Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 17, 2024

Flash PMI data shows US economic outperformance widening in December

The flash PMI data compiled by S&P Global Market Intelligence indicated that the US economy's outperformance widening relative to other major developed economies in December.

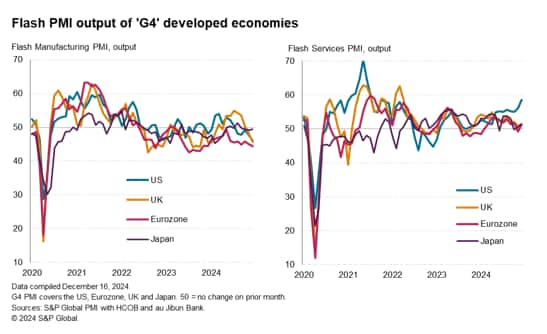

While output growth has surged higher in the US into the closing month of 2024, led by a booming services economy, output fell for a second month in a row across the eurozone and growth remained only very modest in Japan and the UK.

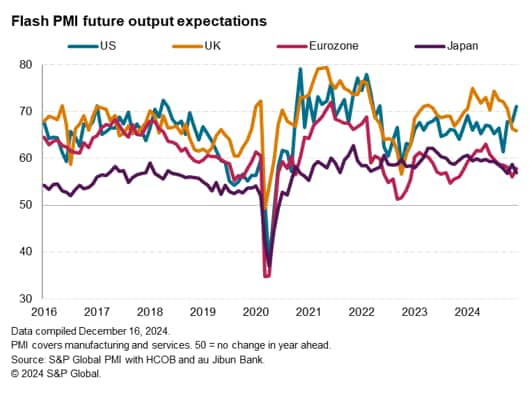

Furthermore, while US firms have become increasingly optimistic about prospects in 2025 due to the incoming Trump administration, firms in Europe and Japan have become gloomier in recent months amid political worries and concerns over US protectionism.

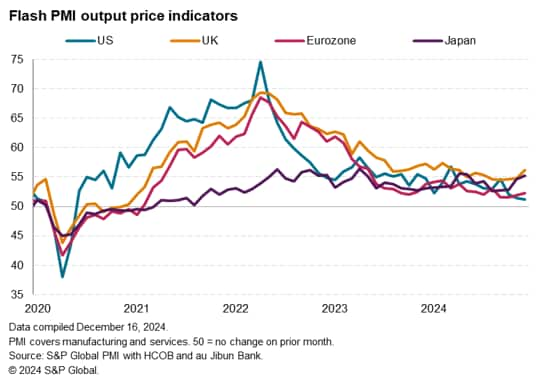

Any hopes that economic weakness in Europe could be met with an aggressive loosening of monetary policy are meanwhile clouded somewhat by a rekindling of inflationary pressures, notably in the service sectors, which contrasted with a further easing of price pressure in the US.

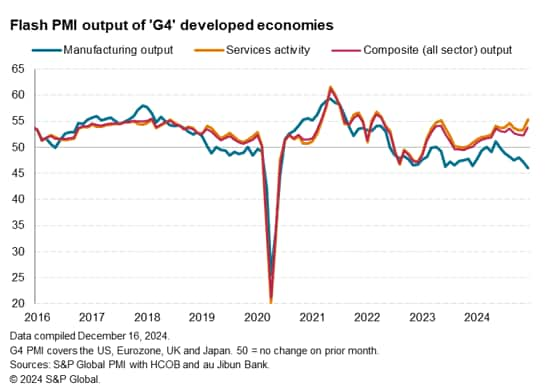

Service sector booms while manufacturing downturn deepens

Flash PMI data from S&P Global Market Intelligence showed divergences widening among the group of four (G4) major developed economies in December.

The G4 PMI output index rose from 52.3 in November to 53.8 in December, according to the provisional data for the closing month of 2024. The improvement signalled the strongest rate of expansion since May 2023. However, while service sector output growth accelerated to the fastest since April 2022 - a time when the services economy was enjoying a surge in demand amid the re-opening of economies from COVID-19 related restrictions, manufacturing output fell at the sharpest rate since June 2020 - a time of heightened COVID-19 lockdowns.

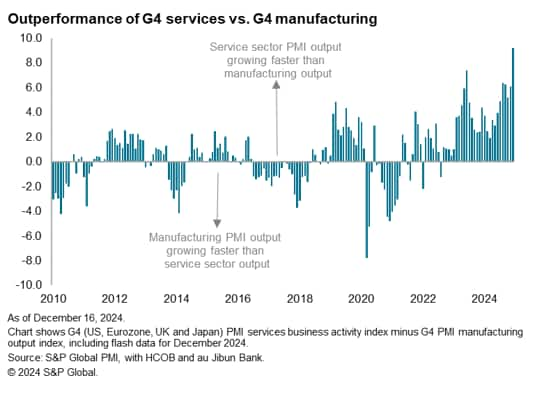

If the pandemic is excluded, the latest G4 service sector expansion is the strongest since June 2018. The manufacturing downturn is meanwhile the steepest since May 2009, during the global financial crisis.

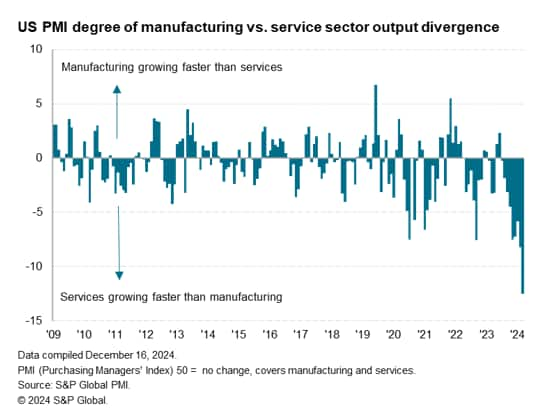

The divergence takes the outperformance of the G4 services economy relative to manufacturing to highest yet recorded by the survey since comparable data were first available in late-2009.

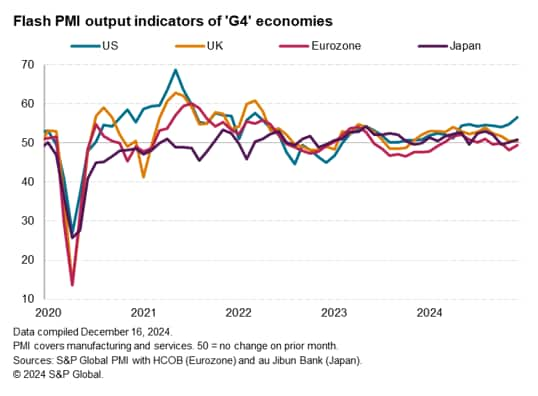

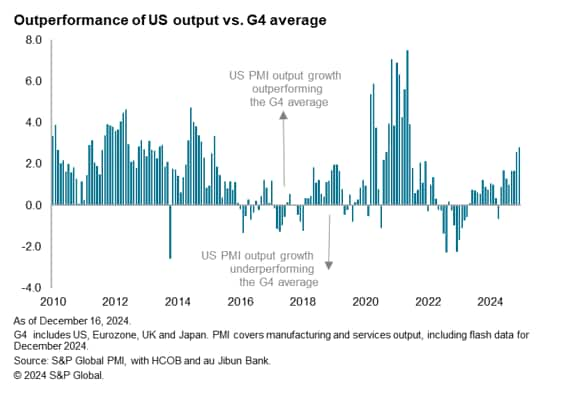

US outperformance

A second key area of divergence within the G4 economies is evident in respect to the US outperforming to an increased degree. Measured across goods and services, US output grew faster than the G4 average in December to the greatest extent since June 2021.

While the composite PMI output index (covering goods and services) rose in the US to 56.6, its highest since March 2022 and indicating increasingly strong economic growth, the equivalent indices for the eurozone, UK and Japan signalled largely stalled performances. At 49.5, the eurozone flash PMI signalled a drop in output for a second month running, to register the weakest performance of the G4, while the PMIs for the UK and Japan signalled only marginal expansions at 50.5 and 50.8 respectively.

In fact, the only area of real strength in the G4 economy at present is the US service sector, where growth accelerated in December to the highest since October 2021 and, barring the pandemic, March 2015. In contrast, only subdued gains were seen in the services economies of the eurozone, Japan and UK.

There was a more universal picture of deterioration meanwhile evident across the G4 manufacturing economies, however, with output falling in all four cases. While the steepest factory decline continued to be reported in the eurozone, rates of decline notably accelerated in both the US and UK. The resulting sectoral divergence in the US is now by far the highest on record for the S&P Global PMI survey.

Confidence highest in the US

The December flash PMI surveys also signaling a divergence in terms of business confidence in the outlook for the year ahead. While US output expectations rose their highest since May 2022, expectations sank to a two-year low in the UK and remained close to post-pandemic lows in Japan. Expectations also remained weak by historical standards in the eurozone. Confidence among the G4 economies in the 12-month outlook is consequently now the highest in the US.

The divergence in sentiment reflects a combination of various issues, including adverse structural factors affecting businesses in Europe and Japan, as well as a groundswell of political related optimism in the US which contrasts with concerns over politics in Europe. This political environment also includes the perceived potential for US tariffs to further widen regional growth disparities in the short term.

Anecdotal evidence collected in the December PMI surveys revealed that US firms are increasingly viewing the incoming Trump administration as positive in terms of lower taxation, looser regulation and greater protectionism. The corollary of the latter is increased pessimism among companies in many other countries, including in the eurozone where manufacturers in particular have already been struggling since the Ukraine war with uncompetitively high energy prices relative to rivals in other countries. Furthermore, while the new US government is widely perceived by survey respondents as likely to be supportive to business, the UK has seen companies react badly to tax-raising policies implemented by the new government, and in France and Germany there are political crises which have created political uncertainty at the heart of the eurozone.

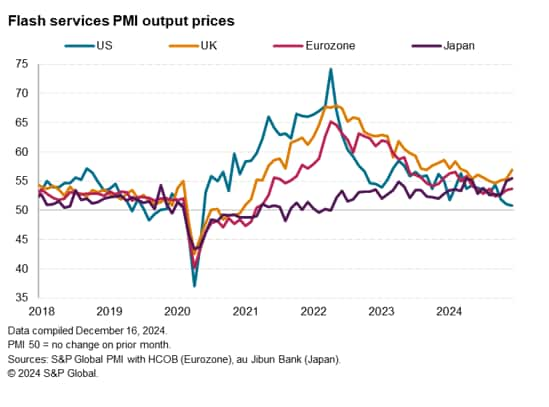

Selling price inflation cools in the US, but rises elsewhere

A further concern about economic outlooks is provided by the G4 flash PMIs in terms one further divergence, relating this time to inflation. Average prices charged for goods and services rose in the US at the slowest rate since prices began rising in June 2020. However, prices rose at increased rates in the UK, eurozone and Japan, the UK reporting the steepest rise among the G4.

Furthermore, the flash PMI surveys showed all-important services inflation varying to a widening degree among the G4 economies. A post-pandemic low was seen in the US - where services prices rose only very marginally - contrasting with reviving rates of services inflation in the other G4 economies, with a notably robust increase recorded in the UK.

A concern is that, since the pandemic, central banks have been especially concerned about stubbornly high service sector inflation, and are monitoring rates of increase closely. Hence, any rekindling of high services inflation in Europe, and in particular the UK, could limit policymaker willingness to cut interest rates to help boost growth.

Access the US, UK, Eurozone and Japan PMI press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-shows-us-economic-outperformance-widening-in-december-dec24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-shows-us-economic-outperformance-widening-in-december-dec24.html&text=Flash+PMI+data+shows+US+economic+outperformance+widening+in+December+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-shows-us-economic-outperformance-widening-in-december-dec24.html","enabled":true},{"name":"email","url":"?subject=Flash PMI data shows US economic outperformance widening in December | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-shows-us-economic-outperformance-widening-in-december-dec24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+data+shows+US+economic+outperformance+widening+in+December+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-shows-us-economic-outperformance-widening-in-december-dec24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}