Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 28, 2023

First Republic Bank shares become harder to borrow

DOWNLOAD PDF VERSION HERE

First Republic Bank recently disclosed that it lost $100B in deposits during Q1 2023. This news has revived some of the pressures experienced earlier in the year by the US banking sector.

Despite the limited degree of contagion sparked by the recent banking turmoil it appears that underlying concerns surrounding the US regional banks are not going away just yet. This is particularly the case for First Republic Bank (FRC). During the first quarter of 2023, First Republic Bank reported that it had lost circa $100 Billion of deposits. This sparked a significant decline in the bank's share price and showed that even with the support of some of Wall Street's largest banks, the market is looking for further reassurances before being satisfied that any further issues will be avoided.

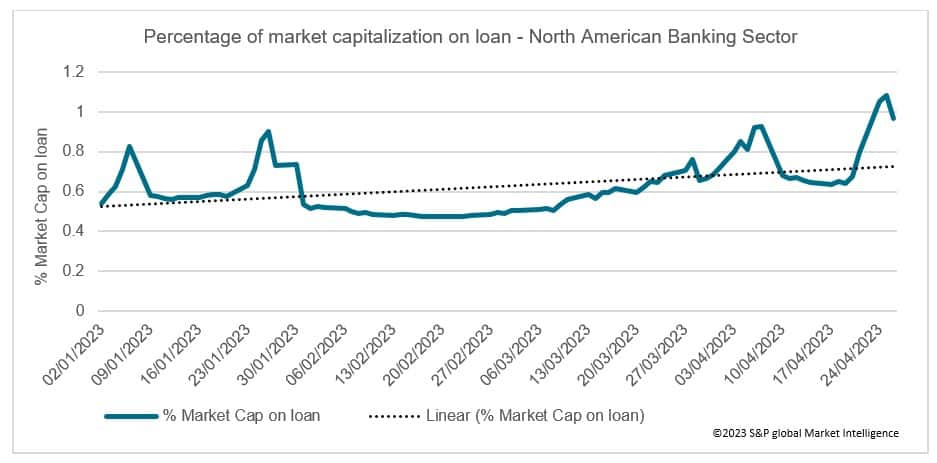

S&P Global Market Intelligence Securities Finance data continues to track short interest across the North American banking sector. The trends shown in the data reflect a recent increase in negative sentiment.

Short Interest across the North American Banking sector has been increasing since the beginning of the year. A clear spike in short interest can be seen just after the recent issues during March, as well as during the second half of April.

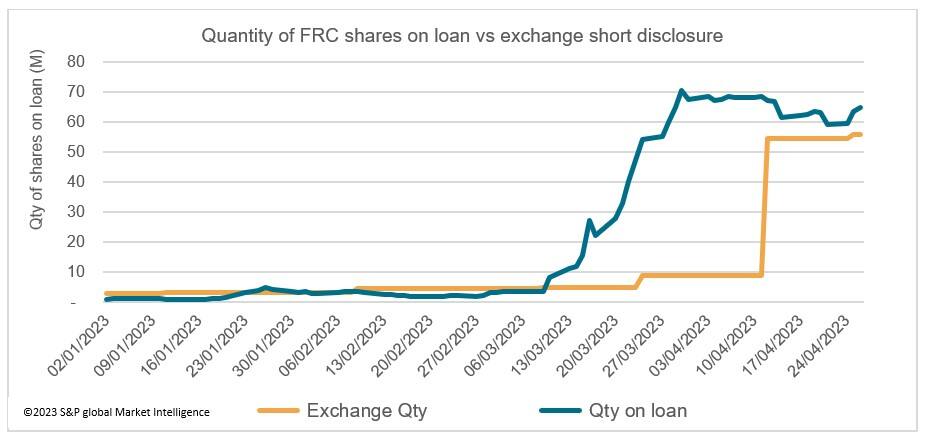

Short interest has also been increasing in First Republic Bank, peaking on March 30th when 37% of the bank's outstanding shares were being borrowed. The percentage of shares on loan then temporarily declined, before increasing again following the news of the deposit outflows. The exchange disclosed data continues to lag the true borrowing activity that is currently taking place across this stock.

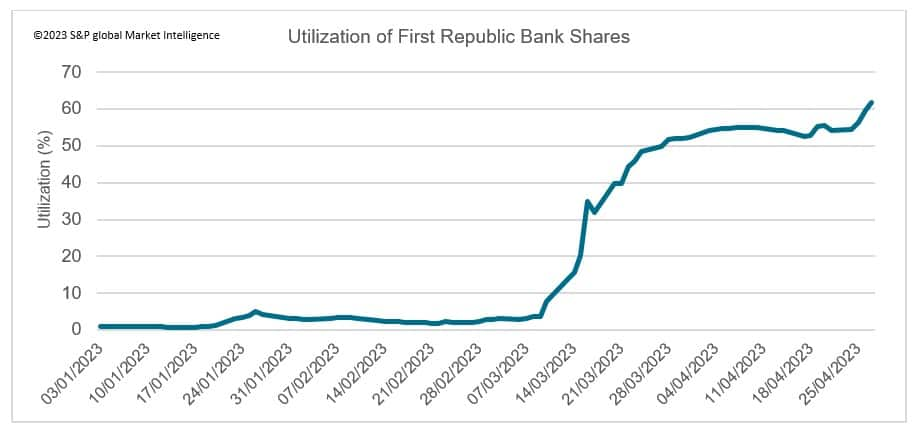

As just over 60% of all available First Republic Bank shares are now being borrowed, any further short positions executed in the market are expected to have to pay increased borrowing fees as a result. This may lower the viability of further short positions in the future.

For more information on how to access this data set, please contact the sales team at: Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-republic-bank-shares-become-harder-to-borrow-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-republic-bank-shares-become-harder-to-borrow-.html&text=First+Republic+Bank+shares+become+harder+to+borrow++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-republic-bank-shares-become-harder-to-borrow-.html","enabled":true},{"name":"email","url":"?subject=First Republic Bank shares become harder to borrow | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-republic-bank-shares-become-harder-to-borrow-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=First+Republic+Bank+shares+become+harder+to+borrow++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffirst-republic-bank-shares-become-harder-to-borrow-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}