Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 24, 2024

Flash eurozone PMI top five takeaways: Economy stalls as price pressures ease

The PMI® survey data for October showed the eurozone economy to have stalled for a second successive month as falling factory activity was accompanied by a further slowing of growth in the services economy.

Whether the economy can avoid a contraction of GDP in the fourth quarter is a growing worry, with a further worsening of business confidence hinting at downside risks in the near-term. Firms are also reducing headcounts at an increased rate amid concerns over the economic situation.

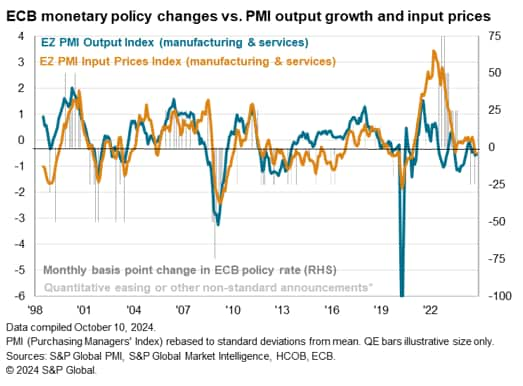

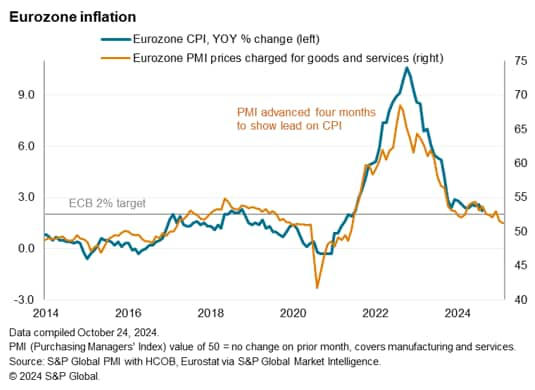

Fortunately, price pressures have continued to moderate in October, with average selling price inflation cooling further to the lowest since early 2021. Notably, cost pressures in the service sector - a key area of concern among inflation hawks - have moderated further.

With the economy showing increased risks of contracting, and the survey selling price index dropping further below a level that is consistent with the ECB's 2% target, the latest PMI data hint at a possible further policy loosening from the central bank to follow the two 25 basis point rate cuts that so far seen this year.

Here are our top five takeaways from the October flash PMI data:

1. Economy stagnates for second month

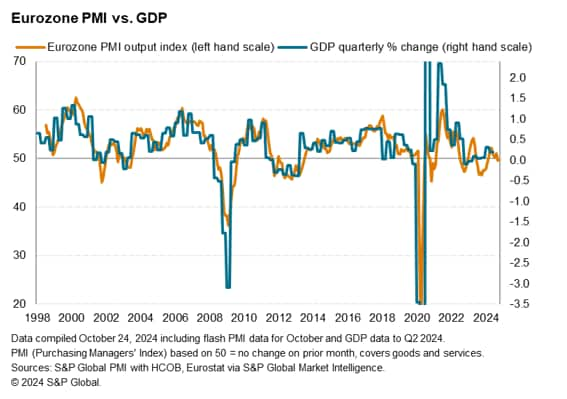

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, posted 49.7 in October. Following a reading of 49.6 in September, the latest figures signalled a second successive monthly marginal fall in euro area business activity.

Comparisons with official data indicate the latest PMI reading is broadly indicative of no GDP growth for a second successive month. The direction of travel in the PMI over the next two months will therefore be closely eyed for a possible GDP contraction in the fourth quarter.

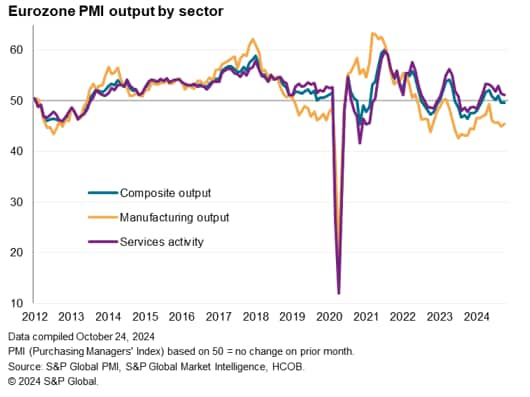

Weakness was again led by the manufacturing sector, where production again fell sharply, down for a nineteenth straight month amid a further steep fall in new orders. While the service sector expanded, growth was the lowest for eight months as new orders for services decreased for a second consecutive month and at the fastest rate for nine months.

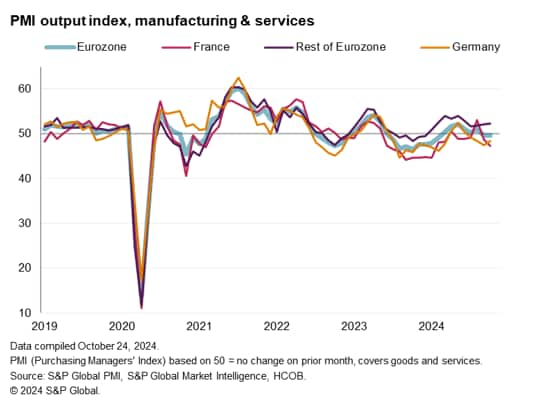

2. Downturns in France and Germany

At the country level, further downturns were seen in France and Germany, contrasting with a sustained - but modest - expansion in the rest of the eurozone as a whole.

Having improved in August on the back of a jump in service sector activity, coinciding with the Paris Olympics, the composite PMI for France remained in contraction territory for a second successive month in October, with output declining at the sharpest rate since January amid steepening falls in both manufacturing and services.

The flash composite PMI for Germany also remained in contraction territory, albeit rising slightly to signal a moderation in the rate of decline. Output has nevertheless now fallen for four successive months as a prolonged and steep downturn in the manufacturing sector was accompanied by only very modest service sector growth in October.

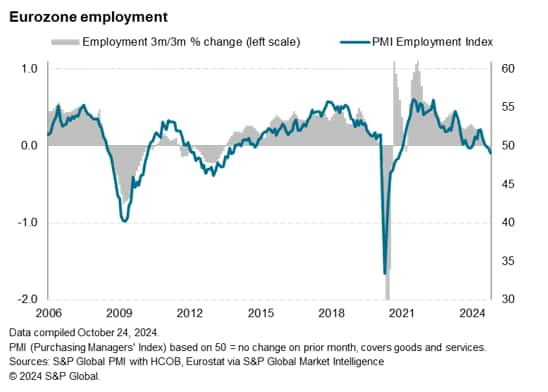

3. Employment drops at fastest rate since 2020

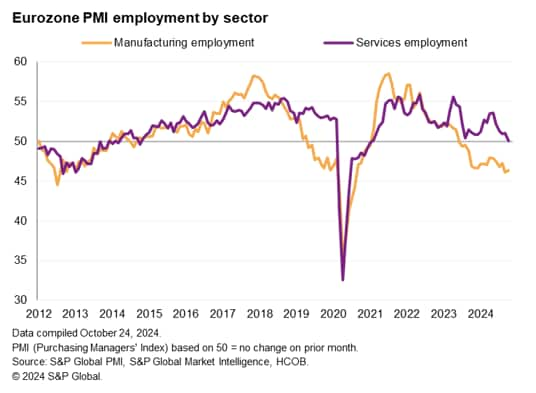

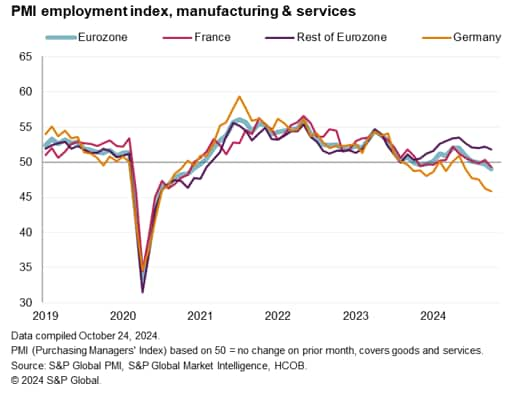

With customer demand waning, firms in the euro area increasingly scaled back their staffing for the third month running, with net job losses reaching the highest since late 2020. Although only modest, barring the pandemic, the drop in employment was notable in being the steepest recorded since late-2013.

While the reduction in staffing levels was centered on manufacturers, the service sector saw a worrying near-stagnation of employment which, excluding the pandemic, represents the worst service sector employment situation seen for ten years.

The jobs picture was particularly bleak in Germany, where headcounts were cut to the largest degree since the opening wave of the COVID-19 pandemic in 2020. Employment also decreased slightly in France, though the rest of the eurozone saw staffing levels rise modestly.

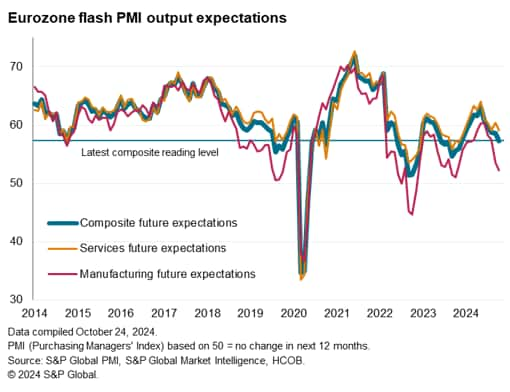

4. Confidence dips further

Business confidence about the year ahead meanwhile dropped for the fifth consecutive month to the lowest for almost a year, and a level increasingly below the series average. Sentiment waned in both the manufacturing and services sectors, the former remaining especially subdued, to hint at near-term downside risks to output for both sectors.

Lower confidence reflected concerns over weak demand, trade barriers and intensifying geopolitical concerns, as well as government fiscal policies.

5. Prices rise at slowest rate since early-2021

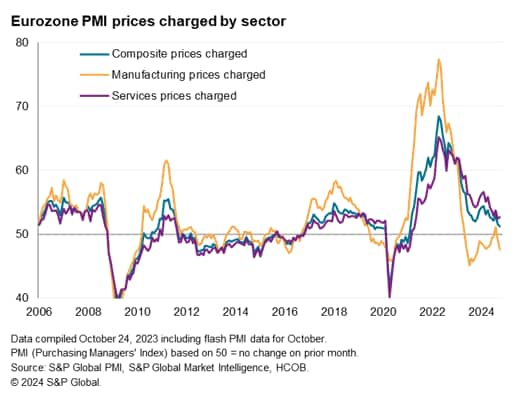

Encouraging news for inflation was provided as firms' selling prices rose in October at the slowest rate since February 2021. A rise in services charges was outweighed by a fall in manufacturing selling prices to reduce the overall rate of inflation, which in recent months has been running at a level consistent with consumer price inflation below the European Central bank's 2% target.

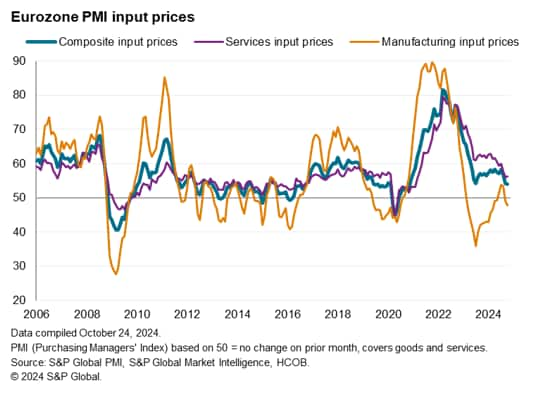

Further downward pressure on selling prices is likely in the near term, as costs rose in October at the slowest rate in just under four years. Manufacturing input costs decreased for the second month running, dropping at the fastest pace since March amid lower energy prices and increased discounting via competition among suppliers. Although services input prices continued to increase, the latest rise was among the smallest witnessed since early-2021.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-stalls-as-price-pressures-ease-Oct24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-stalls-as-price-pressures-ease-Oct24.html&text=Flash+eurozone+PMI+top+five+takeaways%3a+Economy+stalls+as+price+pressures+ease+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-stalls-as-price-pressures-ease-Oct24.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI top five takeaways: Economy stalls as price pressures ease | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-stalls-as-price-pressures-ease-Oct24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+top+five+takeaways%3a+Economy+stalls+as+price+pressures+ease+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-stalls-as-price-pressures-ease-Oct24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}