Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 15, 2020

Global Daily Market Summary - 15 May 2020

Most European and APAC equity markets closed higher and US equity markets held up relatively well to close slightly higher on the day despite a particularly negative US industrial production report where month-over-month percentage declines breached the levels that occurred during the Great Depression and the conclusion of World War II. On a positive note, oil closed higher again and the current conditions index within the University of Michigan Consumer Sentiment Index did show a glimmer of hope that the easing of restrictions in the US is leading to a slightly more positive tone for consumers. Benchmark government bonds were weaker across the globe and US and European high yield credit indices continued to come under pressure today and closed wider across both regions.

Americas

- US equity markets closed modestly higher today; Russell 2000 +1.6%, Nasdaq +0.8%, S&P 500 +0.4%, and DJIA +0.3%.

- 10yr US govt bonds closed +3bps/0.65% yield.

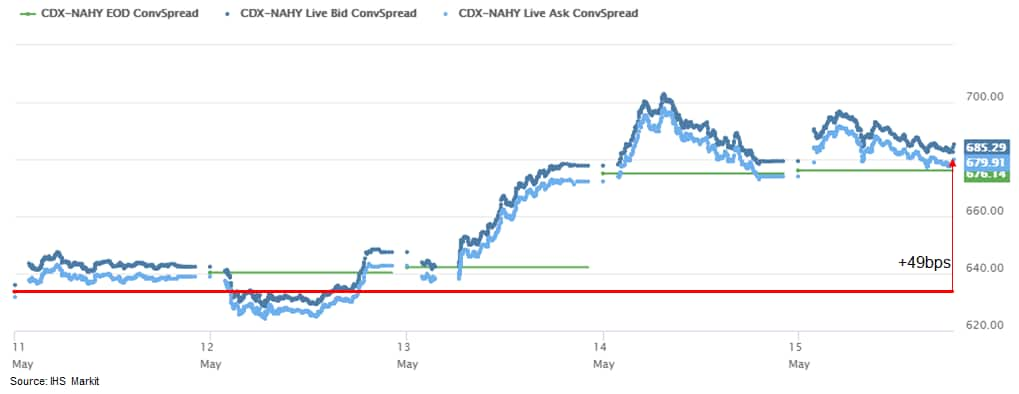

- CDX-NAIG closed flat/96bps and CDX-NAHY +6bps/682bps on the

day. Week-over-week, CDX-NAIG closed +5bps and CDX-NAHY +49bps

(chart below):

- Crude oil closed +5.6%/$29.43 per barrel and is +19.0% higher on the week.

- On 20 April, a frenzy surrounding the expiry of the NYMEX WTI

May 2020 contract pushed front month prices deep into negative

territory, settling at -$37.63/bbl. The breakdown and inversion of

benchmark prices took market participants and regulators by

surprise and left a string of questions in its wake. With the NYMEX

WTI June 2020 contract nearing expiry on 19 May and Cushing storage

capacity still limited, are markets facing a risk of a repeat?

While a return to negative prices cannot be entirely excluded, we

believe several factors have come into play since last month that

significantly lower the likelihood of such an inversion come

expiry. (IHS Markit Energy Advisory's Roger Diwan)

- Physical conditions have tightened materially relative to April as a result of widespread production shut-ins.

- The lack of spare storage capacity in Cushing is now well understood, adding a strong deterrent for speculative investors and arbitrage plays.

- Brokers and market-makers have instituted rigorous constraints on futures market positioning and participation close to expiry.

- Shifts in major oil-linked ETF holding distributions have moved liquidity away from front-month contracts.

- Total US industrial production (IP) declined 11.2% in April,

while manufacturing IP declined 13.7%. Both followed large declines

in March and were the largest one-month percentage declines in data

going back about 100 years, a period that includes the Great

Depression and the manufacturing wind-down following the conclusion

of World War II. (IHS Markit Economists Ben Herzon and Lawrence

Nelson)

- The auto sector was hit particularly hard at -71.7% m/m, as motor vehicle assemblies were virtually shut down for April.

- Mining output declined 6.1% in April, with sharp declines in crude oil extraction, oil and gas well drilling, and coal and nonenergy mining leading the way down.

- The output of electric and gas utilities declined 0.9% in April, with electric power generation down 3.3% and natural gas distribution up 10.7%. Unseasonably cool temperatures raised the demand for heating in April.

- Still, even assuming that the early stages of recovery begin soon, we expect industrial production to post a 44% annualized decline in the second quarter. There are only two quarters in the roughly 100-year history of the index with declines this large: the fourth quarter of 1937 (the later throes of the Great Depression) and the third quarter of 1945 (WWII wind-down).

- The University of Michigan US Consumer Sentiment Index inched

up 1.9 points (2.6%) in the preliminary May reading to 73.7 after

an epic 29.2-point plunge between February and April. This reading

is consistent with our assumption that April represented the low

point of the slump in consumer spending induced by the spread of

and responses to COVID-19. (IHS Markit Economists David Deull and

James Bohnaker)

- Survey collection spanned the lengthy period between 22 April and 13 May. Since 20 April, when approximately 95% of Americans were under stay-at-home orders, more than half of US states have eased restrictions on congregating and doing business.

- 57% of respondents rated the health threat as their highest concern, versus a mere 17% citing finances. This suggests that even as states reopen consumers will continue to exercise caution and consumer demand will remain muted for some time.

- The current conditions index recovered 8.7 points in early May, to 83.0, but the expectations index fell a further 2.4 points to 67.7.

- Consumer sentiment increased 3.9 points to 75.8 among households earning more than $75,000 a year, but for those below that threshold, sentiment fell a further 1.1 points, landing at 70.8.

- The index of expected changes in personal financial situations plunged to the lowest since July 2014.

- Total retail trade and food services sales tumbled 16.4% in

April, following an 8.3% decline in March. Core retail sales

declined sharply and more than expected. As a result, we revised

down our forecast for personal consumption expenditures (PCE) in

the second quarter by 5.7 percentage points to -48.3%. (IHS Markit

Economists James Bohnaker and David Deull)

- The details of the report are sobering. Food services and drinking places (down 29.5%), department stores (down 28.9%), electronics and appliance stores (down 60.6%), furniture and home furnishing stores (down 58.7%), and clothing and accessories stores (down 78.8%) were among the categories that experienced calamitous declines in retail sales.

- Even "essential" retail categories saw fewer sales in April compared with March. Grocery stores (down 13.2%), health and personal care stores (down 15.2%) and building materials stores (down 3.5%) were all down as consumers took fewer shopping trips amid "stay-at-home" orders.

- Sales at nonstore retailers (mostly online) jumped 8.4%, bringing the 12-month growth to 21.6%.

- The March JOLTS report indicates separations rose by 8.9

million to an all-time high of 14.5 million in March. (IHS Markit

Economist Akshat Goel)

- The layoffs and discharges rate shot up to 7.5%; the high during the Great Recession was 1.9%.

- The quits rate, a valuable indicator of the general health of the labor market, fell to a five-year low of 1.8% after averaging 2.3% for almost two years.

- The number of job openings was down by 813,000 to 6.191 million in March. The number of hires fell by 658,000 to 5.206 million.

- US veterinary technology and services provider Covetrus has recorded year-on-year sales growth of 13% during the first quarter of 2020 and a net loss of $33 million compared to a $13 million loss at the same time last year. Revenues for the quarter came to $1.07 billion. When including Vets First Choice's Q1 revenues from the prior year, Covetrus sales increased 10% in the first quarter. Pro forma organic revenues increased 10%, with foreign exchange fluctuations providing a 2% headwind during the period. First-quarter revenues in North America totaled $550 million - an increase of 11%. Covetrus sales climbed 17% to $422m in Europe, while turnover in Asia Pacific (APAC) and emerging markets rose 10% to $95 million. Covetrus recently strengthened its financial profile after it received a $250 million investment from US private equity firm Clayton, Dubliner and Rice. Covetrus expects to use the funds to repay its revolver borrowings, provide short-term liquidity and support general corporate purposes. (IHS Markit Animal Pharm's Daniel Willis)

- IHS Markit's Agribusiness, Energy & Natural Resources and

Economics & Country Risk groups published a report on 14 May

entitled 'The Next Food Supply Chain' to provide key

recommendations for companies that want to prosper, rather than

merely survive, in the future. Here are some of the key themes

within the report:

- In the short-term this dislocation will continue. By our estimates, in certain critical geographies as much as 25% of the global supply of perishable agriculture and food products over the next twelve months is at risk

- After the crash in foodservice demand over the past two months, there will be a medium-term increase in "away from home" food consumption, pursuant to the success or failure of tentative re-openings of shelter-in-place orders

- Labor disruptions have created points of failure in the system and these will continue

- Covid-19 is reinforcing the existing drive for automation in agriculture leading to larger farm size units and creating the necessity for investment in automation at the plant level

- Border risk is emerging as a new long-term concern as supply chains in the "borderless world" have diminished; the assumption of smooth seamless movement of goods across border will not be as valid as we move forward

- Companies and organizations will need greater visibility into the stability of supplier countries and regions where they see the potential for future disruption; they need to plan for alternative supply sources

- The United States' Democratic-led House of Representatives will

vote on its USD3-trillion COVID-19-virus-outbreak fiscal relief

package today. The bill sets aside nearly USD1 trillion for state

and local governments to help them pay for workers' salaries and

operational expenses. Another USD75 billion is allocated for

additional testing and contact tracing. Most of the remaining

proceeds will be disbursed directly to US citizens adversely

affected by the ongoing economic downturn. (IHS Markit Country

Risk's John Raines)

- Republican Senate leaders, including Senate Majority Leader Mitch McConnell, have declared that the Democrat-led bill is "dead on arrival", as it includes funding for Democratic projects such as voting by mail and a deportation ban for undocumented employees in essential industries.

- McConnell told Fox News on 14 May that the Senate would be likely to consider drafting its own legislation. Until then, Republicans have avowed that any new fiscal relief should only come after assessing the effects of the recently passed nearly USD3 trillion in relief packages as these have already produced record fiscal deficits.

- President Donald Trump's administration has suggested that it will consider additional relief measures, such as a social security payroll tax cut, a replenishing of the Paycheck Protection Program, and further direct citizen payments.

- Despite previous Republican efforts to delay negotiations, with unemployment now reaching levels not experienced since the 1930s' Great Depression, the party is almost certain to enter negotiations with Democrats in June.

- Bank of America brought a $1 billion four-year deal to the market yesterday that is noteworthy for being the first social bond in the US market specifically funding COVID-19 relief measures. Proceeds will fund not-for-profit hospitals involved in treating the pandemic and businesses supplying equipment or developing tests and vaccines against the virus. The bank also was the first US bank to offer social bonds, which it did in January 2019, and it has been a regular user of Green debt. (IHS Markit Economist Brian Lawson)

- Cuba and China have "decided to accelerate a project to build the first joint biotechnology park" for the island, Cuba's official state newspaper Granma reported. According to the source, the biotech park, which is the result of an agreement between Cuba's state-controlled biopharmaceutical conglomerate BioCubaFarma and Chinese company Guangxi Fukang, will be established in a development zone in the southern port of Fangchenggang in China. It aims to research, develop, and commercialise Cuban-made pharmaceuticals, including cancer drug Heberferon (CIGB-128A), Melagenina (human placenta extract), proctokinase and hepatitis B vaccine. (IHS Markit Life Science's Ewa Oliveira da Silva)

Europe/Middle East/ Africa

- European equity markets closed mixed; Germany +1.2%, UK +1.0%, France +0.1%, Italy -0.1%, and Spain -1.1%.

- 10yr European govt bonds closed lower across the region; Spain +5bps, Italy/UK +3bps, and France/Germany +1bp.

- Brent Crude closed +4.4%/$32.50 per barrel.

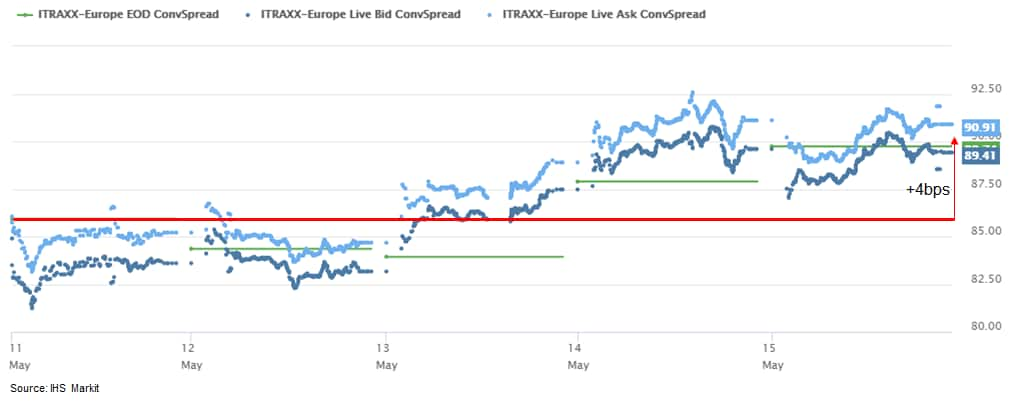

- iTraxx-Europe investment grade index unchanged/90bps and is

+4bps week-over-week:

- iTraxx-Xover high yield closed +4bps/541bps and is +26bps

week-over-week

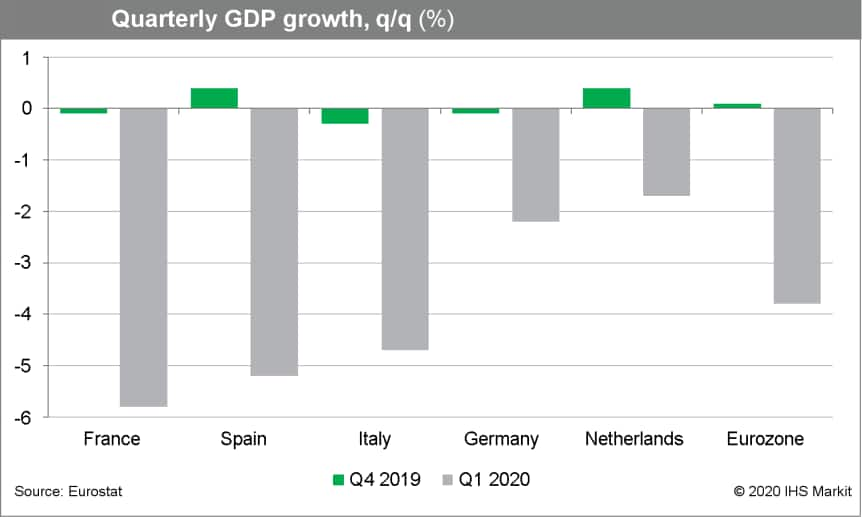

- "Flash" data released by the Federal Statistical Office (FSO) show that German real GDP declined by 2.2% quarter on quarter (q/q) in the first quarter of 2020. Although broadly as expected - our May forecast released earlier today had projected a drop of 2.0% q/q - this is the second-largest quarterly contraction since reunification, only exceeded in early 2009 (then -4.7% q/q). Slight revisions in opposite directions to the data for the two latter quarters of 2019 are having a marginal further dampening effect on average growth in 2020. The year-on-year (y/y) rate based on the calendar and seasonally-adjusted series was -2.3% in the first quarter, down from +0.4% in the fourth quarter of 2019 and the sharpest decline since the aftermath of the global financial market crisis in 2009. (IHS Markit Economist Timo Klein)

- French inflation, as measured by the EU Harmonised Index of

Consumer Prices, stood at 0.4% in April, according to figures

released by the National Institute of Statistics and Economic

Studies (Institut national de la statistique et des études

économiques: INSEE). French inflation has gradually trended

downwards this year since reaching 1.7% in January, and April's

reading is the lowest since October 2016. (IHS Markit Economist

Diego Iscaro)

- The easing of the inflation rate compared with March was mainly caused by a marked fall in energy prices, driven by the recent collapse in crude oil prices. At 4.1% year on year (y/y), April's fall in energy prices was slightly above the 3.9% y/y decline recorded in March. Indeed, it was the sharpest since mid-2008.

- The weakness in inflation was not limited to energy. Core inflation (i.e., excluding energy, food, alcohol, and tobacco) eased from 0.5% in March to just 0.3%, an 11-month low.

- Service price inflation, which accounts for around two-thirds of the core inflation rate, slowed markedly from 1.1% to 0.6% in April, driven down by falling transport prices. These fell by 6.0% y/y, affected by the coronavirus disease 2019 (COVID-19) virus-related containment measures in place since mid-March. The decline in airfares was particularly large at 12.6% y/y.

- According to the Dutch Statistics Office (CBS), in Q1 2020, the

Dutch economy contracted by 1.7% quarter on quarter (q/q) or by

0.6% year on year (y/y). This is the mildest rate of contraction

among the major Eurozone economies (chart below). (IHS Markit

Economist Daniel Kral)

- Looking at the underlying drivers, the main drag came from household consumption, which contracted by 2.7% q/q, which is the largest contraction since the series began in 1987.

- Government consumption contracted by 1.4%, fixed investment by 1.1%, while exports and imports of goods and services by 3.0% and 3.5%, respectively, resulting in a positive contribution from net trade.

- In a separate release, the business confidence indicator, which

measures the mood of non-financial companies with at least five

employees, sank to an all-time low in the second quarter. This is

consistent with the economy already being in a severe

recession.

- The Danish statistics office (Statistics Denmark) released the

first estimate for GDP growth in the first quarter of 2020. It

points to a contraction of 1.9% quarter on quarter (q/q), which

implies growth of 0.3% year on year (y/y).

- Denmark was one of the first European countries to announce a comprehensive lockdown on 11 March. This means that the lockdown has affected roughly half of March (most lockdown measures went into effect on 16 March) or 19% of the days in the first quarter.

- Statistics Denmark notes that passenger transport, hotels and restaurants, public services, culture and leisure have been the most affected. Importantly, it also notes that there have been no clear signs of decline in the commodity producing industries, such as agriculture, industry, and construction.

- McLaren Group is said to be considering its funding options in order to secure its liquidity during the COVID-19 virus pandemic. Sky News has been told by sources that the company is in discussions with JP Morgan to raise between GBP250 million (USD305 million) and GBP275 million by mortgaging its Woking (United Kingdom) headquarters and its historic car collection. (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- APAC equity markets closed mixed; Australia +1.4%, Japan +0.6%, South Korea +0.1%, and China/India/Hong Kong -0.1%.

- Tesla had started producing its long-range Model 3 in its Shanghai factory on 14 May and aimed to deliver the vehicles to consumers soon, said Tesla in a post published on Weibo, a Chinese social media outlet, on 14 May. A separate Reuters report on the same day said that the US automaker plans to introduce a new low-cost, long-life battery in its Model 3 sedan first in China later this year or early 2021. Tesla confirmed on 14 May that it will not adjust the pricing of the long-range Model 3 produced in China after 22 July, when the new subsidy program comes into effective. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Hisense's IT consultancy services subsidiary, Hisense Network Technology, has partnered with Baidu to develop intelligent transport systems, reports CAAM News. Hisense will provide its intelligent network and serve as an important partner for Baidu's autonomous operation system, Apollo. Both companies will conduct technical product research and development on intelligent transport projects in the Chinese cities of Baoding, Changsha, and Qingdao. Baidu has launched version 5.5 of Apollo, which has attracted more than 170 partners. The company has obtained 150 licenses to test autonomous vehicles (AVs) and has conducted road tests in 23 cities, with a range spanning more than 3 million kilometers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China promotes financial cooperation in the Greater Bay Area,

focusing on cross-border trade and investment facilitation.

Connecting financial markets to provide integrated services helps

to increase the region's attractiveness for business investment.

Continuous deregulation is also essential for Hong Kong SAR to

better leverage its role as a global hub for offshore Renminbi

(RMB) business. (IHS Markit Economist Lei Yi)

- China aims to deepen the financial cooperation and push the financial sector opening-up in the Greater Bay Area, according to a guideline jointly issued on 14 May by the People's Bank of China (PBOC), China Banking and Insurance Regulatory Commission (CBIRC), China Securities Regulatory Commission (CSRC), and State Administration of Foreign Exchange (SAFE).

- 12 out of the 26 measures in the guideline focus on facilitating cross-border trade, investment, and financing in the Greater Bay Area, including piloting cross-border private equity and venture capital investments. In particular, the PBOC allows for cross-border capital pooling of both local and foreign currencies, making it easier for participating multinationals in the region to funnel liquidity to their subsidiaries.

- In terms of promoting the collaboration among Guangdong, Hong Kong SAR, and Macao SAR institutions, regulators allow for joint establishment of RMB overseas funds to provide financing services for Chinese companies investing abroad, as well as domestic funds targeting infrastructure and industry development of the Greater Bay Area.

- A spokesperson for China's Foreign Ministry on 12 May announced

that the Chinese authorities had suspended imports of beef from

four Australian meat processing firms due to "violations of

inspection and quarantine requirements". (IHS Markit Country Risk's

David Li and Hannah Cotillon)

- Furthermore, Australia's trade minister reportedly requested contact with the Chinese commerce minister regarding plans to impose tariffs of about 80% on Australian barley, following the expected completion of an anti-dumping investigation on 19 May.

- Australia's bilateral relationship with China has deteriorated under Prime Minister Scott Morrison, with several Chinese investment projects blocked over national security concerns.

- There is significant backing for a cautious Australian response to the suspension: mining and agriculture interest groups and the mainstream Labor opposition have called for restraint.

- According to Australia's National Farmers' Federation, two-thirds of agricultural production is exported with 28% going to China. This includes almost half (49%) of total barley production and approximately one-fifth (18%) of beef output production.

Complimentary Access to Price Viewer

In light of current events, IHS Markit is offering complimentary access for qualified market participants to our historical cross asset coverage of global fixed income pricing and liquidity data, as well as OTC Derivatives data via the Price Viewer web-based data portal.

We use screenshots from the Price Viewer very frequently in this report and corporations use the credit default swap and bond price/yield data to identify potential risks to their supply chains. Request complimentary access here or contact sales@ihsmarkit.com.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-15-may-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-15-may-2020.html&text=Global+Daily+Market+Summary+-+15+May+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-15-may-2020.html","enabled":true},{"name":"email","url":"?subject=Global Daily Market Summary - 15 May 2020 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-15-may-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Daily+Market+Summary+-+15+May+2020+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-15-may-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}