Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 24, 2024

Flash PMIs show the US leading developed world expansion in July as eurozone lags

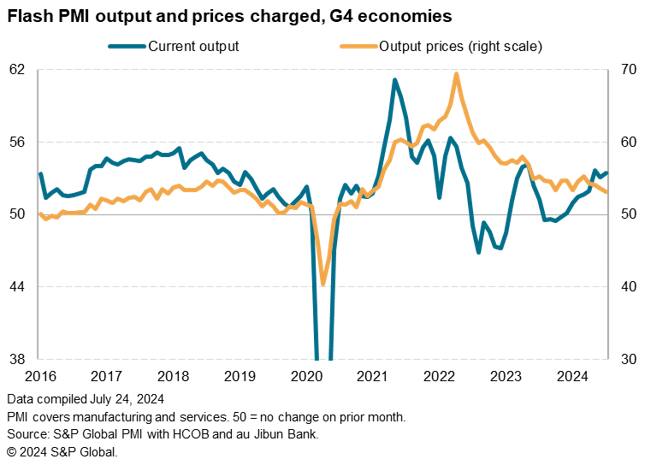

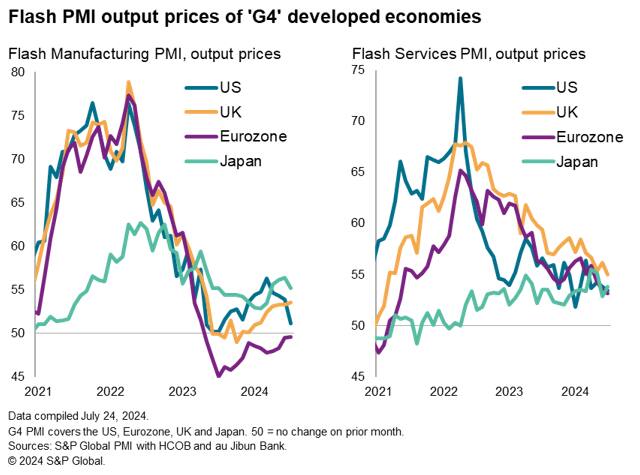

The flash PMI data from S&P Global signaled a welcome combination of lower selling price inflation and robust, accelerating, economic growth across the 'G4' major developed economies in July.

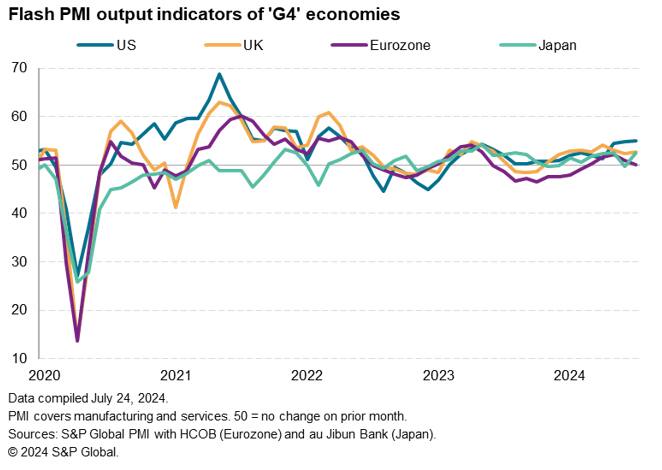

Trends varied, however, with the US leading the expansion, accompanied by accelerating growth in Japan and the UK, while the eurozone came close to stalling.

Price trends also varied, as slower rates of inflation for average prices charged for goods and services in the US and Europe contrasted with an uptick in Japan.

US leads global expansion as eurozone lags

Flash PMI data provided mixed news on economic trends in the major markets, notably in relation to output.

US growth accelerated to the fastest since April 2022, outpacing the other 'G4' major developed economies for a third successive month. Growth also rebounded sharply in Japan after a brief decline in June, posting the largest expansion for nearly a year. Robust growth was likewise seen in the UK, the pace of expansion reviving after a lull that was often attributed by companies to paused spending ahead of the General Election.

In contrast, growth slowed in the eurozone to register a near-stagnation of output, indicating the region's weakest performance since February.

UK bucks manufacturing malaise

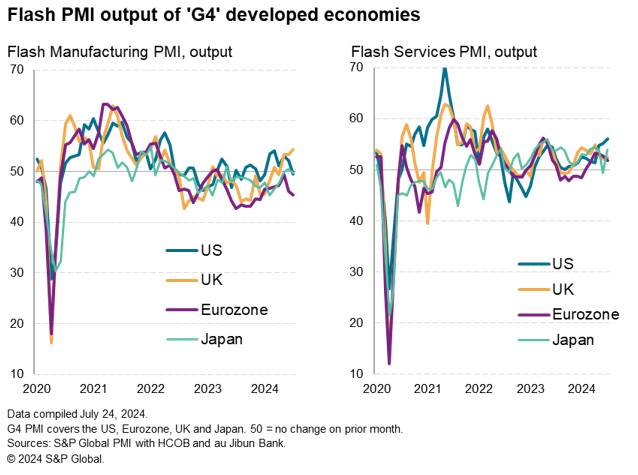

The US and Japanese expansions were powered by resurgent service sector activity, which offset declines in manufacturing output. The eurozone also saw a steep manufacturing decline, but its service sector expansion also waned. This waning would likely have been even greater had the French Services PMI not been buoyed by the Paris Olympics; a boost which is likely to prove short lived.

The UK therefore stood out as the only major G4 economy to report higher manufacturing output in July, which it enjoyed alongside a sustained service sector upturn. Moreover, the pace of manufacturing growth hit a two-year high, widening the UK's outperformance relative to the G4 to its greatest since August 2020.

G4 selling prices rise at slowest rate since January 2021

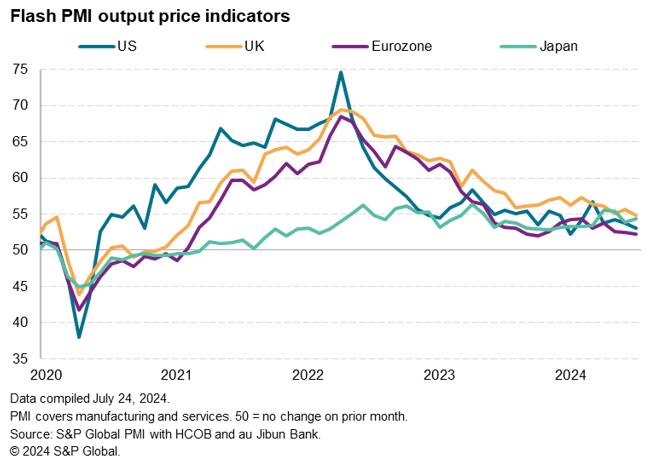

A further feature of the July flash PMIs was a further cooling of inflationary pressures. Measured across the G4 economies, average prices charged for goods and services rose in July at the slowest rate since January 2021, the rate of inflation cooling in all four economies except Japan.

US selling price inflation fell to the lowest since October 2020 bar a dip seen at the start of the year, the rate of inflation now running only modestly above the pre-pandemic average and hinting at a softening of inflation to the Fed's 2% target.

Eurozone selling price inflation also moderated, dropping to the lowest since last October to signal one of the slowest rates seen over the past three-and-a-half years. While above the pre-pandemic average, the eurozone selling price data are now also at a level broadly consistent with inflation falling to the central bank's 2% inflation in the coming months.

In comparison to the US and eurozone, UK selling price inflation remained elevated in July, though also showed signs of moderating, slipping to its lowest since February 2021, to hint at some further progress being made toward the policy target.

In contrast, prices rose at an increased rate in Japan, adding to speculation that the Bank of Japan may hike rates soon.

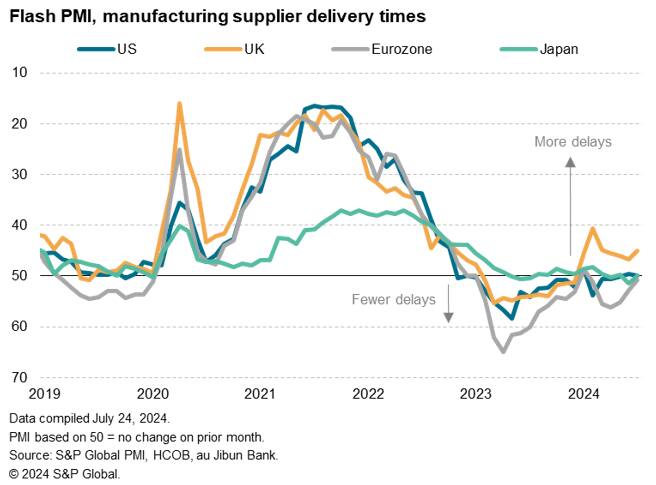

Notably, in Europe and the US, service sector inflation rates (the stubbornly elevated natures of which have been widely cited as key causes of higher-for-longer interest rates) moderated in July. Services selling price inflation remained relatively more elevated in the UK than in the US and eurozone, but a key further difference in the UK was an acceleration of manufacturing selling price inflation, in part linked to the pass-through of higher costs associated with supply constraints (as signalled by longer supplier delivery times).

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-the-us-leading-developed-world-expansion-in-july-as-eurozone-lags.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-the-us-leading-developed-world-expansion-in-july-as-eurozone-lags.html&text=Flash+PMIs+show+the+US+leading+developed+world+expansion+in+July+as+eurozone+lags+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-the-us-leading-developed-world-expansion-in-july-as-eurozone-lags.html","enabled":true},{"name":"email","url":"?subject=Flash PMIs show the US leading developed world expansion in July as eurozone lags | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-the-us-leading-developed-world-expansion-in-july-as-eurozone-lags.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMIs+show+the+US+leading+developed+world+expansion+in+July+as+eurozone+lags+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-the-us-leading-developed-world-expansion-in-july-as-eurozone-lags.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}