Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 14, 2022

ESG and exclusionary policies affecting Latin America

Banks, sovereign wealth funds, and multilateral institutions are paying increased attention to environmental, social, and governance (ESG) standards and compliance in Latin America. That scrutiny increases the risk of projects being halted due to ESG-related divestments or being excluded from sources of finance on ESG grounds.

During a recent S&P Global Market Intelligence webinar, almost half of those responding to a poll highlighted that environmental factors, including changes in corporate climate policies, were becoming more important in the financial landscape.

Volumes of ESG assets under management have rapidly increased over the last five years. These will soon comprise half the total global investment market, with multiple international media sources reporting over 100% increases in ESG funds under management over the last five years.

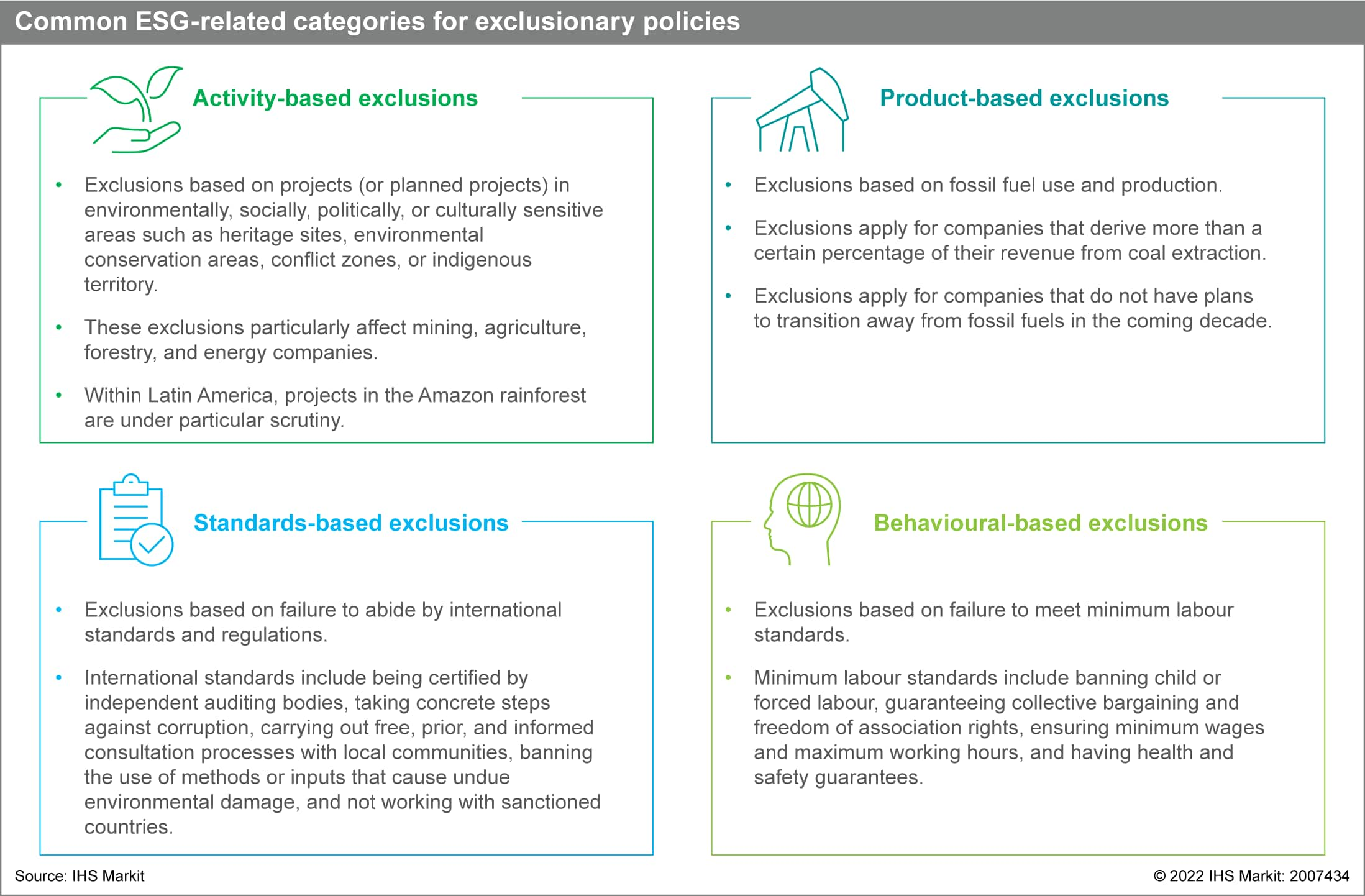

To align with ESG-related standards, investment funds and financial institutions are seeking to establish broader criteria to exclude certain products, sectors, or specific projects from their portfolios of investment or loan assets.

The lack of defined parameters for ESG regulation and compliance means that consumers and investors often rely on voluntary company disclosures that are generally heavily weighted towards environmental goals, focusing on emissions, natural resource use, and pollutants. As such, changes in investment policy are tending to react to shareholder or public criticism. Adverse pressure of this type potentially generates immediate reputational damage and risks forcing ESG-focused financial entities to divest from problematic assets after receiving criticism — and potentially at a loss.

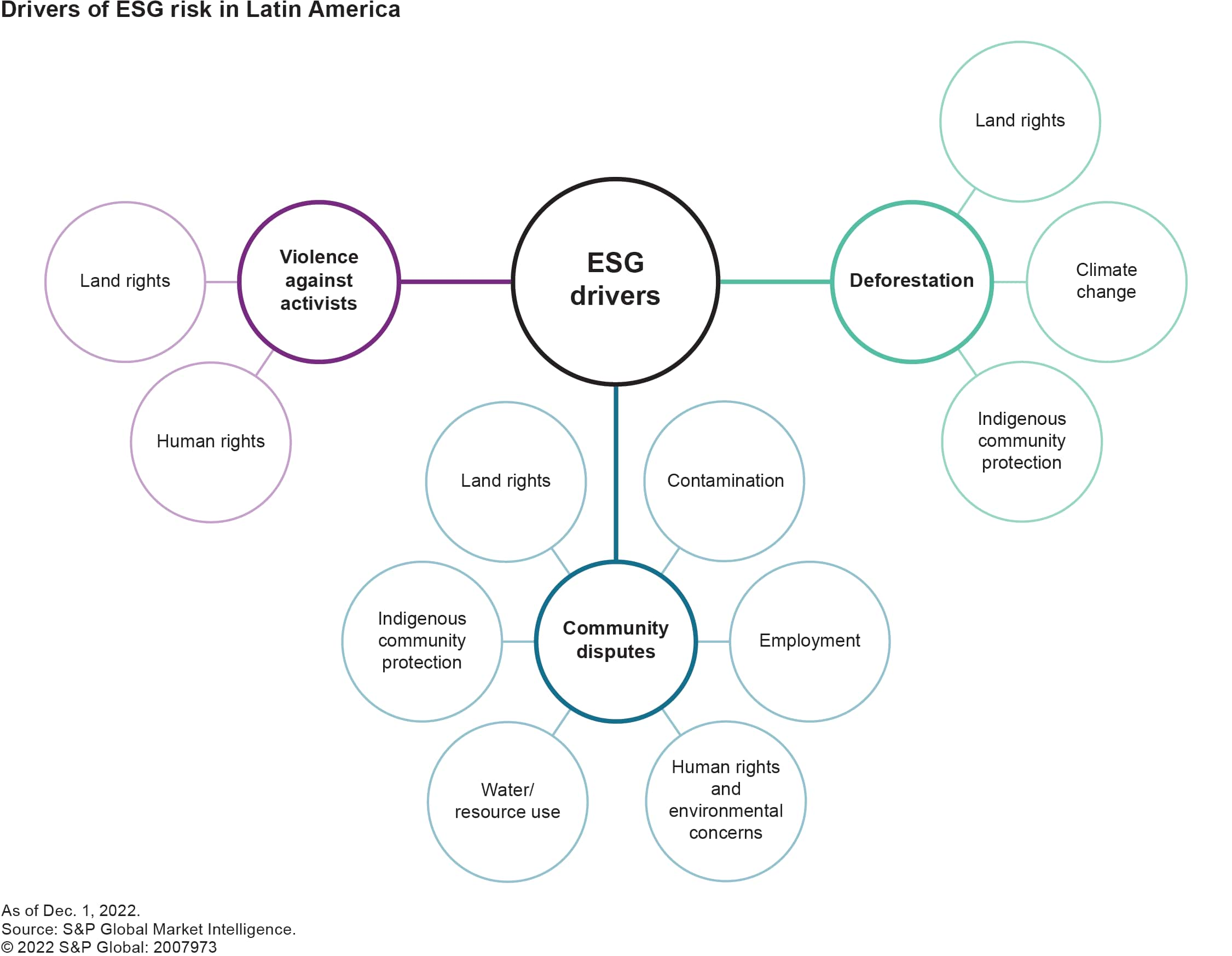

This is particularly applicable in Latin America where the trend of activism against projects generates mounting attention to social concerns, through NGO reporting, social media, and community discontent expressed via protests. S&P Global Market Intelligence assesses that ESG-related scrutiny will significantly increase for projects in the region, especially for ESG-oriented lenders or investors with a focus on Latin America, with the most likely drivers of this highlighted below.

Community disputes and extractives

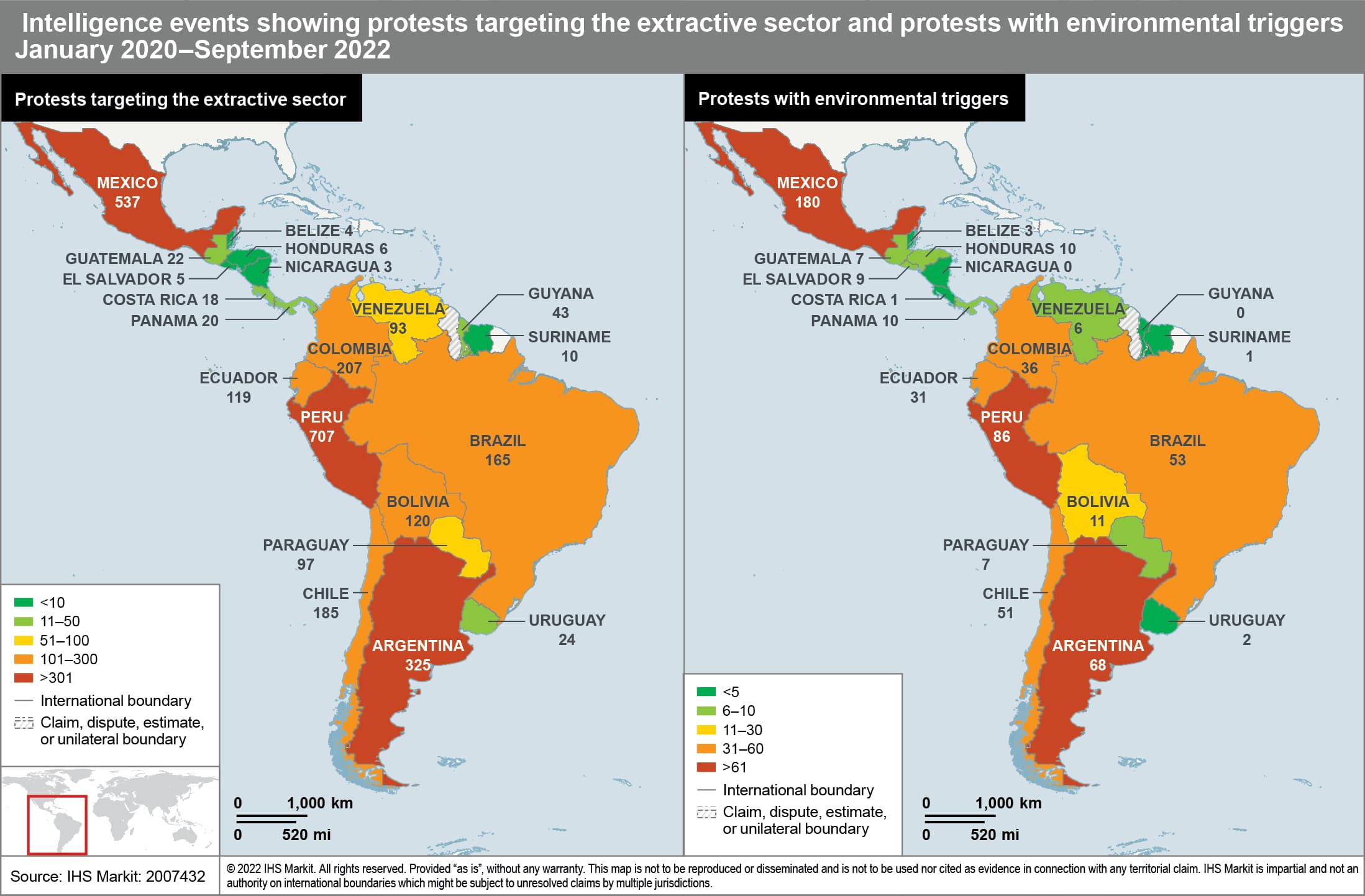

Latin America has a long history of social conflicts driven by local community opposition to projects, particularly in the hydrocarbon and mining sectors, with most project disputes taking place in hotspots such as Argentina, Colombia, Ecuador, Mexico, and Peru. These sectors remain critical government revenue sources in many Latin American countries, but extractive projects now face consistent scrutiny from environmental and social activists.

Community opposition to mining and oil in Panama and Argentina has halted the development of new projects and in Ecuador there is sustained resistance to planned extractive sector expansion. There are growing concerns surrounding the environmental impact of these projects and the perceived lack of adequate consultation, particularly in the context of sector or project expansion.

S&P Global's Economics and Country Risk open-source intelligence event collection system captured at least 985 incidents related to protests affecting extractive industries during January-September 2022, out of which 61% were concentrated in Peru, Argentina, and Mexico.

With local communities increasingly becoming aware of their rights for prior consultation and their co-ordination with domestic and international NGOs expanding, combined with efforts to grow these industries, it is highly likely that opposition to extractive projects will increase.

Community disputes beyond extractives

ESG-related risks are also expanding to other sectors throughout Latin America, including infrastructure, renewables, and electricity.

Based on current trends, other key sectors and projects likely to face growing ESG pressures over the next few years include environmentally sensitive projects located in forested regions, tourism developments in indigenous territory or archaeological sites, agribusiness, and hydroelectric projects.

For example, the USD20-billion Maya Train in Mexico has faced multiple legal challenges from groups of residents, environmental activists, and rural communal landowners expressing ESG-related concerns.

In Colombia, the Guajira department is an area with high potential for renewable energy projects, particularly wind power. Indigenous communities in the area, however, have opposed renewable projects, calling for consultation processes.

Consultation processes can take many months and occasionally cause much longer delays if communities reject the process or if multiple communities need to be consulted.

Violence against activists

Reputational and exclusion-related risks are likely to rise in countries where human rights, labor, and environmental activists are prosecuted or murdered.

Although extractive industries will face the strongest opposition from environmental activists, increasing water stress and the occurrence of extreme climate events throughout the region are likely to enhance activism against projects in other sectors such as agribusiness, renewable energy, and water-intensive manufacturing.

The 2016 assassination of environmental activist and indigenous leader Berta Cáceres in Honduras led to financial institutions withdrawing support for the hydropower project opposed by members of her community. According to data collected by NGO Global Witness, 68% of worldwide lethal attacks against environmental activists between 2012 and 2021 occurred in Latin America, with 2020 and 2021 reporting the first- and second-highest numbers of cases.

With social activism a rising trend in Latin America, the targeting of activists is also expected to increase, likely prompting financial institutions with ESG-related concerns to withdraw financing to force governmental change via the protection of activists.

Deforestation and encroachment into environmentally sensitive areas

The Amazon rainforest has been a focal point for activism surrounding ESG concerns, particularly in Brazil. Agribusiness is a major driver of deforestation in Brazil, a problem that has been exacerbated by lax environmental policy under President Jair Bolsonaro.

While focus on the Brazilian Amazon is unlikely to dissipate, a shift in policy surrounding the Amazon is highly likely under incoming President Lula. Lula will probably increase scrutiny surrounding illegal activity and the encroachment of economic activity into environmentally sensitive areas. Given the remoteness of environmentally sensitive areas, this process is likely to be slow, and reputational risk related to the mining and agribusiness sectors is likely to remain high for at least the next 12 to 24 months.

Outside Brazil there has been a focus on hydrocarbons, with adverse focus on the sector's activity in the Amazon likely to increase as campaigns by NGOs gain media and social media coverage.

Contributions to this article from Roger Padierna.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fesg-and-exclusionary-policies-affecting-latin-america-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fesg-and-exclusionary-policies-affecting-latin-america-.html&text=ESG+and+exclusionary+policies+affecting+Latin+America++%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fesg-and-exclusionary-policies-affecting-latin-america-.html","enabled":true},{"name":"email","url":"?subject=ESG and exclusionary policies affecting Latin America | S&P Global&body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fesg-and-exclusionary-policies-affecting-latin-america-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ESG+and+exclusionary+policies+affecting+Latin+America++%7c+S%26P+Global http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fesg-and-exclusionary-policies-affecting-latin-america-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}