Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 11, 2018

Economic Preview - Week of 11 June 2018

- FOMC set to hike US interest rates

- ECB policy meeting eyed for QE guidance

- UK official output, retail sales, inflation and labour market data updates

- Bank of Japan interest rate decision

- China data to provide second quarter insights

The coming week sees monetary policy meetings at the US Federal Reserve, ECB and Bank of Japan, with a welter of data releases to also guide policy and investor decisions around the world.

US Fed set to hike

After a string of upbeat data, including solid employment growth, buoyant survey data, upside inflation surprises and signs of rising wages, the US Fed is widely expected to hike interest rates for its second time this year at its June FOMC policy meeting.

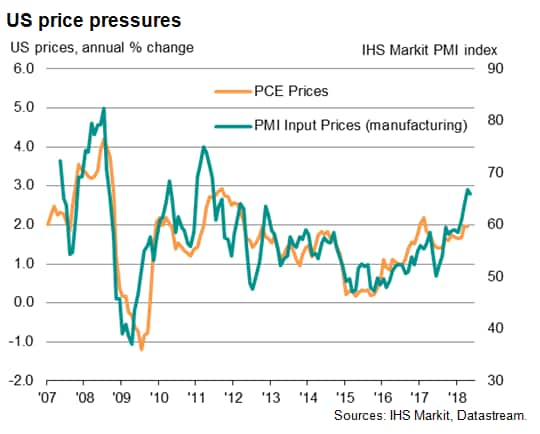

Recent PMI survey data have not only shown the US taking the lead in the global economic upturn, but the US is also seeing the steepest price pressures for seven years. Official US data updates include retail sales, inflation and industrial production, all of which are expected to show underlying rising trends.

ECB rhetoric under scrutiny

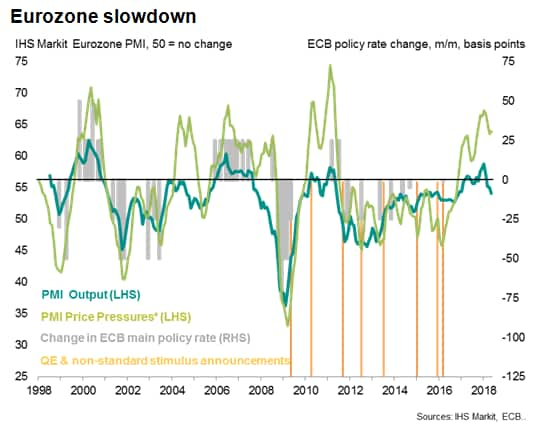

The ECB's Governing Council also meets to set monetary policy. No change is expected, but traders will be seeking guidance as to whether the central bank remains on track to taper its asset purchases later this year, after both soft and hard data continue to indicate signs of weaker economic growth in the second quarter.

PMI numbers registered the slowest euro area expansion for one-and-a-half years in May, though the rate of growth remained relatively robust and strong price pressures persisted. Official eurozone industrial production data are expected to show a decline, while inflation numbers are set to confirm a marked increase in May.

UK data eyed for Bank of England signals

The Bank of England will meanwhile be scouring a new batch of data releases to ascertain whether the economy is reviving from a soft patch earlier in the year.

Better data will pave the way for an August rate hike. Official data releases for retail sales, manufacturing output, industrial production, construction output and trade are likely to confirm signs of some rebound at the start of the second quarter, albeit possibly still muted.

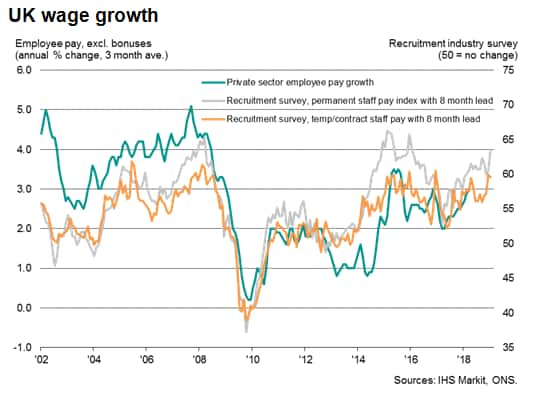

The latest set of UK inflation and labour market releases will likewise be eagerly awaited, especially wage data. Subduing base effects mean the data need to be treated with some caution, but recruitment industry survey data show pay growth hitting a three-year high in May as employers fought to attract suitable staff. UK inflation is also likely to have ticked up in May, largely thanks to higher oil costs.

Bank of Japan and China growth under spotlight

No policy change is meanwhile expected at the Bank of Japan after the economy shrank in the first quarter. Survey data have since indicated that the economy grew in the second quarter and that price pressure remained elevated, but the latter once again suggests that inflation is running well below the central bank's target.

China's official 'data dump' of output, retail sales, investment and inflation will be scrutinised for confirmation that the economy is holding up well in the second quarter. Caixin PMI surveys pointed to steady economic growth in May, albeit with exports declining for a second straight month.

Download the report for a full diary of key economic releases.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-11-june-2018.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-11-june-2018.html&text=Economic+Preview+-+Week+of+11+June+2018+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-11-june-2018.html","enabled":true},{"name":"email","url":"?subject=Economic Preview - Week of 11 June 2018 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-11-june-2018.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Economic+Preview+-+Week+of+11+June+2018+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feconomic-preview-week-of-11-june-2018.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}