Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 04, 2023

Global manufacturing labour market cools amid shift to cost-cutting

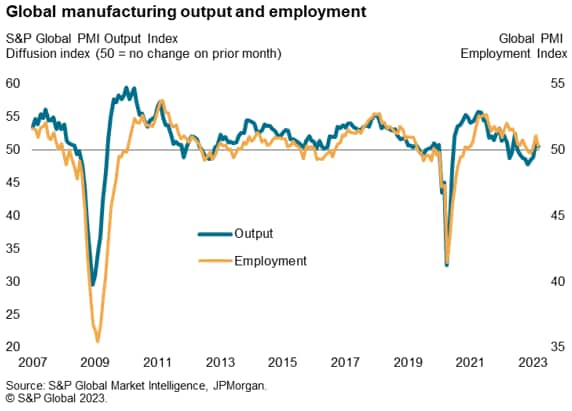

Global manufacturing employment barely rose in March, according to the latest PMI surveys compiled by S&P Global, the rate of job creation moderating from February's eight-month high. The sluggish payroll expansion reflects a similar near-stalling of production growth during the month, but also reflects a growing trend towards cost cutting and fewer concerns over staff shortages, all of which is helping to alleviate upward pressure on inflation from staff costs.

Factory employment close to stalled

Worldwide factory jobs growth ground almost to a halt in March, with the JPMorgan Global PMI's Employment Index barely above 50 and down from an eight-month high in February. The broadly flat employment picture is commensurate with a similar disappointing production trend in recent months, with both February and March having seen only marginal output gains linked in turn to a further decline in new order inflows.

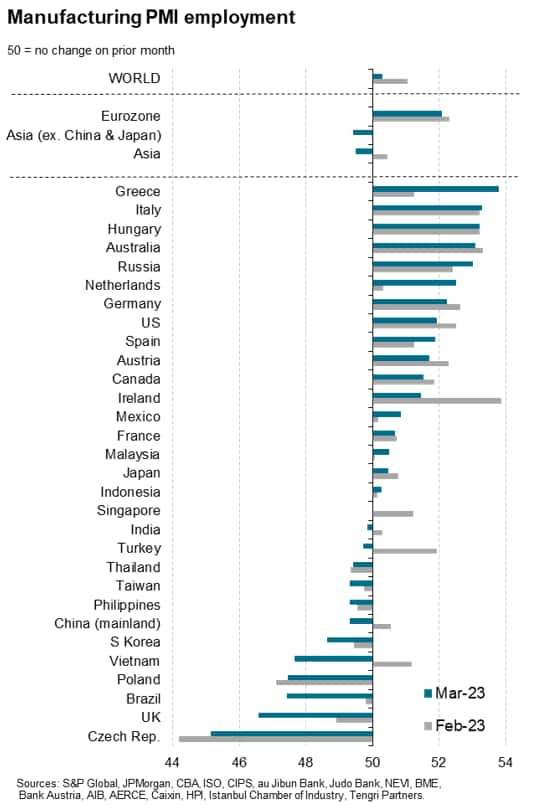

There was a broad spectrum of job market changes around the world. Higher employment was recorded in 17 of the economies for which S&P Global compiles PMI surveys (led by Greece and Italy), with employment falling in 12 (led by the Czech Republic and UK), and running unchanged in one (Singapore).

Notably, only 8 of the 30 economies covered by the surveys saw employment growth accelerate in March.

Staff shortages back to normal

A key change in the job market in recent months has been a turnaround in the number of staff shortages reported, which has curbed the need to hire extra workers. While a lack of available staff severely constrained production during much of the pandemic, the incidence of employment-driven production constraints has moderated significantly to a degree which is now broadly in line with the survey's long-run average. In other words, the impact of staff shortages on global production is now roughly normal, which means there is less need for firms to seek new, additional staff.

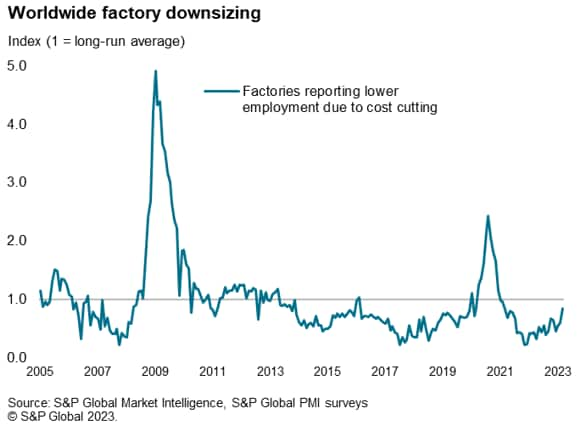

Job losses amid cost cutting

Furthermore, looking at the reasons provided by manufacturers for changes in their business metrics in the PMI surveys, it is also evident that recent months have seen a marked increase in the number of companies reporting that employment is being reduced due to pressure to cut costs. The incidence of cost-cutting fueled job losses has in fact risen close to its long-run average in March, up to its highest in two years.

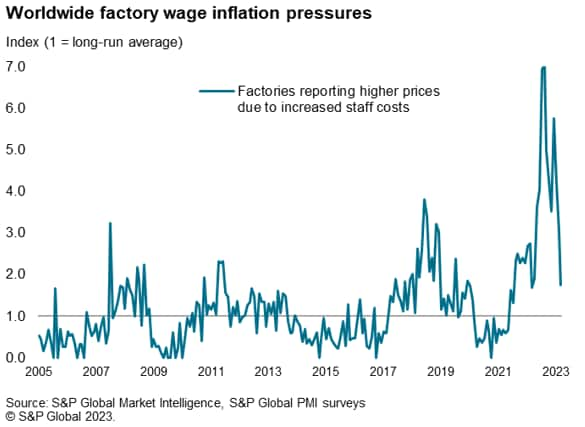

Reduced wage pressures

With staff shortages having a diminished impact on manufacturing production capacity, and firms increasingly moving to cost-driven job shedding, it is no surprise to see a concomitant easing of wage pressures. Measured globally, the number of companies reporting that higher staff costs exerted upward pressure on their overall production costs fell to the lowest in the past 20 months.

Whereas staff costs were exerting upward pressure on input costs to a degree of eight times the long run average back in mid-2022, this has now fallen to less than twice the long run average. This is of course good news for the global inflation outlook, as it hints at limited second-round inflation effects from the labour market, at least in the manufacturing sector.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-labour-market-cools-amid-shift-to-costcutting-April2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-labour-market-cools-amid-shift-to-costcutting-April2023.html&text=Global+manufacturing+labour+market+cools+amid+shift+to+cost-cutting+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-labour-market-cools-amid-shift-to-costcutting-April2023.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing labour market cools amid shift to cost-cutting | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-labour-market-cools-amid-shift-to-costcutting-April2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+labour+market+cools+amid+shift+to+cost-cutting+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-labour-market-cools-amid-shift-to-costcutting-April2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}