Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 11, 2024

Emerging market growth accelerates amid fastest rise in exports for six months

Emerging market economic growth accelerated in the penultimate month of the year, according to S&P Global's PMI surveys. This was mainly driven by quicker expansions in manufacturing new orders and production while services growth remained solid despite easing from October.

Notably, manufacturing export orders returned to growth for the first time since July, supported by an improvement in export conditions alongside faster services export business expansions. Evidence gathered from the survey indicated that the latest uptick in manufacturing exports were partially driven by front-running the threat of US tariffs.

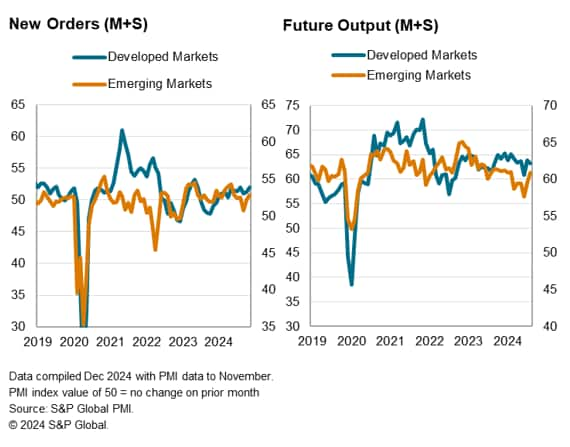

Overall, sentiment improved among emerging market businesses into the end of 2024, with November's Future Output Index reading being the highest in six months.

Emerging market manufacturing output expands at quickest pace since June

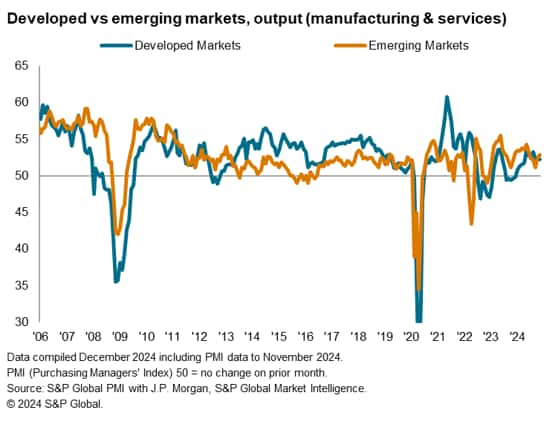

The PMI surveys compiled globally by S&P Global revealed that the rate at which output expanded across the emerging markets collectively accelerated for a second successive month in November to the fastest since June. The GDP-weighted Emerging Market PMI Output Index rose to 52.8, up from 52.5 in October. This was attributed to a quicker rise in manufacturing output, the fastest in five months, while services activity continued to grow at a solid pace. The latest data also signalled that emerging markets have extended their growth streak to nearly two years as of November.

Improvements in emerging markets growth contrasted with a softer rise in developed markets activity in November. The rate at which developed economies expanded was the weakest in seven months as faster services activity growth failed to offset a deepening manufacturing downturn. As such, the key source of divergence in the growth trend between developed and emerging market lies in the difference in manufacturing performance in the penultimate month of 2024.

Emerging market manufacturing sector receives US tariffs threat boost

With the acceleration in emerging market factory production growth, the goods producing sector reclaimed the lead from services for the first time in five months, albeit with only a slight margin. Underpinning the latest change was a quicker rise in manufacturing new orders, the fastest since May. Moreover, the new export orders gauge also revealed that international trade in emerging market goods improved for the first time since July.

Data from the PMI surveys further showed that the easing in global exports decline stemmed from global manufacturers shifting away from a period of inventory reduction towards stockpiling. To a certain extent, the threat of US tariffs encouraged manufacturers, and notably those in the US, to raise purchases in a bid to front-run the impact of tariffs by buying additional imported inputs. This mainly benefitted emerging market manufacturers with three out of only four economies that recorded growth in exports orders among the top ten trading economies being emerging economies.

Meanwhile, emerging market services activity expanded at a softer but still solid pace in November, mirroring the trend seen for services new business growth.

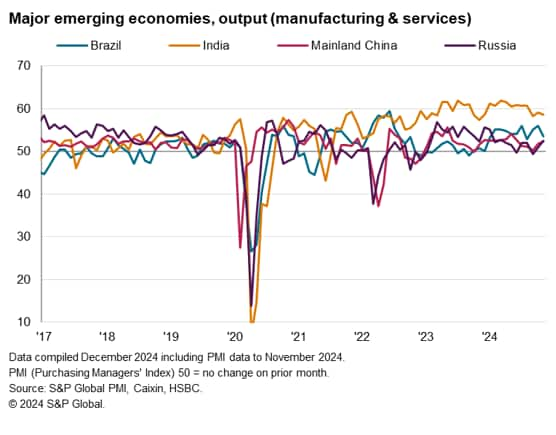

India continues to lead growth among major emerging economies

All four of the major emerging market economies remained in growth for a second successive month in November. India continued to lead growth, with Brazil following in second place. That said, growth rates across both India and Brazil softened in the latest survey period, with broad-based easing of growth momentum across sectors.

In contrast, Russia and mainland China saw their rates of business activity growth accelerate in November. While Russia's manufacturing production expanded for the first time in three months, mainland China's manufacturing output notably rose at a rate that was the fastest in five months. The rise in mainland China's manufacturing output also exceeded that of services activity in November, reflecting the impact of rising demand for Chinese manufactured goods amidst looming US tariffs.

Business confidence improves despite rising uncertainty

In addition to the acceleration in growth in November, forward-looking PMI indicators suggested that output may remain on the rise in the near-term. Over and above the uptick in new business inflows, the level of backlogged orders rose for the first time in the second half of 2024 thus far. The latter index serves as a useful barometer of capacity utilisation and signalled that business activity may continue to expand in the coming month as emerging market businesses work through their unfinished work.

Moreover, the survey's only sentiment indicator, the Future Output Index, indicated that business optimism rose to the highest in six months among emerging market firms. This was with sentiment improving for both manufacturers and service providers among emerging market firms. That said, globally, instances of businesses highlighting 'uncertainties' observed via the survey's anecdotal evidence jumped to the highest in one-and-a-half years, often linked to worries over trade protectionism.

Thus, while looming US tariff threats have provided a short-term boost for emerging markets, companies are reporting that the longer-term outlook is clouded with greater uncertainties.

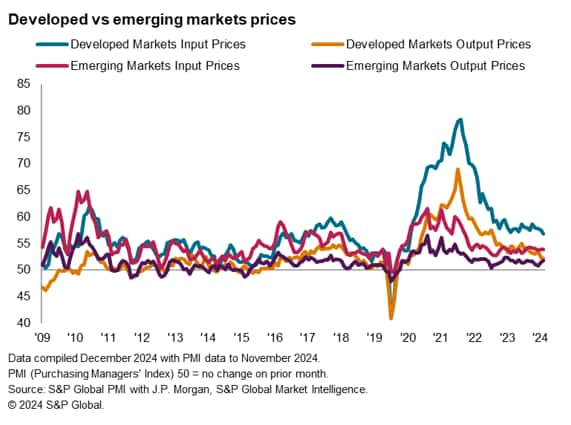

Manufacturing prices rise among emerging market manufacturers

Turning to prices, manufacturing output prices notably rose at a more pronounced pace than services charges for the first time in three months during November. This was attributed to a quicker rise in manufacturing input prices in November, in turn linked to higher demand being observed in November. The rate at which manufacturing input prices increased was the fastest recorded since July 2022, though remained below the long-run average.

Measured overall, emerging market output prices were reported to have been rising at a pace in line with long-run averages across sectors despite the uptick in the goods producing sector. As such, the latest PMI prices data outlined still-muted price pressures in the emerging market space which remain conducive for further easing of interest rates.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-fastest-rise-in-exports-for-six-months-Dec24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-fastest-rise-in-exports-for-six-months-Dec24.html&text=Emerging+market+growth+accelerates+amid+fastest+rise+in+exports+for+six+months+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-fastest-rise-in-exports-for-six-months-Dec24.html","enabled":true},{"name":"email","url":"?subject=Emerging market growth accelerates amid fastest rise in exports for six months | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-fastest-rise-in-exports-for-six-months-Dec24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+growth+accelerates+amid+fastest+rise+in+exports+for+six+months+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-accelerates-amid-fastest-rise-in-exports-for-six-months-Dec24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}