Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 07, 2025

Global economic growth closes 2024 on four-month high but future optimism wanes

The worldwide PMI survey - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - registered the strongest global economic growth for four months in December. Employment meanwhile edged higher for the first time in five months in response to rising inflows of new orders.

However, growth was again dependent on the services economy, where a stronger rate of expansion - fueled in particular by surging financial services activity - contrasted with a renewed downturn of manufacturing output.

Moreover, growth disparities widened by region, with the US outperforming the other major developed economies - all of which reported either falling or near-stalled output - and India far outpacing the other major emerging markets.

Business confidence meanwhile slipped lower, ending 2024 at one of the lowest levels seen over the past year, amid rising concerns over economic growth prospects in the year ahead, which were often linked to geopolitical and protectionism worries. Although sentiment lifted higher in the US, confidence fell across the emerging markets and remained subdued in Canada, the eurozone and UK, the latter reported a particularly marked deterioration in business confidence.

Global economic growth at four-month high

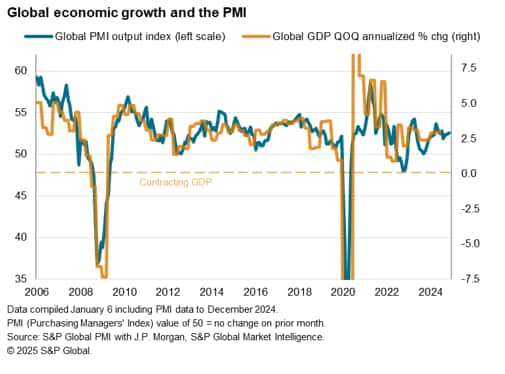

S&P Global Market Intelligence's PMI surveys indicated that global business activity expanded for a fourteenth successive month in December. The rate of expansion ticked higher for a third month running to register the strongest growth since last August.

The headline J.P. Morgan Global Composite PMI® Output Index, covering manufacturing and services in over 40 economies, rose from 52.4 in November to 52.6 in December.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.8%. That compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic.

The current growth rate signalled by the PMI is therefore one that is modestly below-trend but accelerating.

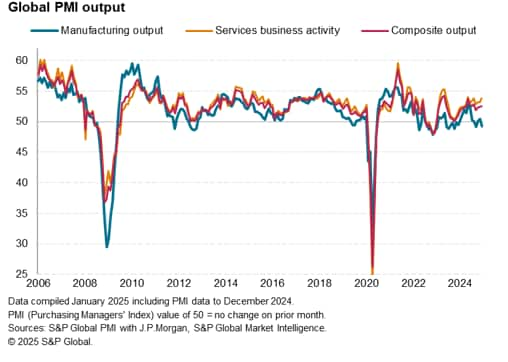

Two-speed global economy evident as manufacturing-services gap widens

The gap in performance between the global services and manufacturing sectors widened in December to the greatest for one-and-a-half years. While services growth revived to a four-month high, registering one of the strongest rates seen over the past one and half years, manufacturing output contracted slightly for the second time in four months.

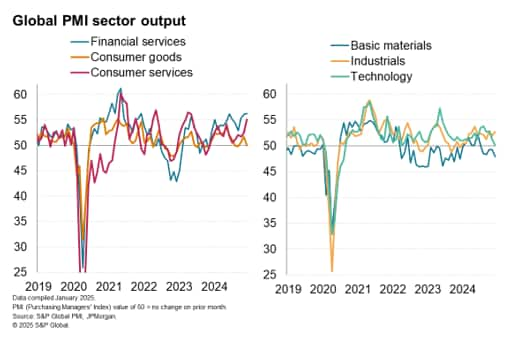

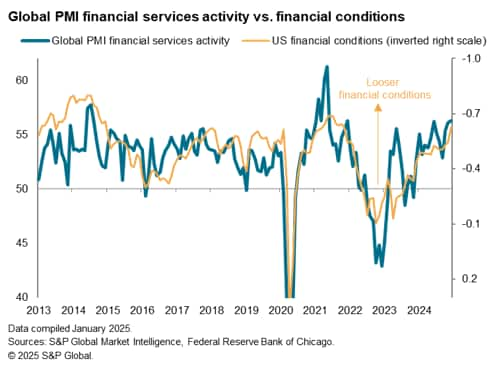

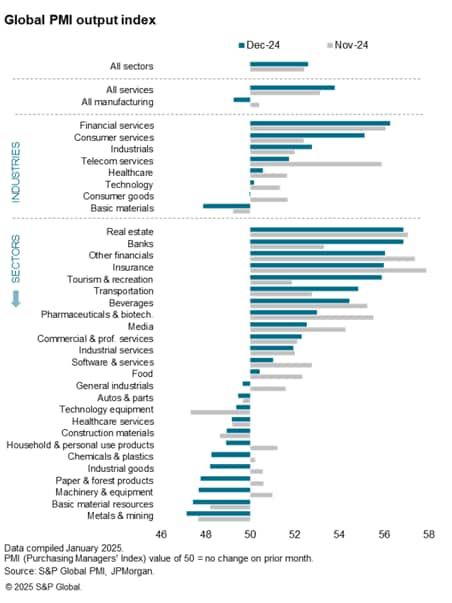

By broad industry, December's expansion was again led by financial services, where growth hit a three-year high, followed by consumer services, which enjoyed the strongest growth for 19 months. In contrast, basic material producers reported the sharpest contraction for a year and output of consumer goods stagnated.

In more detail, real estate led the sector rankings amid the lowering of interest rates, followed by banking, other financials and insurance, underscoring the dominance of financial services in driving the current expansion amid looser financial conditions.

While basic industry sectors saw the steepest downturns, machinery and equipment makers notably also reported the sharpest drop in output for 32 months.

US pulls further ahead of other major developed economies

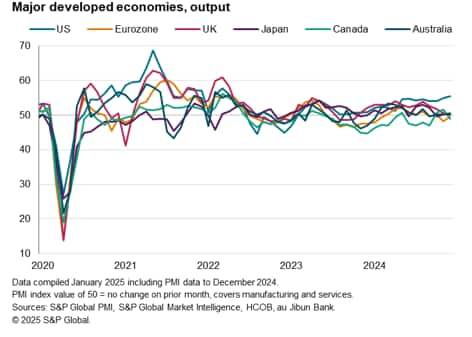

Among the major developed economies, the US saw the strongest expansion for an eighth successive month, the rate of growth rising to the fastest since April 2022 as surging services growth (a 33-month high) offset a steepening manufacturing decline.

The improved performance of the US contrasted with malaise reported elsewhere in the major developed markets. Only marginal output gains were reported in Japan, the United Kingdom and Australia during December, while eurozone output fell for the third time in four months and output fell in Canada for the first time in three months. However, in both the eurozone and Canada the falls in output were only modest.

While the eurozone, UK, Japan and Australia all reported higher services output, all four reported lower manufacturing output in the closing month of 2024, with especially steep factory output falls seen in the eurozone, UK and Australia. Canada bucked the trend, with higher factory output reported, but it was the only major developed economy to report lower services activity.

India extends its lead among major emerging markets

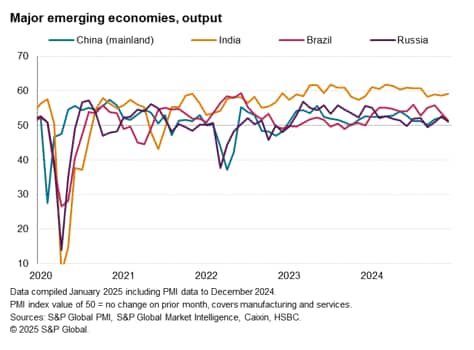

India once again led growth among the BRIC 'emerging' economies by a wide margin, as has been the case since July 2022, with growth picking up slightly in December amid sustained strong performances across both manufacturing and services.

Growth meanwhile slowed in the other 'BRIC' emerging economies.

Mainland China reported only modest growth and the weakest expansion of output for three months. Although services growth edged up to a seven-month high, November's export-led manufacturing growth revival waned to near-stagnation.

Brazil also reported a considerable loss of momentum, with growth down to a 12-month low amid weakened expansions across both manufacturing and services.

Only modest growth was likewise reported in Russia, the expansion cooling from November's eight-month high, thanks to a near-stalled manufacturing economy and slower growth of service sector activity.

Global employment edges higher

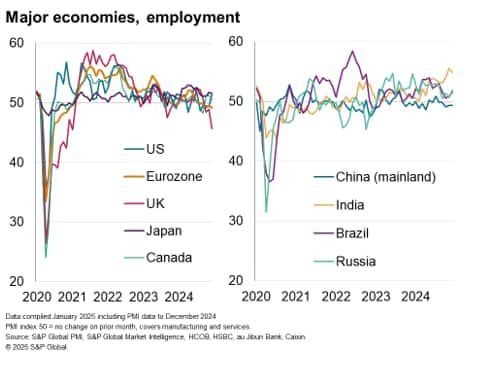

Improved inflows of new orders, which rose globally at the fastest rate for seven months, helped global private sector employment edge higher in December for the first time in five months. A marginal rise in service sector staffing offset a slight fall in factory payrolls.

In the major developed markets, US firms reported an upturn in the pace of job creation to the highest since last July, thanks to the strongest rise in new orders for 32 months, driven by renewed hiring in services.

In contrast, UK employment fell at the sharpest rate since January 2021 due in part to the sharpest fall in new order for 14 months, but also in reaction to recent tax changes.

Falling orders also prompted a further loss of in eurozone jobs, where the rate of decline hit the joint-steepest since December 2020. Rates of job creation also cooled in Japan and Canada.

In the major emerging markets, robust (near-survey-record) job gains in India were accompanied by further net job creation in Russia and Brazil, but jobs were cut for a fifth straight month in mainland China.

Manufacturing worries subdue global business optimism

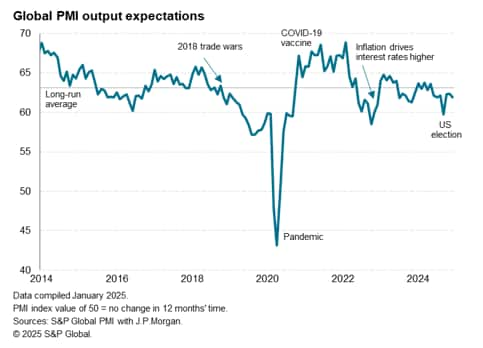

Looking to 2025, worldwide business expectations for output in the year ahead remained well above the near-two-year low seen in September, which had seen sentiment slump on uncertainty over the US election outcome. Sentiment nonetheless remained below the long-run average, having dipped slightly again in December, due principally to ongoing geopolitical concerns and intensifying economic growth worries.

Although service sector companies became slightly more optimistic in December, often reflecting hopes of lower interest rates and the waning cost of living squeeze, future sentiment slumped to the second-lowest in 14 months in manufacturing, as factories around the world grew more concerned over the impact of the potential rise in trade protectionism.

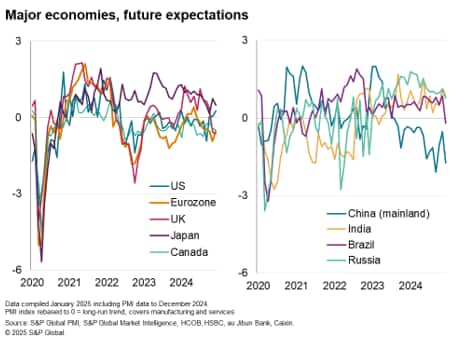

Among the major developed economies, the lowest confidence relative to long-run averages was recorded in the UK, where expectations hit a two-year low amid growing reports of concerns over the impact of recent government policy changes, followed by the eurozone and Canada, both of which saw ongoing concerns over proposed US tariffs.

US confidence, in contrast, rose further above its long-run average as companies warmed to the prospect of a more business-friendly administration in 2025. Future expectations in the US rose to the joint-highest since May 2022.

It was nevertheless Japan which saw the highest business optimism of the big, developed economies relative to its long-run average, though the degree of positivity faded to one of the lowest seen over the past two years, in part on trade worries.

Confidence about the year ahead meanwhile deteriorated across all four major emerging markets, often linked to trade protectionism worries. Business expectations dropped especially sharply in Brazil (to the lowest since April 2021) and mainland China (to the second-lowest since June 2019 and notably far below its long-run average). Although dipping, sentiment remained well above long-run averages in both India and Russia.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-closes-2024-on-fourmonth-high-but-future-optimism-wanes-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-closes-2024-on-fourmonth-high-but-future-optimism-wanes-Jan25.html&text=Global+economic+growth+closes+2024+on+four-month+high+but+future+optimism+wanes+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-closes-2024-on-fourmonth-high-but-future-optimism-wanes-Jan25.html","enabled":true},{"name":"email","url":"?subject=Global economic growth closes 2024 on four-month high but future optimism wanes | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-closes-2024-on-fourmonth-high-but-future-optimism-wanes-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+growth+closes+2024+on+four-month+high+but+future+optimism+wanes+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-growth-closes-2024-on-fourmonth-high-but-future-optimism-wanes-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}