Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 23, 2024

Falling Rates, Diverging Paths: US Treasuries vs Canadian Govies.

DOWNLOAD PDF VERSION

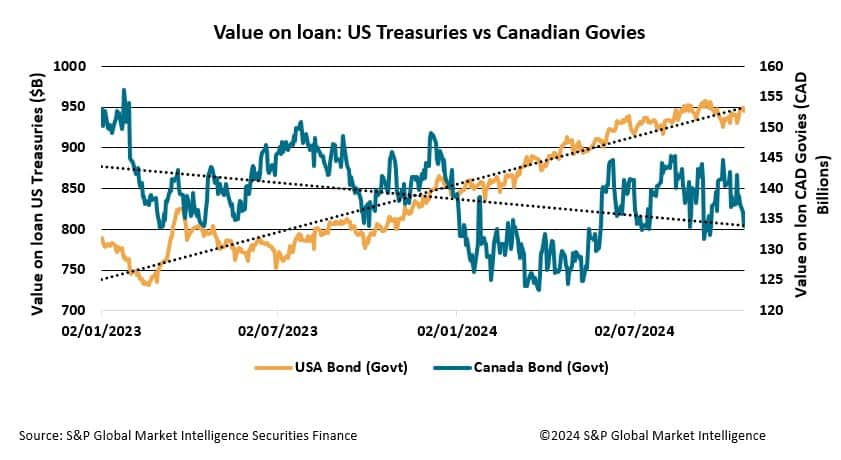

Falling interest rates have led to a decline in Canadian government bond borrowing while U.S. Treasury borrowing continues to surge amid economic resilience.

Despite the backdrop of falling interest rates in both Canada and the U.S., the dynamics in the securities lending market are telling a divergent story: the value on loan of Canadian government bonds has decreased, while the value on loan of U.S. Treasuries has surged. The reasons for this divergence lie in the contrasting economic outlooks and monetary policy expectations between the two countries, as well as the borrowing strategies that investors are employing.

Canada's Softer Economy and Aggressive Rate Cuts

In Canada, weaker economic data and an increasing likelihood of a soft landing have caused a decline in the value of Canadian government bonds on loan. The Bank of Canada has responded to slowing growth and moderate inflation by cutting rates aggressively, signalling a dovish stance. The more rapid and decisive rate cuts have contributed to lower volatility in Canadian bond markets, reducing short-selling and hedging demand, two key drivers of bond borrowing.

Investors see fewer opportunities for arbitrage or yield curve trades, as the outlook for future rate cuts is clear and largely priced into the market. Additionally, the softer economic backdrop in Canada suggests limited upside for taking speculative positions against government bonds, further reducing borrowing demand. With less uncertainty surrounding the pace of future rate changes, borrowers are scaling back, leading to a decrease in the value on loan for Canadian bonds.

U.S. Economic Resilience and Uncertainty

In contrast, U.S. Treasuries have seen an increase in the value on loan, driven by the relative resilience of the U.S. economy and the uncertain pace of future rate cuts by the Federal Reserve. The U.S. economy has defied predictions of a deep slowdown, showing stronger-than-expected growth and more robust labour market data. This has left investors and borrowers uncertain about how aggressively the Fed will continue cutting rates, creating more volatility in U.S. bond markets.

This uncertainty encourages borrowing of U.S. Treasuries, particularly for short-selling or hedging strategies. Borrowers may be positioning themselves to take advantage of potential rate changes, as markets fluctuate in response to shifting expectations. Additionally, the yield curve in the U.S. remains steeper compared to Canada, providing opportunities for arbitrage trades, which further increases demand for borrowing U.S. Treasuries.

Borrowing Strategies and Market Impact

Borrowers in the Canadian market are scaling back bond borrowing due to limited arbitrage and speculative opportunities, while U.S. Treasuries are being used in a variety of strategies, from short-selling to repo transactions, driven by a more dynamic market environment. The contrast highlights the impact of different macroeconomic conditions and central bank approaches on the securities lending market.

In summary, while interest rates are falling in both countries, the clear path to rate cuts and soft landing in Canada has dampened demand for borrowing Canadian bonds, while economic resilience and uncertainty in the U.S. continues to bolster demand for Treasuries.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffalling-rates-diverging-paths-us-treasuries-vs-canadian-govies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffalling-rates-diverging-paths-us-treasuries-vs-canadian-govies.html&text=Falling+Rates%2c+Diverging+Paths%3a+US+Treasuries+vs+Canadian+Govies.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffalling-rates-diverging-paths-us-treasuries-vs-canadian-govies.html","enabled":true},{"name":"email","url":"?subject=Falling Rates, Diverging Paths: US Treasuries vs Canadian Govies. | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffalling-rates-diverging-paths-us-treasuries-vs-canadian-govies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Falling+Rates%2c+Diverging+Paths%3a+US+Treasuries+vs+Canadian+Govies.+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffalling-rates-diverging-paths-us-treasuries-vs-canadian-govies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}