Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 10, 2019

Factor performance cycle inversion

Research Signals - August 2019

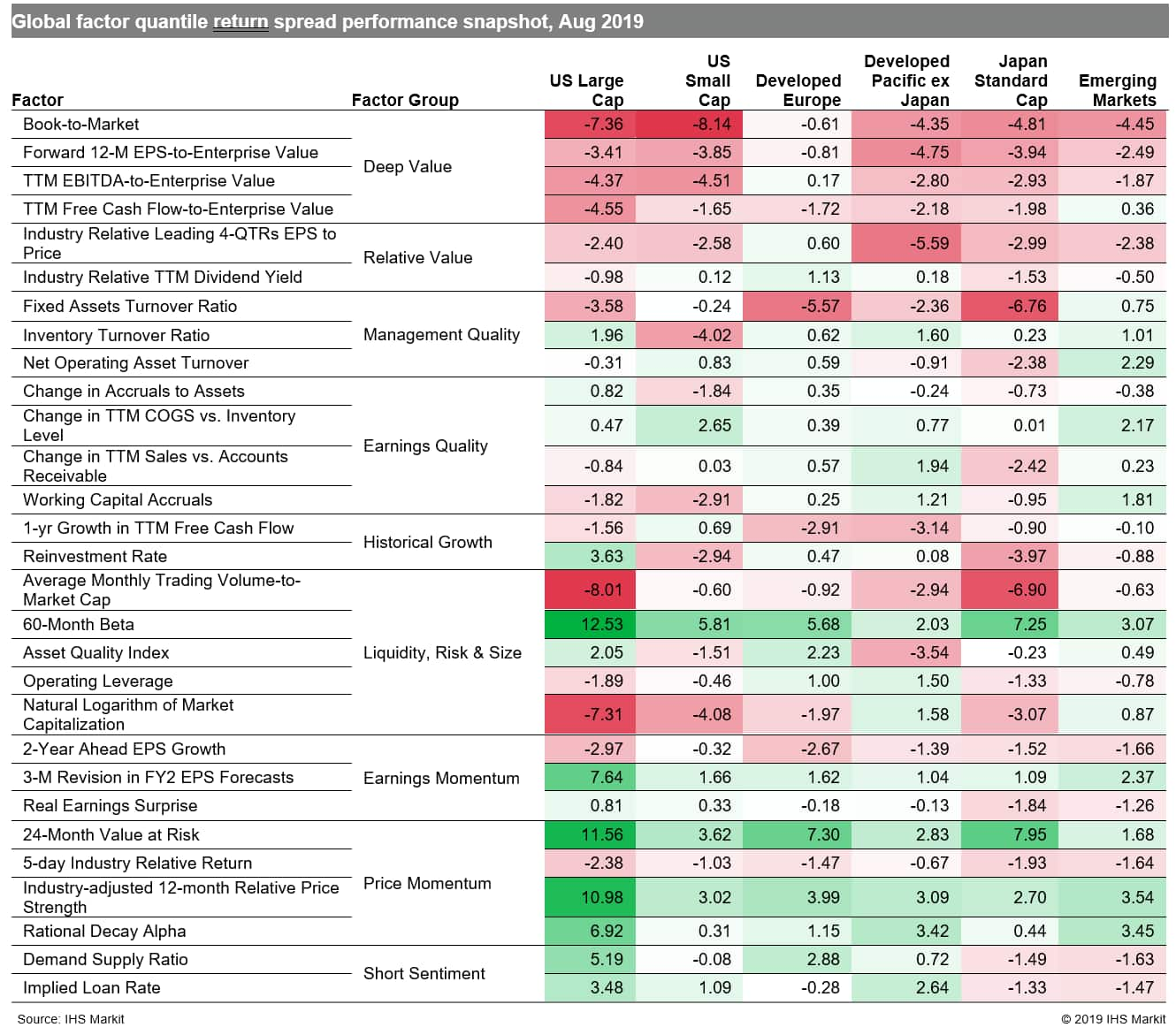

Investors' concerns over trade wars and a downshift in the global economy were reinforced by the August J.P.Morgan Global Manufacturing PMI residing below the neutral 50.0 mark for the fourth consecutive month. A global flight to safety led to an inversion of the US yield curve for the first time since 2007, contributing to another bout of volatile equity markets which coincided with a strong penchant for low risk stocks in many regional markets. However, the momentum trade was able to break out of its recent cyclical pattern, with a second consecutive month of positive performance in August (Table 1).

- US: After several months of flip flopping, Price Momentum tacked on a second month of outperformance, as captured by Industry-adjusted 12-month Relative Price Strength

- Developed Europe: The risk off trade was prominent, elevating the performance of 24-Month Value at Risk and 60-Month Beta

- Developed Pacific: In markets outside Japan, investors took cues from the securities lending markets, with positive performance associated with factors such as Implied Loan Rate

- Emerging markets: Factor performance at the two extremes was dominated by Price Momentum (e.g., Rational Decay Alpha) at the top and Deep Value (e.g., Book-to-Market) at the bottom

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-performance-cycle-inversion.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-performance-cycle-inversion.html&text=Factor+performance+cycle+inversion+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-performance-cycle-inversion.html","enabled":true},{"name":"email","url":"?subject=Factor performance cycle inversion | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-performance-cycle-inversion.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Factor+performance+cycle+inversion+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffactor-performance-cycle-inversion.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}