Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 05, 2023

Global PMI data hint at higher goods prices offsetting cooler service sector inflation

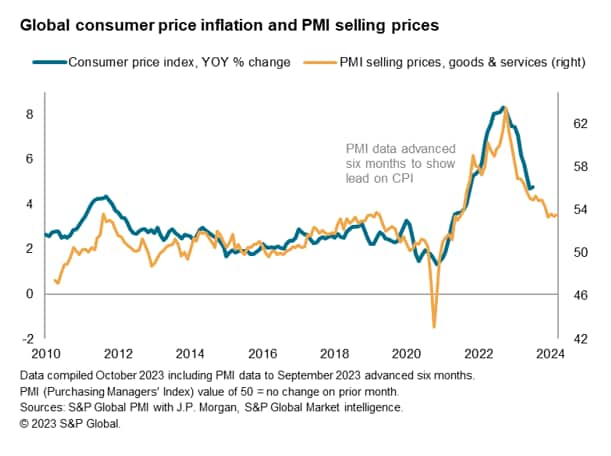

The Global PMI data - compiled by S&P Global across over 40 economies and sponsored by JPMorgan - showed the rate of inflation of average prices charged for goods and services ticking higher in September and therefore continuing to rise at an elevated rate by historical standards.

Although some cooling in service sector inflation was again evident, linked to waning demand, manufacturing prices are now rising again, in part due to higher oil prices and persistent wage growth.

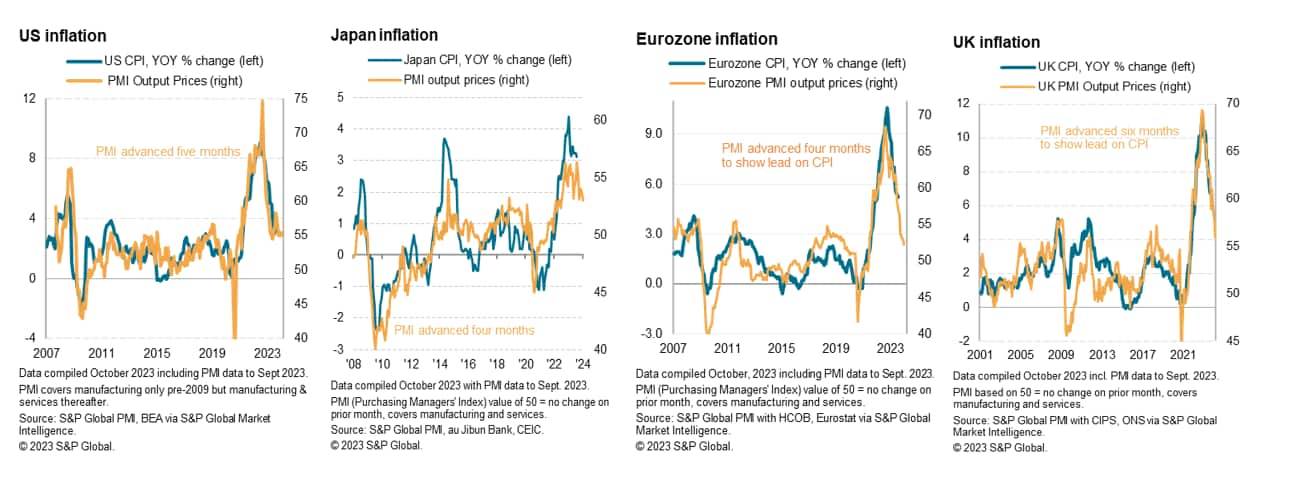

The overall picture is therefore one of inflation stickiness in the months ahead, as the PMI data tend to move ahead of consumer price inflation by several months. Such stubbornness of inflation is most evident in the UK and the US, with the eurozone seeing price pressures cool especially sharply. Fears over deflation in mainland China meanwhile seem to have bene overplayed, with prices now rising again.

Global prices rise at increased rate

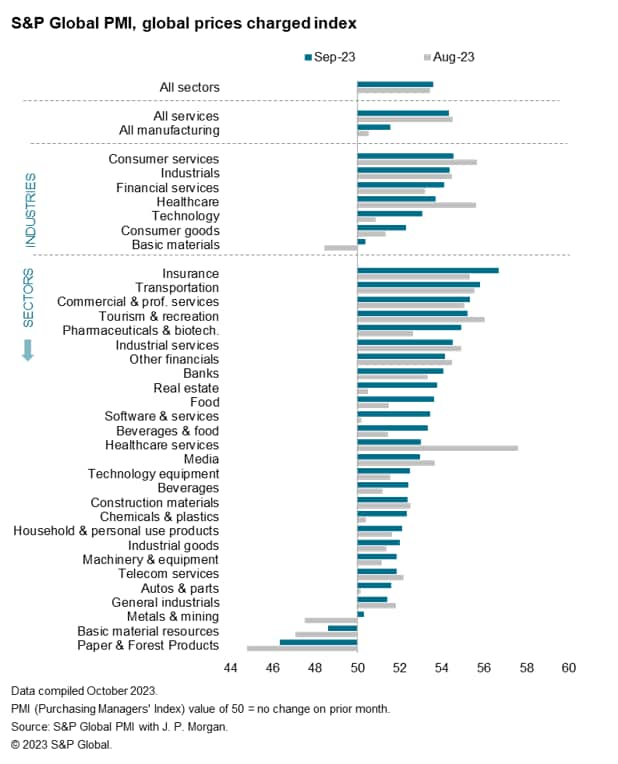

The global PMI selling price index - compiled by S&P Global and covering prices charged for both goods and services in all major developed and emerging markets - ticked higher in September, rising from 53.4 in August to 53.6 in September to signal stubbornly elevated global price pressures. The rate of increase notably remains higher than at any time seen prior to the pandemic since comparable survey data were available in 2009.

Although the leading-indicator properties of the PMI mean that global inflation is signaled to cool further from the 5.8% annual rate estimated from various national sources for July to just below 4% by the turn of the year, the selling prices index has held broadly steady over the past four months to suggest that the rate may fail to cool further in the new year.

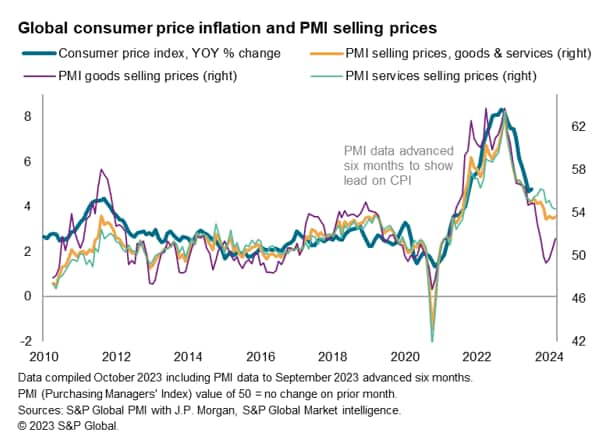

This stubbornly elevated rate of inflation continues to be driven primarily by the service sector, where the selling price index remained high by historical standards in September. The rate of increase nevertheless continued to moderate, slipping to a 31-month low in September to hint at some of the heat having been further taken out of service sector inflation.

While manufacturing prices have acted as major disinflationary force on headline inflation over the past year, with factory prices having even fallen globally between May and July amid improved supply chains and slumping demand, goods prices are now rising again. Although only modest, the rate of increase of prices charged for goods leaving the factory gate has re-accelerated to its highest since April.

Thus, while service sector inflation is showing welcome signs of cooling further at the end of the third quarter, some of the disinflationary force from manufacturing sector is now reversing to offset the better news from the service sector.

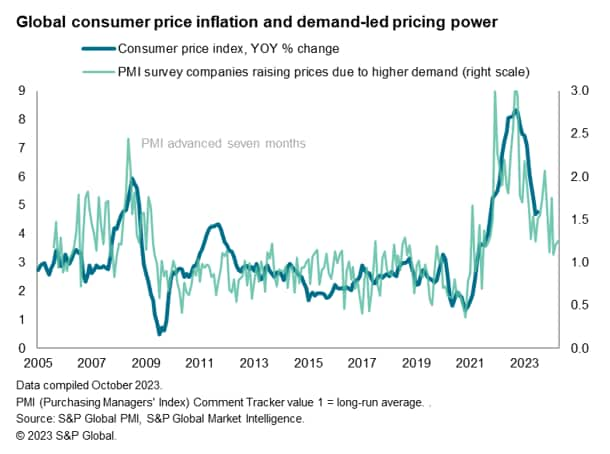

Demand-pull inflation on the wane

As well as seeing sector divergences, September is also witnessing some changes to the dynamics of prices. Most notably, demand is acting as less of a driver of inflation across the board. In fact, the number of companies worldwide reporting that higher demand allowed prices to be raised is now running at one of the lowest levels seen since early 2021. Thus, while demand had led to surging goods prices in 2022 and then reignited services inflation in early 2023, these pressures are now falling back closer to long-run averages.

However, September is now seeing higher price pressures from oil, the increased cost of which is hitting manufacturing and transportation in particular, and is being passed on to customers. Higher wage growth meanwhile continues to be reported across both sectors, acting as an ongoing underlying upward force of inflation.

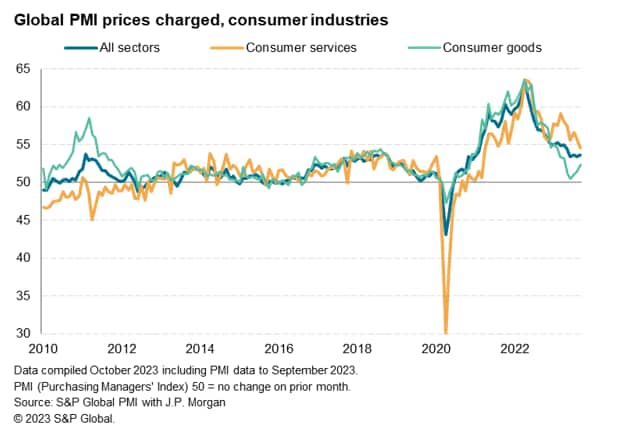

These changing dynamics are especially evident in prices charged for consumer goods and consumer services globally: the cooling of upward pressure in the service sector is clearly being countered by a re-acceleration of price pressures in manufacturing.

The strongest disinflationary forces meanwhile continue to be seen for basic materials, where the running-down of inventories worldwide remains a strong persistent downward force on demand and pricing power. These prices could seen hit a floor, however, once inventories return to more normal levels.

Cooler service sector price growth

Some of the price trend variations around the world are also especially noteworthy.

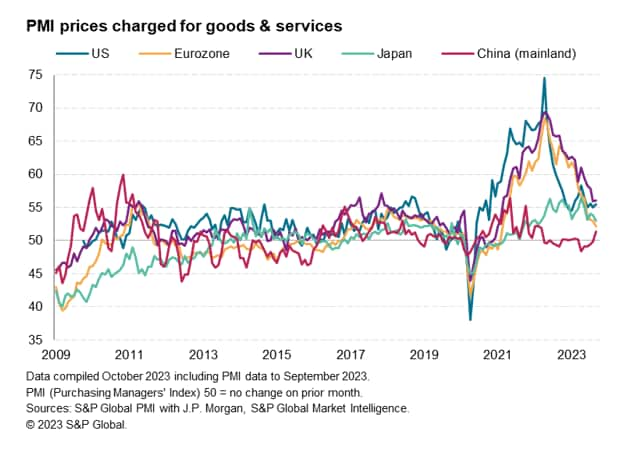

Recent fears over deflation in China seem overplayed, as average prices charged for goods and services in the mainland rose in September at the fastest rate since March 2022, having fallen in each of the past five months.

Price growth meanwhile cooled in the eurozone and Japan, sliding in the former to the lowest since February 2021 (when prices first began rising during the pandemic), and in Japan to the lowest since March 2022.

Price growth meanwhile ticked higher in both the US and UK, though only the US saw increased price pressures in both manufacturing and services.

The indications for headline inflation from the PMI data are therefore for some further near-term stickiness of US inflation around the 3-4% mark (current 3.7%) in the coming months, but for UK and eurozone rates to likely fall further as we head towards the new year, notably in the eurozone, albeit remaining above central bank target in the UK and to a lesser extent in the eurozone. In Japan, inflation looks set to run just under 2% by the early months of the new year.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-hint-at-higher-goods-prices-offsetting-cooler-service-sector-inflation-oct23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-hint-at-higher-goods-prices-offsetting-cooler-service-sector-inflation-oct23.html&text=Global+PMI+data+hint+at+higher+goods+prices+offsetting+cooler+service+sector+inflation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-hint-at-higher-goods-prices-offsetting-cooler-service-sector-inflation-oct23.html","enabled":true},{"name":"email","url":"?subject=Global PMI data hint at higher goods prices offsetting cooler service sector inflation | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-hint-at-higher-goods-prices-offsetting-cooler-service-sector-inflation-oct23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+data+hint+at+higher+goods+prices+offsetting+cooler+service+sector+inflation+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-data-hint-at-higher-goods-prices-offsetting-cooler-service-sector-inflation-oct23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}