Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 26, 2020

The escalating pandemic and the prospects for the six largest European economies

Key points:

- The outbreak of the novel coronavirus (COVID-19) is for the time being the most significant black swan of 2020 and possibly the largest since the end of the second world war for most of the world economies

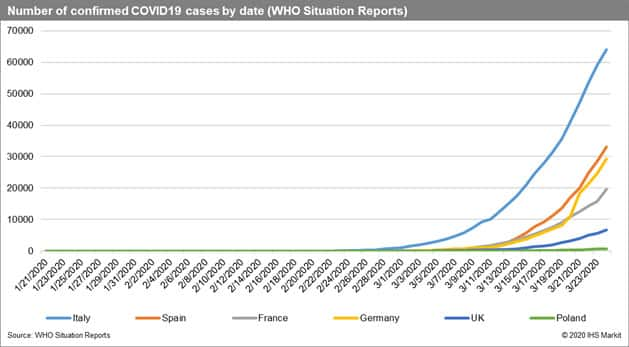

- The impact of COVID-19 is by now significantly larger than SARS in 2002-2003 and thus cannot at this stage no longer be compared to it; the number of confirmed cases by March 25 exceeded 414,000 globally with few countries unaffected; the number of cases in Europe exceeds 220,500 and number of deaths has reached 12,000

- The center of the COVID-19 pandemic according to the WHO is in Europe with Italy (especially Lombardia) and Spain the most affected states with health systems under extreme pressure

- The global spread of the COVID-19 epidemic is the single biggest risk facing the world economy in early 2020; from an economic point of view Q1 is lost, Q2 is unlikely to bring a major improvement

- IHS Markit estimates that global growth in 2020 will be 1.7% and 2.7% in 2021 and are significantly lower than prior estimates; the forecasts for global trade have also been cut by GTA Forecasting to 1.5% in 2020 and 3.8% in 2021

- According to IHS Markit's newest forecast, Europe will be more adversely affected, with Germany and Italy in or near recession even before the outbreak. This is highly likely to lead the rest of the Eurozone into recession. For 2020, the current forecast of IHS Markit for the Eurozone is 0%, with the 2021 growth rate now predicted to reach only 0.9%

- The GTAF forecasts for exports in 2020 vary from 3.1% for Poland to 0.5% for the UK and 0.8% for Germany; these forecasts are very likely to be adjusted downwards if the pandemic is not brought under control quickly

- In contrast to the global financial crisis of 2008-2009, we are nowadays dealing with the real-side crisis with actual impact on production, global value and logistic chains in addition adversely affecting global demand and having a potential of leading to a major financial crisis

Market's reaction to COVID-19

Financial markets have reacted heavily to the acceleration of the pandemic in Europe and the introduction of strict measures by countries. Market sentiment is weak and is turning worse. Uncertainty levels are extremely high and markets, in general, are allergic to uncertainty.

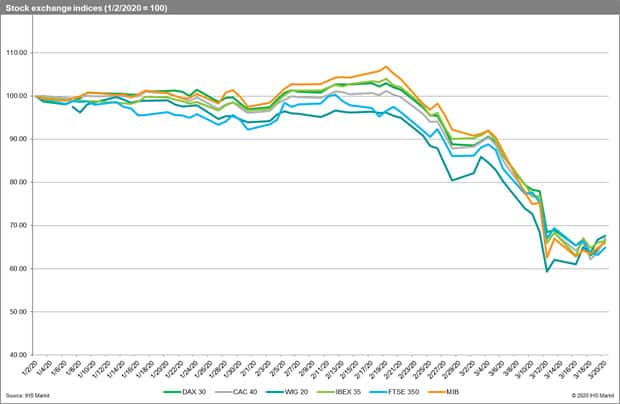

Stock exchange indices (DAX30, CAC 40, WIG 20, IBEX 35, FTSE 350 and MIB) lost more than 30% of the value in comparison to the beginning of the year starting from the mid of February and having the sharpest declines in the first two weeks of March. The response was quite symmetric despite the differences in the size and maturity of markets.

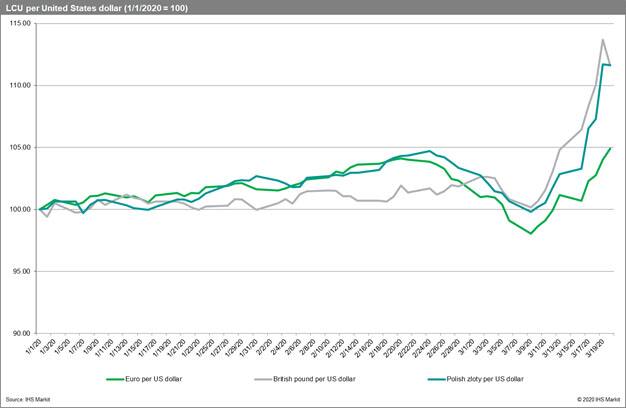

All three currencies lost heavily to the United States dollar with a change in the trend around the second week of March. Polish zloty and British pound depreciated significantly more to the US dollar than the Euro despite the core of the Eurozone being more adversely affected by COVID-19 itself. This could reflect the perception of country risk in the financial markets with the British economy affected besides Brexit and ongoing negotiations and the Polish economy perceived in general as weaker. The depreciation of currencies can potentially help their export perspectives, however, the fall in purchasing powers will adversely import potential.

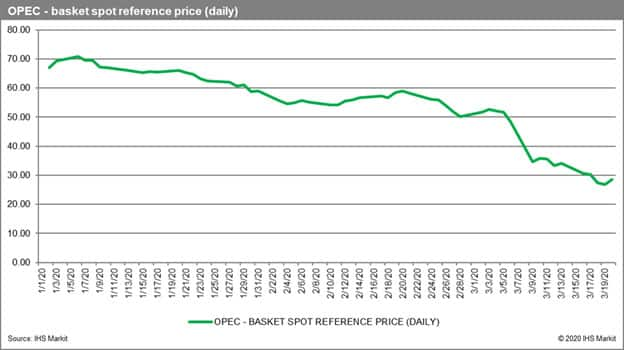

It is also interesting to look at the global oil market. Oil markets plummeted since the beginning of the year, with the OPEC basket spot reference price of crude dropping below the level of USD 30 per barrel last week, reflecting the collapse in demand due to decreased production and trade. This was in particular due to an extra dose of uncertainty after the declaration of a global pandemic by the WHO and the spread of the outbreak in Europe as well as tensions within the OPEC+ (failed negotiations on supply cuts between Saudi Arabia and Russia). The latest forecasts from the liquid bulk team at IHS Markit, point to a decrease in global demand for oil by more than 1.0 MMb/d in 2020. At the same time, significant recovery is predicted for 2021 with demand for oil predicted to increase by more than 2.0 MMb/d.

Lower prices of crude oil decrease the cost of transport and could help the recovery. At the same time, they destabilize the macroeconomic situation of OPEC countries which could have global consequences. The price of oil is, however, likely to respond fast to increased global demand only with a limited lag. A U-shape pattern can be followed. If this the case, the rapid increase in the price of oil can slow down the recovery of global trade from the outbreak.

The impact on trade flows so far

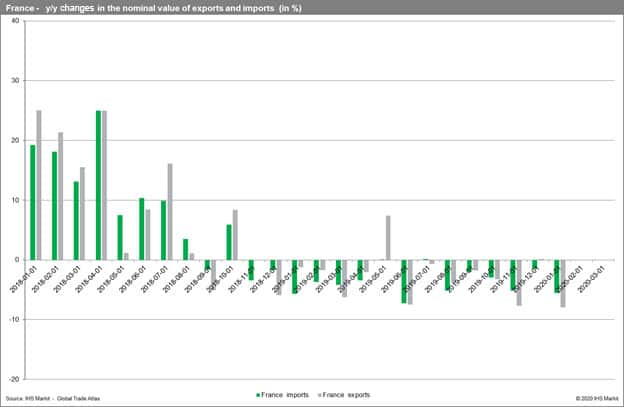

The historical trade data from the IHS Markit Global Trade Atlas for the analyzed states is available with monthly granularity. Due to different reporting schedules, these are available now till the end of December 2019. Only France and the United Kingdom have reported values for January 2020 so far. The data thus does not provide information on the full impact of the pandemic which started at the end of December 2019 (WHO was informed on 30 December 2019). On 30 January 2020, WHO issued a Public Health Emergency of International Concern and declared the Global Pandemic at the beginning of March.

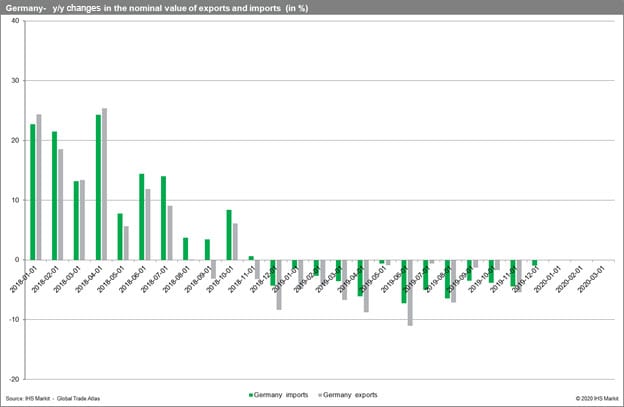

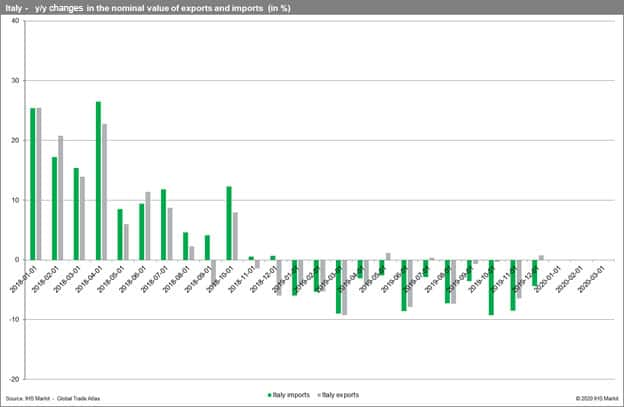

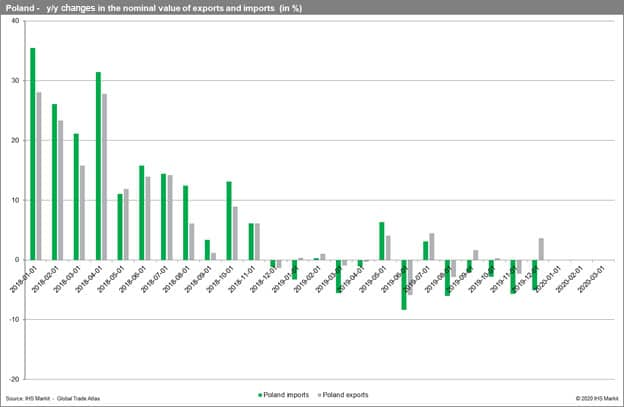

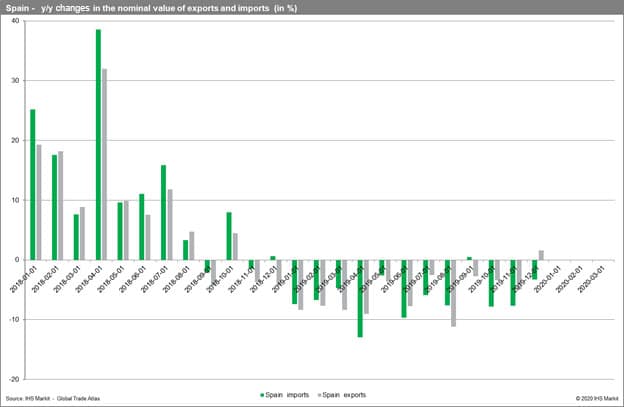

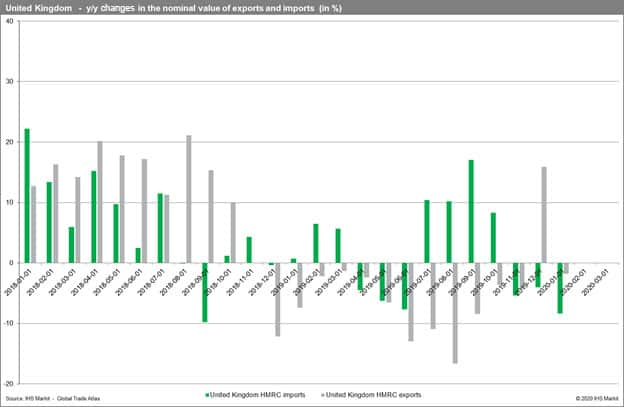

The year-on-year changes in the total value of exports and imports show that 2019 was already a difficult year in comparison to 2018. It was characterized by sluggish growth (or technical recession for Germany and Italy) and decreases in trade flows. Expectations were for a revival in 2020. Due to the black swan, they did not materialize. British imports went down by 8.3% and exports by 1.8% in January 2020 y/y. For France, they were equal to -5.6% and -7.9 % y/y respectively.

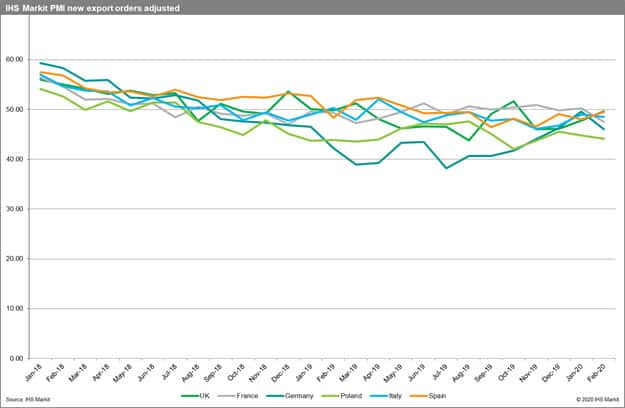

The data for exports on a monthly basis is highly correlated with IHS Markit's PMI new export orders index with a lag of one to two periods. The latest PMI readouts are available for February 2020. In all the analyzed states they were below the benchmark value of 50.0 indicating contraction. The most optimistic readouts were present only for Spain and the UK. The most pessimistic values were for Poland. The values for February did not take into account the escalation of the outbreak at the end of February and measures introduced in all the states in March. The next readouts (for March and April) can be significantly lowered fully incorporating the COVID-19 situation and overall weak market sentiments. Nonetheless, we can expect the trade and GDP of major European economies contracting in the forthcoming months.

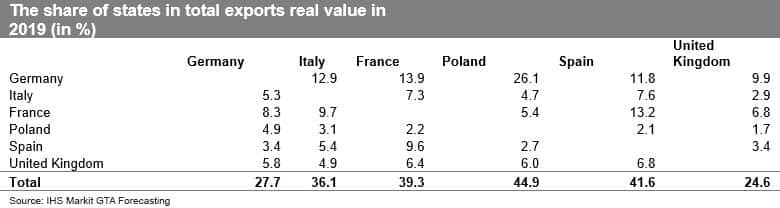

Furthermore, we must take into account the linkages between the analyzed states. They are all significant trade partners for each other with the share of the five states in total exports in 2019 ranging from 24.6% in the case of the UK to 44.9% in the case of Poland. Thus, every single country is highly exposed to the situation in the other market with the Eurozone states further linked by a common currency. The disturbances in production and trade of each states will affect others quickly. For instance, Toyota announced the production outage simultaneously in several states due to logistic chains in production.

The prospects for the near future

The prospects for the main European economies is dependent on the duration and gravity of the pandemic. We cannot at this stage predict it. The firm measures introduced by the states similarly to China may likely remain in place long after the turning point of the epidemic is reached.

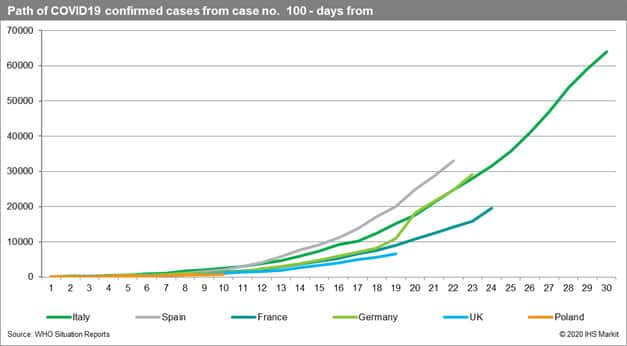

The pattern of the epidemic (from the moment the 100 cases was confirmed) shows that Germany is on a similar trajectory to Italy and Spain. France and the UK are for the time being on a flatter trajectory. As to Poland, it is difficult to predict the evolution at this stage - the path on close up is similar to the British case (it will be possible to judge in one-two weeks).

As for now all the measures forcing social distancing should enable the turning point to reach quicker or to flatten out the curve to allow the health systems of each state to deal more efficiently with the ongoing situation. It is hard to be optimistic now, however, the fall in the number of reported deaths in Italy for several days shows some light at the end of the tunnel.

It is stressed that the current outbreak of coronavirus will end with an introduction of a vaccine or reaching the states of the so-called "herd immunity." Herd or community immunity is the situation when a high percentage of the given community becomes immune to the disease, either through vaccination or prior illness. At that point, it is less likely to spread from person to person and illness can disappear.

Governments, central banks, and international organizations are taking unprecedented measures to deal with the crisis including financial aid to falling enterprises. These can at least partially soften the impact on the economy. Their efficiency, however, cannot be predicted.

Main European economies are only now becoming affected by production outages. These lasted around two months in China are likely to be longer in Europe due to the greater severity of the outbreak. The disturbance to industrial production could be even more severe due to a drag caused by the prolonged production shutdowns. These create significant supply outages and disruptions to the internal and external logistics networks and trade flows. The trade itself is more difficult due to the reintroduction of border controls and other instruments reducing international trade flows and increasing trade costs.

If the situation is prolonged, the adjustments to global value chains will be necessary with some production shifting to countries less affected by the outbreak. The impact on global trade flows and shipments could thus be significant and could last longer than the outages in production themselves.

Psychological effects of COVID-19 could affect decision making processes in particular in the largest MNEs causing at least some of them to reallocate from China (reallocation of a large part of manufacturing to East Asia created a large exposure to the region, and the COVID-19 situation made them realize it - for the security of GVC reasons a more balanced approach to the location of production could be favored). If this materializes, a reallocation of production and trade flows globally could take place.

When the pandemic will be brought under control the COVID-19 recovery is likely to be U-shaped with a large boost in consumption and economic activity however the drag caused by prolonged production shutdowns is likely to impact global trade chains for several quarters.

Longer-term consequences

We are very likely to experience over mid to long-term a major restructuring of the global economic and social order in which businesses and societies have operated so far. For the time being all decisions are focused on guaranteeing business continuity (introduction of business continuity plans) if possible. Different countries, sectors and individual organizations have different exposure, sensitivity and adaptive capacity to the crisis. Some will prove more resilient. Some will fail. For sure business must start to prepare for the resumption of activities which will not be easy (severe shutdowns are extremely challenging as the Chinese enterprises are now experiencing a rather slow pace of recovery).

It seems that this time return to business, as usual, will not take place. We must prepare for a major transformation and significant adjustments both economic and social. In the very end, looking from a more optimistic point of view, the crises will create significant opportunities for these businesses who will survive. Creative destruction will also be on the agenda.

Prospects for trade in 2020 and 2021

The February release of the trade forecasts from IHS Markit GTA Forecasting point to an increase in total global trade volume to 14.465 million metric tons in 2020 and 14.997 million metric tons in 2021. The estimates for 2020 and 2021 are significantly lower in comparison to the previous release and growth rates predicted are now equal to 1.7% and 3.7% (in comparison to 2.7% and 5.0% forecasted previously). The real value of global trade is expected to grow to USD 19.403 billion in 2020 and USD 20.139 billion in 2021. In other words, we expected an increase of 1.5% in 2020 and 3.8% in 2021.

The forecasts for the analyzed economies varied from an increase of 3.1% for Polish exports to 0.5% for the UK and 0.8% for Germany in 2020. A sharp recovery was predicted for all the countries in 2021 (an increase from 2.5% in Germany to 3.8% in the UK). This is still possible if the situation is quickly brought under control.

It seems that the forecasts will have to be significantly adjusted downwards - they did not account for the current situation. The prospects for global trade and the global economy in 2020 are turning weak (The Eurozone is likely to be already in recession). The situation is partially shown by the current values of PMI indices shown above (below of 50.0 for all the analyzed stats in the February release).

Furthermore, the fall in the price of oil can at least to some extent reflect the depth of the actual decrease in global trade flows. It is difficult to fully assess due to the lags in reporting of a trade by individual states. At the same time, the data on the dry bulk flows reported from Commodities at Sea from IHS Markit shows a significant contraction of trade globally already at the end of 2019 and even deeper in the first quarter of 2020 - by 2.5% q/q in Q4 2019 and 3.0% q/q in Q1 2020 (data available till mid-March 2020).

It is thus possible that global trade will contract in 2020 unless the fast recovery will occur in Q3 and Q4. In this case, it will be the second year after the II World War apart from 2009.

Background

On 25 March 2020, the number of confirmed COVID-19 cases surpassed 414,000 globally. Europe became the center of the global pandemic with 220,516 confirmed cases and 11,986 deaths so far. The situation in China is slowly improving with a total of 81,848 cases so far and no new cases reported for the fifth day in a row in the origin of the outbreak - Wuhan.

The worst affected countries in Europe are Italy (69,176), Spain (39,673), Germany (31,554), France (22,025), Switzerland (8,789), United Kingdom (8,081) and the Netherlands (5,560). The health systems of Italy and Spain are now under extreme pressure and are unable to cope (shortages of ventilators and medical staff) with a substantial number of deaths reported daily (exceeding 500 a day).

The present report deals with the situation in the most populous countries of the European Union (namely Germany, France, Italy, Spain, and Poland) and the UK. The first case of COVID-19 was reported by France on 25 January, followed by Germany (28 January) and Spain, Italy and the UK on 1 February. In contrast, the first case was reported by Poland only on 4 March 2020.

Despite the ongoing situation in China, the situation in Europe was relatively calm. The number of cases was relatively low. The situation started to deteriorate quickly entering the acceleration phase of the epidemic curve in Italy at the end of February (100 cases reported on 24 February) and in the first week of March in the remaining countries (in Poland on 15 March less than two weeks after the first reported case). Due to the escalating situation and following the WHO guidelines and recommendations from China where the epidemic was to a large extent brought under some control the countries one by one started introducing hard measures (the UK followed a different strategy and was the last to introduce firm measures). As a result, the authorities in most states have imposed drastic restrictions on everyday life, in a move to slow down any further spread of the virus. These include the reintroduction of border controls, introduction of no entry for foreigners, shutting the airspace, forcing quarantine, limiting movements of citizens, forbidding mass gatherings, closing all schools and universities, limiting going out of home, shutting some types of enterprises (restaurants, clubs, pubs, cinemas, theaters, gyms, etc.), canceling all sports events, shutting all manufacturing plants with certain exceptions (strategic reasons - Italy). The restrictions with the pandemics escalating are becoming stricter. They are unlikely to be lifted unless the epidemic reaches the turning point and starts to diminish. Unfortunately, the second and third pandemic waves are also possible.

This column is based on data from IHS Markit Maritime & Trade resources including Global Trade Atlas, GTA Forecasting and Commodities at Sea as well as other resources available from IHS Markit.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fescalating-pandemic-and-prospects-for-largest-euro-economies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fescalating-pandemic-and-prospects-for-largest-euro-economies.html&text=The+escalating+pandemic+and+the+prospects+for+the+six+largest+European+economies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fescalating-pandemic-and-prospects-for-largest-euro-economies.html","enabled":true},{"name":"email","url":"?subject=The escalating pandemic and the prospects for the six largest European economies | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fescalating-pandemic-and-prospects-for-largest-euro-economies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+escalating+pandemic+and+the+prospects+for+the+six+largest+European+economies+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fescalating-pandemic-and-prospects-for-largest-euro-economies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}