Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 24, 2022

Factor and style model performance: 2021 record book

Research Signals - January 2022

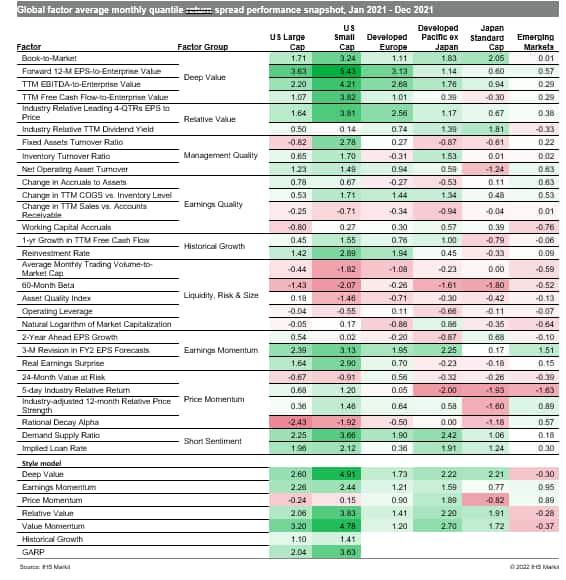

2021 was a year of records, as stocks extended prior year gains following the significant disruption in economic activity caused by the COVID-19 pandemic. Tailwinds from both monetary and fiscal stimulus helped push stocks to all-time highs in several major markets including the US and Europe, though elevated inflation may turn into a headwind as central banks switch to a new tightening regime. Value factors staged a comeback, though with some interruptions, in 2021 (Table 1) after an extended period of underperformance since 2007, as yields and, in turn, the value/growth cycle reacted to the developing inflation and economic growth expectations priced into equity and bond markets.

- US: Our thematic models turned in strong results in 2021, especially among small caps, led by Value Momentum and Deep Value Models

- Developed Europe: Net Operating Asset Turnover and Reinvestment Rate outperformed on average last year, alongside valuation measures

- Developed Pacific: The Deep Value Model and related factors such as Book-to-Market were rewarded throughout much of 2021

- Emerging markets: The Earnings Momentum Model and its component measure, 3-M Revision in FY2 EPS Forecasts, were once again successful in distinguishing winners from losers on average last year

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2021-record-book.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2021-record-book.html&text=Factor+and+style+model+performance%3a+2021+record+book+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2021-record-book.html","enabled":true},{"name":"email","url":"?subject=Factor and style model performance: 2021 record book | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2021-record-book.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Factor+and+style+model+performance%3a+2021+record+book+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-and-style-model-performance-2021-record-book.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}