Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 12, 2023

Global trade falls at fastest rate for five months in June

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced withGTAS Forecasting. Read the latest onConnect™ by S&P Global.

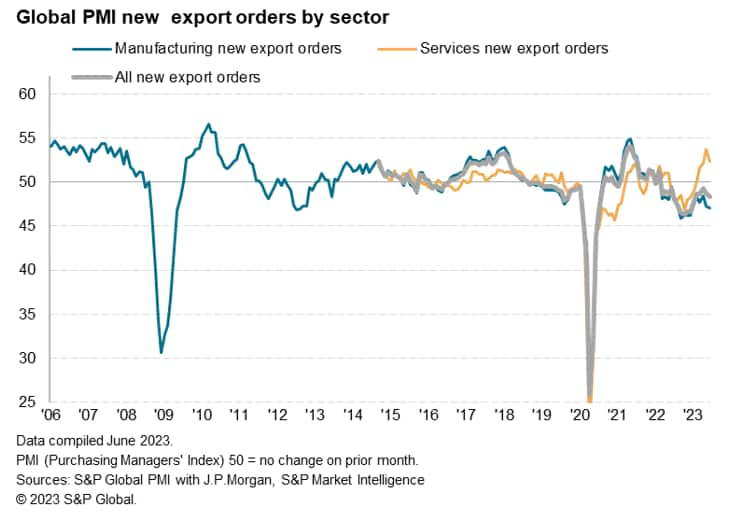

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a sixteenth monthly fall in export orders for goods and services at the end of the second quarter. At a five-month low of 48.3, down from 48.8 in May, the seasonally adjusted PMI New Export Orders Index signalled a steepening downturn in global trade, as falling goods trade was accompanied by a softening expansion of services exports.

Services trade helps offset manufacturing export decline

The divergence in performance between goods and services exports persisted in June, albeit narrowing on the near-ten-year record gap seen in May. Although manufacturing new export orders fell at the steepest rate for six months, marking a sixteenth successive monthly contraction, service sector exports rose for a fourth consecutive month. However, the rate of growth of services exports cooled from May's record rise, albeit remaining the second strongest seen since comparable services data were first available in 2014.

The slump in goods trade broadened out by sector in June. A downturn that had been principally characterised earlier in the year with the reduced exportation of intermediate goods (inputs supplied to other firms) has increasingly spread to investment goods, such as machinery and equipment, and consumer goods. That said, the steepest downturn in goods exports in June continued to be seen for 'raw materials' such as paper & timber products, basic materials, basic metal goods and construction materials amid an ongoing inventory drawdown of inputs by producers, their suppliers and their customers.

The downturn in global machinery exports is particularly concerning as such a decline typically signals reduced investment spending. The reduction in exports of consumer goods meanwhile points to reduced household demand, though some of this reduction merely reflects a post-pandemic diversion of consumer spend away from goods towards services, facilitated by reduced travel restrictions in 2023 compared to the prior three years.

A spring surge in travel and tourism exports, the former buoyed by corporate as well as leisure trips, has helped drive worldwide service sector exports higher at a survey record pace over the second quarter as a whole, though June saw some evidence of this upturn losing some momentum. This slowing is likely attributable to the lagged impact of interest rate hikes and the increased global cost of living, according to anecdotal evidence from PMI survey respondents. However, global trade in professional and commercial services and financial services continues to fare especially well.

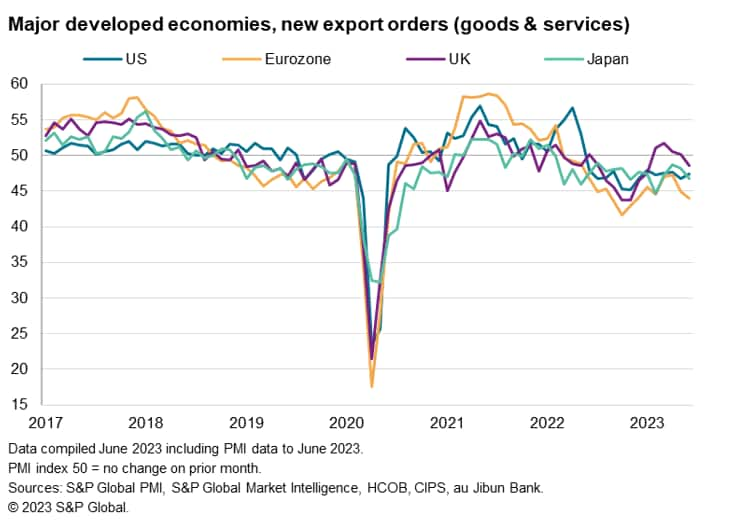

Comparing the regions, the weakness in trade was more apparent for developed economies - where export orders for goods and services collectively fell in June at the steepest rate for six months - than the emerging markets. The latter nevertheless merely saw a marginal uplift in trade thanks to a stalling of goods exports.

Eurozone suffers largest export loss

Within the developed world, US exports fell for a thirteenth successive month according to S&P Global's PMI data, with trade falling sharply albeit with the rate of decline moderating slightly compared to May. Japan's exports meanwhile fell at the sharpest rate for just over a year and the eurozone's export decline hit a seven-month high. The UK meanwhile reported its first drop in orders since January. In most cases, the declines were led by falling manufacturing trade accompanied by weakening services growth (and, in the case of the eurozone, a decline in services exports). The exception was the UK, where services exports ticked higher. The eurozone consequently reported the sharpest overall export decline of the major developed economies.

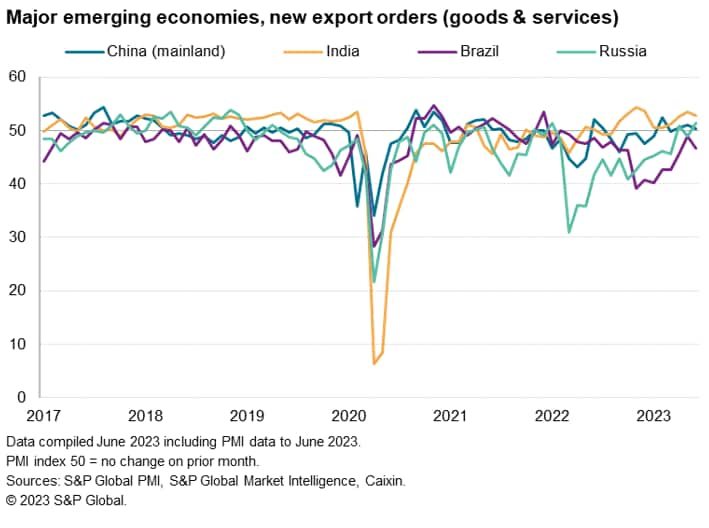

India leads trade from major emerging economies

Looking at the major emerging markets, India continued to

outperform in terms of trade growth, reporting a tenth successive

month of export gain in June thanks to rising sales of both goods

and services. Russia also notably saw a return to export growth,

led by a resurgence in services trade. Brazil's exports meanwhile

continued to contract at a marked pace as a strengthening upturn in

services trade was countered by a steepening loss of goods exports.

However, it was mainland China that arguable reported the most

disappointing performance, as a post-pandemic trade surge in

services showed signs of waning for a third month in a row while

goods exports remained flat. Overall export growth from mainland

China was largely unchanged during the month as a result.

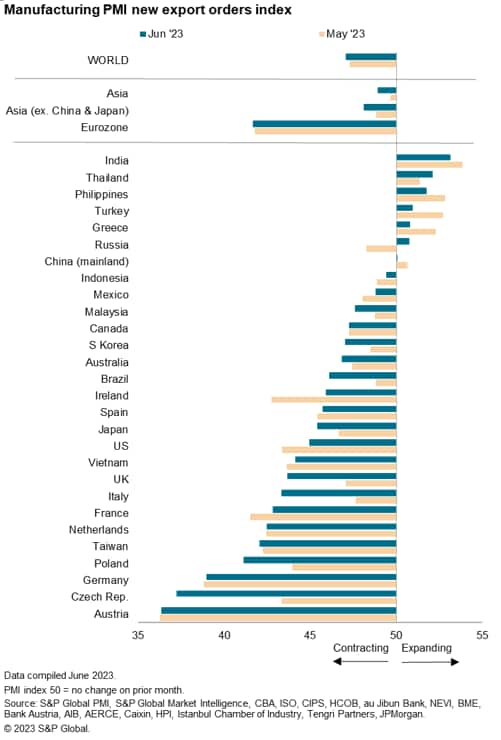

Notable goods export gains limited to just three economies

Looking in more detail at manufacturing export flows, only seven of the 28 economies covered by the S&P Global PMI surveys reported any goods export growth in June. Moreover, in one of these - mainland China - the increase was only marginal and only very modest gains were seen in Russia, Greece and Turkey, leaving India, Thailand and the Philippines as the only markets reporting any noteworthy export gains. Key exporters South Korea and Taiwan meanwhile saw their goods exports fall at the sharpest rates for five months, adding to a gathering global manufacturing export downturn .

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-falls-at-fastest-rate-for-five-months-in-june-Jul.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-falls-at-fastest-rate-for-five-months-in-june-Jul.html&text=Global+trade+falls+at+fastest+rate+for+five+months+in+June+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-falls-at-fastest-rate-for-five-months-in-june-Jul.html","enabled":true},{"name":"email","url":"?subject=Global trade falls at fastest rate for five months in June | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-falls-at-fastest-rate-for-five-months-in-june-Jul.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+falls+at+fastest+rate+for+five+months+in+June+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-falls-at-fastest-rate-for-five-months-in-june-Jul.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}