Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 07, 2023

Financial services lead global growth higher in May, stoking inflation

S&P Global PMI survey data show global growth to have been led by the financial services industry in May, for which a broad-based upturn was recorded across the US, Europe and Asia. Demand for financial service grew at the steepest rate since 2014, with new business placed at banks surging at rate amongst the quickest since comparable data were available in 2009.

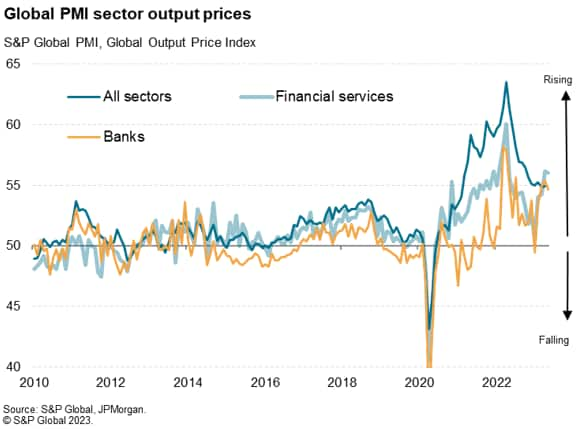

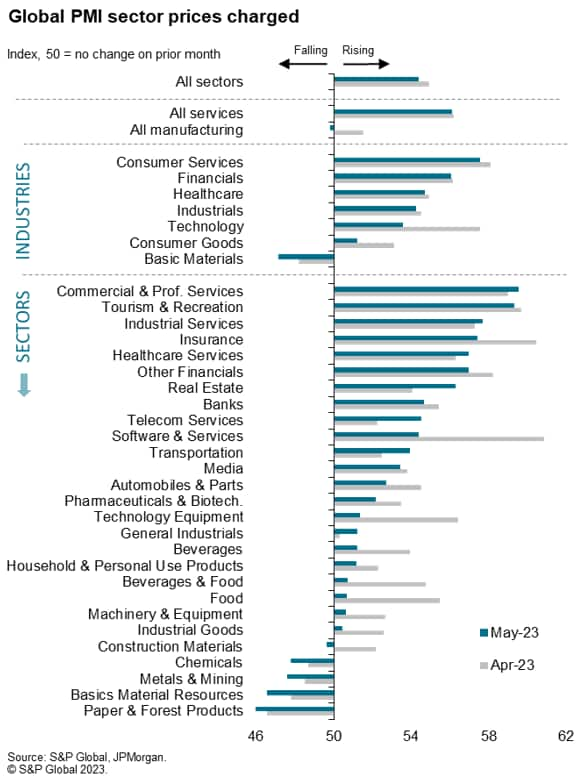

The upturn is accompanied by rising charges for financial services, however, which also rose at a rate well above anything seen prior to the pandemic, representing a major source of upward pressure on overall inflation in the global economy.

The revival of the financial service sector corresponds with rising financial markets and improving financial conditions from the lows seen late last year but, with the full impact of higher interest rates yet to be felt, the outlook remains highly uncertain.

Reviving demand for services

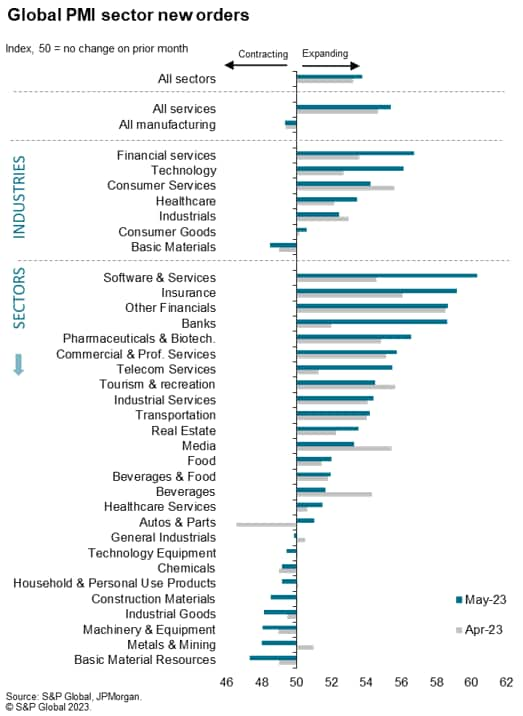

The Global PMI - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - rose for a sixth straight month in May from 54.2 in April to 54.4, climbing to its highest for one and a half years. Driving the upturn was a revival of demand, as measured by new orders, which rose for a fourth successive month in May, increasing at the steepest rate since March 2022.

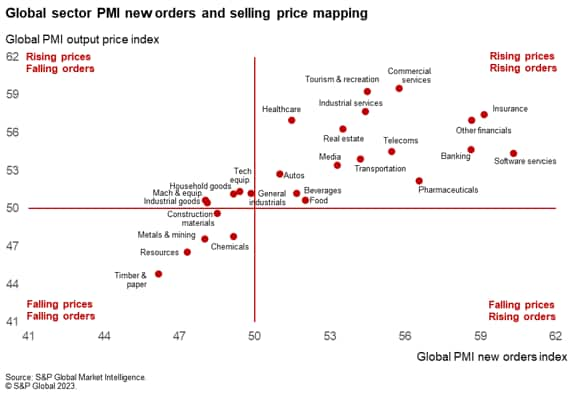

However, the pattern of demand growth varies by sector. Resurgent demand for services contrasts with falling demand for goods. While new business placed at service providers rose globally at the sharpest rate for 22 months in May, new orders received by factories were down for an eleventh straight month.

Near-record surge in demand for banking services

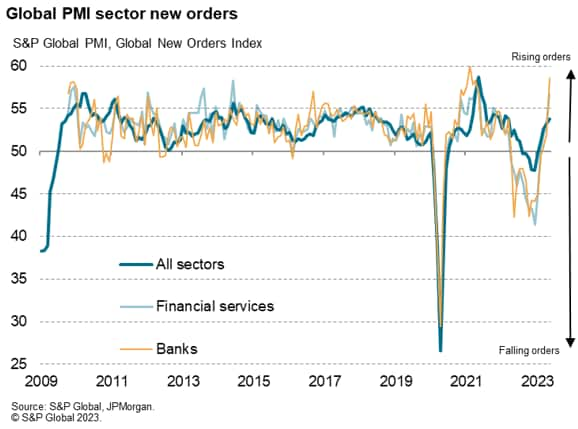

Digging deeper by broad industry, the strongest growth of demand was recorded for financial services, where new orders growth hit the highest since May 2021. Within financial services, new orders growth for insurance, 'other financials' and banking were the fastest growing of all detailed subsectors tracked by the PMI bar only Software & Related Services.

Measured overall, financial services activity grew in May at the fastest rate since 2014 barring the post-vaccine pandemic reopening in early 2021. The latest increases in new business for Banking Services was especially notable in being the largest since comparable data were first available in 2009, barring early 2021. Moreover, Insurance registered the strongest growth in new business on record.

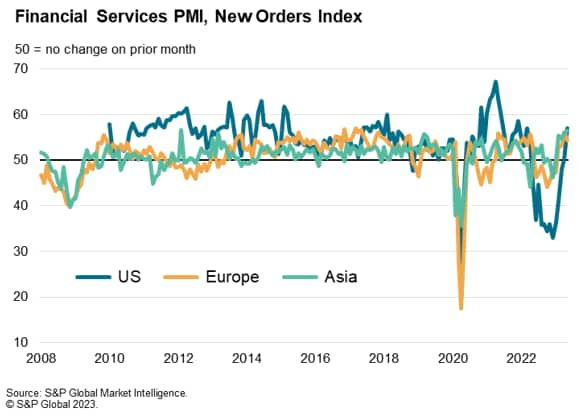

An interesting feature of the recent improvement in demand for financial services is the broad-based nature of the revival geographically, with new orders for financial services rising sharply across the US, Europe and Asia, in all three cases recovering from downturns seen during 2022.

Higher prices for services

The resurgent demand for financial services also means that these companies have been able to charge higher prices. In fact, the rate of inflation for financial services products ran above the global average for all goods and services in May for a second successive month, with the rate of inflation exceeded only by that seen in the Consumer Services industry. Charges for financial services are in fact now rising at a rate far in excess of anything seen prior to the pandemic, with only the immediate post lockdown reopenings of 2021 having witnessed steeper rates of price increase.

Financial conditions

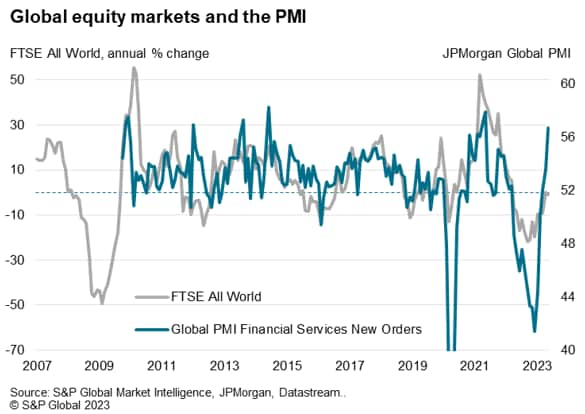

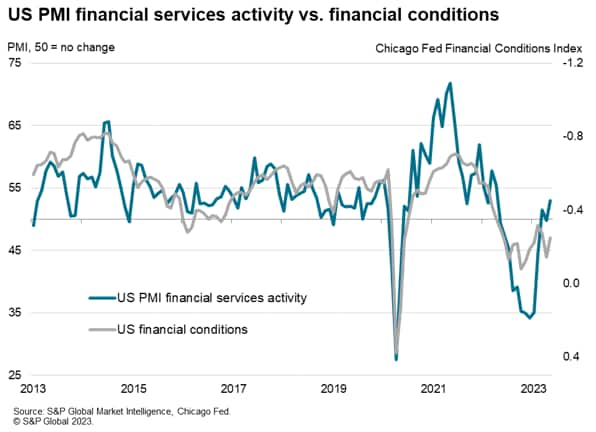

The steep upturn in the PMI new orders index for the global financial services sector from a low point seen last December has corresponded with an improvement in financial conditions since late last year. Global equities, for example, as measured by the FTSE All World Index, were up almost 17% from the low plumbed last September on average in May. Financial conditions in the US, as measured by the Chicago Fed, have likewise lifted off the low seen last October.

Markets have improved, but companies also report that recent hikes in interest rates, although cooling demand for loans and mortgages, are driving more interest from savers.

However, the recent hikes in interest rates will act with a lag, and undoubtedly the full impact of rate rises in the US and Europe will have yet to take their full toll on economic activity and demand for financial services. There also remains a great deal of uncertainty as to when rates will peak in the US and Europe, adding risk to the outlook. While we have no crystal ball, the sector PMI data will be a key instrument to help assess this rate hike impact as we head into the summer months.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-lead-global-growth-higher-in-may-stoking-inflation-june2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-lead-global-growth-higher-in-may-stoking-inflation-june2023.html&text=Financial+services+lead+global+growth+higher+in+May%2c+stoking+inflation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-lead-global-growth-higher-in-may-stoking-inflation-june2023.html","enabled":true},{"name":"email","url":"?subject=Financial services lead global growth higher in May, stoking inflation | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-lead-global-growth-higher-in-may-stoking-inflation-june2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Financial+services+lead+global+growth+higher+in+May%2c+stoking+inflation+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffinancial-services-lead-global-growth-higher-in-may-stoking-inflation-june2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}