Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 06, 2022

The ECB will continue to support bond markets in 2022 despite lower net purchases

- European Central Bank (ECB) asset purchases will be substantially lower in 2022 compared with 2021, as net purchases under the pandemic emergency purchase program (PEPP) will end in March.

- However, the ECB will continue playing a pivotal role in bond markets through its asset purchase program (APP) and reinvestments.

- We expect total purchases (i.e., net purchases plus reinvestments) to account for most of the eurozone governments' net issuance in 2022.

- Therefore, asset purchases are likely to prevent a substantial widening of sovereign bond spreads in 2022, preventing a marked tightening of financial conditions.

Eurozone governments' funding needs will decline in 2022

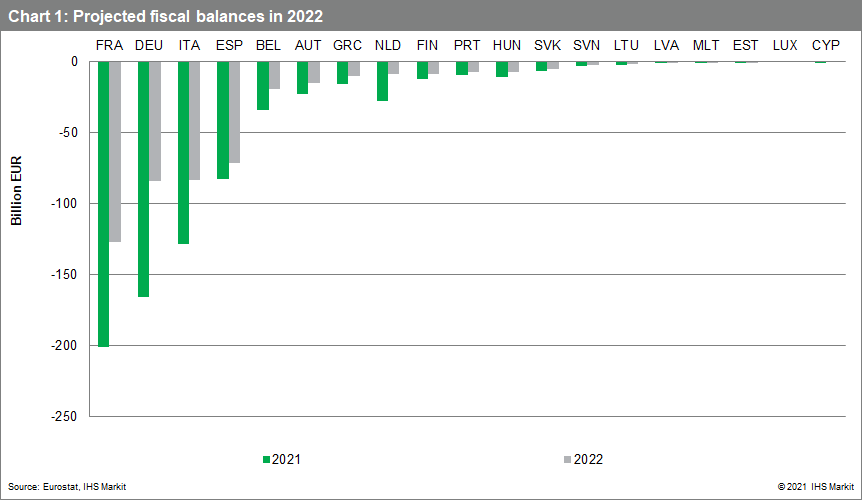

Fiscal deficits will be lower in 2022 than in 2021.

The collapse of activity, and the measures introduced to mitigate the impact of the pandemic on the economy, led to a sharp deterioration in public finances in 2020 when all eurozone member states posted large fiscal deficits. Fiscal shortfalls have declined in most countries in 2021 and are projected to fall further in 2022. France will have the largest fiscal deficit in the eurozone in nominal terms in 2022, followed by Germany, Italy, and Spain. We estimate that the combined fiscal deficit for the eurozone will go down from EUR729 billion (USD825 billion) in 2021 to EUR459 billion in 2022. Despite this decline, the 2022 deficit will still be substantially above the 2019 shortfall of EUR77 billion.

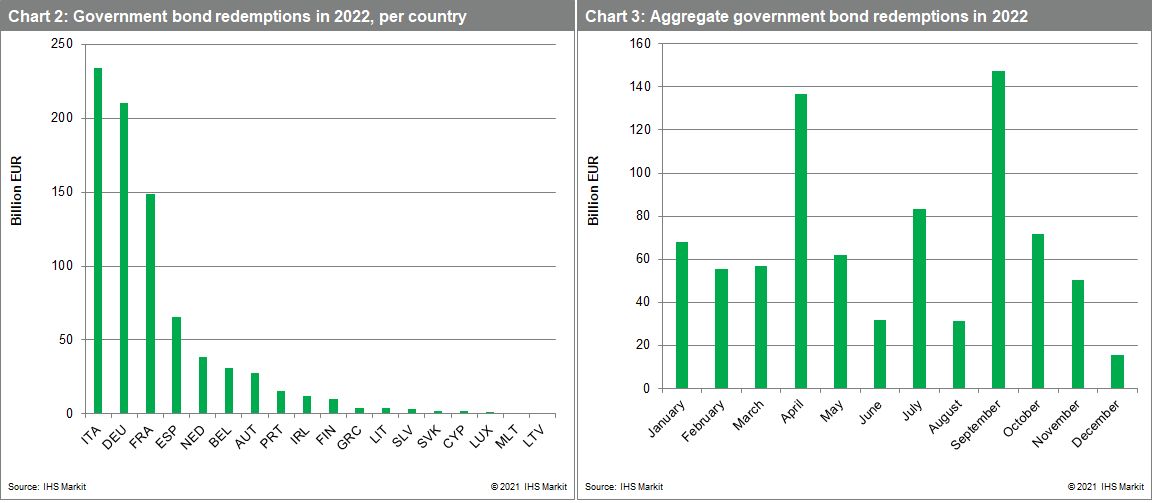

On top of lower fiscal deficits, higher bond redemptions will reduce net bond issuance in 2022.

Government bond redemptions in 2022 are estimated to stand at EUR869 billion, up from EUR663 billion in 2021. Italy, Germany, and France will have the largest bond redemptions in 2022. Bond redemptions will be particularly heavy in April and September.

However, sovereigns' funding needs may be revised as the economic outlook remains highly uncertain.

National budgets have been predicated on the assumption of lower coronavirus disease 2019 (COVID-19)-related spending in 2022, but the increase in the number of cases since early November challenges this assumption. The worsening pandemic situation has led to the reintroduction of containment measures in most eurozone countries. The deteriorating pandemic situation will also contribute to weaker growth momentum in late 2021 and early 2022, weighing down on activity and tax receipts. Therefore, there is a material risk that economic conditions in 2022 will be less upbeat than projected in national budgets. This would drive a worsening of countries' fiscal balances and result in higher funding needs.

ECB net purchases will continue to absorb a large share of net issuances by governments

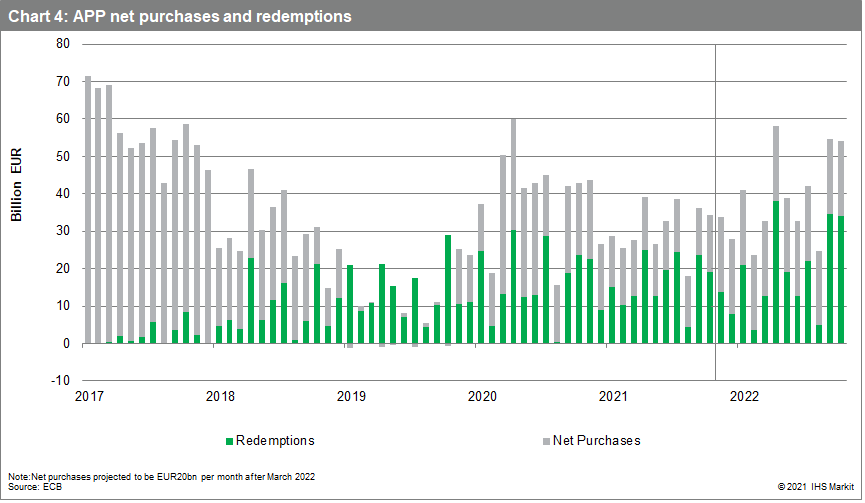

In its December meeting, the ECB announced that net purchases under the pandemic emergency purchase program (PEPP) will be conducted at a slower pace during the first quarter of 2022 and cease by the end of March. Moreover, the reinvestment horizon for the PEPP was be extended until at least the end of 2024 (a year longer than previously). Meanwhile, monthly net purchases under the asset purchase program (APP) will rise from EUR20 billion to EUR40 billion in the second quarter of 2022, and will then be EUR30 billion in the third quarter. From October 2022 onwards, net purchases will be maintained at a monthly pace of EUR20 billion for as long as necessary.

Against a backdrop of lower net purchases, management of stock (i.e., the assets already in the ECB's balance sheet) will become increasingly more important. Reinvestments of government bonds purchased under the APP are expected to be in the region of EUR230 billion in 2022, up from EUR188.5 billion in 2021 and EUR201.5 billion in 2020 (see Chart 4). In total, the sum of projected net purchases and reinvestments in 2022 under the APP is likely to be large enough to absorb governments' net bond issuance in 2022, despite the projected decline in net purchases.

What does this mean for sovereign bond markets in 2022?

Even with lower net purchases, the ECB will continue to be a major player in bond markets in 2022. Even after net purchases under the PEPP expire in March 2022, asset purchases are still likely to prevent a substantial widening of bond spreads. Indeed, the reinvestment of assets already in the ECB's balance sheet will play an increasingly more important role than in the past. Moreover, we believe that the ECB will be ready to act if financial conditions deteriorate.

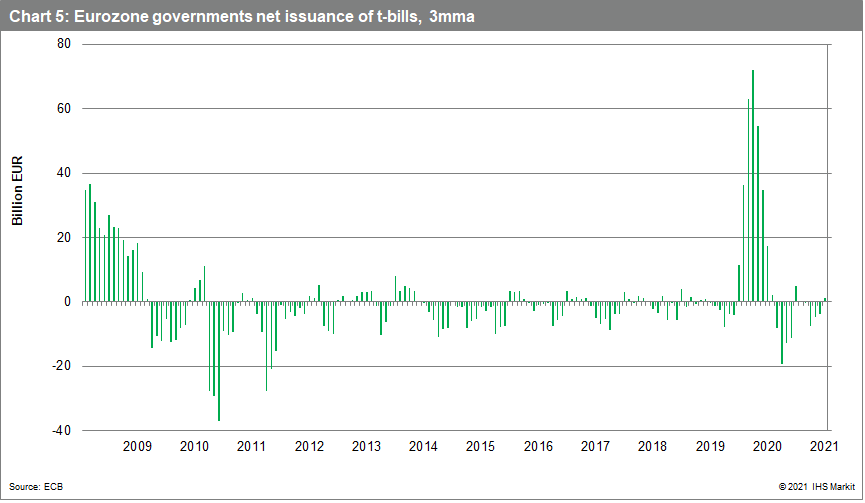

Eurozone governments still have several tools available to navigate the temporary tightening of financial conditions. For example, they could turn to a higher net issuance of T-bills, as seen during the initial stages of the pandemic (see Chart 5). Countries with large cash cushions, such as Portugal and Greece, can draw on them to mitigate temporary increases in borrowing costs. Moreover, the inflow of funds from EU programs, such as the NGEU, is also expected to increase in 2022, providing some extra fiscal space.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fecb-continue-support-bond-markets-2022-despite-low-net-purchase.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fecb-continue-support-bond-markets-2022-despite-low-net-purchase.html&text=The+ECB+will+continue+to+support+bond+markets+in+2022+despite+lower+net+purchases+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fecb-continue-support-bond-markets-2022-despite-low-net-purchase.html","enabled":true},{"name":"email","url":"?subject=The ECB will continue to support bond markets in 2022 despite lower net purchases | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fecb-continue-support-bond-markets-2022-despite-low-net-purchase.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+ECB+will+continue+to+support+bond+markets+in+2022+despite+lower+net+purchases+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fecb-continue-support-bond-markets-2022-despite-low-net-purchase.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}