Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 12, 2024

Emerging market growth decelerates in August while price pressures ease

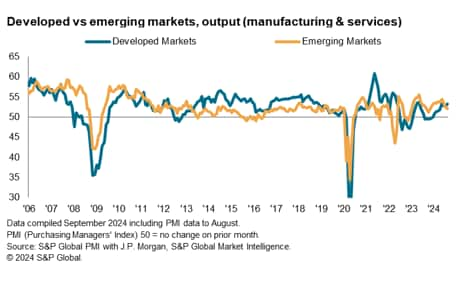

Emerging market economic growth slowed midway through the third quarter of 2024, according to S&P Global's PMI surveys, but remained relatively more broad-based compared with developed markets as both manufacturing and service sector continued to expand. The slowdown in manufacturing output expansion is nevertheless worth monitoring, particularly with trade conditions having worsened for the first time in 2024.

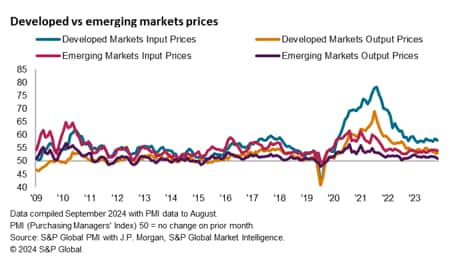

Meanwhile the easing of price pressure, as observed via falling input cost and output inflation rates, provides room for emerging market central banks to lower rates as we await the commencement of Fed cuts in the US.

Emerging market growth lags developed markets again in August

The PMI surveys compiled globally by S&P Global found that rate at which output expanded across the emerging markets collectively slowed for a third successive month, unfolding at the joint-slowest pace since October 2023. The GDP-weighted Emerging Market PMI Output Index fell to 52.1 in August, down from 52.4 in July. This extended the sequence of growth that commenced in January 2023.

Compared with developed markets, this marked a second straight month in which the rate at which emerging market expanded fell behind that of the developed world. The last time that emerging markets underperformed developed economies to at least the current extent was back in May 2022.

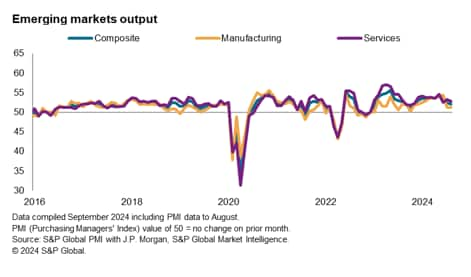

That said, emerging market growth remained more broad-based compared to developed markets. Output has continuously increased in both the manufacturing and service sectors for a twentieth successive month as of August 2024. In contrast, the expansion in developed market activity, while having accelerated to a three-month high, was entirely driven by improvements in the service sector as manufacturing output fell at the quickest pace since January.

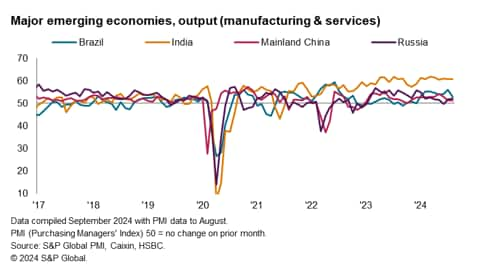

India leads growth among major emerging market economies

Diving into the conditions across the four major emerging market economies, India continued to lead growth with an unchanged rate of expansion in August. That said, here services likewise took over from the manufacturing sector as the sector with a higher rate of growth. Quicker expansion in services activity had offset the slowest rise in manufacturing output since January in India. Notably, business optimism in India's manufacturing sector also eased, sliding to the lowest since April 2023 amid concerns over competition pressures and inflation.

Following India were Brazil and Russia, both recording moderate rates of expansion in August. For Brazil, August saw the first decline in manufacturing production this year, which meant that services remained the only pillar of growth midway through the third quarter of 2024.

Meanwhile mainland China also saw an unchanged rate of expansion, though here a marginal improvement in manufacturing output helped to offset softer services activity growth.

Emerging market manufacturing sector conditions in focus

While services growth remained relatively solid for emerging markets, the slowdown in manufacturing production expansion is a trend worth monitoring.

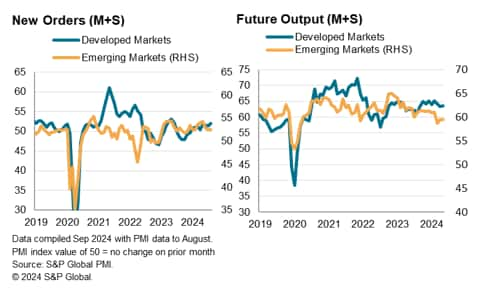

The softest rise in manufacturing output in ten months is underpinned by only a marginal rise in goods new orders, the latter tends to also provide forward-looking properties for sector activity. Despite accelerating from July, the rate at which emerging market manufacturing orders rose was among the lowest in the current 13-month sequence of growth.

Crucially, exports orders for goods fell for the first time this year. Although supply constraints again played a part in dampening export performance, findings from the August PMI also showed that demand conditions weakened as destocking among manufacturers renewed in August. Moreover, confidence levels among global manufacturers deteriorated in the latest survey period, contrasting with improvements observed in the service sector. Fortunately, emerging market good producers broadly maintained the same confidence level as July, evidently with pending rate cuts, especially in the developed world, potentially injecting further confidence in the months ahead.

Selling price inflation at 15-month low

With the US Federal Reserve expected to lower interest rates imminently in September, the focus is also on further potential moves in the emerging market space. Turning to PMI price indicators for clues on inflation, the latest August data showed that price pressures have softened in the latest survey period.

Average selling prices rose at the slowest pace since May 2023 with both emerging market manufacturers and service providers raising charges less quickly. This was also evidently in the Asia excluding-Japan region, whereby service charges in fact fell for the first time since April 2022.

Softer emerging market selling price inflation was underpinned by a slower rise in input costs in August, as we see input cost inflation down at a four-month low. That said, this was entirely manufacturing-driven, as services input price inflation intensified for a second successive month, though with the rate of inflation remaining below the historical-average.

The bigger picture altogether answers the question as to whether there remain room for emerging market central banks to manoeuvre as the Fed embark on their rate cut cycle, though emerging market growth conditions have evidently yet to deteriorate to a state that would compel central banks in the region to swiftly move in step with major developed economies central banks at present.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-decelerates-in-august-while-price-pressures-ease-Sep24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-decelerates-in-august-while-price-pressures-ease-Sep24.html&text=Emerging+market+growth+decelerates+in+August+while+price+pressures+ease+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-decelerates-in-august-while-price-pressures-ease-Sep24.html","enabled":true},{"name":"email","url":"?subject=Emerging market growth decelerates in August while price pressures ease | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-decelerates-in-august-while-price-pressures-ease-Sep24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+growth+decelerates+in+August+while+price+pressures+ease+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-decelerates-in-august-while-price-pressures-ease-Sep24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}