Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2019

Eurozone PMI signals weak and fragile third quarter expansion

- Eurozone PMI rises but still points to weak GDP

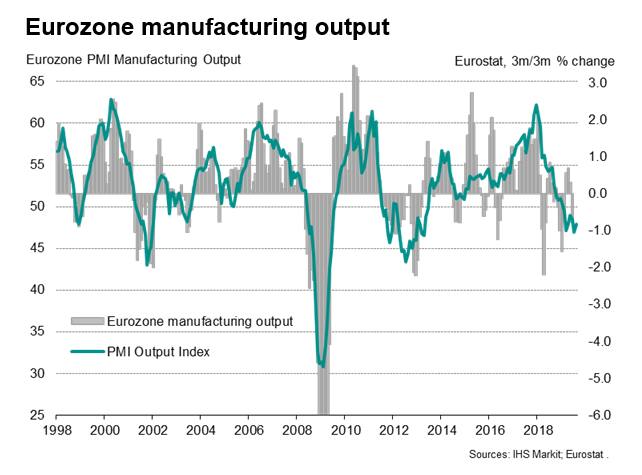

- Manufacturing remains in deepest downturn since 2012, but impact offset by resilient service sector

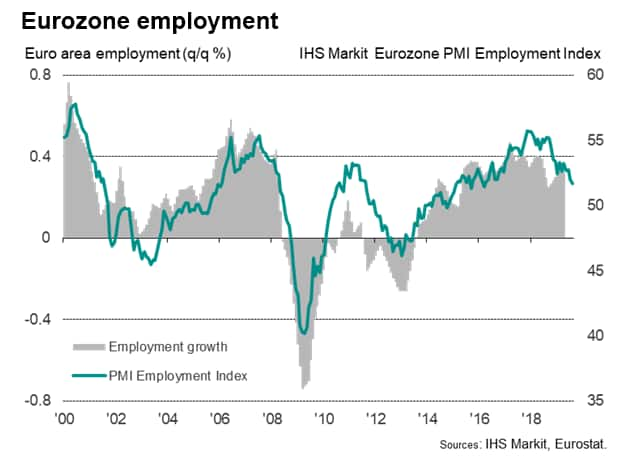

- Slowing jobs growth puts question mark on sustained sector divergence

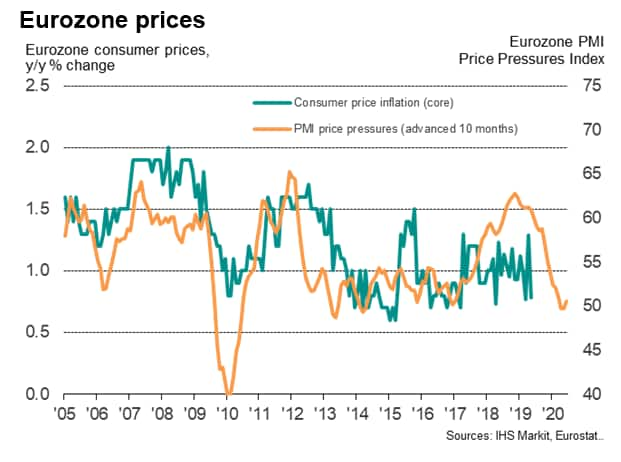

- Price pressures stuck at lowest rate since 2016

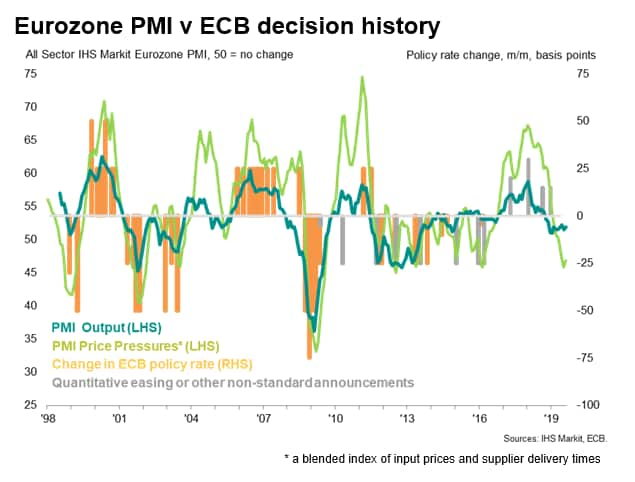

The eurozone economy remained mired in a fragile state of weak and unbalanced growth in August, according to the latest survey data. With price pressures also remaining subdued, the data add to the case for more stimulus from the ECB in September.

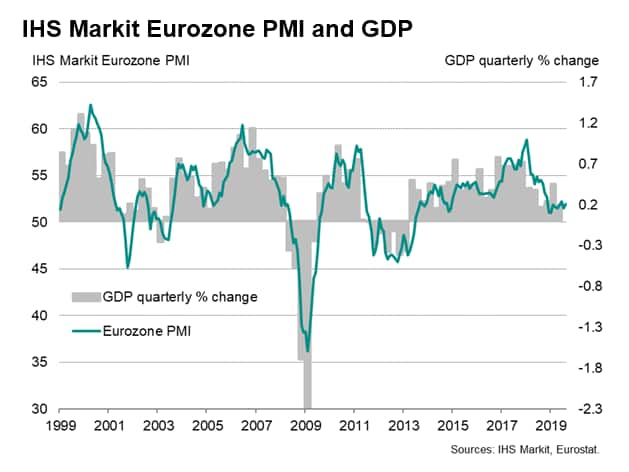

At 51.9 in August, up from 51.5 in July, the IHS Markit Eurozone PMI® Composite Output Index signalled the continued yet still modest expansion of the euro area private sector. The average reading so far for the third quarter indicate that GDP will rise by just 0.2%, assuming no substantial change in September. Official data available so far for the quarter suggest growth could be even weaker.

The picture remained very mixed both by sector and country, highlighting how downside risks continued to persist. The August data showed that a fierce manufacturing downturn, fuelled by deteriorating exports and most intensely felt in Germany, continued to be offset by resilient growth in the service sector, the latter in turn propped up to a large extent by solid consumer spending in domestic markets.

Employment could hold key to divergence

The big question is how long this divergence can extend before the manufacturing weakness spreads to services and households. With jobs growth waning to the slowest since early-2016 a deteriorating labour market looks set to be a key transmission channel in which the trade-led downturn infects the wider economy. A sharp drop in business optimism about the coming year in the service sector, down to the joint-lowest for six years, suggests that companies are already braced for tougher times ahead.

Price pressures lowest since 2016

The surveys also continued to signal weak price pressures. Although input cost inflation rose, the rate of increase remained among the weakest recorded over the past three years and well down on that seen at the start of the year. Similarly, average selling prices for goods and services rose only modestly, recording one of the smallest gains since late-2016, as firms reportedly often competed on price to win new sales.

Policy stimulus

Renewed stimulus from the ECB is therefore expected as the central bank seeks to stem the spreading malaise and revive demand. The minutes from the ECB's July meeting showed there was a wide consensus of the need for a highly accommodative monetary policy stance for a prolonged period of time and there was broad agreement to adjust the forward guidance on policy rates by reintroducing an easing bias and to initiate preparatory work looking at options for new asset purchases. Moreover, the meeting noted that experience had shown that a policy package - such as a combination of rate cuts and asset purchases - was more effective than a sequence of selective actions.

Our European economics team therefore expects a restart of net asset purchases and a reduction in the deposit facility rate (DFR) of 10bp, to a new low of -0.50% on 12th September. The door will likely be left open for further cuts, in tandem with the introduction of a tiering system to attempt to mitigate the adverse effects on commercial banks.

For more detail on our take on the policy outlook, and its potential effects, please see our special report: More ECB policy easing on the way, and soon, but will it make much difference?.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-signals-weak-and-fragile-q3-expansion-050919.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-signals-weak-and-fragile-q3-expansion-050919.html&text=Eurozone+PMI+signals+weak+and+fragile+third+quarter+expansion+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-signals-weak-and-fragile-q3-expansion-050919.html","enabled":true},{"name":"email","url":"?subject=Eurozone PMI signals weak and fragile third quarter expansion | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-signals-weak-and-fragile-q3-expansion-050919.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+PMI+signals+weak+and+fragile+third+quarter+expansion+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-pmi-signals-weak-and-fragile-q3-expansion-050919.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}