Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2023

Global downturn led by slump in financial services as borrowing costs ratchet higher

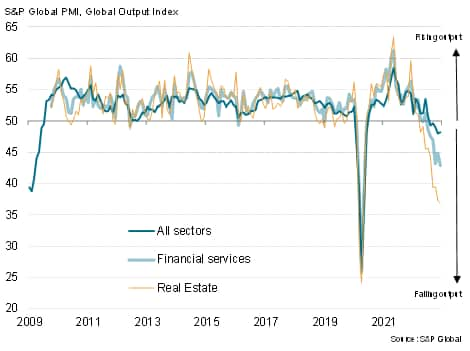

Purchasing Managers' Index (PMI) from S&P Global provide a unique insight into worldwide economic tends, allowing the analysis of business activity by detailed sector in the world's principal regions. The latest data highlight how the global economy remained stuck in decline for a fifth successive month in December, with the downturn led by an increasingly steep deterioration in financial services activity. The latter was in turn led by a severe drop in real estate activity, as well as a steep contraction of banking services.

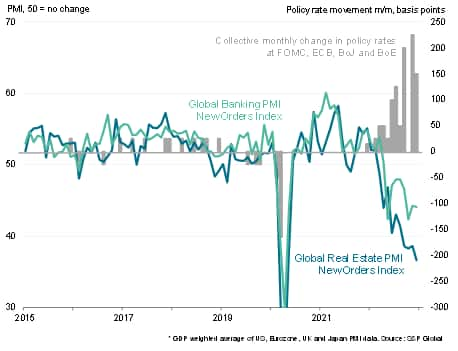

Both real estate and banking have seen a steepening loss of output in recent months, corresponding with an increasingly aggressive hiking of interest rates by the world's major central banks. Thus, while the impact of higher interest rates has yet to become evident in official data such as GDP for countries notably including the US, the economic headwind from tighter policy is certainly being seen in the timelier survey data, suggesting early 2023 could see a worsening in the official economic data flow.

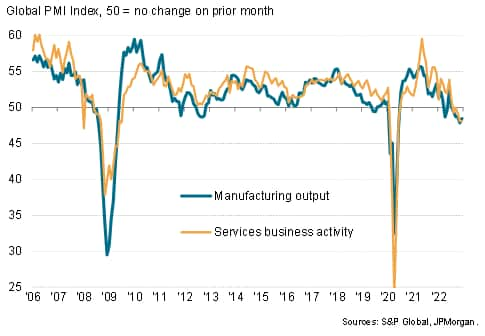

Global manufacturing and services output

Broad-based slump across major developed economies

PMI global output indices

S&P Global PMI surveys recorded a fifth month of contracting worldwide business activity in December, the rate of decline moderating slightly compared to November yet remaining among the steepest seen since the global financial crisis.

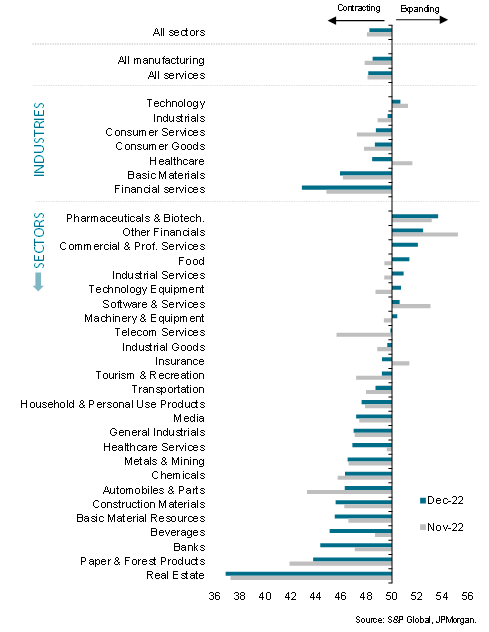

Downturn led by financial services

Only one of the broad industries tracked by the PMI surveys - technology - recorded any growth, and even here the rate of expansion was only modest and the weakest for seven months. There was some brighter news in terms of rates of decline easing for consumer goods, consumer services and industrials compared to November. However, healthcare slipped into decline after two months of growth, and downturns steepened for both basic materials and financial services, the latter continuing to suffer by far the steepest decline of the broad industries covered.

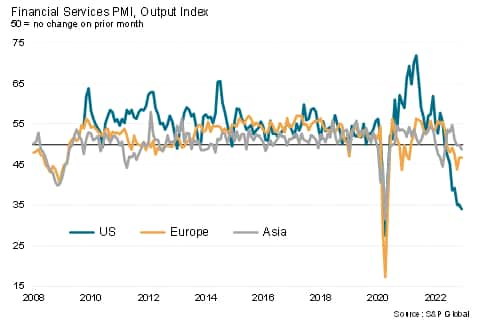

US suffers steepest financial services decline

By region, the US saw by far the steepest deterioration in financial services output, though a relatively steep decline by historical standards was also seen in Europe and a marginal decline was also recorded in Asia.

These regional variations in financial service trends correspond with varying degrees of monetary policy tightening, for which the US has seen a more aggressive hiking of policy rates relative to Europe and especially relative to Asia.

Real estate activity collapses as rates are hiked

There were more pockets of growth evident when the data are analysed at the more detailed sector level. Of the 26 sectors covered, eight reported higher output in December, albeit with half of these only registering very modest expansions. Pharmaceuticals and biotech reported the strongest output gain, followed by 'other financials'.

In contrast, the steepest declines in output were recorded for real estate and banking services, as well as paper and timber products. The decline in real estate activity ease especially noteworthy, with the rate of contraction accelerating further to register a collapse in activity far in excess of anything previously recorded since comparable global data were available in 2009, barring only the initial pandemic lockdowns of early 2020.

It is no surprise to see the collapse in real estate activity correlate with the post-pandemic hiking of interest rates at the major central banks, which continued into December. While the developed world rate hiking cycle started in December 2021, global real estate anew orders inflows subsequently started to fall in March 2022, according to the PMI data, with the rate of decline trending steeper as the rate tightening path became more aggressive. Similarly, banking service new orders for banking services started falling in May 2022, in an indication of a broader financial-led economic decline as borrowing costs ratcheted higher.

Global financial services output

Global PMI new orders vs. central bank policy

Read the accompanying press release here.

Read the accompanying press release here.Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-led-by-slump-in-financial-services-as-borrowing-costs-ratchet-higher-Jan23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-led-by-slump-in-financial-services-as-borrowing-costs-ratchet-higher-Jan23.html&text=Global+downturn+led+by+slump+in+financial+services+as+borrowing+costs+ratchet+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-led-by-slump-in-financial-services-as-borrowing-costs-ratchet-higher-Jan23.html","enabled":true},{"name":"email","url":"?subject=Global downturn led by slump in financial services as borrowing costs ratchet higher | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-led-by-slump-in-financial-services-as-borrowing-costs-ratchet-higher-Jan23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+downturn+led+by+slump+in+financial+services+as+borrowing+costs+ratchet+higher+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-downturn-led-by-slump-in-financial-services-as-borrowing-costs-ratchet-higher-Jan23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}