Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 08, 2024

Global trade near-stabilises at the end of first quarter

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

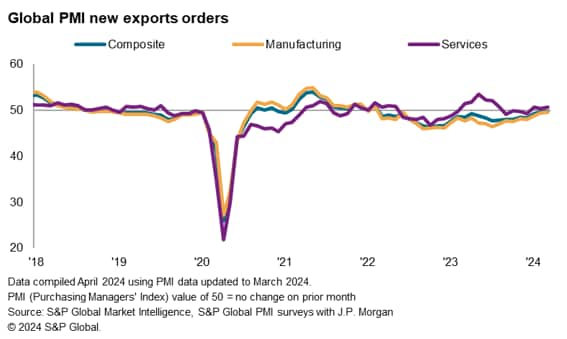

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a near steadying of global trade in March. Although export orders for goods and services have now fallen continually for just over two years, the pace of decline eased further in March to the slowest in the current 25-month sequence to indicate a near-stabilisation of conditions.

The seasonally adjusted Global PMI New Export Orders Index posted 49.8 in March, up from 49.6 in February. The uptick in the index, albeit in sub-50.0 territory, was attributed to both an easing of the manufacturing trade downturn and an acceleration of services export business growth.

Manufacturing trade downturn further ease, services new export orders growth accelerates

Despite the downturn in global trade centring on the manufacturing sector, the pace at which goods new export orders fell across the globe was the joint-slowest in 25 months, matching that seen in June 2022. Moreover, the latest decline was only marginal and represented a sustained easing of the downturn from the recent trough in July 2023.

The survey data also hint at an imminent return of global trade growth. Set against a second successive month of broader new orders growth for goods, and sustained optimism of higher output in the 12 months ahead, further improvements for new export orders look likely, signalling renewed growth for global goods trade with which the PMI's new export orders is highly correlated with.

Meanwhile services trade remained in expansion for a third straight month. Whilst marginal, the pace of export business growth was the fastest since last August and was likewise nestled within stronger improvements of broader worldwide services new business. Confidence among service sector firms also picked up strongly as evidenced via the PMI's Future Activity Index, which rose to the highest level in nine months, hinting at sustained improvements in the near-term.

Turning to more detailed sector data, the improving export trend was led by the consumer services sector in March, though telecommunications services, industrials and technology sectors notably returned to growth, bringing the total number of growth industries to five out of eight, the highest number seen since February 2022. Detailed sector data further showed export growth expanding the quickest in the media and insurance sub-sectors. On the other hand, banks and construction materials recorded the sharpest falls in export business.

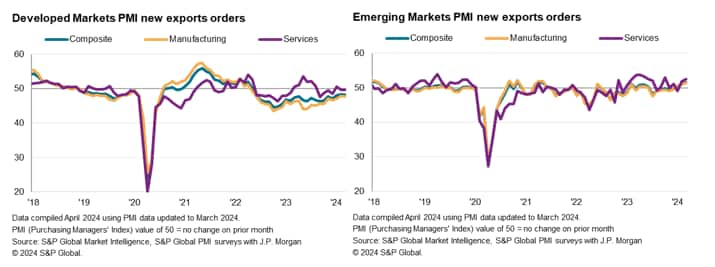

Divergence in developed and emerging market export conditions persists

March's PMI data further brought good news of both developed and emerging market activity growth accelerating, though a divergence in export conditions persisted. While both manufacturing and services export business growth accelerated in the emerging markets, developed market export business fell for a twenty-second successive month. To a large extent, weakness in the manufacturing sector continued to act as a trade dampener for the developed world.

India continues to lead global trade growth while Japan's conditions worsen

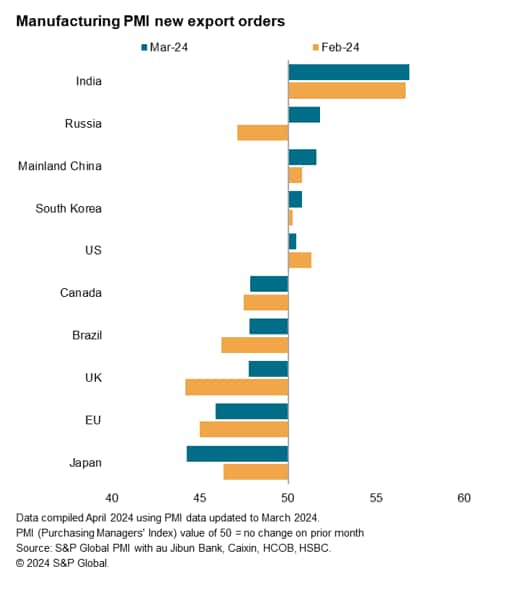

Just three of the top trading economies tracked by the PMIs recorded Composite New Export Orders Index readings above the 50.0 neutral mark, which cover both manufacturing and services.

India once again led the pack with both manufacturing and service sector export business expanding at faster rates in March. This was followed by mainland China, which recorded the fastest growth in export orders in 13 months, led by services. Russia followed with the first expansion in composite export orders in four months. Trade conditions in the US meanwhile remained unchanged after February's expansion with a downturn in services exchange offsetting higher goods trade.

On the other end, Japan became the worst performer, taking over from the EU in March. Improvements in services export business in Japan, stemming from rising tourism activity, were insufficient to offset a sharp decline in goods trade, which took place at the most pronounced pace in just over a year. The New Export Orders Index for the EU meanwhile rose for a sixth straight month in sub-50.0 territory to indicate further gradual easing of the downturn in trade.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-nearstabilises-at-the-end-of-first-quarter-Apr24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-nearstabilises-at-the-end-of-first-quarter-Apr24.html&text=Global+trade+near-stabilises+at+the+end+of+first+quarter++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-nearstabilises-at-the-end-of-first-quarter-Apr24.html","enabled":true},{"name":"email","url":"?subject=Global trade near-stabilises at the end of first quarter | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-nearstabilises-at-the-end-of-first-quarter-Apr24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+near-stabilises+at+the+end+of+first+quarter++%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-nearstabilises-at-the-end-of-first-quarter-Apr24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}