Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 12, 2021

EU-UK trade deal will prevent deeper and longer UK double-dip recession in 2021

- The agreed EU-UK trade deal is a welcome development for the UK economy, which faces ever-tighter coronavirus disease 2019 (COVID-19) virus restrictions in early 2021.

- The new trade arrangement is a "slim" version, dealing predominantly with trade in goods while paying minimal attention to services.

- The agreement allows "zero tariff, zero quota" trade in goods between the EU and the UK.

- The deal provides a clearer path for the planned rollout of the approved COVID-19 vaccine to be more growth supportive from mid-2021.

The EU-UK trade deal for goods

The United Kingdom and European Union reached a trade agreement in late December 2020 that has been approved by the UK parliament and all EU member states. It is being applied provisionally pending expected approval by the European Parliament.

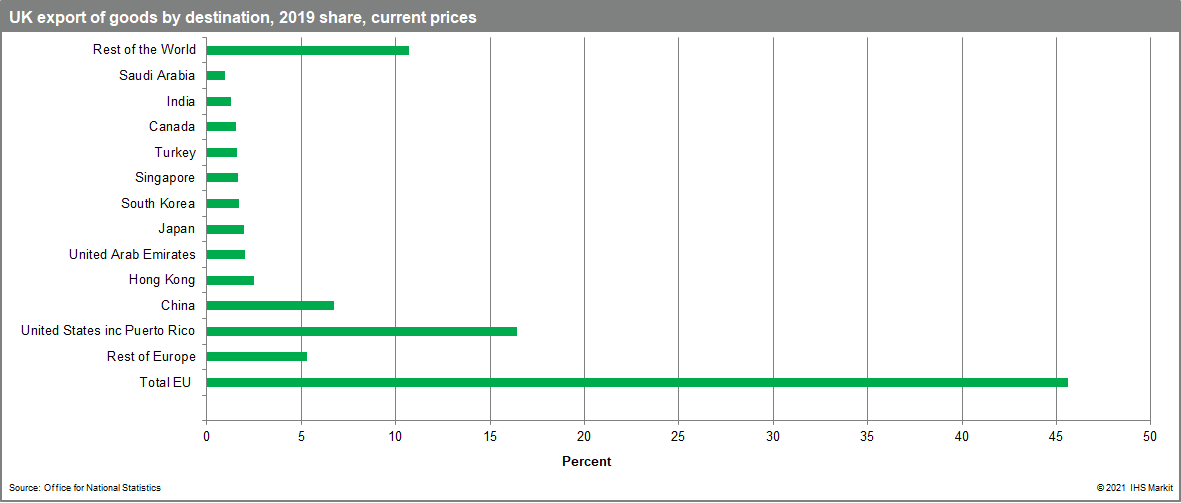

The EU-UK trade agreement allows "zero tariff, zero quota" trade in goods. This covers UK export of goods to the EU which totaled GBP170 billion (7.7% of UK nominal GDP) in 2019. Meanwhile, UK import of goods from the EU were GBP266.1 billion.

The deal ensures that both sides commit legally to a set of "level playing field" principles to ensure aligned rules on environmental regulation and workers' rights.

Both EU and UK have agreed to a non-regression clause in the deal, meaning that the UK and the EU will not distil the shared rules they currently have on workplace rights and environmental standards. A new arbitration mechanism system will be formed to resolve any disputes as a result of regulatory divergences between the two parties using international law. Ultimately, this could allow for sanctions in the form of tariffs if either side seriously diverges from the other's regulations.

Importantly, the UK achieves its primary goal to deny the European Court of Justice a place in settling disputes over the application of the deal.

Manufacturers welcomed an agreement over rules of origin, which allows them to self-certify and ensure that the processing of goods also counts under the zero-tariff regime.

However, with the UK leaving the EU single market and Customs Union, UK exporters are facing additional checks for safety and security documentation, and customs papers.

On balance, the EU-UK trade deal still represents good news for UK manufacturers, given its large export base.

What about services?

The trade deal has shortcomings, namely that large parts of the UK economy are beyond the scope of this agreement, and its future relationship with the EU for much of its UK economy and the financial services sector remains undefined.

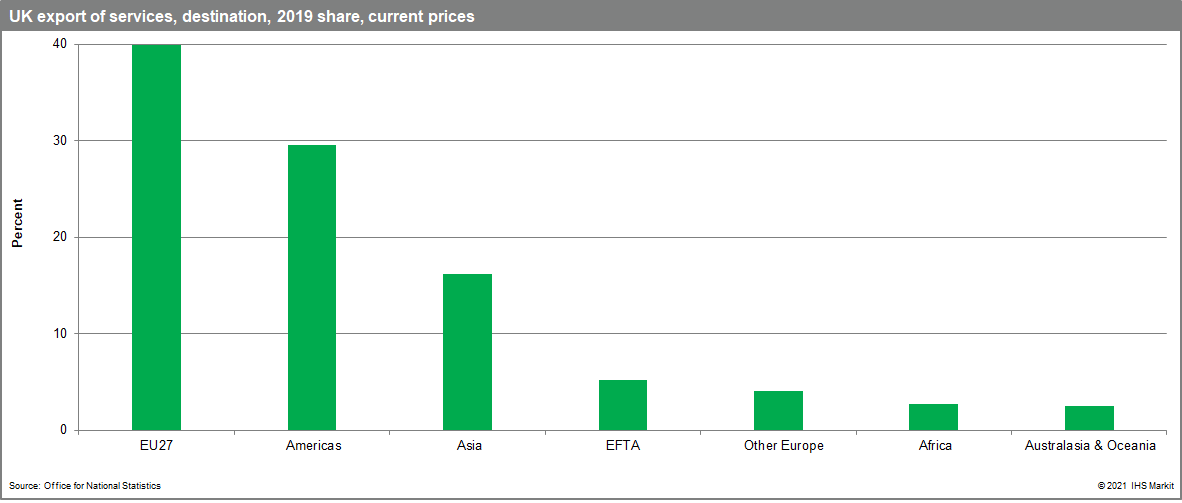

Therefore, the trade deal fails to protect automatic access to an EU market worth around GBP100 billion to UK service firms in 2019.

UK service providers will face more obstacles when exporting to the EU and they are expected to face non-tariff barriers (NTBs), such as regulations and licensing. Furthermore, professional qualifications for many service professions are no longer granted automatic recognition.

This represents some costs to the UK economy, with services sector activity accounting for 80% of nominal GDP. The sector accounts for 46% of total UK exports, with the EU by far its largest market, particularly for financial services.

The key analytical challenge after 31 December 2020 is to foresee how an agreed trade deal will evolve over time to provide greater support to UK services or provide the legal basis to augment the trading relationship over time.

The UK's financial industry hopes for a closer relationship with the EU in future and to build on the foundations of the trade deal by "strengthening arrangements for future trade in financial services". The two sides will hold talks in early 2021 to draft a memorandum of understanding on future co-operation on financial services policy, with the aim of agreeing a text by March 2021. However, the memorandum will not have the same legal force as an international treaty.

The EU and the UK agree that financial services can only access their respective markets if each party declares unilaterally that the other side's regulatory systems are "equivalent" to its own. The equivalence system does not cover all financial services, with access rights able to be withdrawn at just 30-days' notice.

Final assessment

The narrow trade deal still represents welcome relief by removing the prospect of failed EU-UK negotiations adding further stress to the UK economy already scarred by the COVID-19 pandemic.

Stricter COVID-19 virus restrictions in England and elsewhere in the UK point to fresh GDP losses in late-2020 and early 2021, implying the UK will endure a short-lived double-dip recession.

Encouragingly, the trade deal provides a clearer path for the planned rollout of the approved COVID-19 vaccines to be more growth supportive from mid-2021.

The deal represents good news for the UK retail sector and the country's households. Specifically, four-fifths of UK food imports come from the EU, which will remain tariff free. Helen Dickinson, chief executive of the British Retail Consortium, said that a zero-tariff agreement with the EU "should afford households around the UK a collective sigh of relief".

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuuk-trade-deal-prevent-uk-doubledip-recession-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuuk-trade-deal-prevent-uk-doubledip-recession-2021.html&text=EU-UK+trade+deal+will+prevent+deeper+and+longer+UK+double-dip+recession+in+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuuk-trade-deal-prevent-uk-doubledip-recession-2021.html","enabled":true},{"name":"email","url":"?subject=EU-UK trade deal will prevent deeper and longer UK double-dip recession in 2021 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuuk-trade-deal-prevent-uk-doubledip-recession-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EU-UK+trade+deal+will+prevent+deeper+and+longer+UK+double-dip+recession+in+2021+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuuk-trade-deal-prevent-uk-doubledip-recession-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}