Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 14, 2023

The Fiscal Responsibility Act: Reduced fiscal risks, modest fiscal restraint

On June 3, President Biden signed into law the Fiscal Responsibility Act of 2023. The key provisions of the Act suspend the debt ceiling through 2024, establish statutory caps on discretionary spending for fiscal years 2024 and 2025, and set non-statutory caps for fiscal years 2026 - 2029 that limit growth of spending to 1`% annually. The caps for 2024 and 2025 are enforceable through a procedure known as sequestration that, if Congress fails to pass a budget adhering to the statutory limits, will trigger across-the-board cuts in spending necessary to adhere to the caps. The caps for 2026 - 2029 are to be observed through the regular process of enacting budgetary legislation. In other words, after 2025, the spending limits are not strictly enforceable.

The legislation eliminates the near-term risk of a US default and, by determining spending totals for 2024 that should already have been established by Congress in a concurrent budget resolution, might reduce the risk of a government shutdown in October. In recognition of the reduced fiscal risks, upon passage of the legislation S&P Global Market Intelligence raised our forecast for US GDP growth modestly over the second half of this year.

But what about the impact of the spending caps? Is it big enough to restrain economic growth significantly over the following years?

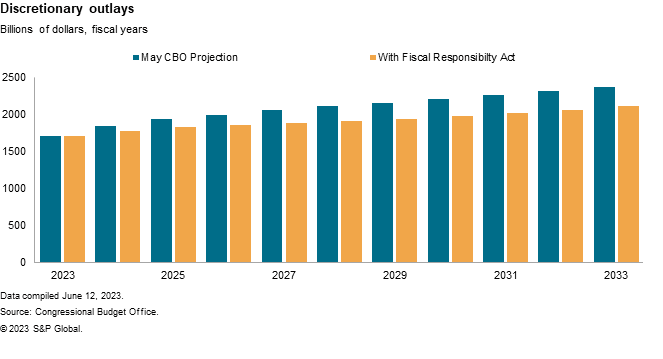

The Congressional Budget Office (CBO) has published an estimate of how much the caps would reduce spending relative to projections CBO made in May. Let's compare the two paths of discretionary outlays.

Under the Fiscal Responsibility Act spending will continue to grow, just more slowly than projected by CBO in May. In other words, the "cuts" in spending, so often mentioned in media coverage of negotiations over the debt limit, are not absolute, only relative to CBO's earlier projections. Through 2033 the cumulative relative reduction in spending is $1.9 trillion, or approximately 2% of GDP.

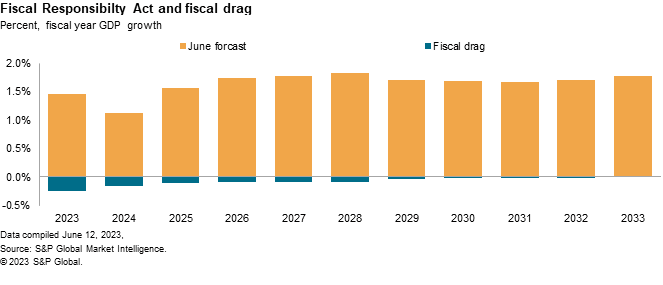

The second chart we include depicts our computation of the "fiscal drag" associated with the relatively slower growth of spending, measured in percentage points of annualized real GDP growth.

For perspective, also shown in the chart is the forecast for US real GDP growth published in June by S&P Global Market Intelligence. The calculation suggests that if the spending caps are enforced, the restraint on growth of spending implied by the Fiscal Responsibility Act would trim approximately ¼ point from GDP growth in 2024, and by lesser, diminishing amounts thereafter. Measurable, yes, but modest in the context of an economy with growth potential near 2%, and not enough to alter our forecast narrative.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffiscal-responsibility-act-reduced-fiscal-risks-modest-restraint.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffiscal-responsibility-act-reduced-fiscal-risks-modest-restraint.html&text=The+Fiscal+Responsibility+Act%3a+Reduced+fiscal+risks%2c+modest+fiscal+restraint+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffiscal-responsibility-act-reduced-fiscal-risks-modest-restraint.html","enabled":true},{"name":"email","url":"?subject=The Fiscal Responsibility Act: Reduced fiscal risks, modest fiscal restraint | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffiscal-responsibility-act-reduced-fiscal-risks-modest-restraint.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Fiscal+Responsibility+Act%3a+Reduced+fiscal+risks%2c+modest+fiscal+restraint+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffiscal-responsibility-act-reduced-fiscal-risks-modest-restraint.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}