Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 23, 2021

Flash Australia PMI signals economy in contraction amid widespread lockdowns

- Delta variant outbreak hits Australian economy

- Divergence in employment conditions seen between manufacturing and services

- Price pressures ease but supply constraints persist

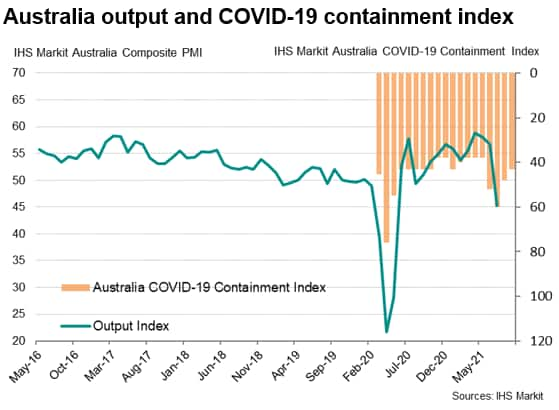

The flash IHS Markit Australia composite PMI output index, covering both services and manufacturing, slipped from 56.7 in June (final reading) into contraction at 45.2 in July, bringing a 10-month growth streak to an abrupt end.

Perhaps of little surprise, the reimposition of COVID-19 lockdown measures covering approximately half of Australia's population into July played a primary role in dampening business conditions in the country. The measures, introduced in response to the spread of the more infectious Delta variant, were extended to a greater number of Australian states into end-June, and it remains uncertain as to when these restrictions will eventually be lifted.

Australia service sector hit by lockdowns

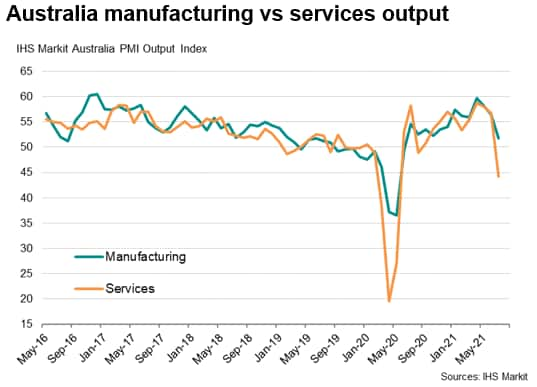

Although both manufacturing and services output indices fell sharply, manufacturing production managed to sustain growth, albeit at the slowest pace since output growth recommenced in July 2020. Anecdotal evidence suggested that firms related to the mining and building industries were most likely to report positive demand and output conditions.

Services business activity meanwhile plunged into contraction for the first time in 11 months and printed the lowest reading since May 2020 amid the reimposition of widespread lockdowns in the country. Demand for services and the level of outstanding work also declined from June, reflecting the toll taken on the service sector.

Services employment growth falls while manufacturing hits record

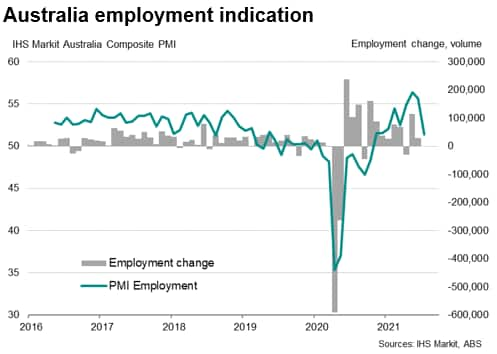

While output across both manufacturing and services were weighed down by the renewed COVID-19 disruptions, employment indices notably reflected diverging trends in July.

Certainly, the lockdowns affecting demand for services had helped to cool the sector's employment crunch, but manufacturers largely shrugged off the current disruptions and continued to hire at a survey record pace. Some anecdotal evidence suggested that manufacturers also continued to experience difficulties in hiring, reflecting the tight labour market conditions at least across the manufacturing sector, although it is also the smaller of the two sectors.

Any extension of the lockdowns into the coming months is expected to continue dampening services activity, which further hit Australia's economic growth in the third quarter. As it is, services employment remained in growth in July, but may well be at risk for further declines should the lockdowns continue for longer. This is also with the vaccination rate still lagging the world's average, a differentiating factor that would be crucial for the restoration of both consumer and workers' confidence amid the presence of the more infectious Delta strain.

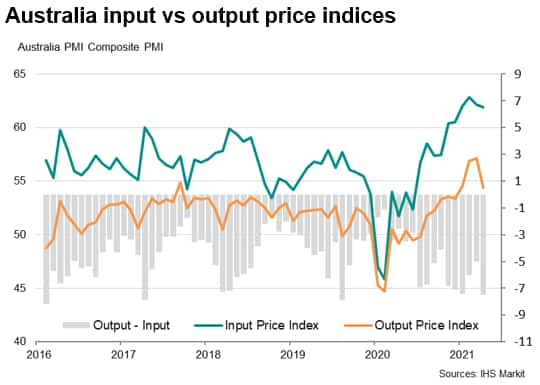

Output price pressures ease faster than input cost inflation

Alongside the contraction of output and demand, the July survey was notable in recording an easing in its price gauges. While welcome as a leading indicator of softer inflationary pressures, a worrying aspect was a quicker rate of decline in output charges compared to input costs for firms, which points to a further strain on margins. The extent to which input price inflation exceeded output price growth was in fact the greatest since November 2019.

At the same time, supply constraints remained a prevalent issue in July, which is evident across both panellists' comments and the severe rate at which suppliers' delivery times continued to lengthen for manufacturers. The deterioration of COVID-19 conditions was a key factor adding fuel to the fire for the supply crunch.

Looking ahead, the ramping up of the vaccination rate may well be the one differentiating factor in supporting relatively better economic recovery amid the spread of the Delta variant around the world, and Australia is playing catch-up here as it seeks to alleviate some of the strains from the renewed lockdowns magnified in July.

Jingyi Pan, Economics Associate Director, IHS Markit

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-economy-in-contraction-amid-widespread-lockdowns-July21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-economy-in-contraction-amid-widespread-lockdowns-July21.html&text=Flash+Australia+PMI+signals+economy+in+contraction+amid+widespread+lockdowns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-economy-in-contraction-amid-widespread-lockdowns-July21.html","enabled":true},{"name":"email","url":"?subject=Flash Australia PMI signals economy in contraction amid widespread lockdowns | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-economy-in-contraction-amid-widespread-lockdowns-July21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+Australia+PMI+signals+economy+in+contraction+amid+widespread+lockdowns+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-australia-pmi-signals-economy-in-contraction-amid-widespread-lockdowns-July21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}