Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 25, 2022

Economic growth in Japan close to stalling in July led by renewed manufacturing decline, price pressures cool from record highs

The preliminary PMI survey results for July signal a significant loss of growth momentum in the Japanese economy at the start of the third quarter. While second quarter growth had been boosted by the reopening of the economy from Omicron-related containment, July has seen this rebound fade leading to much-reduced service sector growth and a renewed fall in manufacturing output. The details found in the survey's sub-indices, such as new orders and inventories, points to the trend deteriorating further in August. Price pressures meanwhile cooled amid the waning demand environment, albeit down only slightly from June's all-time high.

Omicron rebound loses momentum

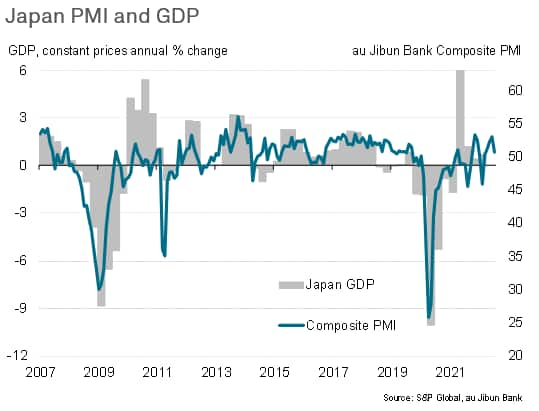

Business activity growth slowed to a near standstill in July, as the economy's rebound from Omicron-related containment measures lost momentum. The au Jibun Bank composite PMI™, compiled by S&P Global, fell from 53.0 in June (its highest level since last November and one of the highest readings seen since 2014) to 50.6, its lowest since March.

While the average PMI reading for the second quarter signalled a return to growth after the mild contraction seen in the first quarter (when GDP fell 0.1% on the prior quarter), the July flash PMI reading points to a renewed weakening in the rate of economic expansion.

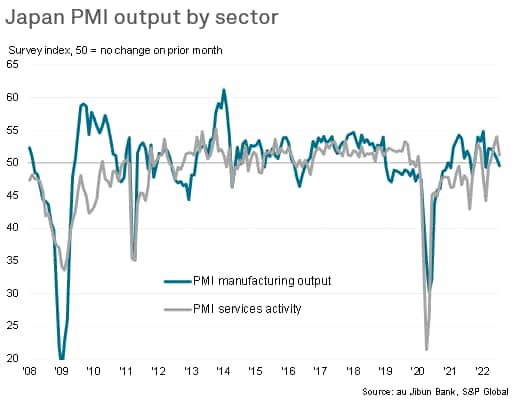

Growth trends worsened in both manufacturing and services. Manufacturing output fell for the first time since February, as factories cut production in line with the first fall in new orders since September of last year. Service sector activity meanwhile grew at the slowest pace for three months, with the rate of expansion cooling markedly from June when activity had grown at the fastest rate since 2013 amid the recent relaxation of COVID-19 restrictions.

Forward-indicators hint at downside risks

Several forward-looking indicators suggest that growth will remain subdued, and could even slow further in the near-term.

First, business expectations about the year ahead fell in July to the lowest since April, and the third-lowest seen over the past 18 months. Such a weakening of business optimism is unusual given the absence of any tightening of COVID-19 containment measures. In fact, Japan's COVID-19 containment is now the lowest since the pandemic began.

Second, inflows of new business rose only modestly in July, reflecting the renewed fall in demand for goods and a weakening rate of demand growth for services. Total new order growth in July increased at the slowest rate for three months.

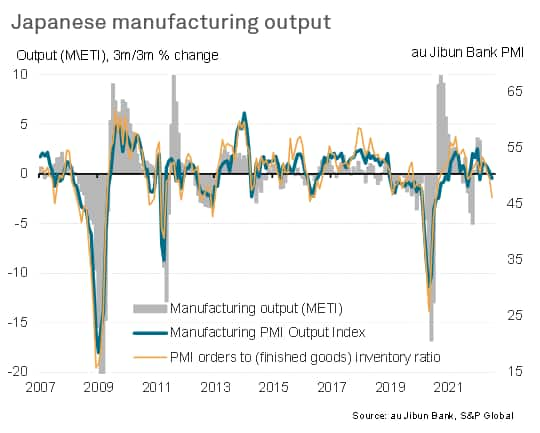

Third, manufacturing companies also reported growing incidences of inventories being accumulated due to weaker than anticipated sales, suggesting that production could be slimmed down in coming months unless demand revives. This is illustrated by the survey's new orders to inventory ratio, which fell to a two-year low in July, dropping to a level consistent with a significant worsening of the output trend in the months ahead.

Manufacturing cost pressures remain elevated

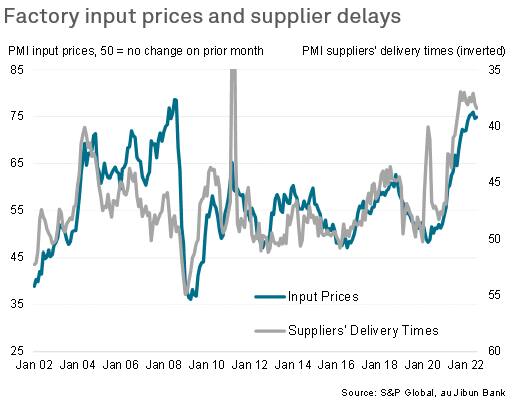

Supplier delivery times meanwhile, continued to lengthen at an historically elevated rate, leading to further upward pressure on raw material prices. However, both supplier delays and input cost inflation showed signs of cooling slightly, reflecting the worsening demand environment and some improvements in supply bottlenecks.

Inflation peak?

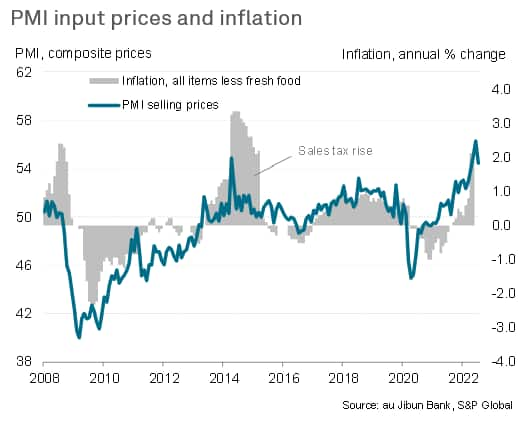

July also saw service sector input cost inflation cool after having hit a survey high in June, meaning overall cost growth among manufacturing and service sector firms in July grew at the slowest rate since April.

This reduced upward pressure on costs, which combined with reports of subdued demand prompting more price competition, led to a moderation of average selling price inflation for goods and services, which had also hit a record high in June.

The easing in the survey price gauges therefore suggests a tentative peaking of inflationary pressures, which should help to moderate consumer price inflation in the coming months, although clearly the rate of increase remains elevated by historical standards, linked to ongoing shortages, still-high energy prices and the recent depreciation of the yen.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-growth-in-japan-close-to-stalling-in-july-led-by-renewed-manufacturing-decline-jul22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-growth-in-japan-close-to-stalling-in-july-led-by-renewed-manufacturing-decline-jul22.html&text=Economic+growth+in+Japan+close+to+stalling+in+July+led+by+renewed+manufacturing+decline%2c+price+pressures+cool+from+record+highs+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-growth-in-japan-close-to-stalling-in-july-led-by-renewed-manufacturing-decline-jul22.html","enabled":true},{"name":"email","url":"?subject=Economic growth in Japan close to stalling in July led by renewed manufacturing decline, price pressures cool from record highs | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-growth-in-japan-close-to-stalling-in-july-led-by-renewed-manufacturing-decline-jul22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+growth+in+Japan+close+to+stalling+in+July+led+by+renewed+manufacturing+decline%2c+price+pressures+cool+from+record+highs+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-growth-in-japan-close-to-stalling-in-july-led-by-renewed-manufacturing-decline-jul22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}