Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 10, 2021

Global PMI at 11-year high as services take the lead, sets scene for strong Q2

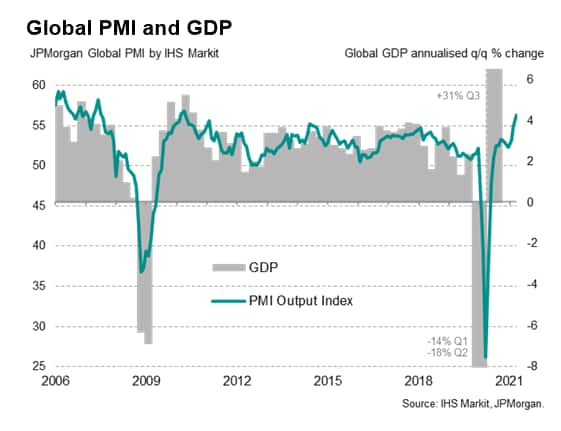

Global economic growth accelerated sharply in April to reach an 11-year high, according to the latest PMI surveys, and further robust growth looks likely in the coming months as more economies open up from covid lockdowns.

At 56.3, up from 54.8 in March, the JPMorgan Global PMI™ (compiled by IHS Markit) struck its highest since April 2010, and not far off the highest for 14 years. The latest expansion took the recent run of growth into its tenth month as many economies around the world continued to recover from COVID-19 downturns.

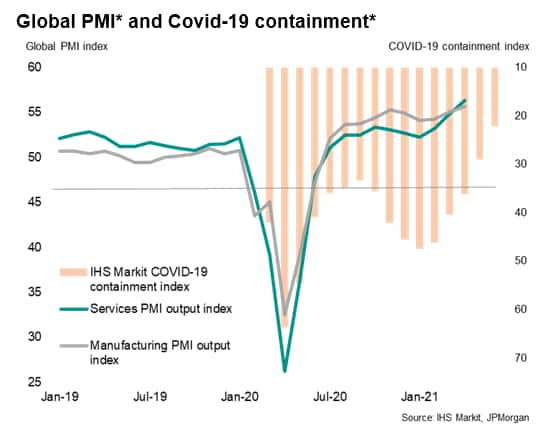

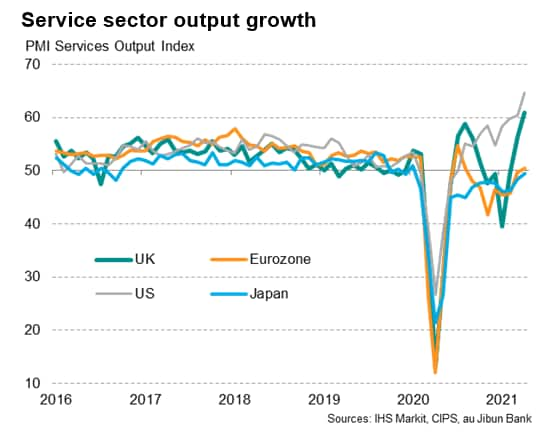

The progress of the recovery from the virus was underscored by the global service sector reporting faster growth than manufacturing for the first time since the pandemic began, achieving its strongest upturn in business activity since July 2007.

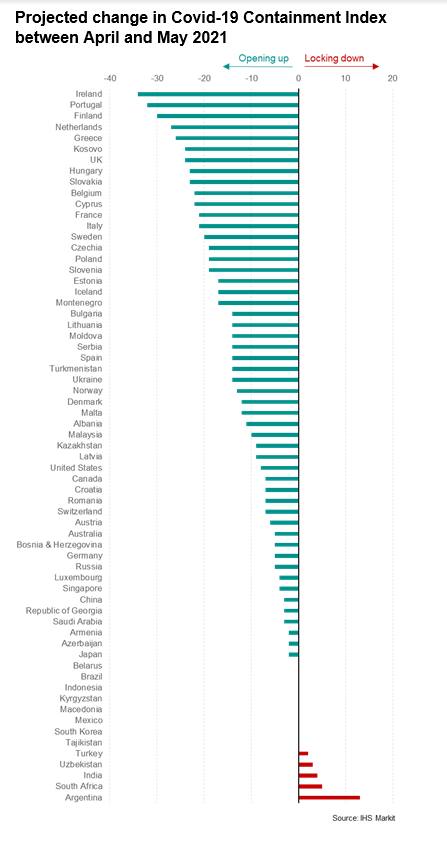

The outperformance of the service sector, which has lagged the manufacturing sector's revival due to strict controls on social distancing and travel, coincided with COVID-related restrictions easing globally to the lowest since last October. IHS Markit's Global COVID-19 Containment Index fell from 40 in March to 36 in April, its lowest since last October, as restrictions were eased on average around the world for a third successive month.

Manufacturing meanwhile saw growth accelerate to the fastest since February 2011 despite near record supply delays and shortages of inputs.

* IHS Markit's COVID-19 Containment Index is based on a basket of measures applied by governments to control the spread of the pandemic, such as non-essential business closures, school closures and travel and mobility restrictions linked to social distancing policies. As these measures are tightened, the index rises towards 100 and a relaxation of measures causes the index to fall towards zero.

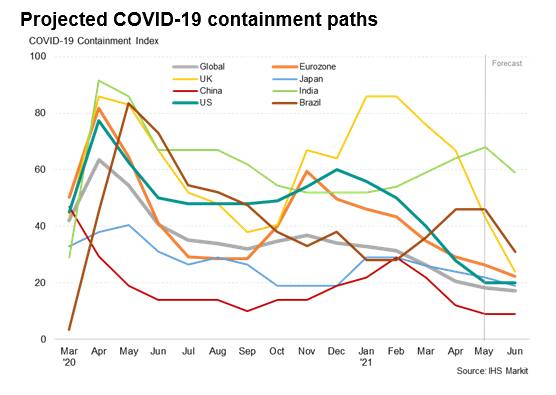

Encouragingly, the COVID-19 Containment Index is set to fall further to 29 in May and 22 in June, according to official government roadmaps, as efforts to fight the pandemic allow the further reopening of economies, albeit with some exceptions, notably India and Brazil.

The easing of containment measures should facilitate faster economic growth in many economies, especially those such as the eurozone, where vaccine progress has picked up markedly in recent weeks and service sector growth in particular has been relatively subdued.

Of the 65 economies covered by IHS Markit's COVID-19 Containment Index, the biggest lockdown easings in May are scheduled for European countries. Ranked by the change in the Containment Index between April and May, the 31 countries seeing the biggest lockdown easings are all located in Europe (including eastern Europe).

The recent progress of vaccine rollouts and the rise in the PMI in April therefore support our view that global real GDP will reach a new peak in the second quarter of 2021.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-11year-high-as-services-take-the-lead-sets-scene-for-strong-q2-may21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-11year-high-as-services-take-the-lead-sets-scene-for-strong-q2-may21.html&text=Global+PMI+at+11-year+high+as+services+take+the+lead%2c+sets+scene+for+strong+Q2+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-11year-high-as-services-take-the-lead-sets-scene-for-strong-q2-may21.html","enabled":true},{"name":"email","url":"?subject=Global PMI at 11-year high as services take the lead, sets scene for strong Q2 | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-11year-high-as-services-take-the-lead-sets-scene-for-strong-q2-may21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+at+11-year+high+as+services+take+the+lead%2c+sets+scene+for+strong+Q2+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-at-11year-high-as-services-take-the-lead-sets-scene-for-strong-q2-may21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}