Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 20, 2022

Demand Shortfall indices suggest manufacturing downturn could accelerate rapidly

New S&P Global PMI™ Comment Trackers provide unique insights into the key macroeconomic trends shaping the global economy. The trackers are derived from qualitative evidence provided by PMI survey panellists around the world, comprising in excess of 30,000 business executives and decision makers in over 40 countries. The trackers help to better understand the causes of changing business conditions, including the impact of changing supply chain conditions, price and demand drivers and recession risks. Demand shortfall trackers, analysed in more detail here, in particular give unique insights into why global demand indicators are currently presenting a worsening economic outlook.

Calculating the trackers

Alongside the standard response data to S&P Global's monthly Purchasing Managers' Index™ (PMI) business surveys, companies are invited to provide additional qualitative information on the reasons as to why these variables (such as output, new orders and employment) have changed from the previous month. A panel comments tool tracks the frequency of words or phrases mentioned in these qualitative replies.

Every index is calculated as a multiple of its long run average, which is set equal to a value of 1.0. A reading of 5.0, for example, therefore suggests that the issue being tracked is being mentioned by survey participants five times more than average.

Demand Shortfall indices

The Global PMI Comment Trackers are organised into five themes to demonstrate the state of the global business cycle. These themes are: Capacity Expansion, Demand Shortfall, Inflation, Supply Shortages and Inventories. In September, we focused on the unique insights that the Supply Shortages dataset has provided throughout the COVID-19 pandemic - you can read our analysis here.

This month we put the spotlight on our Demand Shortfall trackers, which aim to detail the impact of key influences on business demand worldwide. These trackers span a wide range of topics, such as price pressures, spare capacity, cost cutting, recession risk and uncertainty.

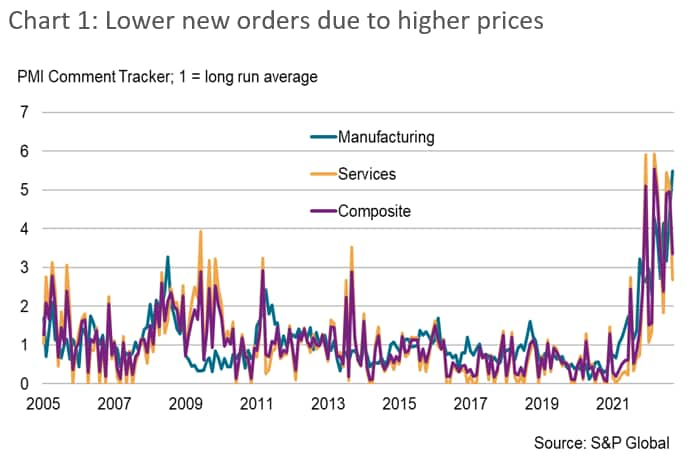

The trackers in chart 1 show the frequency at which survey panellists are mentioning higher prices as a contributing factor to a fall in new order volumes. Amid steepening global inflation and the resulting cost-of-living crisis, mentions by panellists of higher prices as a cause of poor demand have risen dramatically across both the manufacturing and services sectors in 2022. Among manufacturers, reports of lower new orders due to higher prices increased to a record high of 5.5 times the long-run average in September, suggesting that inflationary pressures are leading to rapid cutbacks in global client demand.

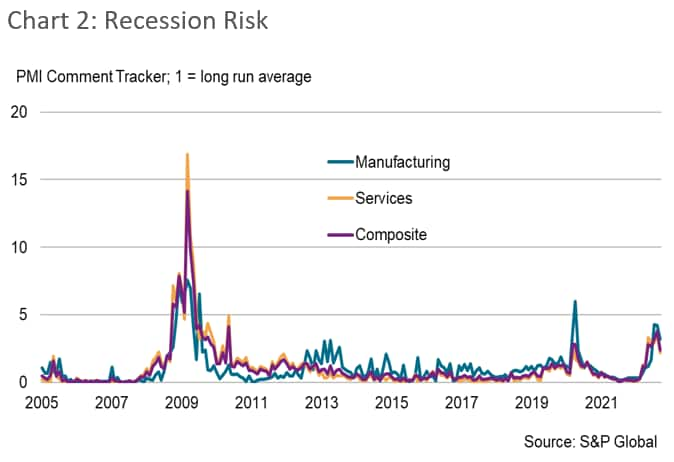

Chart 2 showcases our Recession tracker, which looks at mentions of "recession" from our global survey panellists in response to our standard PMI questions. At the composite level, the tracker posted its highest reading since May 2010 at 3.8 in August, before falling to 2.4 in September. Whilst indications that businesses expect a recession are still well below the peak observed during the global financial crisis, they have risen steeply since the turn of the year (0.16) and are now greatly in excess of the long-run average. With expectations rising, companies are likely to be more cautious around spending which should feed into a drop in global demand.

Global manufacturing output amid demand shortfalls

Comparing the demand shortfall trackers against the J.P.Morgan Global Manufacturing PMI™ Output Index (which is achieved through taking an average of the readings for each tracker in a given month, across the 11 unique Global Manufacturing Comment Trackers within the demand shortfall theme), we note an inverse relationship: a higher average reading of the trackers within the demand shortfall theme usually corresponds to a lower reading of the Manufacturing Output Index (see chart 3).

The relationship between the two is even more visible during the Global Financial Crisis and the COVID-19 pandemic, when the average demand shortfall tracker recorded peaks of 2.8 and 2.5, respectively. At the same time, the Global Output Index bottomed out at 29.5 and 32.5 respectively.

However, recently, while demand has thinned out greatly, especially since March, manufacturing output has recorded only modest contractions, breaking from the trend observed previously for such Demand Shortfall readings as those seen recently.

Continuing to post comfortably above the series average since late last year, the average demand shortfall tracker for manufacturing registered some of the highest readings on record, especially in recent months. Yet, manufacturing output has remained resilient throughout this period, and any monthly contractions have been mild.

Using the PMI Comment Tracker, we explain why the manufacturing sector has not yet experienced a steep downturn as one would have expected per the historical movements.

Persistent backlogs appear to soften downturn

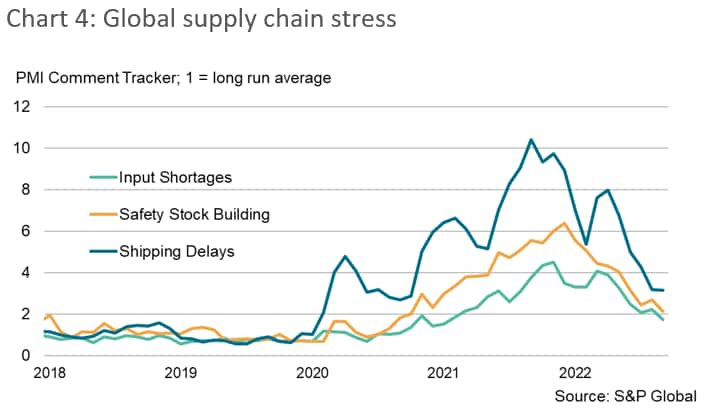

To understand the discrepancy, we need to go back to the pandemic months when businesses realised how greatly exposed they were to the fragilities within the global supply chains. Shipping congestion increased dramatically as governments' imposed lockdown measures, while reduced global production led to severe shortages of inputs. In order to avoid any potential disruptions, firms were keen to build safety stocks. This is shown in chart 4, with firms mentioning safety stocks peaking at 6.4 times the long run average during December last year.

Despite falling rapidly in 2022, these trackers signal that global supply chains are still under duress from the lasting impact of the pandemic. Indeed, anecdotal evidence suggests that firms are still receiving heavily delayed inputs bought in earlier stages of the pandemic. As a result, firms have been slow to meet strong demand conditions, despite safety stock building, which has led to continued rises in backlogs of work even as new orders have fallen.

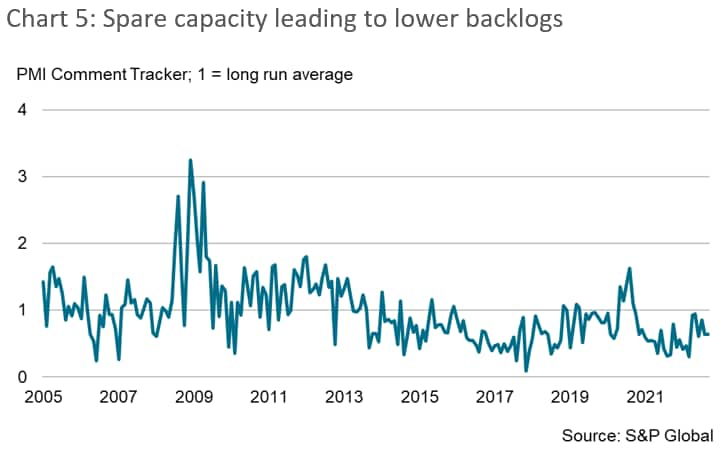

Chart 5 shows another of our Demand Shortfall trackers, which measures mentions by firms of reduced backlogged orders due to increased spare capacity. This tracker has posted below 1.0 in each month since October 2020 and recorded 0.64 in September, in contrast with other periods of economic downturn where firms' ability to cut backlogs has generally expanded. This suggests that capacity remains stretched in some sectors and that firms still have long pipelines of work to complete, helping to explain why the downturn in manufacturing has been soft so far.

Outlook

Nevertheless, we are likely to see the recent mild downturns in production levels gain momentum as supply chain conditions continue to improve and backlogs begin to fall, signalling more pronounced and steep declines in the year ahead barring a swift improvement in new order inflows. The high interest rate environment, inflationary pressures, and economic uncertainty will also continue to have a chokehold on consumer demand. Thus it is likely that further mentions of demand shortfall will be reported in the coming months from around the world.

Broader database

The PMI Comment Trackers analysed in this note form only a small part of the overall dataset, which includes over 100 additional indices tracking themes such as supply shortages, energy prices, wage inflation and investment plans.

This dataset is available only via subscription. Please contact economics@spglobal.com for further information.

David Owen, Economist, S&P Global Market Intelligence

Tel: +44 2070 646 237

Maryam Baluch, Economist, S&P Global Market Intelligence

Tel: +44 1344 327 213

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdemand-shortfall-indices-suggest-manufacturing-downturn-could-accelerate-rapidly-october2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdemand-shortfall-indices-suggest-manufacturing-downturn-could-accelerate-rapidly-october2022.html&text=Demand+Shortfall+indices+suggest+manufacturing+downturn+could+accelerate+rapidly+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdemand-shortfall-indices-suggest-manufacturing-downturn-could-accelerate-rapidly-october2022.html","enabled":true},{"name":"email","url":"?subject=Demand Shortfall indices suggest manufacturing downturn could accelerate rapidly | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdemand-shortfall-indices-suggest-manufacturing-downturn-could-accelerate-rapidly-october2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Demand+Shortfall+indices+suggest+manufacturing+downturn+could+accelerate+rapidly+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdemand-shortfall-indices-suggest-manufacturing-downturn-could-accelerate-rapidly-october2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}