Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 03, 2022

Glimpses of risk taking amid tail-risk event

Research Signals - February 2022

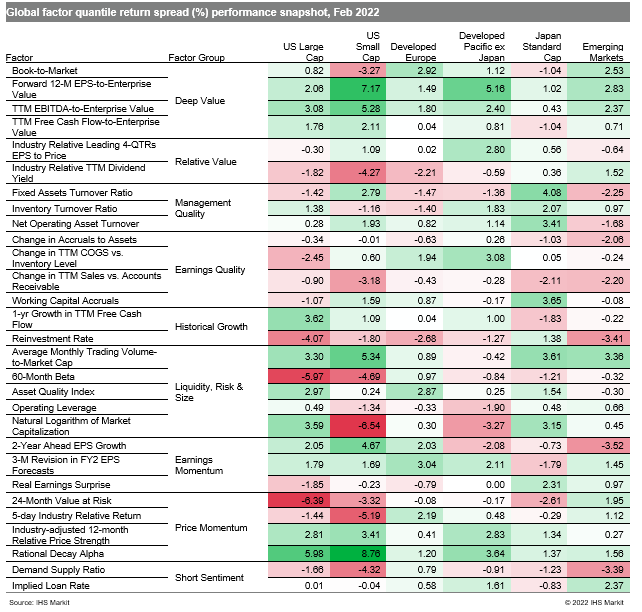

Most regional equity markets extended their losses into February as concerns over higher inflation and ensuing central bank interest rate hikes and monetary tightening were exacerbated by the escalation in the Russia-Ukraine conflict. However, high momentum and risk shares outperformed in several regional markets (Table 1), suggesting investors saw some glimmer of optimism, including that suggested by a mild upturn in the J.P.Morgan Global Manufacturing PMI led by Europe and the US, though a darkening geopolitical backdrop may pose significant risk to demand.

- US: High momentum and risk shares, as tracked by Rational Decay Alpha and 60-Month Beta, respectively, picked up steam in February, despite the market selloff

- Developed Europe: Firms with positive analyst outlook outperformed last month, as measured by 3-M Revision in FY2 EPS Forecasts and 2-Year Ahead EPS Growth

- Developed Pacific: High quality firms gauged by Inventory Turnover Ratio and Net Operating Asset Turnover outperformed in February

- Emerging markets: Investors favored low risk shares last month, as captured by 24-Month Value at Risk

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglimpses-of-risk-taking-amid-tail-risk-event.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglimpses-of-risk-taking-amid-tail-risk-event.html&text=Glimpses+of+risk+taking+amid+tail-risk+event+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglimpses-of-risk-taking-amid-tail-risk-event.html","enabled":true},{"name":"email","url":"?subject=Glimpses of risk taking amid tail-risk event | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglimpses-of-risk-taking-amid-tail-risk-event.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Glimpses+of+risk+taking+amid+tail-risk+event+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglimpses-of-risk-taking-amid-tail-risk-event.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}