Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 16, 2023

Global inflation and growth: what to watch for in the upcoming August PMI surveys

The global economy continued to lose growth momentum at the start of the second half of 2023, underpinned by waning of service sector growth momentum and a deepening manufacturing downturn. Whether this continues in August and to what extent if so, will be eagerly watched with the upcoming flash PMI releases for major developed economies on August 23rd, followed by worldwide PMI figures at the start of September.

Furthermore, global inflation has shown signs of 'stickiness' in July, driven by higher service sector prices. To understand if elevated inflation will sustain for longer, we will be tracking the price indices with upcoming PMI releases, especially given how monetary policy trajectories vary around the world with inflation trends.

We recap the key messages from July's PMI and highlight key themes to watch with the upcoming releases here.

July PMI indicate slowing global growth momentum

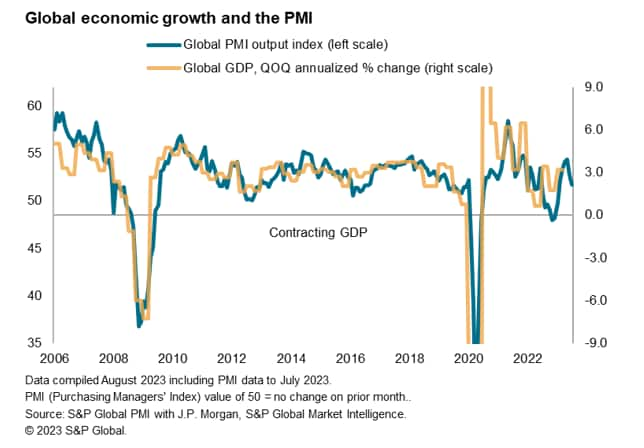

The global economy expanded at the slowest pace in six months according to the Global PMI data - compiled by S&P Global across over 40 economies and sponsored by JPMorgan. At 51.7 in July, the headline PMI, covering manufacturing and services, takes the PMI further below the survey's long-run average. Furthermore, it is broadly consistent with annualized quarterly global GDP growth of around 2% at the start of the third quarter, which is likewise lower than the 2.9% long-run average.

Services rebound further losing steam?

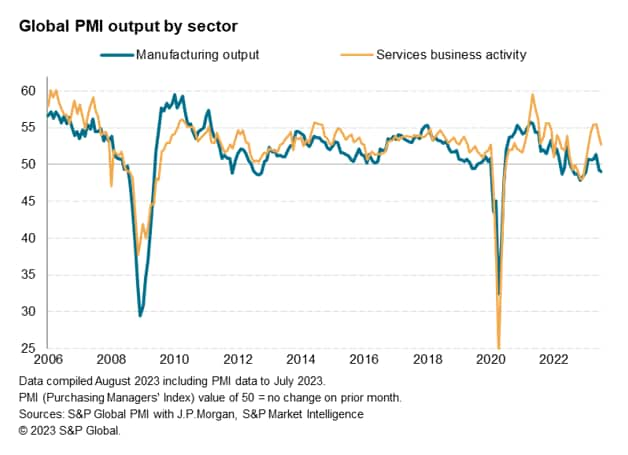

Service sector expansion, which primarily supported growth into 2023, slowed further in July to the weakest since February. The travel and leisure boom that had previously boosted demand for services further dissipated into the start of the second half of 2023. That said, with the first summer season since the easing of worldwide travel restrictions continuing into the busy August period, it will be of interest to observe how the sector will trend with upcoming releases.

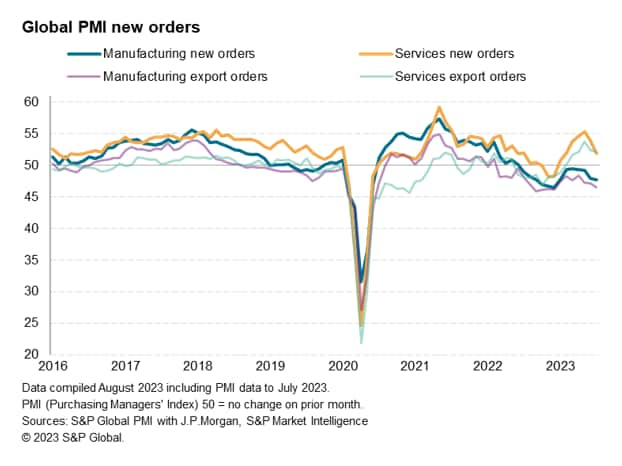

Manufacturing sector's destocking problem

Meanwhile the manufacturing malaise continued in July with production contracting at an even sharper rate compared to June. While modest overall, any contraction of global production is nevertheless a rare occurrence and a continuation of which may garner further concerns. As it is, the new orders for goods continued to fall globally in July, hinting at the likelihood of production falling at an increased rate in August. A key reason for this has been the sustained unwinding of inventory that had previously accumulated among manufacturers in the immediate aftermath of the pandemic and we are still watching for clear signs of a turnaround with this ongoing destocking trend.

Global inflation pressures persist?

Another key focus with the August PMI releases will be developments on the inflation front. July's PMI surveys showed global inflationary pressures ticking higher on rising staff costs.

The global PMI survey's selling price index, covering prices charged for both goods and services in all major developed and emerging markets, registered 53.6 in July. Although this was down almost ten points from the survey record of 63.5 in April 2022, indicating that we will continue to see global inflationary pressures decline, it was nevertheless higher than in June and consistent with a global inflation rate of around 4%, thus signalling sticky inflationary pressures going into the start of the third quarter.

We are cautious not to read too much into one data point, and therefore August data will be important in providing a clearer direction on where the price indices are headed. So far, the stickiness in inflation have stemmed primarily from the service sector with higher services selling prices contrasted by falling average prices charged for goods, even though the rate of decline slowed in July. The impact from higher interest rates have had a relatively reduced effect for services inflation compared to goods and whether this continues to be so will be watched with upcoming figures.

Inflation trends will be central to informing us on the likely monetary policy trajectories for major central banks around the world with uncertainties still lingering over the course of action by policymakers such as in the US and UK given still-elevated inflation.

Mixed growth performance across developed economies

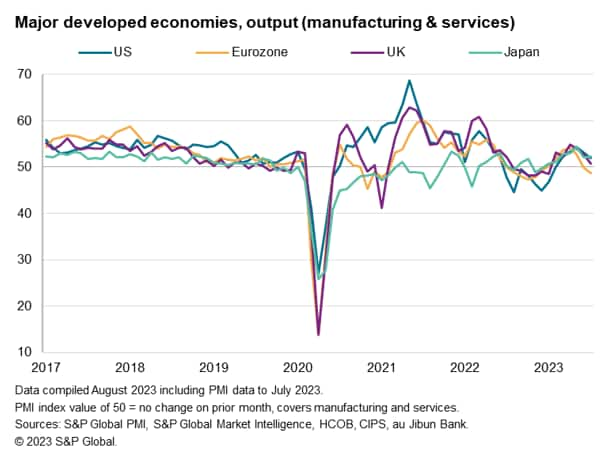

Despite higher interest rates continuing to run its course for the global economy, concerns over recession have so far remained subdued. This was even as recent PMI readings revealed falling growth momentum across various major developed economies with the eurozone notably sliding deeper into contraction territory.

Whether the eurozone remains the only one of the G4 economies to post a sub-50.0 reading for the composite PMI, or if the UK with near-stalling output growth will join their counterparts in the euro area in the contraction territory, or even Japan that had showed resilience in July with slightly higher output growth may converge with the rest of the G4 economies, will all be watched with the upcoming flash PMI due August 23rd.

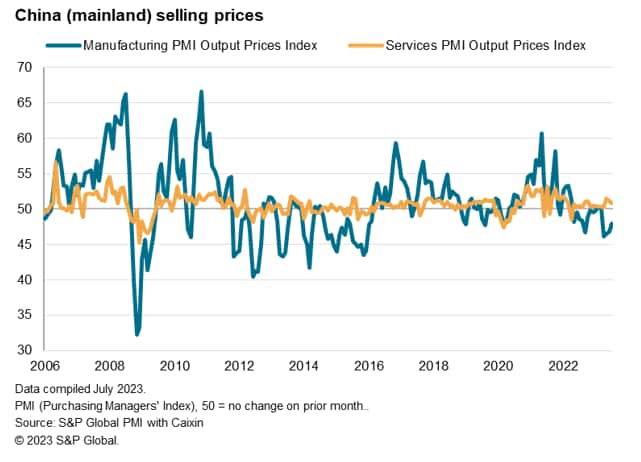

Mainland China's divergent growth and price trends

Finally, PMI survey data from S&P Global and Caixin showed the mainland Chinese economy losing growth momentum at the start of the third quarter. A renewed manufacturing downturn was accompanied by relatively subdued service sector growth compared to earlier in the year. As a result, the headline Caixin PMI, compiled by S&P Global, signalled a cooling in the rate of output growth for a second successive month at the start of the third quarter, registering the weakest expansion since January. This was also consistent with an annualized quarterly rate of just 3.2%, down from 8.8% at the start of the year.

Deteriorating output and demand conditions have led to prices remaining subdued in mainland China at the start of the second half of 2023. Further discounting by manufacturers to drive sales coupled with slowing of price hikes by service providers in mainland China have led to overall selling prices for goods and services to fall for a fourth month in a row. Given the importance of mainland China's expansion for the Asia-Pacific region, August's data will be scrutinized for the latest updates. As it is, some uptick in inflation from supply chains had been signalled by July's data, though pressures remain muted by historical standards.

Worldwide manufacturing and services PMI, including Caixin China PMIs, will be due September 1 and September 5 respectively. Refer to our release calendar here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-what-to-watch-for-in-the-upcoming-august-pmi-surveys-august2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-what-to-watch-for-in-the-upcoming-august-pmi-surveys-august2023.html&text=Global+inflation+and+growth%3a+what+to+watch+for+in+the+upcoming+August+PMI+surveys+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-what-to-watch-for-in-the-upcoming-august-pmi-surveys-august2023.html","enabled":true},{"name":"email","url":"?subject=Global inflation and growth: what to watch for in the upcoming August PMI surveys | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-what-to-watch-for-in-the-upcoming-august-pmi-surveys-august2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+inflation+and+growth%3a+what+to+watch+for+in+the+upcoming+August+PMI+surveys+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-inflation-and-growth-what-to-watch-for-in-the-upcoming-august-pmi-surveys-august2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}