen in the first three quarters of 2020.

- We expect credit growth to decelerate in the final quarter of

2020 as some stimulus measures are curtailed and pressure on asset

quality begins to rise, with headline credit growth rates

registering about 28% at the end of the year.

- The Central Bank of Eswatini, in consultation with the Monetary

Policy Consultative Committee (MPCC), decided to leave its policy

rate unchanged at 3.75% throughout November. (IHS Markit Economist

Archbold Macheka)

- Year-on-year (y/y) inflation is trending upwards. Headline inflation in October ticked up to 4.7% y/y from 4.1% y/y in September, driven by higher prices for food and non-alcoholic beverages (4.4% y/y); housing and utilities (6.4% y/y); and furnishing and housing equipment (5.2% y/y). Consequently, the central bank has revised its average annual inflation forecasts for 2020 and 2021 upwards, to 3.84% y/y (from 3.74% y/y) and 5.23% y/y (from 4.34% y/y), respectively.

- In the second quarter of 2020, Eswatini's economy declined by 8.2% y/y (seasonally adjusted), following the 3.6% y/y contraction in the first quarter of 2020. According to the monetary policy statement, the decline "was largely attributed to poor performance in all three sectors of the economy, especially severe in the secondary sector, which further contracted by a significant 24.5% y/y in the second quarter of 2020, from a 16.4% y/y contraction recorded in the first quarter".

- Private-sector credit weakened by 0.4% due to weak credit extension to households (down 1.2% month on month (m/m)) and the business sector (down 0.3% m/m). The country's foreign reserves stood at SZL9.3 billion (about USD595 million) on 13 November 2020, equivalent to four months' import coverage. At the end of October, the country's total debt stock stood at SZL25 billion (39.6% of GDP), with public external debt at SZL10.8 billion, equivalent to 17.2% of GDP.

- Eswatini's monetary policy remains closely aligned with that of South Africa, therefore its interest rate decisions mirror those taken by the South African Reserve Bank (SARB). IHS Markit expects a 25-basis-point hike in the SARB's policy rate by the fourth quarter of 2021, with the risk tilted towards an unchanged monetary policy stance for the upcoming year.

- Moody's Investors Services has downgraded the South African

government's long-term foreign-currency and local-currency issuer

rating to Ba2 (Likely to Fulfil Obligations on the generic scale).

The outlook for both ratings has been left unchanged at Negative.

(IHS Markit Economist Thea Fourie)

- The key driver behind the decision from Moody's to downgrade the South African government's long-term foreign currency and local-currency issuer rating to Ba2 is the further deterioration of South Africa's fiscal strength over the medium term. The difficult fiscal backdrop will hamstring the country's ability to address economic challenges and social obstacles to reform. Moody's warns that South Africa's capacity to mitigate the shock from the fallout of the COVID-19 virus pandemic is lower than that of other sovereigns facing similar fiscal, economic, and social constraints and rising borrowing costs.

- Moody's expects South Africa's public-sector debt - including state-owned enterprises (SOE) guarantees - to reach 110% of GDP by the end of fiscal year (FY) 2024. This will leave South Africa's public-sector debt burden 40 percentage points above the FY 2019 level. Moody's warns that wider fiscal deficits will persist over the medium term. The government's medium-term spending objectives rest heavily on cuts in the public-sector wage bill. "Its ability to do so is questionable," Moody's warns.

- From FY 2022, Moody's estimates show that interest costs will become the largest contributor to the rising debt-to-GDP ratio and will reduce South Africa's fiscal flexibility further. The proportion of government revenue needed to cover interest costs could increase to 25% over the medium term.

- Moody's expects South Africa's GDP growth rate to average 1% over the medium term, limited by structural constraints in the economy. The COVID-19 crisis will worsen the country's long-standing economic and social constraints and hamstring its ability to implement much-needed reforms. Among the areas in need of reform, South Africa's rigid labour market is the most pressing.

- The Negative outlook reflects the possibility that South Africa's debt burden and debt affordability could exceed current estimates. Downside risks to GDP growth and fiscal consolidation efforts are the most prominent in Moody's view, in conjunction with the potential for further financial demands from SOEs or higher interest rates due to local or global shocks.

- IHS Markit's medium-term sovereign risk rating for South Africa is currently set at 55/100 (B+ on the generic scale) with a Stable outlook. Our medium-term sovereign risk rating is higher than those of S&P Global Ratings, Moody's, and Fitch.

- South Africa's external debt burden is modest but has been increasing, from 39.2% of GDP in 2015 to an estimated 67.6% of GDP in 2020. By the end of 2020, external debt is expected to average 219.4% of total foreign-exchange earnings, while external debt servicing costs will take up 27.3% of total foreign-exchange earnings, up from 14.6% in 2019. South Africa relies heavily on volatile portfolio flows as a source of external liquidity.

Asia-Pacific

- APAC equity markets closed mixed; India -1.6%, Mainland China -1.2%, South Korea -0.6%, Hong Kong +0.3%, Japan +0.5%, and Australia +0.6%.

- Subaru has partnered with SoftBank to demonstrate 5G-based cellular vehicle-to-everything (C-V2X) communication technology to assist autonomous vehicle (AV) applications. To conduct the demonstration, SoftBank will deploy its portable device that provides 5G connectivity with high radio wave, called 'Outing 5G', at Subaru's Meishen test site in Hokkaido (Japan). SoftBank will also use its high-precision positioning technology 'ichimill' that will help in sourcing vehicle position information. The demonstration involves AVs merging to the main road from the branch line under two different scenarios. The first one is an AV merging smoothly from the confluence to the main road on highways and the other is an AV merging when there is no space available on the main road owing to traffic jams. Last year, Subaru partnered with SoftBank to conduct a joint research on 5G-based C-V2X communication systems. C-V2X systems enable vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure and assist operations of advanced driver assistance systems (ADAS). C-V2X technology not only supports AV functioning but also helps in optimizing traffic flow and reducing vehicle emissions. Subaru aims to reduce traffic accidents, including deaths, and advance its safety technology developed through its EyeSight driver assist system. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Singapore's real GDP increased sharply in the third quarter,

but it was not nearly enough to offset the decline induced by the

COVID-19 virus pandemic. (IHS Markit Economist Dan Ryan)

- Singapore's economy in the third quarter grew 9.2% over the second (actual percent, not annual rate). This recovered roughly half of the decline experienced in the first half of the year.

- The biggest contributor was private consumption. In some ways this was surprising, given the pandemic, but then again Singapore managed to lower cases quickly after the initial impact.

- Government consumption showed a small decrease, which at first glance seems contrary to the goal of fiscal stimulus. However, some policies were instituted via tax policy, and may be partly responsible for the rise in fixed investment.

- Exports and imports both increased, showing an increase in demand both abroad and domestically. Interestingly, external demand has been the dominant factor recently, with net exports - exports minus imports - rising sharply in the second and third quarters.

- From the production point of view, most of the gain was from increased services. This correlates with the increase in private consumption, and again is somewhat surprising in light of the shutdowns caused by the coronavirus.

- The next gaining sector was manufacturing, reflecting the rise in exports. And lastly there was a rise in construction, though this only recovered one-fourth of the decline in Q2.

- Singapore's bounce-back in the third quarter was welcome but not exceptional. Other Asian exporters in the third quarter regained three-quarters of their prior losses, making Singapore something of a laggard.

- Toyota Motor has expanded its partnership with Intelematics to launch connected car services in Australia. From late 2020, select Toyota vehicles will be integrated with Intelematics' ASURE product suite that will support the automaker's connected safety and security offering, including automatic collision notification (ACN), SOS emergency call (SOS), and stolen vehicle tracking (SVT). Stephen Owens, CEO of Intelematics Australia, said, "Intelematics has a heritage in providing highly valued services to the Australian Automobile industry and being an integral part of this program continues that tradition. The Intelematics ASURE product suite has again proven its capability in supporting large scale connected vehicle programs in local and global market." Communications technology is essential to enhance vehicle connectivity and Toyota has been increasing its efforts in this space. Recently, it collaborated with KDDI and Telstra to deploy 4G mobile network connectivity for select vehicles introduced in Australia later this year. In 2019, Toyota's Lexus Australia partnered with Telstra to test cellular vehicle-to-everything (C-V2X) technology and advanced driver assist features on Victorian roads. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Australia's milk production has experienced a significant turnaround in 2020, after the worst drought in the last 25 years put the brakes on the country's dairy product manufacturing and export ambitions. According to the USDA's Foreign Agricultural Service (FAS), milk production in 2020 is pegged at 9.2 million tons, which is 4% higher than 2019's drought-driven 8.83 million tons. Sufficient rains in 2020 have resulted in a dramatic reversal of Australia's falling milk production, and the effects of these drought-breaking rains, good pasture conditions, a bumper grain crop and improved water availability are expected to overspill into 2021. The scene is set for 2021 milk production to recover to near pre-drought levels of 9.4 million tons, up 2% on 2020. With increased milk production, the manufacturing industry is expected to continue to prioritize cheese production over other manufactured products, which is a continuing trend. As a result, cheese is anticipated to see the largest rise in production, with practically all of this increase being exported. FAS forecasts cheese production for 2020 to be revised down to 385,000 tons, from the official USDA estimate of 390,000 tons. Despite the revision, the 2020 cheese production estimate is still an increase of almost 6% over 2019 production of 364,000 tons. In addition, 2021 production of cheese is to reach 395,000 tons, up 3% on the 2020 estimate. If realized this would be the highest production since 2002 and the second highest in Australia's history. The primary reason for the increase in cheese production is the forecast for expanded milk production in 2021, along with the trend by manufacturers in Australia over recent years to focus on cheese production at the expense of WMP, butter, and SMP. (IHS Markit Food and Agricultural Commodities Jana Sutenko)

- Perusahaan Listrik Negara (PLN), Indonesian public utility company, has signed a memorandum of understanding (MOU) with four companies to encourage the adoption of electric vehicles (EVs) in Indonesia, reports The Jakarta Post. The agreement is signed with three automakers - Gesits, Hyundai, and Wuling - and ride-hailing company Grab to examine ways to ensure easy electricity access for EV owners and operators. This deal is aimed at introducing special electricity charges for nighttime EV charging at home and improving Cost.IN, the utility firm's app that tracks public EV charging stations. Significance: The latest development follows the Indonesian government's 2019 regulation aimed at making the country an electrified-vehicle hub of Asia and beyond, with 2022 being the target for the start of production of such vehicles. The country also aims for electrified vehicles to account for 20% of its total car production by 2025. By pushing for electrified vehicles, the government plans to reduce its carbon footprint and reliance on fossil fuels, as well as create a downstream industry for the country's rich supply of nickel laterite ore. Nickel and cobalt are key materials to make lithium-ion batteries. (IHS Markit Automotive Mobility's Surabhi Rajpal)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-25-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-25-2020.html&text=Daily+Global+Market+Summary+-+November+25%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-25-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - November 25, 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-25-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+November+25%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-november-25-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}