Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 04, 2022

Global manufacturing PMI falls into contraction territory for first time since 2020 lockdowns

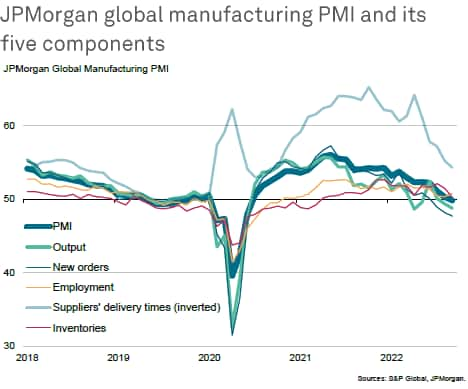

Global business conditions worsened in the manufacturing sector in September, with the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™), compiled by S&P Global, dropping below the neutral level of 50.0 for the first time since June 2020. The headline index dropped from 50.3 in August to 49.8 in September.

The survey's sub-indices, explored further in this paper, point to the production trend deteriorating in the coming months amid an intensifying downturn in global trade flows, subdued demand linked to the ongoing cost-of-living crisis and growing economic uncertainty about the outlook. One positive came from an easing of supply chain delays, though these in turn were largely the result of cooling demand.

Global factories set for steepening downturn

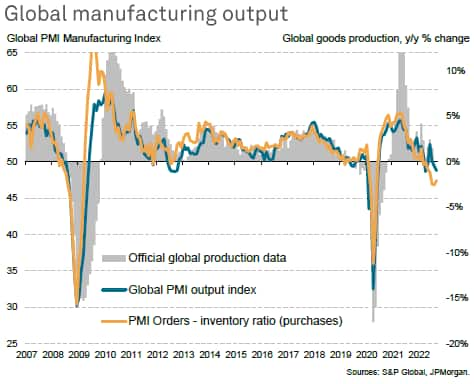

The global manufacturing PMI survey's Output Index, which acts as a reliable advance indicator of actual worldwide output trends, signalled a second-successive monthly drop in worldwide factory production in September. The rate of decline accelerated to the fastest since April, when lockdowns in mainland China had disrupted global production growth. Barring pandemic related shutdown months, the latest decline was the steepest recorded since the euro area debt crisis of 2012.

Other survey indices, notably the new-orders-to-inventory ratio, have been signalling a worsening of the production trend in recent months, and remained worryingly low - amongst the lowest in the survey history barring times of extreme stress - in September.

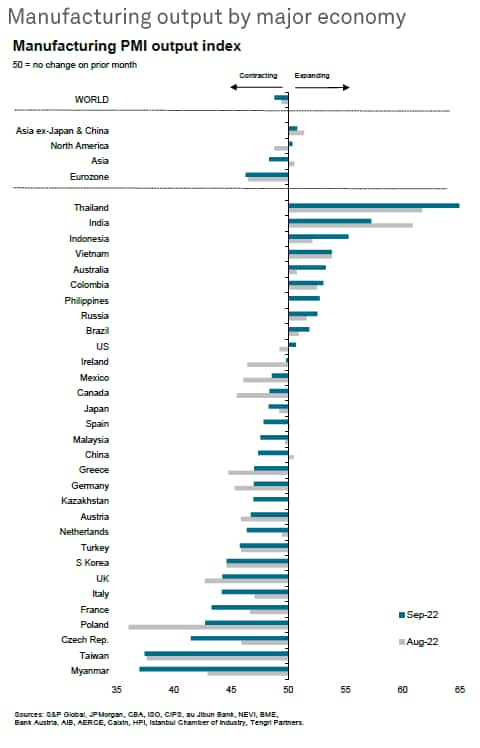

Downturns seen in 21 out of 31 economies

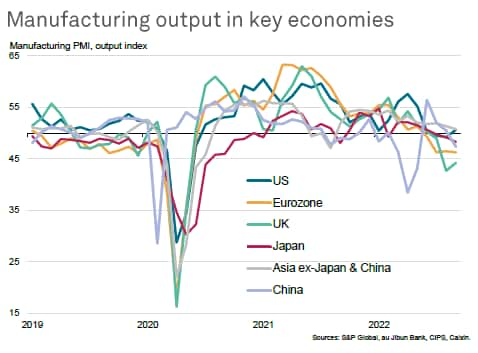

Of the 31 economies for which S&P Global PMI data are available for September, some 21 reported falling production. Myanmar and Taiwan are seeing the steepest downturns, followed by the Czech Republic and Poland, the latter two suffering from their proximity to the war in Ukraine and soaring energy costs. The eurozone and UK are likewise seeing above average downturns, also linked to Europe's energy crisis.

Similarly, production remained under pressure across North America, largely linked to the cost of living crisis.

At the same time, ongoing COVID-19 containment measures continued to contribute to further manufacturing weakness in mainland China, in turn acting as major drag on global growth.

While US producers reported a marginal return to growth, driven in part by moderating supply chain constraints and signs of weakening industrial price pressures, evidence of any substantial growth in production was largely confined to APAC, led by advances in Thailand, India, Indonesia and Vietnam.

Global trade downturn deepens

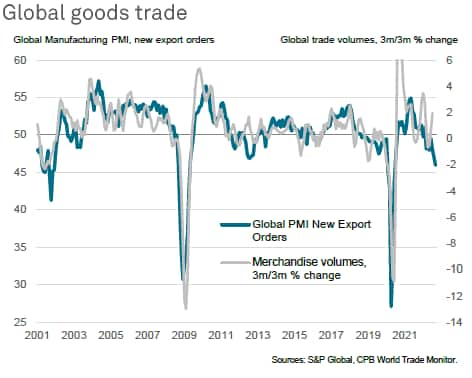

The deteriorating demand picture continued to be driven by a slump in global trade. The global PMI's new export orders index, which provides an accurate advance guide to official trade statistics, fell further into negative territory in September.

The survey has now indicated falling worldwide goods exports for seventh straight months, with the rate of decline gathering pace in September to the fastest since the initial pandemic lockdowns of early-2020 and, prior to that, the global financial crisis (albeit with the rate of deterioration remaining far off the peaks seen in 2020 or 2008-9).

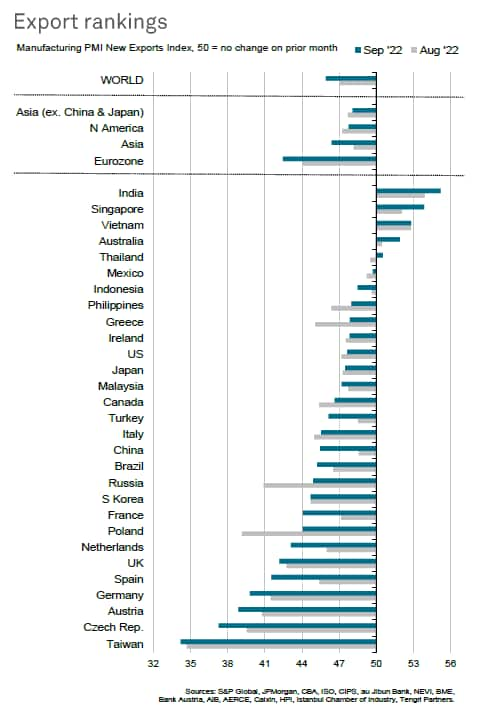

Export growth was limited to India, Singapore, Vietnam, Australia and Thailand, though trends varied markedly even with APAC, with Taiwan recording the steepest export losses again in September. However, besides, Taiwan, the worst export trends were generally seen in Europe, reflecting the detrimental impact from the Ukraine war and cost of living crisis.

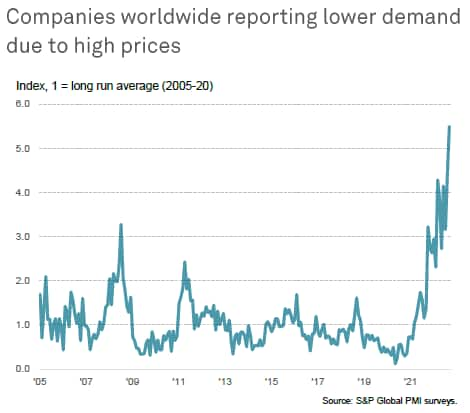

Demand destruction from high prices

The adverse impact of the cost of living crisis was reflected in a sharp rise in the number of manufacturers worldwide reporting that orders had fallen directly as a result of higher prices during September. The incidence of such price-driven order book losses is now running at 5.5 times the long-run average, the highest reading since the series began in Jan 2005.

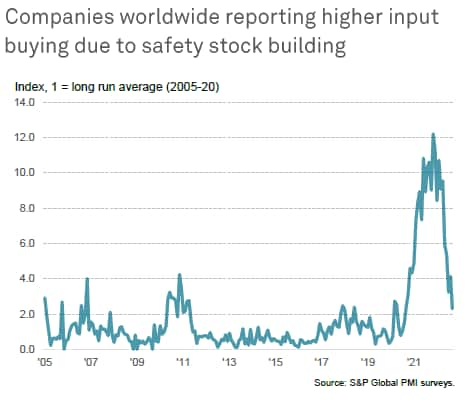

The slowdown in global demand and production has also led to an alleviation of supply constraints, as indicated by the incidence of supply chain delays easing to the lowest for two years in September. This in turn is causing a shift in inventory management. In particular, the number of manufacturers worldwide reporting that input buying has risen due to concerns over the need to build safety stocks of items in short supply has fallen sharply, down from a peak of over 12 times the long-run average in late-2021 to just over two times the long run average in September.

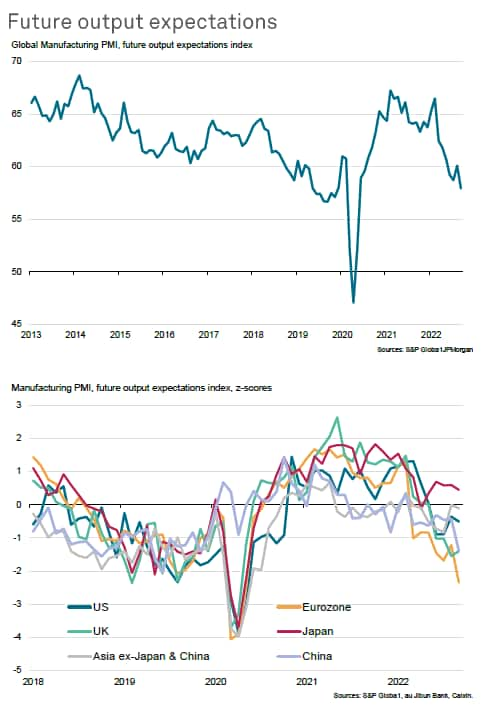

Future output expectations

This combination of cooling final demand and reduced inventory building is in turn leading to a deteriorating production outlook, which manifested itself in September by a sharp drop in future output expectations among global manufacturers. This gauge of business optimism is now running at the lowest since May 2020, and is especially weak in terms of its comparison to long-run trends in the Eurozone, the UK and mainland China.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-falls-into-contraction-territory-for-first-time-since-2020-lockdowns-Oct22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-falls-into-contraction-territory-for-first-time-since-2020-lockdowns-Oct22.html&text=Global+manufacturing+PMI+falls+into+contraction+territory+for+first+time+since+2020+lockdowns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-falls-into-contraction-territory-for-first-time-since-2020-lockdowns-Oct22.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI falls into contraction territory for first time since 2020 lockdowns | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-falls-into-contraction-territory-for-first-time-since-2020-lockdowns-Oct22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+falls+into+contraction+territory+for+first+time+since+2020+lockdowns+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-falls-into-contraction-territory-for-first-time-since-2020-lockdowns-Oct22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}