Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2023

Global factory output buoyed by healing supply chains, but demand for goods continues to fall

The JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™) compiled by S&P Global, registered 49.6 in May, unchanged for a third successive month and indicating a marginal deterioration of business conditions. Conditions have now worsened for nine straight months.

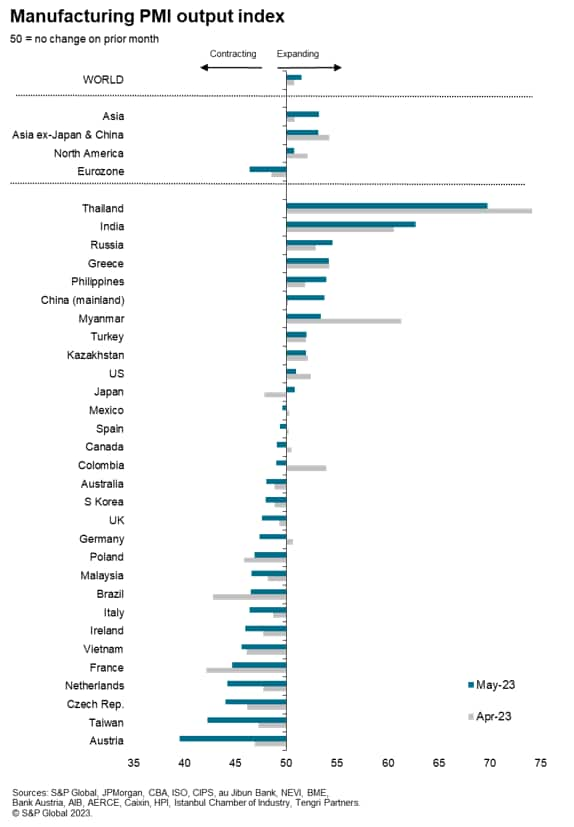

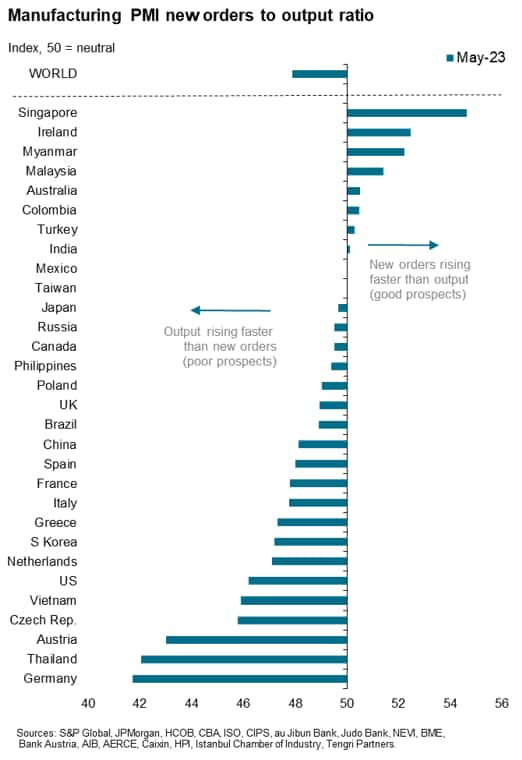

While there was some brighter news on the production front, with output rising for a fourth month in a row, the production gains were again driven by improved supply (enabling the fulfilment of orders placed in prior months) rather than any new inflows of orders. Moreover, of the 30 economies for which PMI data are so far available, only 11 reported higher production in May. Some 20 economies meanwhile saw new orders growth fall behind production growth, a development which hints at weakness ahead. As such, the manufacturing sector's prospects look subdued for the near-term, an outlook which was supported by producers themselves becoming less optimistic about the year-ahead.

Global factories boost output for fourth straight month, but growth remains subdued

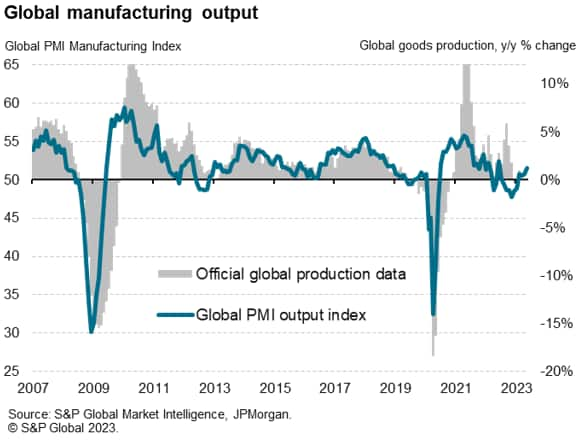

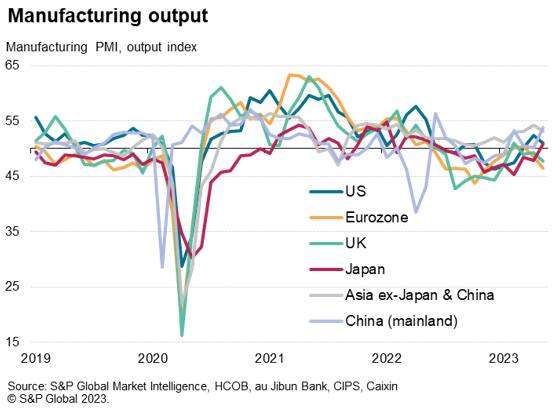

Global manufacturing output rose for a fourth successive month in May, according to the latest PMI surveys compiled by S&P Global, growing at the fastest rate since June last year. However, although the recent readings are a welcome improvement on the steep production declines signalled late last year, at 51.5 the output index from the JPMorgan Global Manufacturing PMI remained only modestly above the 50.0 threshold which separates contraction from expansion, consistent with global production growing by only around 1% year-on-year.

Supply improves, but demand continues to weaken

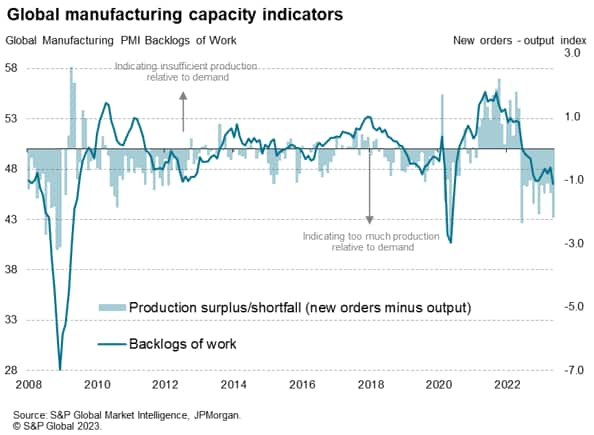

Furthermore, there are worrying signs in terms of demand conditions, which suggest the current global expansion could lose momentum. Most notably, new order inflows into manufacturers fell for an eleventh consecutive month in May. The index measuring production has consequently now exceeded that for new orders for 12 successive months, in a reversal of the output-new orders divergence seen in the prior 15 months.

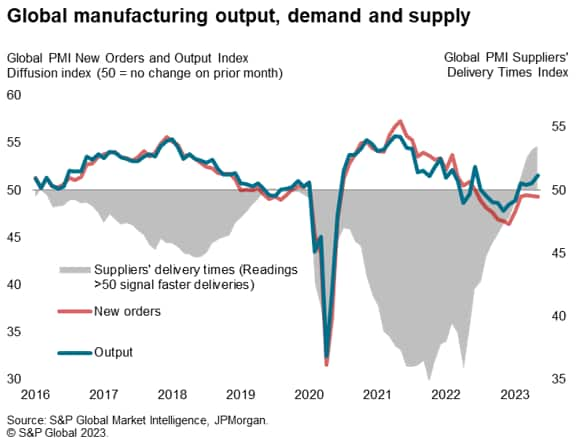

This excess of production relative to new order inflows has been possible due to manufacturers eating into backlogs of work placed in prior months - in many cases during the height of the pandemic. In 2021-22, backlogs of work accumulated at manufacturers to an unprecedented extent, principally because of supply chain delays and shortages of key inputs. These backlogs have now been falling for 11 successive months, with additional production capacity having been facilitated by improving supply chains. Suppliers' delivery times, which lengthened to record degrees at the height of the pandemic, have now been shortening for four straight months, signaling the most marked improvement of global supply chains since 2009.

Dwindling optimism

The data therefore suggest that current growth is being driven principally by improving supply, which has allowed companies to fulfil previously-placed orders. However, a dearth of new orders means the rate of production growth is very subdued, and likely to deteriorate in coming months unless sales improve. Manufacturers are less optimistic about any such improvement, with worldwide business expectations about the year ahead sliding in May to their lowest for five months.

Asia leads upturn, Eurozone lags

Of the 30 economies for which manufacturing PMI data are so far available (Indonesia is published with a delay due to holidays), only 11 reported higher production in May, led by Thailand and India. Notably, output growth in mainland China accelerated to an 11-month high, and production returned to growth in Japan for the first time in 11 months. Russian output growth also notably accelerated amid increasing import substitution.

The steepest decline was meanwhile seen in Austria, followed by Taiwan, the Czech Republic, the Netherlands and France. Output contracted across the Eurozone as a whole at the steepest rate for six months, making it the worst performer of the world's major markets.

While the US eked out growth, the rise was only modest and weaker than April. Production in Canada and Mexico slipped back into decline. The UK meanwhile saw the steepest output drop for four months.

Future prospects

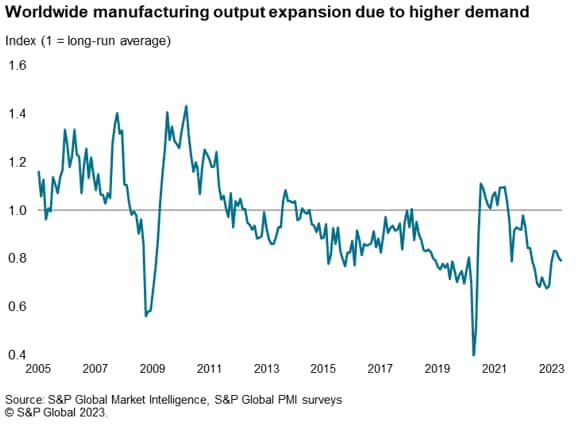

We can use the divergence between new orders and output growth to get some insight into likely near-term production tendencies. In our chart we use the new orders index divided by the output index, then multiplied by 50 to demonstrate the data as a PMI-equivalent "diffusion index".

The biggest drags are seen for Germany, Thailand and Austria, for example, where production is currently exceeding order book growth to the greatest extents. At the other end of the scale, prospects are brightest for Singapore, Ireland and Myanmar, where new orders indices are exceeding their output counterparts to the greatest extents. In fact only 10 of the 30 economies covered by the May PMI release have new orders indices running higher than their output indices, adding to the gloomy global prospects for the coming months.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-buoyed-by-healing-supply-chains-but-demand-for-goods-continues-to-fall-June2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-buoyed-by-healing-supply-chains-but-demand-for-goods-continues-to-fall-June2023.html&text=Global+factory+output+buoyed+by+healing+supply+chains%2c+but+demand+for+goods+continues+to+fall+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-buoyed-by-healing-supply-chains-but-demand-for-goods-continues-to-fall-June2023.html","enabled":true},{"name":"email","url":"?subject=Global factory output buoyed by healing supply chains, but demand for goods continues to fall | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-buoyed-by-healing-supply-chains-but-demand-for-goods-continues-to-fall-June2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+factory+output+buoyed+by+healing+supply+chains%2c+but+demand+for+goods+continues+to+fall+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-factory-output-buoyed-by-healing-supply-chains-but-demand-for-goods-continues-to-fall-June2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}