Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2024

Flash PMI signals US economy ending 2024 on strong note as output surges higher

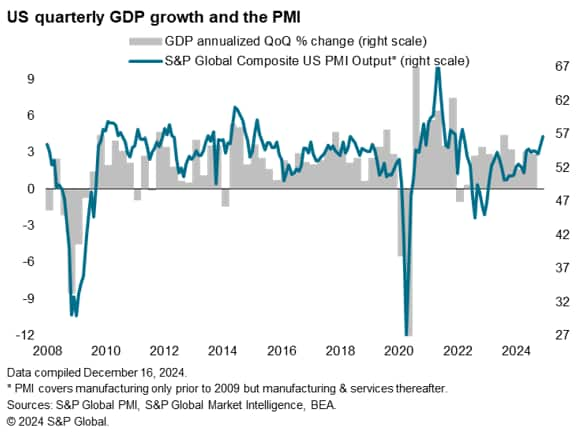

Business is booming in the US services economy, according to the S&P Global flash PMI, which showed output growing at the sharpest rate since the reopening of the economy from COVID lockdowns in 2021. The service sector expansion is helping drive overall growth in the economy to its fastest for nearly three years, consistent with GDP rising at an annualized rate of just over 3% in December.

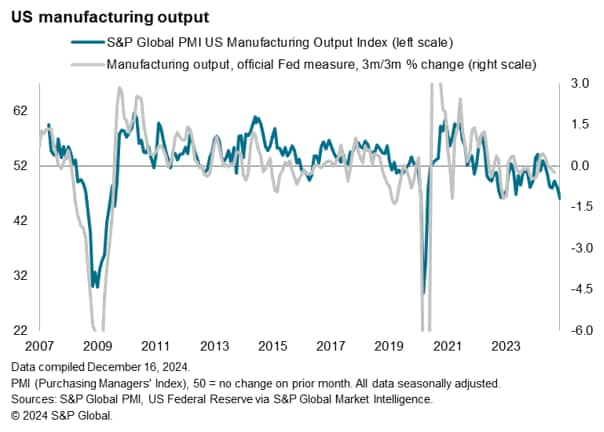

It's a different picture in manufacturing, however, where output is falling sharply and at an increased rate, in part due to weak export demand.

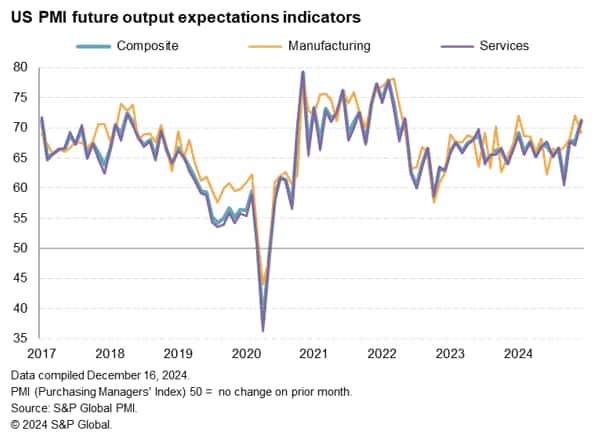

Encouragingly, confidence in the 12-month outlook has lifted to a two-and-a-half year high, suggesting the robust economic upturn will persist into the new year and could also become more broad-based by sector.

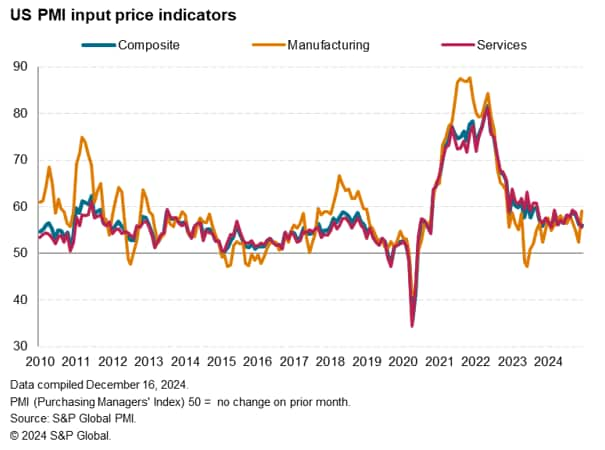

However, some of the high spirits seen after the election in the manufacturing sector have been checked over concerns surrounding tariffs and the potential impact on inflation resulting from the higher cost of imported materials. December saw raw material prices spike sharply higher amid supplier-led price rises and higher shipping costs, in a reflection of busier supply chains in advance of threatened protectionism in the new year.

Output surges higher

The headline S&P Global Flash US PMI Composite Output Index rose from 54.9 in November to 56.6 in December, signaling the fastest expansion of business activity since March 2022. The PMI has now recorded continual growth since February 2023, with especially robust growth recorded over the second half of 2024. Activity levels were expanded at an increased rate in December in response to strengthening demand. New orders rose at the sharpest rate since April 2022.

To put the latest expansion into perspective, the December flash composite PMI reading has not been exceeded since May 2015 if the pandemic months are excluded. The December reading is consistent with GDP growing at an annualized rate of 3.1%, based on a simple regression model, with the fourth quarter PMI average indicative of 2.6% growth.

Two-speed economy

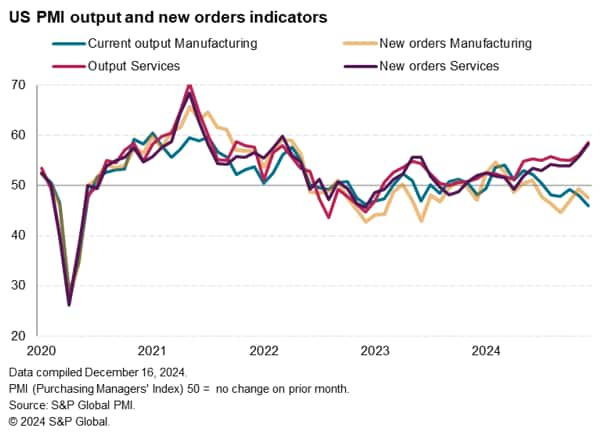

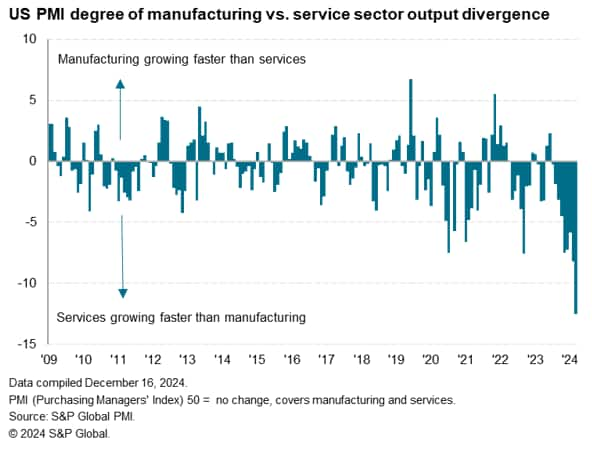

Growth was once again uneven across the economy, however, with a further surge in service sector activity - which rose at a rate not seen since October 2021 - contrasting with the steepest fall in manufacturing production since May 2020.

If the pandemic months are excluded, the latest service sector expansion was the strongest recorded since March 2015, while the latest manufacturing downturn was the sharpest since the global financial crisis in August 2009.

A similar sector divergence was seen in demand conditions. New orders for services rose at a rate not witnessed since March 2022, but new orders for goods placed at factories fell sharply and for a sixth successive month.

The degree to which the service sector is outperforming manufacturing in terms of current output is now by far the greatest recorded by the survey.

Future sentiment highest since May 2022

The survey's forward-looking sentiment indicators suggest that growth could become more balanced in the coming year. Optimism about output in the next 12 months improved further in December from the pre-election low recorded in September, striking the highest since May 2022. Service sector confidence was the highest in just over two-and-a-half years and, although cooling slightly, manufacturing confidence remained among the highest seen over the past year.

A clearing of uncertainty following the Presidential Election has been accompanied by improved prospects for the year ahead, according to anecdotal evidence provided by survey respondents, linked to expectations of a more business-friendly administration under the Trump Presidency, especially in terms of looser regulation and heightened protectionism. However, some companies, notably in manufacturing, have expressed concern over the weak demand environment and the potential for tariffs to add to inflation.

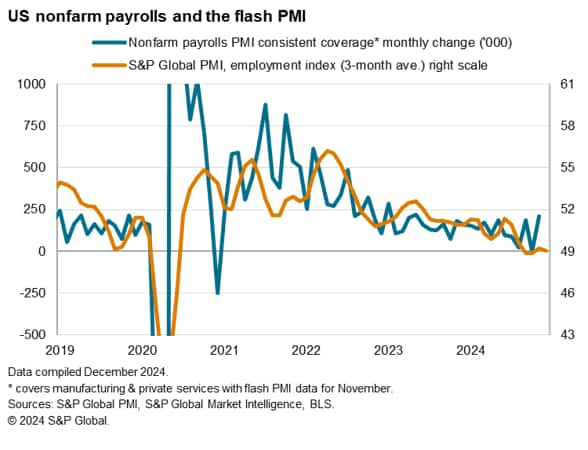

Hiring picks up

The improved outlook helped drive a return to hiring. Employment edged higher in December, up for the first time in five months, reflecting a second successive monthly rise in manufacturing jobs and the first increase in service sector employment since July. The increase in both sectors was only modest, however, reflecting ongoing caution with respect to payroll numbers as many firms sought to keep costs as low as possible, while other firms often reported difficulties finding or replacing staff.

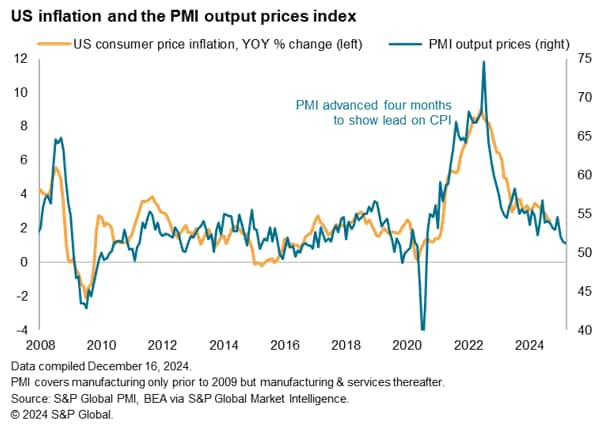

Prices show smaller rise

Inflationary pressures meanwhile cooled further at the headline level in December, albeit with a jump in input cost inflation in manufacturing. Average prices charged for goods and services rose only very modestly, increasing at the slowest rate since prices began rising in June 2020.

The latest easing pushed the rate of inflation further below the pre-pandemic long-run average, with an especially low rate of inflation again evident in the services economy, where charges rose only marginally and at the slowest rate since May 2020.

Manufacturing selling prices rose at a rate unchanged on November's pace, thereby running slightly above the pre-pandemic long-run average.

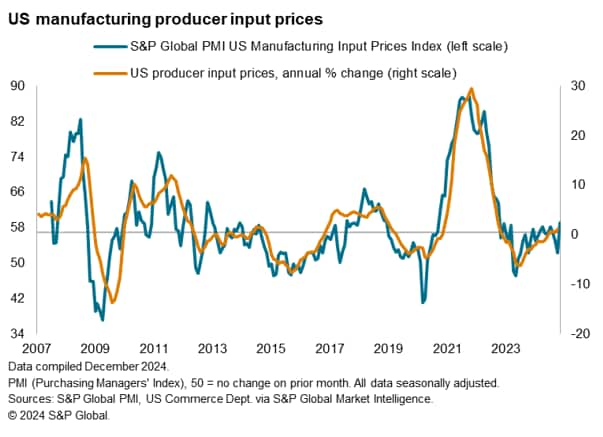

Costs spike higher in manufacturing

Input cost inflation also slowed when measured across both goods and services, dipping to the lowest for ten months. However. the softening in cost growth in the services economy to a four-and-a-half year low contrasted with a spike in input price inflation in the goods-producing sector to the highest for just over two years. While slower cost growth in services was in part due to weaker wage growth, higher materials prices in manufacturing were commonly linked to supplier-related price hikes and increased shipping rates.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-us-economy-ending-2024-on-strong-note-as-output-surges-higher-dec24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-us-economy-ending-2024-on-strong-note-as-output-surges-higher-dec24.html&text=Flash+PMI+signals+US+economy+ending+2024+on+strong+note+as+output+surges+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-us-economy-ending-2024-on-strong-note-as-output-surges-higher-dec24.html","enabled":true},{"name":"email","url":"?subject=Flash PMI signals US economy ending 2024 on strong note as output surges higher | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-us-economy-ending-2024-on-strong-note-as-output-surges-higher-dec24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+signals+US+economy+ending+2024+on+strong+note+as+output+surges+higher+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-us-economy-ending-2024-on-strong-note-as-output-surges-higher-dec24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}