Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 03, 2019

Dry Bulk Trade: Record Brazil Corn Shipments a Warning Signal for Q4 US Grain Season

We are seeing warning signs in the traditionally strong fourth quarter of the Panamax freight market, as the strength of Brazilian grain exports seen in the third quarter could weaken US grain exports in the fourth quarter.

Brazilian corn chartering activities has been one of the main drivers for the current strong grain freight market. A record harvest, competitive pricing, and much-improved logistics in recent years have allowed Brazil to export 7.65 million tonnes of corn in August, the highest monthly amount ever, according to Brazil’s economic ministry.

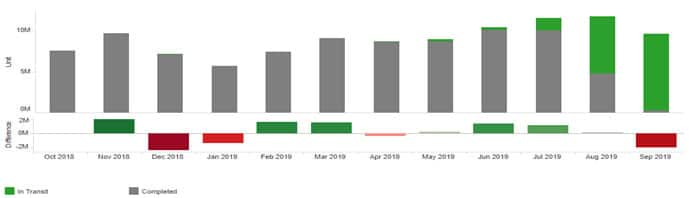

Based on commodities trade flow intelligence, IHS Markit Commodities at Sea, Brazilian corn exports, mostly carried by Panamax and Supramax, are expected to decline in the coming months eventually after peaking in August, while US grain exports are expected to increase in the fourth quarter as the price spread against Brazil has narrowed from the last few months with harvest season starting in the US.

However, very slow US corn sales for the next marketing year are still a main concern for US farmers, caused by heightened competition and the impact of African swine fever.

Brazil grain exports to decrease in coming months after peaking in August

Source: IHS Markit Commodities at Sea

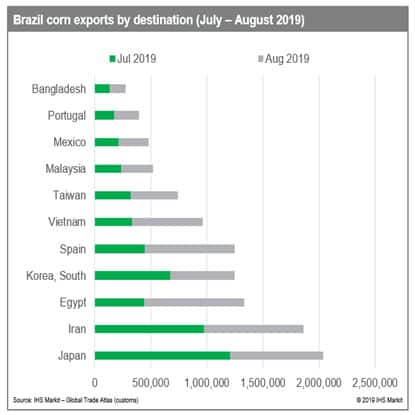

Japan has been one of the top importers of US corn, although its appetite for US crop is currently at lower levels because of the availability of much cheaper Brazilian corn.

According to IHS Markit Global Trade Atlas, US corn exports to Japan has decreased since May 2019. On the other hand, Japan has become the top destination for Brazilian corn for July and August 2019. It explains the reason behind US President Donald Trump’s recent request for Japan to purchase more US corn.

In our view, there will be an increase in US corn exports to Japan and possibly to China as part of the trade deal, but any growth in feed use in China with US grain is expected to be limited by African swine fever.

China’s hog production has dropped significantly and other Asian countries, including South Korea and the Philippines, have also suffered from the pig disease.

Source: IHS Markit Global Trade Atlas

IHS Markit Freight Rate Forecast for Panamax is currently taking the following view:

- We are likely to see new seasonality of world grain trade flow this year. The strength of East Coast South American and Black Sea grain chartering season in the third quarter will result in the weakening of US grain chartering activities in the fourth quarter.

- Japan and China could increase grain imports from the US as part of the trade deal, but the total import amount will be limited as many consumers have already bought large volumes of grains from alternative sources, including Brazil, and any growth in animal feed use will likely decrease because of the large reduction in hog production caused by African swine fever.

- Overall, Panamax freight rates are expected to stable in the short-term with strong ECSA grain chartering activities and speculative coal demand in China. However, there remains a downside risk in the medium-term, with weak US grain demand and potential Chinese coal import control in the fourth quarter.

Source: IHS Markit Global Trade Atlas, IHS Markit Commodities at Sea, IHS Markit Fright Rate Forecast

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-record-brazil-corn-shipments.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-record-brazil-corn-shipments.html&text=Dry+Bulk+Trade%3a+Record+Brazil+Corn+Shipments+a+Warning+Signal+for+Q4+US+Grain+Season+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-record-brazil-corn-shipments.html","enabled":true},{"name":"email","url":"?subject=Dry Bulk Trade: Record Brazil Corn Shipments a Warning Signal for Q4 US Grain Season | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-record-brazil-corn-shipments.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dry+Bulk+Trade%3a+Record+Brazil+Corn+Shipments+a+Warning+Signal+for+Q4+US+Grain+Season+%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-trade-record-brazil-corn-shipments.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}