Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 24, 2020

Daily Global Market Summary - September 24, 2020

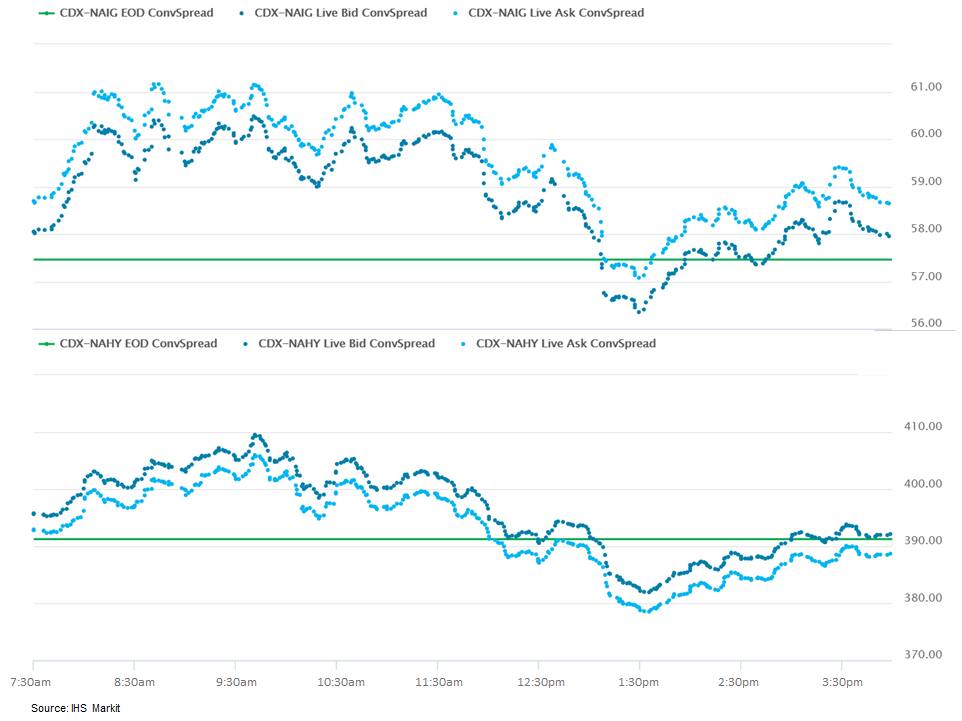

The major European and APAC equity markets closed lower, while US markets were modestly higher after starting the day in negative territory. Benchmark European government bonds closed mixed, while US bonds and the dollar were close to flat on the day. Credit was weaker across IG and high yield, with iTraxx closing sharply lower on the day. CDX-NAHY began the day an additional 16bps wider after yesterday's significant sell-off, but retraced most of the widening to close only modestly lower. Silver, gold, and oil all closed higher on the day.

Americas

- US equity market closed modestly higher on a rollercoaster of a day; Nasdaq +0.4%, S&P 500 +0.3%, DJIA +0.2%, and Russell 2000 flat.

- 10yr US govt bonds closed -1bp/0.67% yield and 30yr bonds -1bp/1.41% yield.

- Seasonally adjusted (SA) US initial claims for unemployment

insurance rose by 4,000 to 870,000 in the week ended 19 September

and remain at historically high levels, although well below the

all-time high of 6,867,000 in the week ended 28 March. The not

seasonally adjusted (NSA) tally of initial claims rose by 28,527 to

824,542. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 167,000 to 12,580,000 in the week ended 12 September. Prior to seasonal adjustment, continuing claims fell by 176,510 to 12,264,351, the largest decline in four months. The insured unemployment rate in the week ended 12 September inched down 0.1 percentage point to 8.6%.

- There were 630,080 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 19 September. In the week ended 5 September, continuing claims for PUA fell by 2,956,176 to 11,510,888.

- In the week ended 5 September, there were 1,631,645 claims for Pandemic Emergency Unemployment Compensation (PEUC) benefits.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 5 September, the unadjusted total fell by 3,723,513 to 26,044,952.

- CDX-NAIG closed +1bp/58bps and CDX-NAHY +1bps, but were as wide

as +3bps and +16bps, respectively, during the morning.

- DXY US dollar index closed close to flat/94.35.

- Gold closed +0.5%/$1,876 per ounce and silver +0.4%/$23.20 per ounce.

- Crude oil closed +1.0%/$40.31 per barrel.

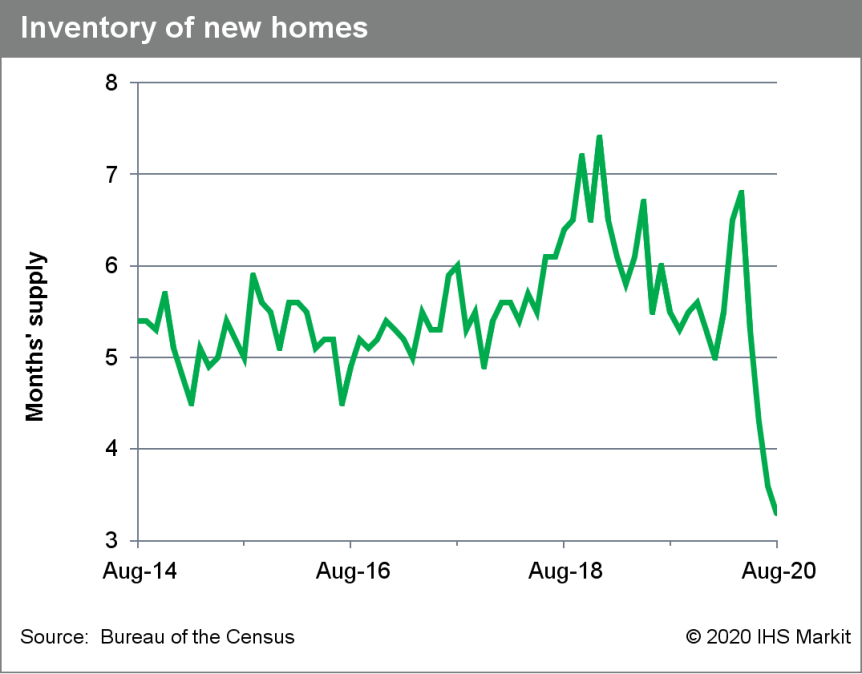

- New US home sales sizzled again in August, rising 4.8% (+/-

10.5%) to a seasonally adjusted annual rate of 1,011,000—the

highest level since September 2006. The reading was not

statistically significant, however (90% confidence intervals). (IHS

Markit Economist Patrick Newport)

- a. Sales in the South shot up 13.4% (+/- 15.3%) from July—up 50% from August 2019 and the fourth straight double-digit monthly increase, as sales increased to a 636,000 rate, the highest since December 2005 (the reading also was not statistically significant, however).

- Sales for the prior three months were revised up a cumulative whopping 125,000.

- The number of units for sale dropped 9,000 to 282,000; completed homes for sale came in at 54,000, down 5,000.

- The months' supply of un

- Although most of the numbers in this report fail the statistical significance threshold, they are consistent with other housing data in showing activity rising to levels last seen in the mid-2000s. The housing market is reaping the benefits of record-low interest rates and pent-up demand. But low inventory levels, which have led to bidding wars, are also fanning the flames.

- Three items things stand out in this impressive report:"

- The stunning sales numbers. True, the headline number is not statistically significant (mainly because the sample is too small). But a three-month moving average, which is more trustworthy than a single monthly estimate, is at levels last seen in January 2007.

- The cumulative 125,000 upward revision to sales in the previous three months (we do not recall an upward revision this large). Over a quarter of new home sales are imputed to account for homes sold before a builder takes out a permit. The monthly revisions mainly replace imputed data with actual data.

- The months' supply, which is at an all-time low. This will

drive up new home prices, incentivizing builders to ramp up on

single-family housing starts.

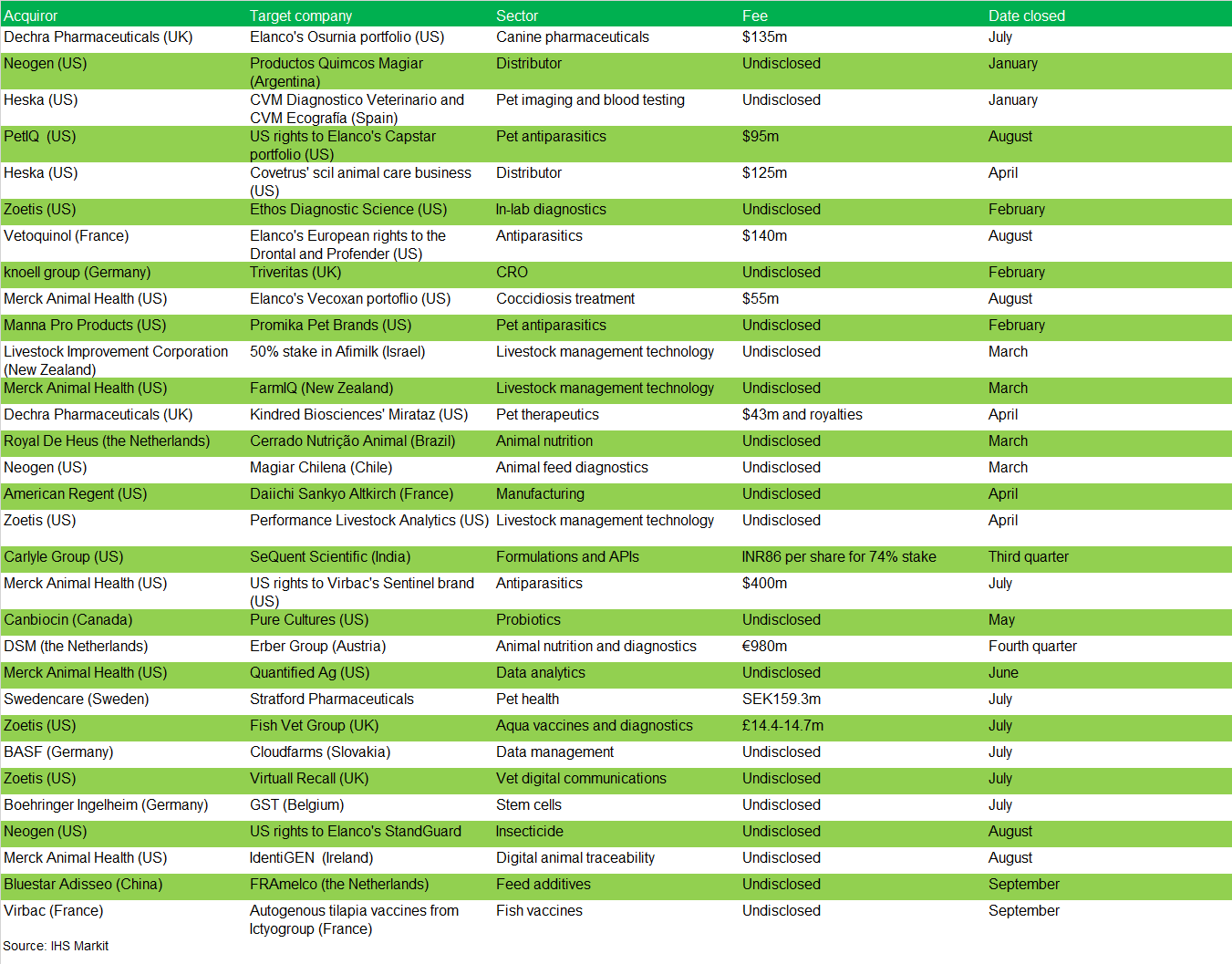

- The below table is this year's M&A activity in the animal

health sector tracked by IHS Markit's Animal Health team:

- Lion Electric will deliver 10 battery electric trucks to Amazon, with the first two to be delivered in 2020. The trucks are planned for use in Amazon's middle-mile trucking operations, transporting items within the company's distribution network. Lion Electric will also provide one-time training to Amazon and the drivers operating the trucks, and establish a maintenance program for the vehicles. According to a Lion company statement, the trucks will be manufactured at the company's Canadian facility, which it says has capacity for 2,500 units per year. The Lion electric vehicles (EVs) have a range of up to 250 miles, are agnostic on charging technology and vehicle-to-grid enabled. Marc Bedard, CEO and founder of Lion, said in the statement, "This vehicle delivery for Amazon represents a very significant milestone for Lion. Amazon is a leader in adopting decarbonizing technologies that can improve sustainability among their trucking fleet. Our all-electric trucks will be a valuable addition to Amazon's trucking operations as they work to deliver on their sustainability goals… Designing and manufacturing all-electric vehicles is a challenging and lengthy process. We've been at it for more than 10 years now; we know what works in practice, but also what only works on paper. We are in a unique position to disrupt the heavy-duty truck segment by offering an unmatched all-electric product, as we have already done in the school bus segment." In addition, Fleet Owner reports that Lion Electric has a new deal with ABB, an electric charging infrastructure provider, to supply charging equipment for customers. A Lion Electric energy specialist, Christopher Ralph, is cited as saying that the move enables Lion to provide an end-to-end charging infrastructure solution; Lion Energy can develop, design and install an area for fleets to park and charge. "We can customize and project manage the solution from end to end. When I say customize, we know your vehicles. We know that they have different operational requirements and that they have different needs, different routes, different tasks, and they are all doing different things on a day-to-day basis," Ralph is quoted as saying. Lion's experience includes more than 300 electric school buses in the US and Canada, and this Amazon deal provides a more high-profile contract. Amazon has made a pledge to decarbonize its transportation operations across its global business by 2040, and Amazon has been making good on those efforts with purchases of EV trucks and vans from a variety of automakers. Amazon's partnership with Rivian garnered the most headlines. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Mexico's National Committee of Banks and Securities (Comisión

Nacional Bancaria y de Valores: CNBV) on 23 September announced a

second loan restructuring program. The new program either extends

measures taken in March 2020 or introduces new regulatory easing.

(IHS Markit Banking Risk's Alejandro Duran-Carrete)

- The capital conservation buffer requirement will be maintained at zero until the end of 2021, rather than the previously introduced limit of the end of 2020, while banks' liquidity coverage ratios may now remain temporarily below 100% until March 2021.

- New regulatory processes permit the reduction of specific reserve requirements for restructured loans and allow banks to treat additional provisioning as capital. These measures reflect a request from the Mexican Banking Association (Asociación de Bancos de México: ABM) for such regulatory relief.

- The measures will be supported by the Central Bank of Mexico (Banco de México: Banxico), which stated on 15 September that it will extend its COVID-19 liquidity facilities until February 2021.

- The new program reflects the slower-than-expected recovery in Mexico's economy. Mexico's recession is now likely to extend, at least, until the first quarter of 2021, increasing pressure on borrowers. Credit deterioration will also be increased by the government's decision to not offer a fiscal package to aid corporations (and has even increased tax burdens this year).

- Roughly one-quarter of the sector's total lending was deferred between March and April 2020, and IHS Markit expects a substantial proportion of deferred loans to be renegotiated. This indicates severe distress in the sector, which is likely to translate into high impairment when forbearance measures are ended. We assess that the second wave of renegotiations is risk positive for banks, giving them time to increase their provisioning, set strategies to reduce losses, and start screening for more distressed loans.

- The sector started the pandemic from a strong position to resist credit deterioration. In June 2020, non-performing loans (NPLs) constituted 1.9% of total loans and the coverage ratio was 158%. Net NPLs made up 5.2% of shareholders' equity. The capital adequacy ratio was 16.5%, its highest level since 2013, aided by a tier-1 ratio of 14.8%.

- Moody's Investors Service has downgraded Bolivia's sovereign

risk rating from B1 to B2 (57.5 on IHS Markit's generic scale) as a

result of recent social and political unrest, which clouds the

economic outlook, as well as a rapid deterioration of external

buffers. (IHS Markit Economist Rafael Amiel)

- The deterioration in Bolivia's foreign reserves is of particular concern given the economy's reliance on commodity exports and its stabilized exchange rate of BOB6.9:USD1.00, which IHS Markit considers significantly overvalued.

- Moody's assesses that the current level of reserves is no longer sufficient by all metrics; furthermore, the economy is at risk of capital flight. Reserves amounted to USD3.6 billion in July, down from USD13 billion in 2014. In relative terms, foreign-exchange reserves have come down from 40% of GDP to 9% of GDP.

- Bolivia's creditworthiness was also based on fiscal buffers, which Moody's reports declined from 27% of GDP in 2013 to 10% of GDP in 2019. During this period, public debt increased from 38% of GDP to 57.7%.

- The current account has been in deficit since 2015 because of expansive public spending during a time of falling hydrocarbon revenues, due mainly to low prices.

- Moody's forecasts that the fiscal deficit and public debt will amount to 13.5% of GDP and 72% of GDP, respectively, in 2020, driven by the COVID-19 virus outbreak and relatively weak hydrocarbon sector revenues.

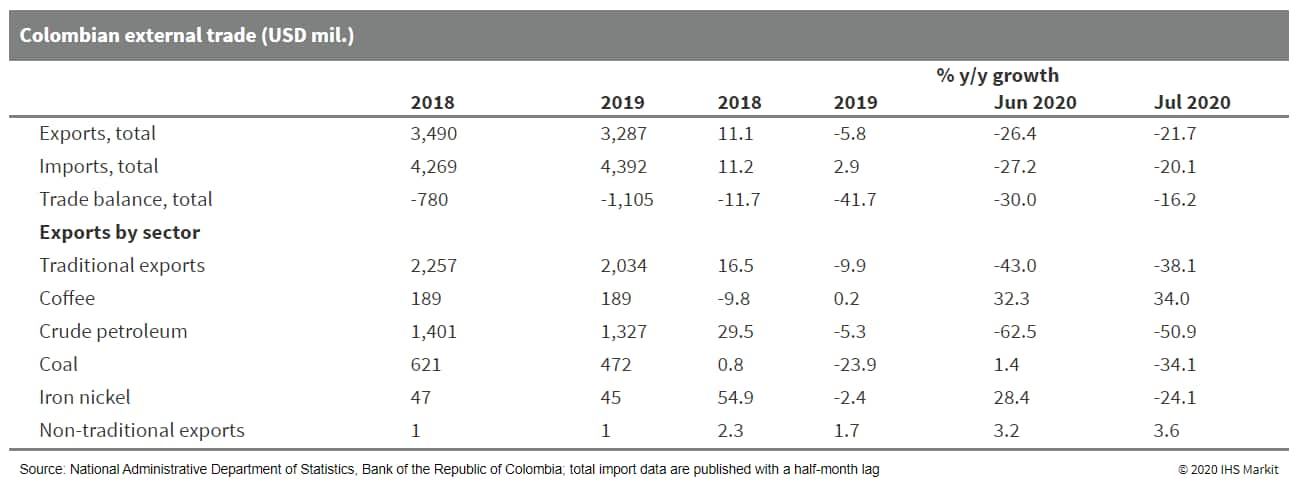

- Colombian imports of consumer goods, intermediate goods, and

capital goods began to recover month on month (m/m) in July after

hitting a low in May and barely moving in June. (IHS Markit

Economist Lindsay Jagla)

- Overall imports increased 25.8% m/m in July, according to data from the Colombian National Administrative Department of Statistics (Departamento Administrativo Nacional de Estadística: DANE). Imports of consumer goods (+28.8%), intermediate goods and primary materials (+21.6%), and capital goods and construction materials (+28.9%) all expanded compared with June.

- Exports, which have gradually been increasing since reaching a trough in April, grew 11.9% m/m in July, driven primarily by slowly increasing oil prices and recovering external demand as economies began to reopen globally.

- The recovery of imports in July, especially consumer,

intermediate, and capital goods, reflects some reactivation of the

Colombian economy in terms of consumption and investment as well as

a resumption of production as isolation measures imposed to stem

the coronavirus disease 2019 (COVID-19) virus outbreak were

gradually lifted throughout the summer. The Purchasing Managers'

Index (PMI) also shows this increase in economic activity,

remaining in expansionary territory in May, June, and July as

output and quantity of purchases grew.

- Brazil's pigmeat industry is enjoying a bumper year. Favored by the exchange rate and soaring external demand, the sector is largely unscathed by the Covid-19 pandemic - with new records being set for both export volumes and domestic pig prices. Pork exports in the first eight working days of September performed well, as shown by the data of the Secretariat of Foreign Trade (Secex) and in line with expectations that the country will benefit from the African Swine Fever (ASF) outbreak in Germany. Daily shipments of unprocessed pork reached 4,123 tons, up 54.61% year-on-year. The price paid per ton averaged USD2,316.8/ton, down 0.2% y/y but 3.6% higher than in August. From January and August, Brazil shipped 599,213 tons of fresh pork, and if shipments continue at the daily pace for the entire month of this month, Brazil will have exported more in the first nine months of 2020 than during the all year of 2019, when 656,992 tons were exported. With many key markets now closed to German pork, Brazilian exporters can expect to make further gains in Asia - although the US may be the biggest winner in China. On the animal supply side, live hog prices remain at record high levels - although markets were little changed last week. Wholesale pork prices also held onto recent gains but may be nearing the limit of what is affordable to many Brazilian consumers. In the state of Santa Catarina, wholesale pork quotes remained at BRL12.40 (USD2.31)/kg* for the week ending 18 September while live hogs stayed at BRL7.10 (USD1.32)/kg*. (IHS Markit Food and Agricultural Commodities' Ana Andrade)

- As per IHS Markit's Commodities at Sea, Chilean iron ore and concentrates shipments during the first eight months of 2020 are calculated at 9.1mt, up 67% from previous year levels. The rebound in Chilean iron ore shipments this year is on the back of resumption in loading activities from Huasco' s Guacolda Terminal 2 and strong Chinese demand for high-grade iron ore cargoes. Compañía Minera del Pacífico (CMP) iron ore & concentrates shipments were significantly impacted since Nov 2018, because of an accident due to which ship loader at the Huasco's Guacolda Terminal 2 went unavailable for the entire 2019. In absence of this major loading facility, CMP had to shift operations to its other terminals (like Las Losas Terminal). During 2019, the company had to incur additional operational as well as freight costs due to the unavailability of Guacolda Terminal 2 but benefited from the surge in international iron ore prices after high-grade Fe ore availability tightened because of the Vale's Brumadinho dam disaster. Huasco's Guacolda Terminal 2 resumed operations from January 2020 this year. Total Chilean iron ore and concentrates shipments in terms of import countries, in the first eight months of this year were 92% to China (versus 88% a year ago), and the rest were shipped to Japan, Algeria, USA, and South Korea. In terms of vessel segments, Newcastlemax and Capesize for the same duration garnered share of 27% (versus 15% a year ago) and 68% (versus 72% a year ago), respectively in the total tonnage shipped outside Chile. Chinese steel mills are scouting for ownership in iron ore mines as far as in South America as prices of iron ore remain strong. Iron ore is the main steel-making ingredient for the steel mills. In August 2020, HBIS Resources, a unit of China's second-biggest steelmaker HBIS Group, signed an initial deal to develop the Pampa de Pongo iron ore mine in Peru alongside current license-holder Zhongrong Xinda. Both companies to jointly develop mine as well as construct the port. This is the first investment from HBIS Group in South America. Overall, during 3Q20 and full 2020, Chilean iron ore and concentrates shipments are forecasted at 3.5mt and 13.9mt, respectively. An increase in shipments to employ 17 Newcastlemax (versus eight last year) and 85 Capesize vessels (versus 52 last year). (IHS Markit Maritime & Trade's Rahul Kapoor and Pranay Shukla)

Europe/Middle East/Africa

- European equity markets closed lower; UK -1.3%, France -0.8%, Germany -0.3%, Spain -0.2%, and Italy -0.1%.

- 10yr European govt bonds closed mixed; Italy +3bps, France/Spain +1bp, and UK/Germany flat.

- iTraxx-Europe closed +3bps/61bps and iTraxx-Xover +23bps/355bps.

- Germany's headline Ifo index, which reflects business

confidence in industry, services, trade, and construction combined,

has increased for the fifth consecutive month, from 92.5 in August

to 93.4 in September. This means that business confidence has not

regained February's pre-pandemic level of 95.9 yet, let alone the

long-term average of 97.1. The Ifo Institute summarized the results

by saying that "the German economy is stabilizing despite rising

infection numbers". (IHS Markit Economist Timo Klein)

- Expectations increased by 0.5 point to 97.7, which is now the highest level since November 2018. Expectations improved the most in the wholesale sector, as well as in manufacturing and construction. Services-sector expectations, in contrast, experienced a small setback after their major rebound during May-August. Meanwhile, the overall current conditions index improved from 87.9 to 89.2, which is a smaller margin than the average monthly increase by 3.0 points during June-August. The latest level remains well below February's 98.8 prior to the COVID-19 virus outbreak.

- The breakdown of overall indices by sector, which combines expectations and current conditions, also reveals that wholesale-sector confidence improved the most in September, followed by manufacturing and construction. In contrast, the retail and service sectors, which had benefitted the most in May-June from the loosening of lockdown restrictions, only stagnated or even slipped slightly. Nevertheless, service-sector confidence remains ahead of the others in level terms, followed by construction.

- The Ifo graph portraying the cyclical position of the diffusion index of the headline measure - setting the current conditions and expectations balances against each other - signals that the economy has returned firmly to boom territory because both components are clearly positive now. The assessment of current conditions improved anew from 0.4 to 3.2, while expectations increased from 3.9 to 4.9. That said, as these levels are only in single rather than double digits, confidence remains at risk of turning negative again if COVID-19 cases extend their recent increase, leading to a renewed tightening of administrative restrictions that would harm economic activity.

- September's Ifo survey results signal that the German economy remains on an upward path but that recovery momentum is slowing and a return to pre-pandemic activity levels will take considerable time.

- Traton Group and TuSimple announced a global partnership regarding autonomous trucks, which will involve Scania trucks testing the technology. According to a joint statement, the partnership is the first of its kind in Europe, with a global OEM working with an SAE Level 4 autonomous technology company. The two are launching a development program to operate the first SAE Level 4 autonomous hub-to-hub route from Södertälje to Jönköping in Sweden. The route will use Scania trucks. Although financial details were not disclosed, it was confirmed that Traton will take a minority stake in TuSimple. Matthias Gründler, Chief Executive Officer of Traton, said in the statement, "The global partnership with TuSimple is another step towards becoming a Global Champion. Innovative future technologies that provide additional value to our customers represent a key part of our strategy." Cheng Lu, president of TuSimple, said "Our partnership with TRATON GROUP accelerates the introduction of autonomous truck technology to new international markets, and we look forward to our global partnership." This agreement moves Traton forward on testing autonomous technology in Europe, and the stake in TuSimple could prove to be valuable for Traton independently if TuSimple grows and its technology is commercialized. Although it was not referenced in the announcement, TuSimple also has a partnership with US commercial truck-maker Navistar, and Traton and Navistar are in negotiations on Traton acquiring Navistar. (IHS Markit AutoIntelligence's Stephanie Brinley)

- BMW's Leipzig plant will start battery module production in 2021, with the company planning investment of more than EUR100 million by 2020 in e-drive production at the plant. The investment will expand BMW's Germany-based production capacity for electric drivetrains. BMW head of planning and production engines and e-drives, Michael Nikolaides, said in a statement announcing the investment, "We are consistently ramping up the production of e-drives to meet our ambitious electric mobility targets. Just recently, we opened our Competence Center for E-drive Production in Dingolfing and doubled the production capacity for high-voltage batteries at BMW Brilliance Automotive in China by opening another battery center. Now we are also stepping up our battery production output in Germany." With this investment, Leipzig will join BMW's locations in Dingolfing (Germany), Spartanburg (US), and Shenyang (China) as part of BMW's in-house battery production network. BMW also noted that by 2025, one in three BMW vehicles sold in Europe will have an electrified drivetrain. (IHS Markit AutoIntelligence's Stephanie Brinley)

- A survey shows that the majority of Germans would buy cell-cultured meat. As consumer attitudes change in Europe, a new survey shows the majority Germans are limiting their consumption of conventionally-produced meat - with more than half also open to the concept of eating cell-cultured alternatives. The research, published in the journal Foods by an international research team from the University of Bath (UK), Université Bourgogne Franche-Comté (France), and Ipsos (Germany), finds that there is growing acceptance of non-meat diets, both in Germany and France - although a strong sense of tradition and culture still hold sway in terms of attitudes, particularly in France. For the study, researchers surveyed 1,000 people in each country, asking them a series of questions about their current and intended dietary habits, as well as about their thoughts on cultured meat, which is produced without raising and slaughtering animals. Their analysis found that just 45% of German respondents identified as full meat-eaters, with a further 31% now actively following flexitarian or reduced-meat diets. Meat consumption was more common in France, where 69% identified as full meat-eaters, with 26% following a flexitarian diet. The research also reveals promising markets for cultured meat in both countries. Although the majority of consumers in France and Germany had still not heard of cultured meat, 44% of French respondents and 58% of German respondents said that they would be willing to try it, with 37% of French consumers and 56% of Germans willing to buy it themselves. The publication notes that per-capita meat consumption has been trending down in Germany for several decades. Now, for the first time, evidence suggests that German consumers who are not deliberately limiting their meat consumption are in the minority. In France, almost half of meat-eaters aim to cut down on their consumption of animal-based products in the future, although attitudes in the population as a whole are harder to shift. (IHS Markit Food and Agricultural Commodities' Max Green)

- The French business confidence indicator has improved from 90

in August to 92 in September, its highest level since March. The

indicator has recovered strongly since hitting 53 in April, but

remains well below its level of 105 during the first two months of

2020. (IHS Markit Economist Diego Iscaro)

- Confidence has improved in all the sectors included in the composite index (manufacturing, services, wholesale/retail trade, and construction). However, these improvements have mainly been driven by large increases in the indices measuring past activity, while more forward-looking indices are less rosy.

- This is particularly true in the services sector, where the index measuring past activity has jumped from -25 to +1, while the indices related to expected activity (down by 3 points), demand (-2), and the general outlook (-2) have all deteriorated in September.

- In the manufacturing sector, the indices measuring orders overall and foreign order books have improved by 4 and 9 points, respectively, while the general production expectations index has also improved by 2 points. Both indices remain well below their long-term average. On the other hand, the index measuring personal production expectations has declined for the second consecutive month, by 10 points.

- Although the increasing number of COVID-19 cases since August has not resulted in a reversal in business confidence, the impact on the more forward-looking parts of the survey is clear. The risk is that increasing concerns about the outlook may take their toll on firms' hiring and investment decisions, with negative implications for activity.

- The Swiss National Bank (SNB) in its regular quarterly review

has not changed the policy or deposit rates but stressed that it

will continue to provide the banking system with "ample" liquidity

via its COVID-19 refinancing facility (CRF) and occasionally also

via the repo market. It also emphasized its motivation to buffer

the negative consequences of the pandemic on the business cycle and

inflation, stating that the CRF together with government loan

guarantees have substantially helped to provide the economy with

credit and liquidity. (IHS Markit Economist Timo Klein)

- Both the Swiss average rate overnight (SARON), the key policy rate, and the sight deposit rate are kept at -0.75%. The SNB is also maintaining the higher exemption thresholds (compared with pre-pandemic levels) up to which banks do not need to pay any negative interest on their sight deposits at the SNB (an allowance factor of 30). This has reduced banks' payments to the central bank and thus their cost burden despite the persistence of a deeply negative interest rate environment. Furthermore, the SNB is maintaining the deactivation of the counter-cyclical (equity) capital buffer that banks are normally required to keep in order to counteract asset overvaluation risks in the Swiss mortgage and real-estate market.

- The SNB currently calls the Swiss franc "persistently highly valued" (refraining, as in the March and June reviews, from using the term "overvalued") and said that it is "prepared" to intervene more strongly in the currency market, taking into account the "overall" situation in the foreign exchange markets.

- The central bank repeats anew that there currently is an unusually large degree of uncertainty with respect to growth and inflation predictions. It highlights that GDP levels worldwide declined by between 10% and 20% in the second quarter compared with the end of 2019, but also that short-time work programs in many countries have limited the increase in unemployment and that GDP will rebound strongly in the third quarter of 2020 owing to a loosening of COVID-19 virus-related restrictions.

- The basic assumption that the SNB makes for its projections is that it will be possible to keep the pandemic under control without having to return to the severe lockdown conditions observed in most countries during March-April. The central bank stresses the important supportive role played by monetary and fiscal easing worldwide, although this will still not prevent the underutilization of capacity and low inflation "for an extended period".

- Total says it will invest more than €500 million ($584 million) converting its Grandpuits refinery in France into a facility for the production of bioplastics, biofuels, and the chemical recycling of plastics. Crude oil refining at the facility will stop in the first quarter of 2021, with the storage of petroleum products to cease in 2023, it says. The conversion will be complete by 2024, Total says. An audit conducted over several months on a 260-kilometer pipeline carrying oil from the port of Le Havre to the refinery found that replacing it would cost nearly €600 million. The refinery was unable to operate for five months last year due to leaks from the pipeline, it says. The planned 100,000-metric tons/year polylactic acid (PLA) bioplastics plant will be constructed by Total Corbion PLA (Gorinchem, Netherlands), an equal joint venture (JV) between Total and Corbion, and start operations in 2024. It will be Europe's first PLA manufacturing plant, according to Total. PLA is produced entirely from sugar, is biodegradable and recyclable, with a market growing at up to 15% per year, Total says. "Demand is rising fast, particularly in the markets for film wrap and rigid packaging and in numerous industrial applications," it says. The JV launched its first 75,000-metric tons/year PLA production plant in Rayong, Thailand, in 2018, with the second unit set to make Total Corbion the world's largest producer of PLA, it adds. The planned plastics recycling plant will be France's first chemical recycling facility, with the unit to be majority owned by Total with a 60% share and UK-based partner Plastic Energy holding 40%. The facility will convert plastic waste using pyrolysis into a liquid known as Tacoil, which will then be used as feedstock for the production of polymers. The new unit will help Total meet its objective of producing 30% of its polymers from recycled materials by 2030, it says. The planned biorefinery will feature a renewable diesel unit, primarily producing sustainable aviation fuel. To be commissioned in 2024, it will produce up to 170,000 metric tons/year of aviation fuel and 120,000 metric tons/year of renewable diesel. Up to 50,000 metric tons/year of renewable naphtha will be produced for bioplastics manufacturing. The unit will process primarily animal fats from Europe and used cooking oil, supplemented with other vegetable oils.

- According to Statistics Finland, Finland's current account in

the second quarter turned into a deficit of EUR807 million

(USD942.6 million), which marks a narrowing of nearly 80% year on

year (y/y) and 50% quarter on quarter (q/q). The first-half-2020

shortfall of EUR2.4 billion is 34% lower than in the first half of

2019. (IHS Markit Economist Venla Sipilä)

- After registering a deficit in the second quarter of 2019, the goods trade balance turned into a surplus of EUR994 million in the second quarter of 2020, as imports fell faster than exports. Meanwhile, the fall in services imports was not able to keep up with the contraction of 28% y/y in services exports, and the services account deficit widened y/y.

- Primary income outflows fell particularly sharply and the primary-income-account deficit narrowed y/y, although the deficit represents a deterioration compared with the first quarter's surplus. Interests and dividends on portfolio investments account for the most important category of primary income outflows, while property income flows related to direct investments were important in determining inflows.

- In the second quarter, there was a net capital inflow of EUR2.2 billion, which was mostly driven by inflows of portfolio investments, in the form of liabilities in bonds and money market instruments. Meanwhile, there was a net capital outflow of other investments of EUR5.2 billion, and a net foreign direct investment (FDI) outflow of EUR1.6 billion.

- At the end of the second quarter, Finland's net international investment position was negative by EUR2.0 billion, with its gross foreign assets standing at EUR844.6 billion and liabilities at EUR846.6 billion. The net international investment position fell compared with the previous quarter, when it had stood at EUR3.8 billion, mostly owing to falling stocks of derivatives and other investments.

- The results for second-quarter external finances reflect the impact of the COVID-19 virus crisis. Finland's current account strengthened as the fall in imports, which reflects weakness in domestic demand, offset the effect of decreased exports.

- Mobileye has signed a memorandum of understanding (MOU) with Al Habtoor Group (AHG) for strategic co-operation to bring mapping technologies for advanced driver assistance systems (ADAS), autonomous vehicles (AVs), and smart city solutions to the United Arab Emirates, reports Khaleej Times. The partnership aims to create a fleet of autonomous 'robotaxis' that can run in Dubai by the end of 2022. Amnon Shashua, senior vice-president at Intel Corporation and president and CEO of Mobileye, said, "This historic collaboration between Mobileye and Al Habtoor Group presents an opportunity to transform UAE cities by accelerating smart city development and advancing transportation services with cutting edge technology. The insights Mobileye mapping technology will unlock for Al Habtoor, combined [with] future self-driving mobility solutions, together have the potential to greatly enhance the daily lives of citizens in the region." As part of the agreement, vehicles equipped with Mobileye technology will be deployed in the region and will gather smart city data to gain valuable insights to improve road safety and help in the development of driverless Mobility-as-a-Service (MaaS) solutions. In the starting phase, 1,000 vehicles will be equipped with Mobileye's system to map Dubai and collect data. The collaboration will include smart city solutions, equipping vehicles with Mobileye 8 Connect (a collision-avoidance system that also collects data for safer driving, AV mapping, and city planning); AV testing, which is scheduled to start in 2021, where Mobileye-powered AVs are expected to be deployed in Dubai for public-road testing; MaaS testing, which is expected to start in 2022, with final validation to prepare for a commercialized service; and autonomous MaaS launch and scaling, which will include the assimilation of all insights gained in the first three phases of the collaboration to launch a Mobileye-powered autonomous mobility service for UAE consumers in 2023. (IHS Markit Automotive Mobility's Tarun Thakur)

Asia-Pacific

- APAC equity markets closed lower; India -3.0%, South Korea -2.6%, Hong Kong -1.8%, Mainland China -1.7%, Japan -1.1%, and Australia -0.8%.

- The Bank of Thailand (BOT) has left its monetary policy

unchanged. Although the Thai economy has picked up, the bank's

outlook for weaker recovery could mean that its extra accommodative

monetary policy will continue. (IHS Markit Economist Harumi

Taguchi)

- The BOT maintained its monetary policy rate at 0.5% at its monetary policy committee (MPC) meeting on 23 September. The bank is now anticipating a slightly softer contraction for the Thai economy in 2020 than in its previous projection, but it expects weaker recovery in 2021 because of difficulties in returning figures for foreign tourists to previous levels.

- The BOT maintained its view that economic recovery would vary significantly among sectors, and that it would take at least two years to return to pre-pandemic levels. While its inflation outlooks were revised up slightly on the back of increasing energy prices in line with improved demand, the bank assesses that headline inflation will rise gradually close to the lower bound of its 1-3% target range in 2021, as previously expected.

- The BOT also maintained its views that its extra accommodative monetary policy, as well as fiscal, financial, and credit measures, has helped mitigate the adverse effects of the pandemic. That said, risks remain to the downside as the bank is concerned about the second wave of outbreaks, the vulnerability of financial stability under the weak economic outlook, and the appreciation for the Thai baht (although it has depreciated since the August MPC).

- BOT's decision was in line with IHS Markit expectations, given that economic indicators show more signs of improvements in economic activities. While the low inflation outlook will enable the bank to maintain its extra accommodative monetary policy, the bank appears to be anticipating an upside from the government's targeted and timely measures rather than a lower policy rate, reflecting its view that economic recovery would vary significantly among sectors.

- The BOT is concerned about the deterioration of household debt service capability and ineffective liquidity distribution to businesses and households, although high levels of liquidity in the financial system will remain effective to support businesses and employment. Whether financial institutions can expedite debt restructuring for households and businesses as the BOT anticipates could be a key for lowering risks to financial stability.

- South Korean tire manufacturer, Hankook Tire, has announced its collaboration with data and testing firm, SK Planet. According to a Hankook statement, the companies will create a solution called the Road Risk Detection Solution that is capable of pre-emptively detecting potentially hazardous risks on the road. This new system can analyze road noise acquired from a moving vehicle through artificial intelligence (AI) and deep learning technology to identify potential risk factors on the road such as rain, snow, black ice, accidents, and other factors that may contribute to hazardous situations. This information is then transferred in real-time to various public departments related to road safety and maintenance for a response such as removing excess snow or repairing potholes. Hankook will provide diverse noise data to SK Planet and contribute to improving the accuracy of this AI-based technology by collecting data from its test driving tracks in Geumsan (South Korea), and in Ivalo (Finland). (IHS Markit AutoIntelligence's Jamal Amir)

- Kia has returned to normal production operations at the two plants in Gwangmyeong (South Korea), following days of suspension due to COVID-19 cases, reports the Yonhap News Agency. The number 1 plant in Gwangmyeong resumed operations on 22 September and the number 2 plant on 23 September, as no more infections were reported at the plants, according to an unnamed Kia spokesperson. The two plants in Gwangmyeong have a combined vehicle production capacity of 320,000 units a year. Kia produces the Carnival multi-purpose vehicle (MPV), K9 sedan, and Stinger sports sedan at the number 1 plant, while it produces the Pride hatchback and Stonic sport utility vehicle (SUV) at the number 2 plant. Kia halted production operations at the two plants in Gwangmyeong from 16 September, with all of the 6,000 plant workers staying at home, after some of its workers were confirmed to have contracted COVID-19. The report highlights that 11 assembly line workers were confirmed to have been infected. The number of related cases reached 18, as their family members and acquaintances also caught it. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-september-24-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-september-24-2020.html&text=Daily+Global+Market+Summary+-+September+24%2c+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-september-24-2020.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - September 24, 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-september-24-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+September+24%2c+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-september-24-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}