Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 05, 2023

Eurozone’s tight labor market still faces low wage/price spiral

The strong recovery from the COVID-19 virus pandemic has resulted in tight labor market conditions in the eurozone. The eurozone's unemployment rate trending downwards since standing at a cyclical peak of 8.4% in mid-2020, reaching a eurozone-era low of 6.6% in January 2023. The number of firms reporting labor shortages remains high, particularly in the services sector, while vacancy rates are well above their per-pandemic average.

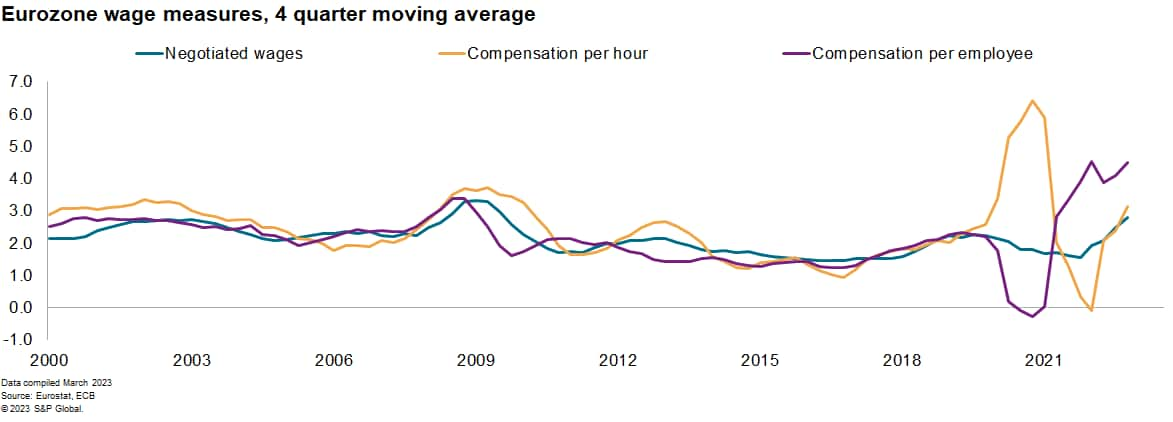

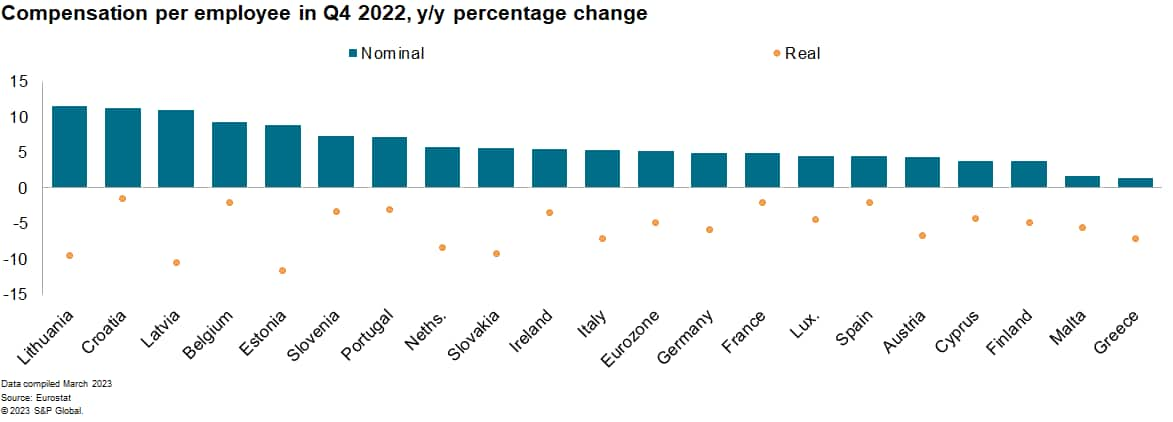

Job retention schemes put in place across the area during the COVID-19 pandemic have injected significant volatility to some wage measures, but all point to an upward trend. Nominal wage growth, as measured by compensation per employee, is particularly strong in the Baltics (which historically experienced relatively higher inflation compared with the rest of the eurozone), Croatia, and Belgium (where price indexation of wages in the private sector is widespread). However, some of the countries experiencing the largest nominal increases also show a large decline in real wages, as the increase in inflation outpaces wage growth.

Wage growth set to hit its peak in 2023, and then gradually decelerate

We expect job creation to decelerate in 2023 as economic conditions cool and the impact of the reopening of the economy in early 2022 dissipates. Market Intelligence's latest forecasts project employment growth to moderate substantially throughout 2023 and 2024 when compared against 2022 and also its pre-pandemic trend. However, we expect employment growth to be high enough to prevent a large increase in unemployment in both years.

On top of softer employment growth, a rising labor pool should ease labor market tightness and therefore counter excessive wage demands. Since the early stages of the pandemic, more people have left economic inactivity to rejoin the labor pool in either an employed or unemployed capacity and this trend continued in the fourth quarter of 2022.

Softer demand for employment should also lead to lower labor shortages. Indicators measuring the number of firms reporting labor shortages remain extremely high for historical standards. However, shortages seem to have peaked in mid-2022 and we expect this downward trend to remain in place in 2023 and 2024. Households' inflation expectations should ease as inflation gradually declines, and this is expected to feed into lower wage demands.

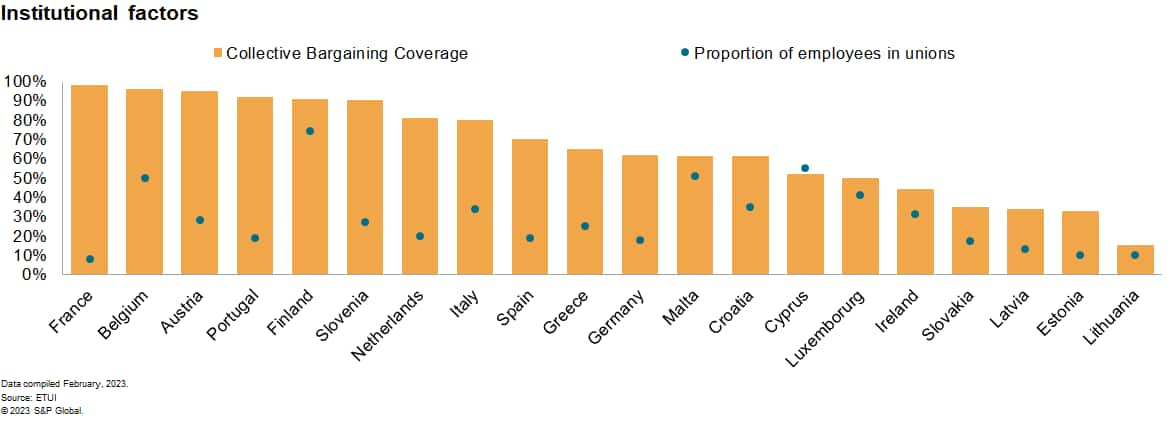

At first glance, the institutional setup of wage negotiations in the eurozone could appear to raise the risk of a wage-price spiral emerging in 2023. Over half of employees in the eurozone are covered by collective bargaining agreements, according to the European Trade Union Institute for Research (ETUI). However, high collective bargaining coverage does not always go hand in hand with union density. Indeed, it is only Finland where both collective bargaining coverage and union density is high, meanwhile in countries such as France, Belgium, Austria, and Portugal the current high levels of collective bargaining coverage reflect in part the legal framework in which collective bargaining takes place rather than union density.

Outlook

The expected strength of wage growth in the short term suggests that it will become an increasingly important driver of underlying inflation in 2023, particularly as the contributions from energy and non-energy industrial goods decline. Labor costs make up a large part of firms' total costs, particularly in the services sector. However, we do not expect to see an ever-accelerating interaction between wages and prices, where consumer prices accelerate and nominal wages rise in at least three out of four consecutive quarters.

The analysis above suggests that the likely slowdown in economic activity and labor markets, limited wage indexation, and the expected decline in inflation expectations as headline inflation eases help mitigate the risk of a wage/price spiral. Factors that may increase the risk of higher wage demands becoming entrenched into prices include a de-anchoring of inflation expectations by households, and stronger-than-expected labor market conditions (in which labor shortages remain abnormally elevated), but these are not our base case.

Following a projected peak in late 2022, a gradual deceleration in wage growth should ensue. Inertia from multi-year collective bargaining agreements as well as the expiry of fiscal support programs will keep nominal wage growth in 2024 considerably above the pre-pandemic average. In the medium term, assuming labor productivity trend growth at around 1% and inflation expectations returning to the ECB's 2% target, we expect nominal wage growth (measured by hourly wages) to trend at around 3% from 2025 onwards. This is higher than an average of 1.9% in the five years preceding the pandemic due to a variety of factors. These include demographics, such as the baby boomer generation leaving the workforce, as well as tight immigration policies. The push for deglobalization following the supply-chain disruptions caused by the pandemic and the outbreak of war in Ukraine is also likely to keep labor shortages in the eurozone more prevalent than in previous decades, particularly in the manufacturing sector. On the other hand, the trend towards an increasing share of services jobs with their typically lower pay is expected to re-establish itself after 2024, leading to a more moderate overall nominal wage growth in the coming decade.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-tight-labor-market-still-faces-low-wageprice-spiral.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-tight-labor-market-still-faces-low-wageprice-spiral.html&text=Eurozone%e2%80%99s+tight+labor+market+still+faces+low+wage%2fprice+spiral+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-tight-labor-market-still-faces-low-wageprice-spiral.html","enabled":true},{"name":"email","url":"?subject=Eurozone’s tight labor market still faces low wage/price spiral | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-tight-labor-market-still-faces-low-wageprice-spiral.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone%e2%80%99s+tight+labor+market+still+faces+low+wage%2fprice+spiral+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-tight-labor-market-still-faces-low-wageprice-spiral.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}