Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 05, 2020

Global recession risks

The global economy is experiencing its deepest recession since 1946. We project that world real GDP will decline by 4.8% in 2020, a far worse outcome than the 1.7% contraction in 2009 at the height of the global financial crisis.

As countries remove restrictions on activities, the global economy is recovering. However, new outbreaks of the coronavirus disease 2019 (COVID-19) virus and the likelihood that a vaccine will not be widely available before mid-2021 make any assessment of the economic outlook challenging. Several forces are likely to impede the post-crisis recovery, including the financial stresses of households and businesses, crowd avoidance, eventual withdrawal of fiscal stimulus, and losses in capital formation.

The United States has experienced the highest number of COVID-19 cases. After a deep recession in March and April, a robust recovery began in May. With infection rates remaining high and fiscal support diminishing, economic growth is now slowing. US real GDP is expected to fall by 3.5% in 2020 and to recover by 3.7% in 2021.

Europe, Japan, and Latin America have experienced severe recessions. After a decade of anemic growth in the eurozone, this setback raises concerns about long-term deflation and debt sustainability. Eurozone real GDP is expected to contract by 8.5% in 2020 and to take until 2023 to regain its late-2019 peak.

Mainland China has enjoyed a broadly based economic recovery. Exports have surprised on the upside, helped by inventory restocking and the demand stimulus policies of advanced economies. Real GDP is projected to expand by 1.7% in 2020 and 7.1% in 2021.

Central banks and governments are taking concerted action aimed at stabilizing financial markets and cushioning economies from downside risks. However, until the COVID-19 virus is more broadly contained and confidence returns, the efficacy of these actions will be limited.

Emerging markets that depend on commodity exports, carry high levels of external debt, and have experienced a currency depreciation are particularly vulnerable.

Parts of Latin America, South Asia, and Africa have been hit hard by the global pandemic. High rates of informal labor and economic inequality, combined with insufficient healthcare facilities in some countries in these regions, put their economies at particular risk.

Signposts

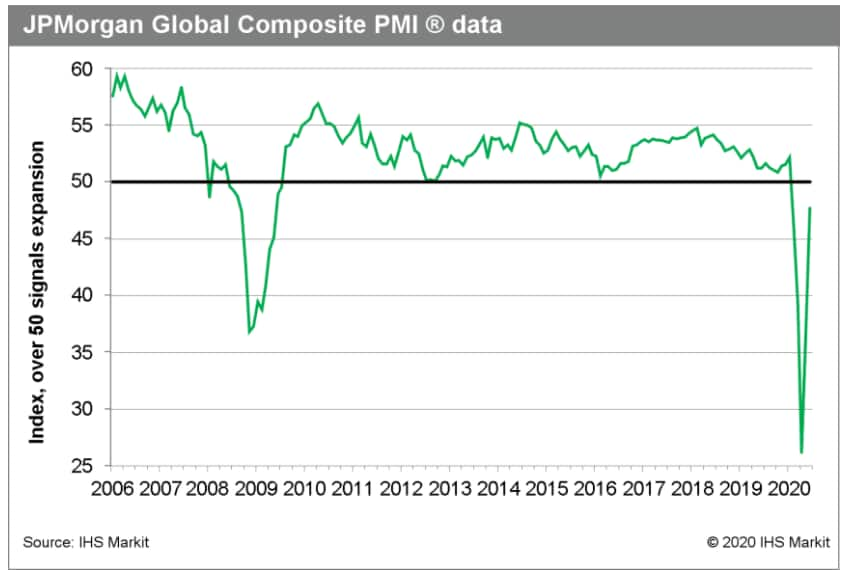

- Purchasing managers' indexes, combined with consumer and business confidence indexes, will be watched as indicators of optimism or pessimism about future consumption, investment, and production.

- The turning point in the economic cycle will depend on the path of the COVID-19 virus and the lifting of restrictions on business activity. Declines in active COVID-19 cases and progress in developing treatments and a vaccine will be encouraging signs.

- Commodity and industrial prices can indicate a variety of factors, including major economies' demand, investment intentions, and uncertainties. Moreover, these prices directly affect the incomes of commodity-exporting countries.

- Another downturn in equity prices would signal a loss of confidence in economic resilience. Flight to safety by investors could increase currency-market volatility and financial risks in highly (foreign-currency) indebted countries. Sudden changes in equity risk premia or the value of the US dollar will be watched carefully.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-risks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-risks.html&text=Global+recession+risks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-risks.html","enabled":true},{"name":"email","url":"?subject=Global recession risks | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-risks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+recession+risks+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-recession-risks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}