Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 23, 2023

With the global economy growing at a moderate pace, inflation will gradually subside

Global economic performance exceeded expectations in early 2023. Led by post-pandemic surges in mainland China and India, world real GDP grew an annual rate of 3.2% quarter over quarter in the first quarter of 2023, double the pace of the previous quarter. This increase was achieved despite stagnation in Western Europe and fragile 1.3% growth in the United States. S&P Global Purchasing Managers' Index™ (PMI) surveys through May highlight a dichotomy between resilient services and struggling manufacturing sectors, reflected in output, new business and prices.

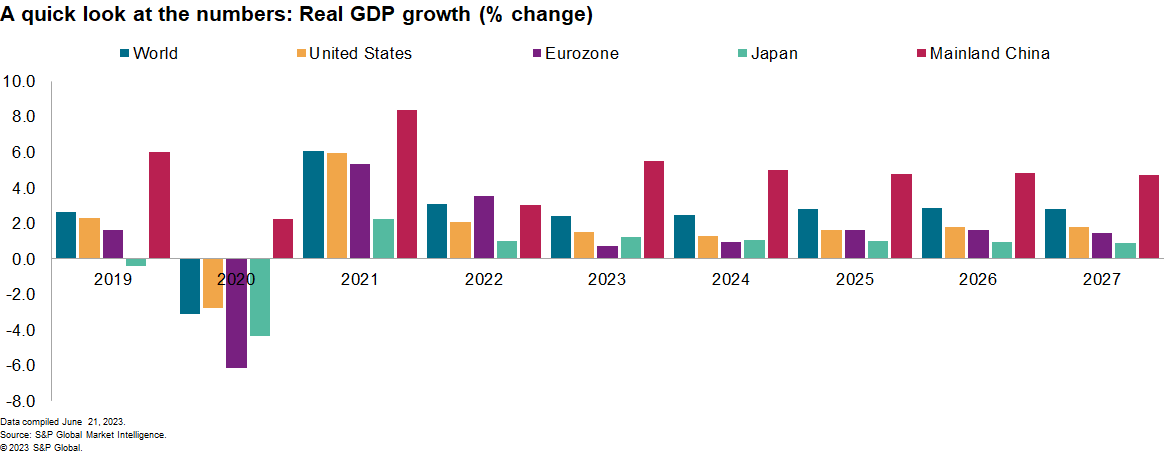

With financial conditions tightening, global growth likely slowed in the second quarter and will remain below potential through mid-2024. Rising interest rates and restricted access to credit will limit growth in business investment and discretionary consumer spending. Meanwhile, the post-pandemic surge in services activity will fade. After a 3.1% advance in 2022, the S&P Global Market Intelligence forecast calls for global real GDP of 2.4% in 2023, 2.5% in 2024 and 2.8% in 2025.

Policy interest rates are nearing their peaks, but the inflation fight is not finished.

With core inflation unacceptably high, the US Federal Reserve and European Central Bank are expected to raise policy rates by 25 basis points in July, and the Bank of England will follow suit in August. Meanwhile, a tightening of bank lending standards will also contribute to more restrictive financial conditions in the months ahead. For countries with heavy debt burdens, the rise in interest rates will cause fiscal strains. In most regions of the world, monetary easing will begin in 2024 after more tangible progress in reducing inflation.

Price inflation is moderating but wage pressures persist.

Global consumer price inflation has slowed from a high of 8.3% year over year in September 2022 to 5.3% in May 2023. Industrial materials prices have retreated in response to improving supply and logistics conditions, high interest rates and weak demand for goods. Food price inflation is beginning to ease as crop production increases. Services price inflation is more persistent, however, owing to labor shortages, pent-up demand and capacity reductions during the pandemic. Thus, further progress in reducing inflation will partly depend on a rise in unemployment (mainly in North America and Western Europe) in the year ahead. As wage pressures diminish, global consumer price inflation is projected to slow from 7.6% in 2022 to 5.6% this year and 3.6% in 2024.

The US economy will travel a slow growth path, avoiding recession.

In early June, President Biden signed legislation suspending the federal debt ceiling through 2024 and restraining government spending through 2025. With a debt crisis averted, this month's forecast of real GDP growth is raised by 0.3 percentage point to 1.5% in 2023 and by 0.4 percentage point to 1.3% in 2024. Recent data on consumer spending and construction have shown more momentum than previously anticipated in the second quarter. A resurgence in homebuilding in May points to a stabilization in housing markets after over a year of sharp declines. One cautionary note is another decline in real domestic income in the first quarter, suggesting a weaker US economy than implied by expenditure data. A key risk is a sharp deterioration in the quality of commercial real estate loans that leads to a further tightening of credit and reduced investment in nonresidential structures.

High inflation and tightening monetary policies subdue eurozone growth.

Eurozone real GDP decreased 0.1% (0.4% annualized) quarter over quarter in both the fourth quarter of 2022 and the first quarter of 2023. Germany's economy fell into recession, while Italy, Spain and France posted moderate growth. First-quarter declines in eurozone consumer spending and inventory investment were partially offset by gains in net exports and fixed investment, which benefited from new projects financed by the EU Recovery and Resilience Facility. While economic growth will resume in the second quarter, tightening credit conditions will restrain consumer and business spending. Eurozone real GDP growth is projected to slow from 3.5% in 2022 to 0.7% in 2023. As inflation and interest rates retreat, growth will slowly improve to 1.0% in 2024 and 1.6% in 2025.

After an initial post-COVID-19 rebound, mainland China's growth is slowing.

Industrial production increased just 3.5% year over year in May — a reflection of weak domestic and foreign demand. Household and business sentiment is low, leading to cautious spending patterns. As in other regions, growth is led by services consumption. While fixed asset investment by state-owned firms increased 8.4% year over year in January-May, investment by private enterprises stagnated. The recovery in housing markets is uneven: despite an upturn in sales, housing starts fell 22.7% year over year in the first five months of 2023. Mainland China's real GDP growth is projected to slow from 5.5% in 2023 to 5.0% next year and 4.8% in 2025. This forecast is marked down 0.3 percentage point in 2024 and 0.2 percentage point in 2025.

Bottom line

The global economic expansion will proceed at a moderate pace. Economic performance will vary across sectors and regions, with Europe and the Americas experiencing sluggish growth and parts of Asia-Pacific and Africa achieving healthy expansions. With commodity prices well below peaks and supply conditions improving, inflation will diminish, allowing monetary policies to ease in 2024-25.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-growing-moderate-pace-inflation-subside.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-growing-moderate-pace-inflation-subside.html&text=With+the+global+economy+growing+at+a+moderate+pace%2c+inflation+will+gradually+subside+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-growing-moderate-pace-inflation-subside.html","enabled":true},{"name":"email","url":"?subject=With the global economy growing at a moderate pace, inflation will gradually subside | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-growing-moderate-pace-inflation-subside.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=With+the+global+economy+growing+at+a+moderate+pace%2c+inflation+will+gradually+subside+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economy-growing-moderate-pace-inflation-subside.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}