Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2024

Flash eurozone PMI top five takeaways: Economy contracts for second successive month

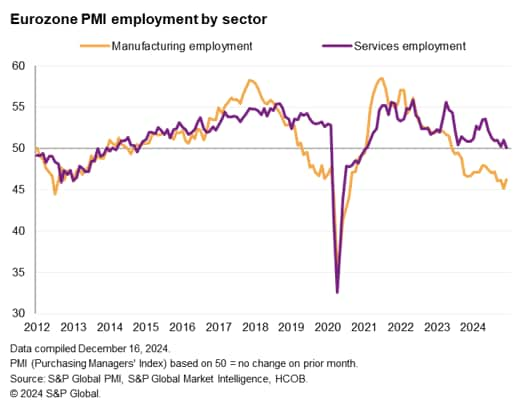

The flash PMI® survey data for December showed the eurozone economy contracting for a second successive month. Although only modest, the downturn in activity reflects an ongoing steep contraction of output in the manufacturing sector which has shown signs of spreading to the services economy. Firms have pulled back on their hiring in response to the weaker business environment, causing employment to fall slightly.

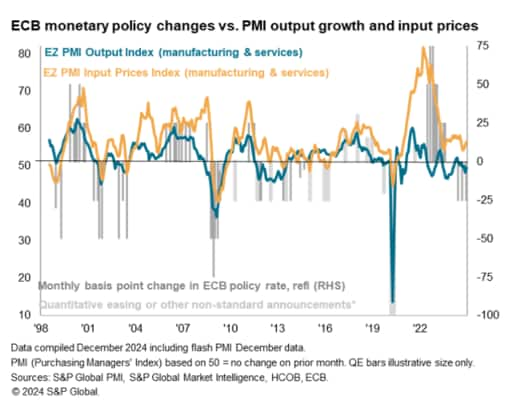

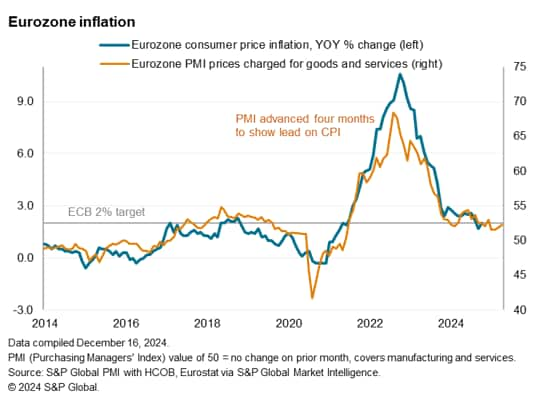

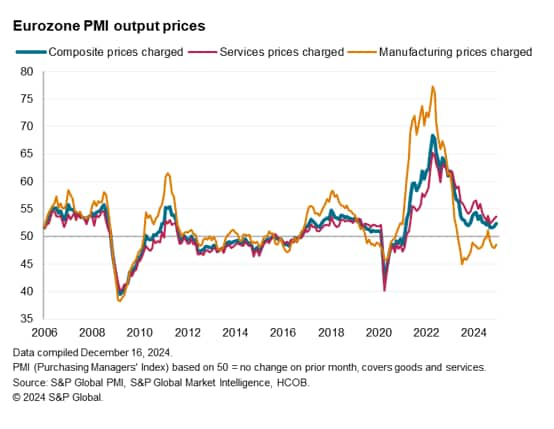

Price pressures ticked higher, though remained subdued by post-pandemic standards and broadly consistent with the ECB's inflation target. A rise in the survey's service sector inflation gauge will nevertheless be something of a concern to those policymakers who are worried about lingering second-round inflation effects.

Here are our top takeaways from the December flash PMI data:

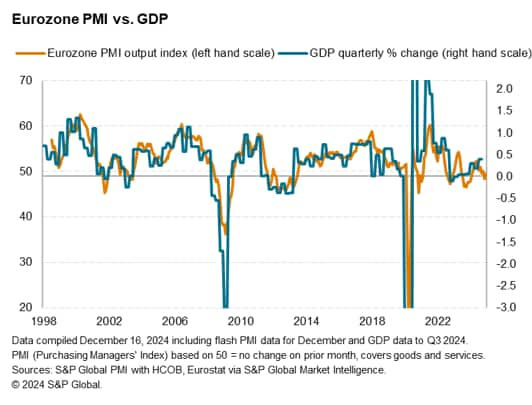

1. Eurozone economy stagnates for second month

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, registered below the 50.0 no-change mark for the second consecutive month in December to signal a further reduction in business activity at the end of 2024. At 49.5, the latest reading was up from 48.3 in November, pointing to a softer and only marginal fall in output. As such, the survey data point to a largely stalled eurozone economy in the fourth quarter.

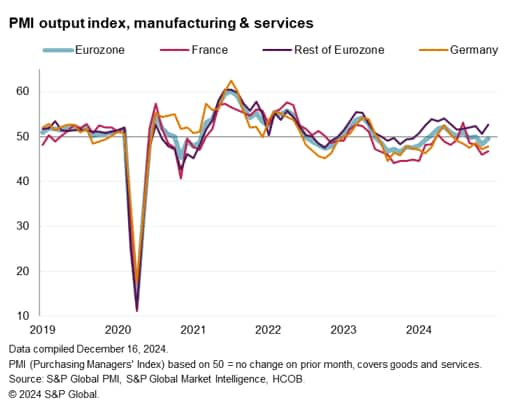

2. Divergence between Franco-German core and rest of region

Growth trends varied between a declining Franco-German core and a strengthening pace of expansion in the rest of the region. The steepest downturn was again recorded in France as political uncertainty was widely cited as retraining activity and spending, though a sustained contraction of output was also recorded in Germany amid a steepening industrial downturn. The rest of the region collectively saw growth pick up from the near-stalled picture seen in November, growing for a twelfth successive month and achieving the strongest expansion since June.

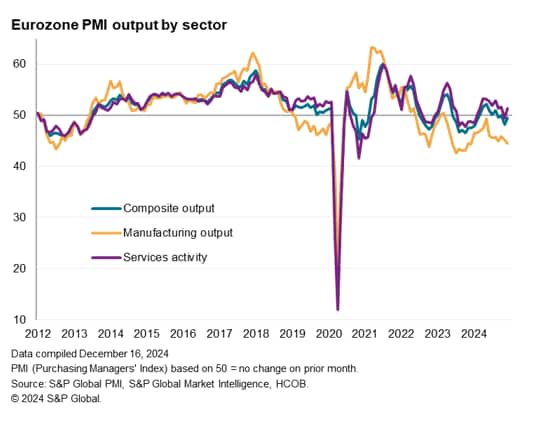

3. Manufacturing-services divergence

As well as seeing a sustained divergence in growth trends among the member states, the December flash PMI also saw marked sectoral divergences. Services activity rose modestly, following a slight fall in November, in part attributed to a boost to from lower interest rates (notably outside of France and Germany), but manufacturing production fell at the fastest rate for a year amid particularly steep declines in France and Germany. Factory output in France fell at the sharpest rate since the pandemic lockdowns of early 2020, while output in Germany fell at the second fastest rate in 14 months.

However, it is worth noting that the December services PMI was still the joint-second-lowest seen over the past ten months amid further signs of the manufacturing downturn spreading to services, notably via the labour market.

4. Employment index at four-year low as job losses are reported

The labour market continued to deteriorate, as companies reduced their staffing levels for a fifth month running. Although still modest, the pace of job cuts quickened slightly to hit the highest in four years.

A solid reduction in manufacturing employment - one of the sharpest falls since 2012 barring only the COVID-19 lockdowns of 2020 - was accompanied by a near-stagnation in the service sector to the worst recorded for nearly four years.

5. Prices rise at increased rate

Prices meanwhile rose at an increased rate. Average charges for goods and services rose in December at the sharpest pace for four months, the rate of inflation ticking higher for a third successive month. It should be noted that September's low point was consistent with headline inflation running slightly below the European Central Bank's 2% target according to historical comparisons and that, despite the uptick, the rate of price inflation recorded by the PMI in December remains broadly in line with the ECB target.

Policymakers may nevertheless be concerned that it is services selling price inflation (and services input cost inflation) that has risen and remains somewhat elevated by historical standards. This is in part linked to higher wage growth in the eurozone, which forms a major component of service sector costs and is a key area of concern among rate setters at the ECB.

Upcoming data will therefore be important to watch in order to ascertain whether services inflation lifts further in the coming months, or whether the cooling of the labour market which has been evident in recent months helps to moderate pay growth.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-contracts-for-second-successive-month-dec24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-contracts-for-second-successive-month-dec24.html&text=Flash+eurozone+PMI+top+five+takeaways%3a+Economy+contracts+for+second+successive+month+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-contracts-for-second-successive-month-dec24.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI top five takeaways: Economy contracts for second successive month | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-contracts-for-second-successive-month-dec24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+top+five+takeaways%3a+Economy+contracts+for+second+successive+month+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-contracts-for-second-successive-month-dec24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}