Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 21, 2024

UK flash PMI signals further economic slowdown at end of second quarter, price rises intensify

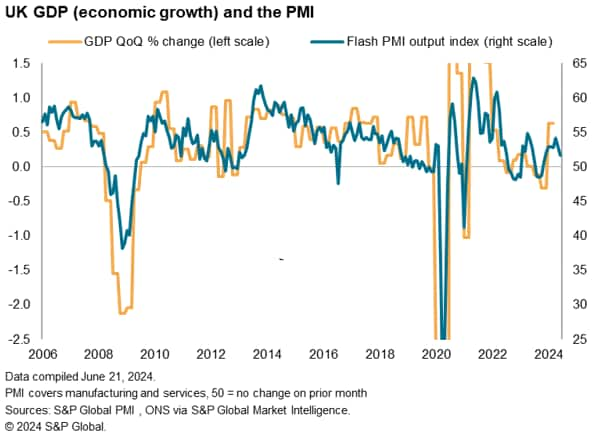

Flash PMI survey data for June signalled a slowing in the pace of economic growth, indicating that GDP will have risen in the second quarter at less than half the 0.6% pace recorded by the Office for National Statistics in the first three months of the year.

The slowdown in part reflects uncertainty around the business environment in the lead up to the general election, with many firms seeing a hiatus in decision making pending clarity on various policies.

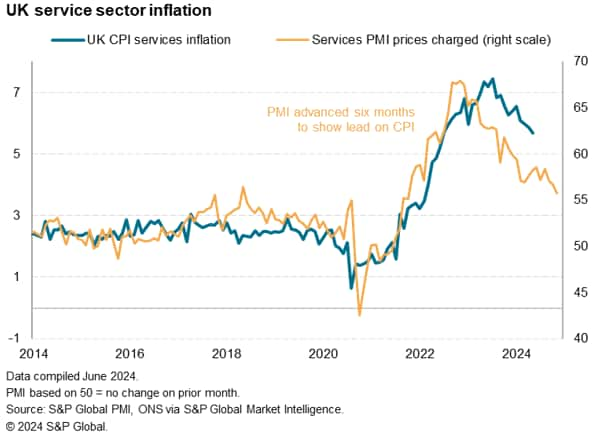

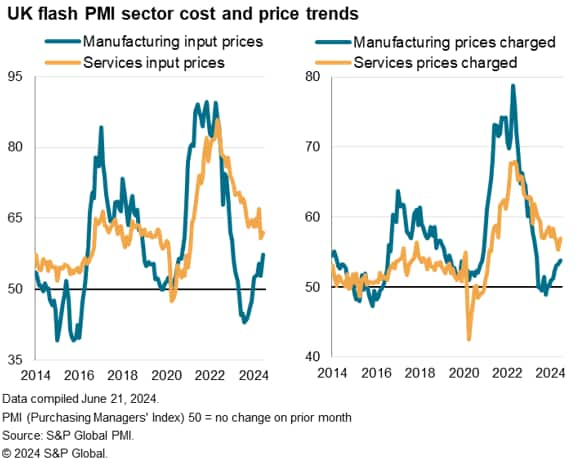

Meanwhile, from an inflation perspective, stubbornly persistent service sector inflation - a major barrier to lower interest rates - remains evident in the survey data, but should at least cool further from the current 5.7% pace in coming months. However, companies' costs are rising, most notably in manufacturing, where shipping costs in particular are spiking again and adding to a renewed rise in inflationary pressures from goods.

In short, while a slowdown in economic growth may prove temporary should businesses react positively to the policies announced by any new government, the stubbornness of underlying inflationary pressures still looks somewhat engrained.

Output growth slips to seven-month low

Although business activity continued to rise for an eighth successive month in June, according to early PMI survey data, the rate of growth slowed further from April's 12-month high to sit at a seven-month low. The headline economic growth indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK PMI Composite Output Index, fell from 53.0 in May to 51.7.

The latest reading is broadly consistent with GDP growing at a quarterly rate of just over 0.1% in June, though across the second quarter as a whole the PMI average of 52.9 is indicative of 0.25% quarterly GDP growth. However, by either measure, the survey data signal a marked cooling in the pace of economic growth compared to the 0.6% GDP rise estimated by the Office for National Statistics in the first quarter.

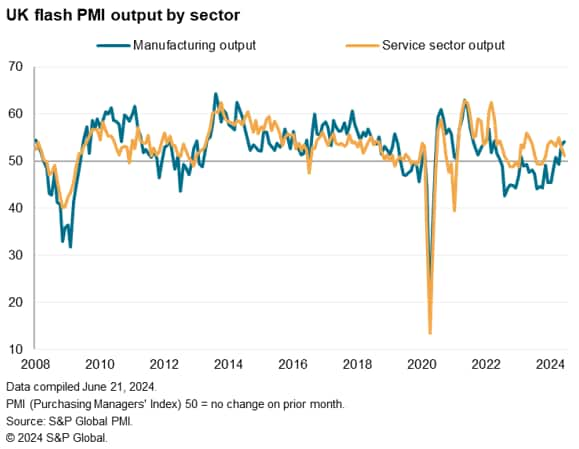

Service sector expansion wanes

The slowdown was led by the service sector, where business activity grew at the slowest rate for seven months in June as a weakening of domestic demand conditions -notably among consumers - countered an increase in foreign spending on services. While services activity has now grown for eight straight months, the rate of expansion has moderated sharply since peaking in April to result on only a very modest monthly increase being recorded at the end of the second quarter.

In contrast, there was better news from manufacturing, where factory output rose at the fastest rate for just over two years, rising for a second successive month in June. Factories also reported stronger new orders growth, though exports continued to decline amid especially weak sales to European markets.

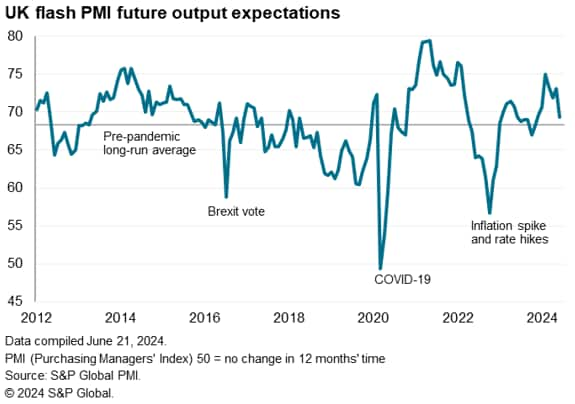

Future optimism retreats

Output growth may weaken further in the coming months, as business optimism about the year ahead dropped to a seven-month low in June. Sentiment fell in both manufacturing and services, driving the overall degree of confidence down closer to the pre-pandemic long run average. The latest subdued data paint a marked contrast to the two-year peak in confidence recorded back in February.

The latest slide in business confidence in part reflected uncertainty around the general election, notably in terms of how policy (especially in relation to taxation) may change with a new government. Many survey respondents therefore anticipate a likely short-term hiatus in decision making pending greater clarity on the policy situation. However, other companies also continued to report on the negative impacts from the high cost of living, higher-for-longer Interest rates, as well as increased cost burdens and red tape, notably for exporting.

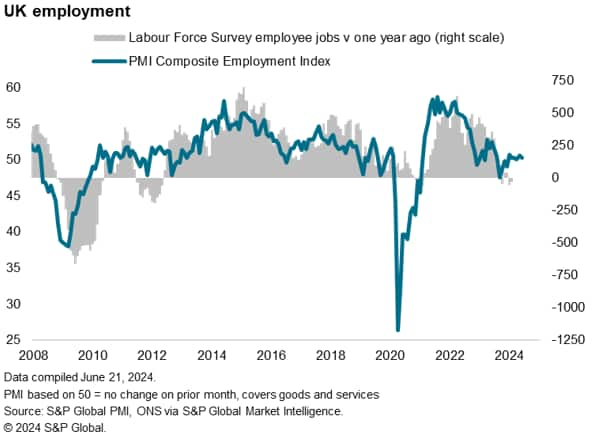

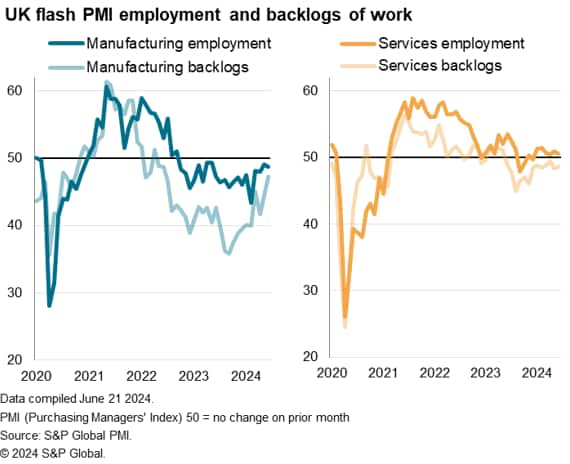

Hiring curbed by skill shortages

The pullback in business confidence dampened hiring, resulting in another month of only very weak jobs growth in June. The PMI has recorded only modest employment gains over the year to date, though this represents an improvement on the net job shedding seen in the closing four months of 2023.

The June survey data are broadly consistent with UK employment growing at an annual rate of 100,000.

June saw a near stalling of service sector job creation accompanied by a further decline in manufacturing jobs. Encouragingly, the rate of decline in the latter has moderated in recent months compared to earlier in the year as companies report a slower rate of loss of outstanding work. June's fall in backlogs of work in factories was the smallest recorded for two years and points to improved levels of capacity utilisation.

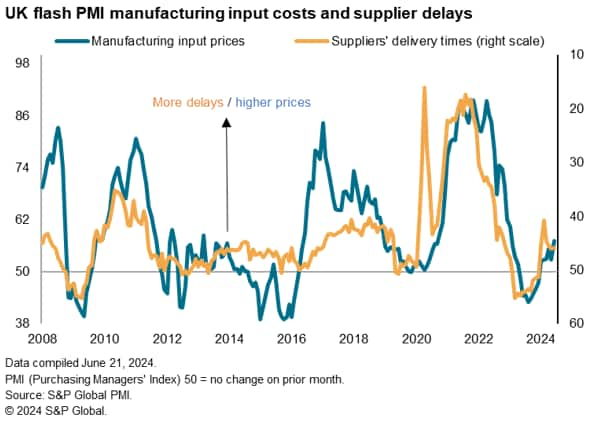

Supply chain delays persist, adding to costs

Factories meanwhile reported longer supplier delivery times for a sixth successive month in June, with Red Sea related shipping delays once again widely cited as a key source of supply chain stress. Higher shipping costs were also commonly reported, notably from Asia, contributing to a steepening rise in overall manufacturing input costs, which rose in June at the sharpest rate for nearly one and a half years.

Higher costs were often passed through to higher selling prices, resulting in average prices charged for goods rising in June at the steepest rate for just over a year.

Stubborn services price growth

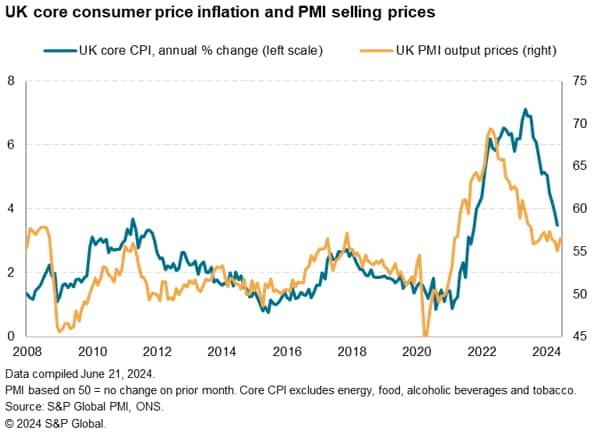

Service sector input cost growth also accelerated in June, feeding through to higher prices. The rate of selling price inflation also ticked higher for services, albeit remaining among the lowest seen over the past three years and consistent with a further moderation in the official annual rate of increase of services price inflation. The latter has proven stubbornly persistent in recent months, running at 5.7% in May. The PMI suggests this should cool to 4% in the coming months, though that would remain above pre-pandemic average levels, largely linked to higher wage growth.

The overall PMI selling price gauge, covering both goods and services, consequently rose to a four-month high in June, though is running at a level broadly indicative of core consumer price inflation close to 3%, according to historical comparisons. The latter registered 3.5% in May, a 31-month low.

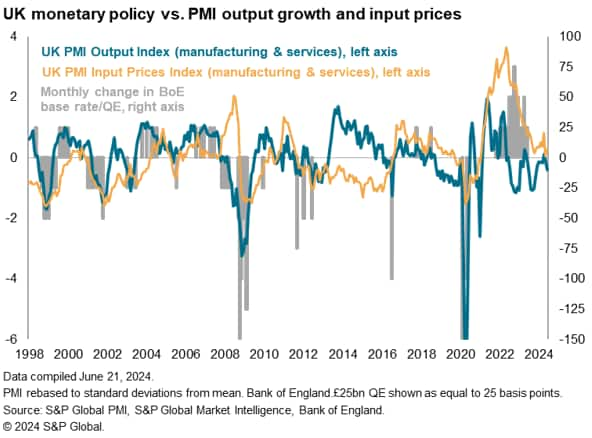

Rate cuts awaited

The latest PMI data sends some conflicting signals to policymakers. On one hand, the cooler rate of expansion recorded in June suggests that restrictive monetary policy is dampening demand, which should in turn feed through to lower inflationary pressures. However, the rise in the survey's price gauges, both for services and goods, suggests that policymakers may want more concrete evidence of core inflation moderating further before cutting interest rates.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-further-economic-slowdown-at-end-of-second-quarter-price-rises-intensify-Jun24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-further-economic-slowdown-at-end-of-second-quarter-price-rises-intensify-Jun24.html&text=UK+flash+PMI+signals+further+economic+slowdown+at+end+of+second+quarter%2c+price+rises+intensify+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-further-economic-slowdown-at-end-of-second-quarter-price-rises-intensify-Jun24.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI signals further economic slowdown at end of second quarter, price rises intensify | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-further-economic-slowdown-at-end-of-second-quarter-price-rises-intensify-Jun24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+signals+further+economic+slowdown+at+end+of+second+quarter%2c+price+rises+intensify+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-further-economic-slowdown-at-end-of-second-quarter-price-rises-intensify-Jun24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}