Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 23, 2023

Eurozone Flash PMI at three-month low as steepening factory downturn offsets services revival

Eurozone business output grew for a fifth straight month in May, according to the latest HCOB flash PMI survey data produced by S&P Global, pointing to robust economic growth so far in the second quarter. The rate of expansion moderated in response to a near-stalling of new business inflows, however, and the upturn grew increasingly uneven. Strong service sector growth contrasted with a steepening loss of factory output, linked in turn to a widening divergence in demand growth for goods and services.

Inflation trends also varied by sector. Resurgent post-pandemic demand buoyed pricing power in the services sector, allowing the pass through of higher costs - notably wages - on to customers to result in a steep and accelerating rate of selling price inflation for services. In manufacturing, however, weak demand and lower raw material prices, linked to surplus supply, pushed selling prices lower for the first time since September 2020.

Business confidence in the outlook meanwhile sank to a five-month low, dropping further below the survey's long-run average amid growing concerns about the economic outlook, albeit still above last year's lows. Sentiment was especially weak in manufacturing but also cooled in the service sector.

Output growth remains robust, for now

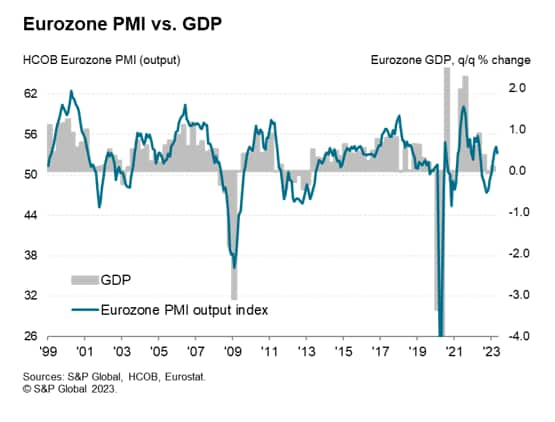

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses, registered expansion for a fifth consecutive month in May. Recording 53.3 compared to 54.1 in April, the flash reading signalled an easing in the rate of growth to a three-month low but the expansion was still robust and the third-strongest seen over the past year.

The PMI data for the second quarter so far are consistent with GDP growth accelerating from 0.1% in the first quarter to 0.4% in the second quarter.

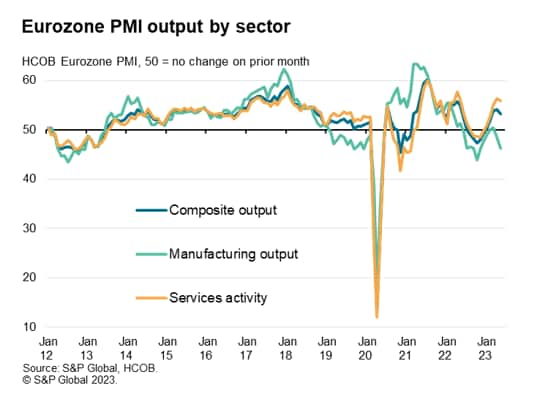

The growth divergence between manufacturing and services widened further, however, pointing to an increasingly uneven recovery. While growth surged in the service sector at the second-fastest pace seen over the past year, the expansion cooling slightly from April's high, manufacturing output contracted sharply, dropping at the fastest rate for six months. The resulting outperformance of services relative to manufacturing was the widest since January 2009. The survey has not previously signalled such a strong service sector expansion at a time of manufacturing decline.

Near-stalling of new orders

The sector divergence was even more marked for new orders. New order inflows into the service sector rose for a fifth successive month, albeit at the slowest rate for three months, while manufacturing new orders fell at an increasingly steep pace, underperforming the service sector to an extent not seen since 2008. Measured overall, new orders rose only marginally and at the slowest rate for four months to point to an overall near-stalling of demand growth.

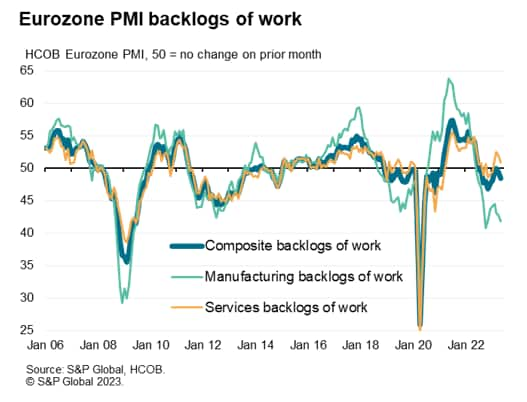

Output growth across the region consequently exceeded growth of new orders to a degree not seen since early 2009. The relatively faster pace of output growth was again supported by companies fulfilling orders placed in prior months, causing backlogs of work to fall at an increased rate, albeit exclusively in manufacturing (though service sector backlogs rose only very modestly).

Employment up sharply in services

Labour market trends also varied by sector. Whereas manufacturing employment rose only slightly, the rate of job creation down to the lowest for 28 months, service sector jobs growth was the second-strongest recorded over the past year. The resulting overall increase in employment was consequently weaker than April but still the second-highest recorded over the past 11 months.

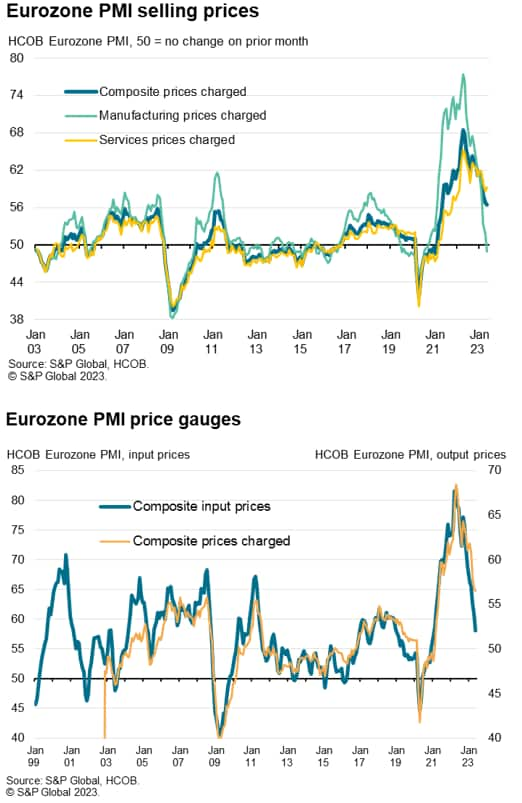

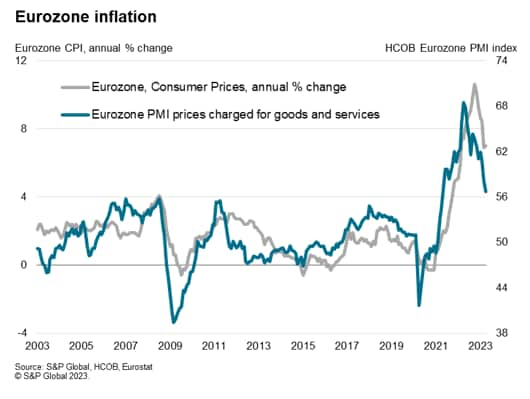

Prices rise at slowest rate for over two years

Average prices charged for goods and services rose at the slowest rate for 25 months in May, having been on a broad easing trend over the course of the past year. However, the rate of increase remained elevated by historical standards, and far above the average seen in the decade leading up to the pandemic. Although prices charged for goods leaving the factory gate fell for the first time since September 2020, average rates levied for services grew sharply, with the rate of inflation accelerating compared to April.

While the variance in inflation trends by sector in part reflected differing demand conditions, with service sector firms reporting higher pricing power amid resurgent demand while goods producers reported an increasing need to offer discounts to stimulate sales, the survey also revealed growing cost divergences.

Input costs in the goods producing sector fell for a third straight month and at the sharpest rate since February 2016, pulled lower by reduced costs for energy as well as for a wide variety of other inputs amid increasingly abundant supply. Supplier delivery times shortened for a fourth successive month, with improved supply conditions also linked to slumping demand for raw materials. Manufacturers cut back on their input buying at the fastest pace for three years, leading to the steepest decline in inventories for three-and-a-half years.

In contrast, service sector input costs continued to rise sharply, the rate of increase remaining elevated, often linked to higher wage and salary costs. Service sector input cost inflation nevertheless moderated slightly to the lowest since August 2021, helping bring the overall rate of input cost inflation across goods and services down to the lowest since January 2021.

Future expectations slip to five-month low

Finally, optimism about the year ahead dipped further from February's 12-month high, down especially in manufacturing but also slipping further in services, reaching a five-month low. Although the number of optimists continued to outnumber pessimists, the overall degree of confidence has dropped further below the long-run average, and is especially low by historical standards in manufacturing. While sentiment has improved considerably since the lows seen late last year on the back of fewer energy and supply chain worries, recent months have seen some cooling of sentiment amid growing concern over weaker customer demand and higher interest rates, fuelling uncertainty about the outlook and adding to recession risks.

National trends

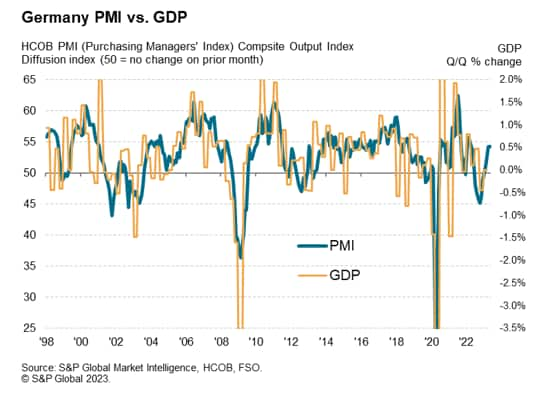

Looking at growth within the euro area, the expansion in May was led by Germany, where output grew at the sharpest rate for 13 months, albeit confined to services. The PMI data for Germany are so far indicative of GDP growing 0.5% in the second quarter. The sharpest expansion of service sector output since August 2021 was countered by the sharpest fall in German goods production for six months. New orders fell, however, after rising in April, to hint at a renewed weakening of demand.

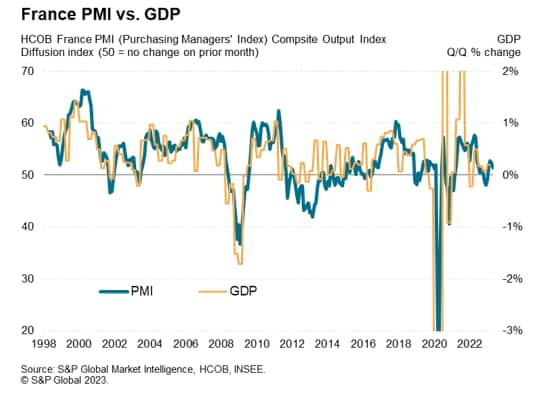

Growth in France meanwhile slipped to the lowest in the current four-month span of expansion, with weakened service sector growth accompanied by a further marked drop in goods production. The PMI data for France are so far indicative of GDP growing 0.2% in the second quarter, albeit losing momentum in May. With May also seeing the steepest loss of new orders for four months, the near-term outlook has darkened.

While the rest of the region as a whole reported growth for the fifth month in a row, the expansion cooled to the lowest since February due to slower (though still buoyant) services growth and an increasingly steep fall in manufacturing output.

Outlook

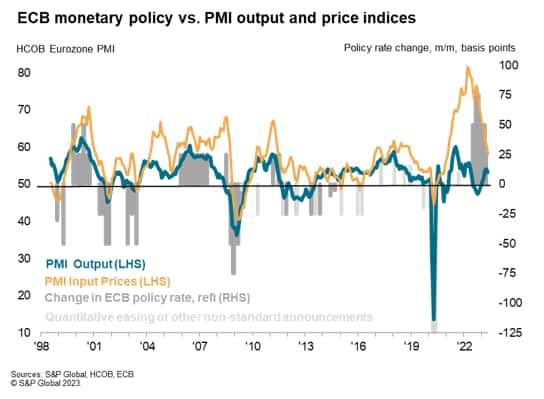

With the survey data indicating that GDP growth has likely accelerated in the eurozone during the second quarter, the ECB may well be encouraged to tighten policy further via more rate hikes in order to help anchor inflation expectations, notably in the service sector.

However, the picture is by no means clear-cut. The near-stalling of new orders growth hints at the upturn losing momentum. Similarly, the deterioration of business expectations about the year ahead to a level below the survey's long-run average points to some loss of pace in output growth.

The unbalanced nature of the upturn is also a major concern, with manufacturing acting as a severe drag amid destocking and falling global trade, leaving the economy reliant on service sector spending, especially from households. Such spending looks prone to weakness amid the elevated cost of living and rising borrowing costs. Meanwhile, lower manufacturing prices should feed through to the broader economy in the coming months.

Two key factors to watch out for in the coming months to help determine growth in the second half of the year are, first, the degree to which stronger spending on services by households can persist for in the face of cost of current headwinds and, second, how long the current inventory adjustment in manufacturing may persist for.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-threemonth-low-as-steepening-factory-downturn-offsets-services-revival-May23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-threemonth-low-as-steepening-factory-downturn-offsets-services-revival-May23.html&text=Eurozone+Flash+PMI+at+three-month+low+as+steepening+factory+downturn+offsets+services+revival+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-threemonth-low-as-steepening-factory-downturn-offsets-services-revival-May23.html","enabled":true},{"name":"email","url":"?subject=Eurozone Flash PMI at three-month low as steepening factory downturn offsets services revival | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-threemonth-low-as-steepening-factory-downturn-offsets-services-revival-May23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+Flash+PMI+at+three-month+low+as+steepening+factory+downturn+offsets+services+revival+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-at-threemonth-low-as-steepening-factory-downturn-offsets-services-revival-May23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}