Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 29, 2020

Global Daily Market Summary 29 April

Most major equity markets closed higher on the day, with a particularly strong close in the US driven by the combination of positive initial results for the Remdesivir COVID-19 trial, paired with the FOMC meeting delivering the supportive message that most were expecting. US GDP came in weaker than the consensus, but the markets have recently appeared to view more dire earnings/economic reports as potentially triggering expansions of government stimulus programs. All eyes will now be on Thursday's ECB meeting and the weekly US initial claims for unemployment insurance report scheduled for 8:30am ET.

Americas

- US equity markets closed sharply higher today; Russell 2000 +4.8%, Nasdaq +3.6%, S&P 500 +2.7%, and DJIA 2.2%.

- 10yr US govt bonds closes slightly weaker at +1bp/0.63% yield.

- US credit closed higher on the day, with the IHS Markit CDX North America Investment Grade index -5bps/87bps and High Yield -33bps/626bps.

- The National Institute of Allergy and Infectious Diseases said Wednesday that advanced Covid-19 patients taking remdesivir in the institute's study had a speedier recovery than patients taking placebo, according to preliminary results. The reported benefit was moderate, however, with remdesivir patients recovering in 11 days, or four days faster than the placebo group. (WSJ)

- The Federal Open Market Committee (FOMC) released its post-meeting statement this afternoon after two days of meetings. The FOMC chose, unsurprisingly, to maintain the target for the federal funds rate at a range of 0% to ¼%. It expects to keep the funds rate at its effective lower bound until confident the economy "has weathered recent events and is on track to achieve" its employment and price stability goals. The FOMC met amid tremendous "human and economic" hardships stemming from COVID-19. The virus and measures intended to support public health have resulted in sharp declines in economic activity, mounting job losses, impaired credit flows, and low inflation. The FOMC made no changes to settings of its principal monetary policy levers related to interest rates, asset purchases, and short-term lending via repurchase agreements. (IHS Markit Economists Ken Matheny and Kathleen Navin)

- US GDP fell at a 4.8% annual rate in the first quarter, according to the Bureau of Economic Analysis's (BEA's) "advance estimate," as individuals and businesses engaged in social distancing and followed a patchwork of mandatory and voluntary stay-at-home and similar policies. The decline in GDP was close to IHS Markit's latest tracking estimate, but more severe than the consensus estimate. (IHS Markit Economists Ken Matheny, Michael Konidaris, and Lawrence Nelson)

- The US Pending Home Sales Index (PHSI) plunged 20.8% to 88.2 in March—the lowest reading since May 2011. These figures reflect the early impact of the COVID-19 pandemic, so next month's readings could be stunningly worse. The National Association of Realtors' chief economist, Lawrence Yun, sees home sales plunging in the coming months but bouncing back later this year. He also expects virtual tours and e-signings to play a greater role in connecting buyers and sellers. The association projects a 14% decline in existing home sales this year, which is closely in line with IHS Markit's 14.1% April forecast. (IHS Markit Economist Patrick Newport)

- Ford has reported a net loss of USD2 billion in the first quarter. Ford's reported results for the first quarter were dominated by the effects of the COVID-19 pandemic, as is expected to be the case for the auto industry as a whole. Ford has taken steps to position itself to weather the storm, but expects a net loss of USD5.0 billion in the second quarter. Along with accessing credit facilities and cutting pay for salaried workers and executives, Ford will see reduced capital expenditure in 2020, and is now expecting to spend between USD6.3 billion and USD6.8 billion, down from USD7.6 billion in 2019. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Crude oil closed +22.0%/$15.06 per barrel today.

- Record low oil prices are sending shudders through the US oil

supply system. IHS Markit's base case paints an extremely difficult

picture for US oil in 2020 as WTI prices languish below $35/bbl for

the rest of the year. (IHS Markit Energy Advisory's Raoul

LeBlanc)

- The first wave of output declines comes this quarter from shut-ins driven by collapsing demand, severely constrained storage and extremely low prices. We now estimate 1.8 MMb/d of total production shut-ins in the second quarter, coming from a mix of 1.5 MMb/d of unconventional wells across the major plays - with the landlocked Bakken especially hard hit - and around 350,000 b/d from conventional high-cost stripper wells

- The second wave of supply declines taking hold over the second half of the year and into 2021 will come from crashing capex levels and a dramatic drop in activity levels, which sees declines from existing wells overwhelm new volumes. Our estimated 2020 lower-48 onshore capex spend has been reduced to just $48 bn, down by half from 2019.

- Houston, Texas-based Diamond Offshore Drilling and select subsidiaries have filed voluntary petitions for reorganization under chapter 11 of the US Bankruptcy Code. Diamond intends to use the proceedings to restructure and strengthen its balance sheet and achieve a more sustainable debt profile. (IHS Markit Upstream Costs and Technology's Matthew Donovan)

- Twelve of the largest developing countries, including Brazil and Russia, reduced their combined reserves by at least $143.5 billion in March in the biggest drawdown since October 2008, according to data from research firm Arkera. Turkey is currently at its lowest foreign-exchange balance since November 2006 and Egypt registered its largest draw on reserves on record in March. (WSJ)

- Brazil's big three beef exporters are hoping to fill gaps in US protein supplies as North American meat plants reduce production in the wake of Covid-19 outbreaks among workers. JBS, Marfrig and Minerva have all been able to ship fresh Brazilian beef to the US market since import restrictions were lifted in February of this year. At the same time, more than 20 US meat plants have temporarily suspended production as a result of Covid-19 outbreaks in recent weeks, sparking concerns that US beef supplies may soon start to run short. US President Donald Trump yesterday signed an executive order to help ensure US meat facilities to stay open. But Brazilian exporters believe there will still be opportunities to boost sales not only to the US but also other large international markets. (IHS Markit Agribusiness' Max Green and Ana Andrade)

- S&P Global Ratings has downgraded Chile's outlook from Stable to Negative and reaffirmed the sovereign-risk rating at 15 (A+ on the generic scale). This carries the same level of risk as IHS Markit's. Chile's key economic fundamentals are still relatively strong and will help cushion the blow from the spread of the COVID-19 virus and lower commodity prices; these factors include the floating exchange rate, proper fiscal policy, monetary policy based on inflation targeting, and strong institutions. (IHS Markit Economist Ellie Vorhaben)

- S&P Global Ratings has revised its outlook for Panama's sovereign risk from Stable to Negative, while maintaining the country's sovereign credit rating at BBB+ (equivalent to 30 on IHS Markit's numerical scale). The Negative outlook suggests that S&P could downgrade the rating in the short term if the government fails to return to fiscal prudence and sound debt management after the COVID-19 crisis. Conversely, the rating outlook could return to Stable if the government's policies are successful at stabilizing the economy during the pandemic and at sparking a robust recovery in 2021/22. (IHS Markit Economist Paula Diosquez-Rice)

Europe/Middle East/ Africa

- Spain's annualized retail sales for March were 14.1% lower than a year earlier, which was the sharpest fell since the series began in 2001. It was preceded by 1.8% year-on-year (y/y) gain in February. A breakdown by type of good reveals non-food products plunged by 29.6% y/y in March, with sales of household and personal equipment falling by 32.0% y/y and 53.9% y/y, respectively. Meanwhile, food sales bucked the trend, up by 8.9% y/y. Surprisingly, employment in the retail sector held up well, as the INE's employment index in in March declined by just 0.4% when compared to a year earlier. (IHS Markit Economist Raj Badiani)

- According to data published by the Spanish Association of Passenger Car and Truck Manufacturers (Asociación Española de Fabricantes de Automóviles Turismos y Camiones: ANFAC), Spanish passenger car output during March declined to 115,354 units. This has dragged production volumes during the first quarter of 2020 down by 13.4% year on year (y/y) to 508,501 units. It has also recorded a decline in the number of pick-ups built in the month of 74.3% y/y to 703 units, which has meant that it is now down by 50.1% y/y during the year to date (YTD) to 5,696 units. In the commercial vehicle category, light commercial vehicle (LCV) output fell 39% y/y to 15,193 units in March, resulting in YTD production being down by 11.3% y/y to 70,049 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- Italian passenger car registrations are expected to fall by up to 98% year on year (y/y) during April due to the measures brought in to prevent the spread of the coronavirus disease 2019 (COVID-19) virus, according to the National Association of Foreign Vehicle Makers' Representatives (Unione Nazionale Rappresentanti Autoveicoli Esteri: UNRAE). In a statement, the trade association said up until 24 April, only 2,073 units have been registered. This has meant that it now anticipates a fall of between 97% and 98% y/y for the whole month, or between 3,000 and 4,000 units. The decline comes on top an 85% y/y fall recorded in March as the measures started to be implemented and is likely to be indicative of the performance of other markets in Europe during April. (IHS Markit AutoIntelligence's Ian Fletcher)

- The VW Group has posted an 83.1% y/y decline in profit after tax in the first quarter to EUR517 million, down from EUR3,053 million at the equivalent point in 2019, according to a company statement. The huge decline in profit after tax and 23.0% decline in sales volumes was the result of the global COVID-19 pandemic, which first hit its operations in China before starting to affect Europe and North America in March. (IHS Markit AutoIntelligence's Tim Urquhart)

- Innogy has contracted Siemens Gamesa for the supply of 38 SG 8.0-167 DD Flex wind turbines for the 342 MW Kaskasi project off Germany. The order includes a two-year service and maintenance contract. Turbine installation is expected to commence in July 2022. Project commissioning is expected by end 2022. (IHS Markit Upstream Costs and Technology's Chloe Lee)

- On 28 April, the UK's Financial Conduct Authority (FCA) published the text of a standard letter being sent to the CEOs of major financial institutions. This noted that the FCA had heard "credible reports" of banks "failing to treat their corporate clients fairly" when companies have sought to negotiate new facilities or renegotiate existing ones. The FCA statement clearly shows its desire to stop banks "leveraging" provision of loan finance to seek other ancillary income, particularly in parallel equity-raising exercises. FCA action against banks would not require new regulation, falling instead under the FCA's existing principles. Specifically, it cites Principle 5 (proper standards of market conduct), Principle 1 (acting with integrity), and Conduct of Business Sourcebook rules 2.1 and 11A.2 (acting in the best interests of clients and avoiding clauses that restrict client choice of providers for future business). (IHS Markit Country Risk's Brian Lawson)

- The Central Bank of Azerbaijan (CBA) on 28 April announced that it has revoked the licenses of Atabank and Amrah Bank, citing deteriorating financial situation of these banks. The two banks are among Azerbaijan's 15 largest lenders and together, account for 2.1% of total banking sector assets. As Azerbaijan's energy-dependent economy falls sharply in 2020 because of the unprecedented collapse in global crude oil prices in the wake of the COVID-19 virus pandemic. IHS Markit expects that more bank closures and mergers of weakest players will follow in 2020 as banks struggle to recapitalize, compromising the banking sector's stability. (IHS Markit Banking Risk's Greta Butaviciute)

- European credit closed higher today; IHS Markit's iTraxx Europe Investment Grade index -4bps/78bps and iTraxx-Xover High Yield index -19bps/475bps.

- 10yr European govt bonds closed mixed, with Italy +3bps, UK flat, Germany -3bps, and France/Spain -4bps.

- European equity markets closed higher across the region; Spain +3.2%, Germany +2.9%, UK +2.6%, and France/Italy +2.2%.

Asia-Pacific

- Internet penetration rate has reached 64.5% in China with a netizen population of 904 million as of March 2020, according to the latest (45th) internet development report published by China Internet Network Information Center on 28 April. In particular, 99.3% of netizens access the internet through their mobile phones, and the shares of urban and rural internet users registered at 71.8% and 28.2%, respectively. The number of online shoppers has increased by 16.4% from the end of 2018 to 710 million by March this year, approximating 80% of overall internet users. About 265 million students switched to online study as schools were all closed offline, which brings the number of users of online education to 423 million in March, up by 110.2% from 2018 year end. (IHS Markit Economist Lei Yi)

- China's auto market has been overwhelmed with electric vehicle (EV) news over the past few weeks. EV startups such as Xpeng Motor and NIO have rolled out fresh or updated models, while traditional automakers have remained committed to the EV market, encouraged by the government's decision to maintain the subsidy program as a backstop. The competition landscape of the battery EV segment will look different in 2020 with new entrants joining. In IHS Markit's April forecast update, we expected China's light-vehicle production to drop 15.5% during 2020 to around 20.6 million units. The new energy vehicle (NEV) segment will face the same market forces and experience slow demand recovery in 2020. Production volumes of NEVs in China are currently forecast to drop to less than 1.1 million units in 2020, compared with 1.24 million units in 2019. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese automaker Guangzhou Automobile Group (GAC Motor Group) has released its financial results for the first quarter of 2020, ended 31 March 2020. Revenues decreased by 24.5% year on year (y/y) to CNY10.8 billion (USD1.53 billion). Its net profit to shareholders of the listed company slumped 95.7% y/y to CNY118.5 million during the quarter. GAC lowered its sales forecast for 2020 in March, saying it expected 3% growth in 2020, compared to 8% previously announced.

- China General Nuclear Power Corporation (CGN) has contracted MingYang Smart Energy for the supply of 64 MySE6.25-180 wind turbines for the 400MW Huizhou Gangkou Phase 1 project off China. The delivery of the turbines will commence in October 2020 and is expected to complete by August 2021. The wind farm is expected to be connected to the grid in late June 2022. (IHS Markit Upstream Costs and Technology's Chloe Lee)

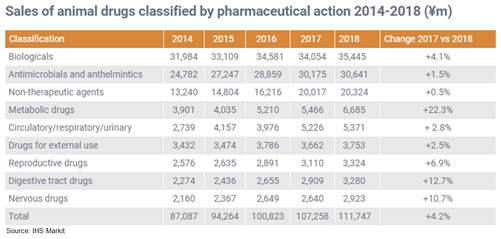

- The Japanese Ministry of Agriculture, Forestry and Fisheries

(JMAFF) and the National Veterinary Assay Laboratory (NVAL)

reported sales of animal health products for 2018 came to ¥122

billion ($1.14 billion). While this marks the fifth year in a row

of growth for the Japanese animal health sector, the latest

increase was the lowest since 2014. This was prompted by slowing

sales of antibiotics. Last year, sales of animal health products in

Japan grew by 6.5%. The largest category of veterinary drugs in

Japan is biologicals, which accounted for 32% of total annual sales

in 2018. The second largest segment is antimicrobials and

anthelmintics (27%) and third is non-therapeutic products including

insecticides (18%). (IHS Markit Animal Pharm's Dr Atsuo Hata)

- Hyundai's plan to sell corporate bonds worth KRW300 billion (USD245.3 million) has received a strong market response despite the impact of the COVID-19 virus pandemic on the automotive industry, reports the Yonhap News Agency. The automaker has received KRW1.41 trillion-worth of orders, more than three times the planned issuance. It is expected to double the value of corporate bond issuance to KRW600 billion (USD495 million). (IHS Markit AutoIntelligence's Jamal Amir)

- Imported vehicle sales in the Philippines plunged 34.4% year on year (y/y) to 14,404 units during the first quarter of 2020, reports BusinessWorld, citing data released by the Association of Vehicle Importers and Distributors (AVID). Imported passenger vehicle sales totalled 4,506 units during the quarter (down 43% y/y), imported light commercial vehicle (LCV) sales stood at 9,806 units (down 29% y/y), and imported medium and heavy commercial vehicle sales fell 62% y/y to 92 units. (IHS Markit AutoIntelligence's Jamal Amir)

- Shin-Etsu Chemical reports a rise of 1.6% in net profit to

¥314.02 billion ($2.9 billion) for the fiscal year ended 31 March.

Operating income increased 0.6% to ¥406 billion and sales declined

3.2% to ¥1.54 trillion.

- The polyvinyl chloride (PVC) and chlor-alkali business Shintech saw operating income decline 13.5% to ¥92.1 billion, on sales of ¥484.3 billion, down 7.6%.

- The silicones business recorded 5% growth in operating income to ¥61.4 billion.

- The specialty chemicals business operating income increased 4.2% to ¥27.7 billion and sales declined 5.2% to ¥114.7 billion.

- The company's semiconductor and silicon business increased its operating income by 8.6% to ¥143.2 billion on sales of ¥387.6 billion, up 1.9%, with profit boosted by a high level of shipments.

- The electronics and functional materials business reported a 2.3% rise in operating income to ¥68.5 billion on a 0.4% slip in sales to ¥225.1 billion.

9. APAC equity markets closed higher across the region; India +1.9%, Australia +1.5%, South Korea +0.7%, China +0.4%, and Hong Kong +0.3%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-29-april.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-29-april.html&text=Global+Daily+Market+Summary+29+April+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-29-april.html","enabled":true},{"name":"email","url":"?subject=Global Daily Market Summary 29 April | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-29-april.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Daily+Market+Summary+29+April+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-daily-market-summary-29-april.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}