Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2020

IHS Markit European GDP Nowcasts: Eurozone growth remains muted despite return to growth of Germany in first quarter

Summary: 24th January 2020

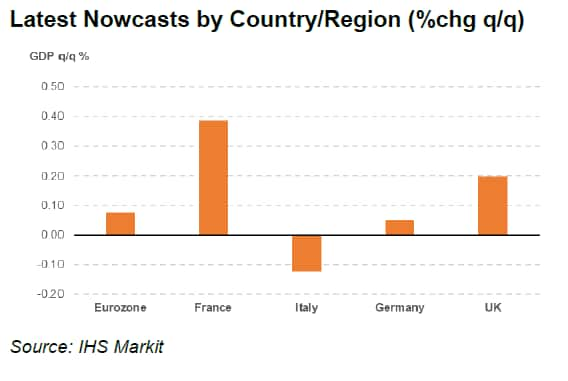

Our first growth estimates for the opening quarter of the new decade point to a continuation of meagre expansion across the European economy, although there are further signs that the recent downturn is bottoming out.

Of note, Germany looks set to record a stronger performance than in the fourth quarter, largely thanks to renewed strength in its more domestic-facing services economy. January PMI data showed activity rising at its best rate for five months, supported by firmer gains in new work and rising employment. However, with industrial recession persisting - the respective manufacturing PMI improved in January but remained well below the crucial 50.0 no-change mark - expect growth to remain weak at best and reflected by the initial Q1 2020 nowcast of 0.05% q/q expansion.

France meanwhile is maintaining expansion, with the headline PMI moving down only slightly in January. Growth is estimated to be running at a level of just below 0.4% q/q, a little slower than the previous quarter's punchy performance, but nonetheless on track for a robust gain.

Outside of the biggest two eurozone economies, we presently see

Italy inside negative territory

(-0.1% q/q) although we await next week's January PMI data for a

better steer on underlying economic performance at the start of the

new year.

With Italy continuing to drag on regional output, and Germany only just inside growth territory, we anticipate another quarter of slight expansion at the overall euro area level (nowcast: +0.08% q/q).

Meanwhile, further signs of a release of pent-up demand in the UK following the decisive election outcome in early December are sure to provide some food-for-thought for the Bank of England as it mulls over a possible rate cut at the end of January.

Adding to earlier evidence of strengthening housing and labour market activity, PMI figures for January showed positive momentum across activity, new orders and employment variables. Confidence about the future hit its highest level in over four-and-a-half years.

All this added up to a Q1 2020 nowcast estimate of +0.2% q/q for the UK, a subdued rate in isolation, but nonetheless a notable improvement in underlying performance compared to previous quarters.

Next Nowcast Update: February 5th 2020

Joe Hayes, Economist, IHS Markit

Tel: +44 1491 461006

joseph.hayes@ihsmarkit.com

Paul Smith, Director, IHS Markit

Tel: +44 1491 461038

paul.smith@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-remains-muted-jan20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-remains-muted-jan20.html&text=S%26P+Global+European+GDP+Nowcasts%3a+Eurozone+growth+remains+muted+despite+return+to+growth+of+Germany+in+first+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-remains-muted-jan20.html","enabled":true},{"name":"email","url":"?subject=S&P Global European GDP Nowcasts: Eurozone growth remains muted despite return to growth of Germany in first quarter | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-remains-muted-jan20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=S%26P+Global+European+GDP+Nowcasts%3a+Eurozone+growth+remains+muted+despite+return+to+growth+of+Germany+in+first+quarter+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropean-gdp-nowcasts-eurozone-growth-remains-muted-jan20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}