Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 30, 2023

High interest rates and the euro area economy

The eurozone has yet to experience the full impact of high interest rates on economic activity and demand.

These rates will likely lead to a contraction in investment while private consumption remains relatively resilient — at least until the second-round effects on credit availability and job market dynamics fully manifest in the economy.

The rate shock will likely affect consumers in an indirect fashion, through income via the credit channel, ultimately leading to activity, job, and revenue losses. Interest rates also affect individual income flows in a much more direct, almost mechanical, way: by defining the amount of money households must pay on their liabilities, as well as the revenue they earn on their assets.

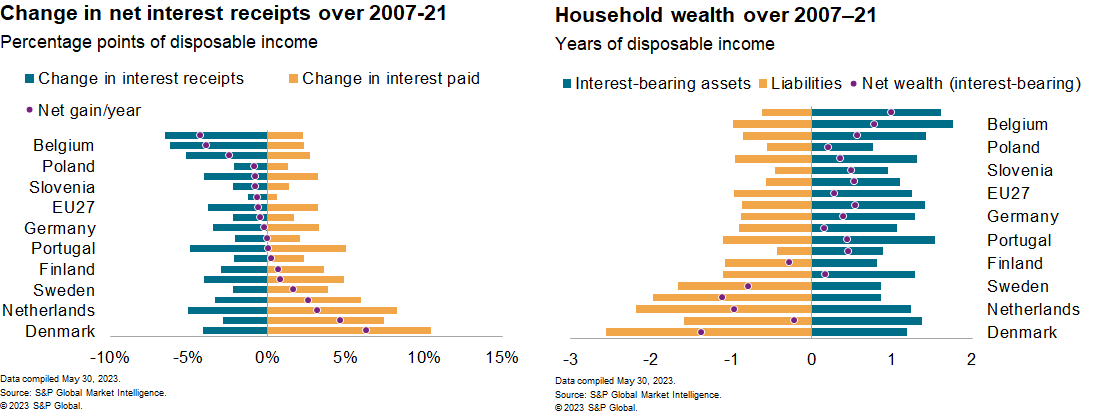

With the surge in interest rates that started last year, interest-related flows started increasing in the eurozone. The geographies where households have comfortable net wealth positions have seen a gain of up to 1.5% in disposable income between third quarter 2021 — before the rate increase — and today. The places where interest income grew the most were also those where household consumption better resisted the inflationary pressures experienced at the end of last year. We expect this trend to continue and even intensify as higher rates fully diffuse to household receipts and payments. (We estimate that only a third of the rise has passed through so far.)

In all, higher rates will not be a bad thing for European consumer finances and spending — at least not everywhere. We see a few caveats to that:

- The proceeds are unlikely to be spent in full as the marginal propensity to consume is lower than average among the households who own the bulk of the interest-bearing assets — largely high incomes. The boost may also concern a limited set of goods and services that are more present in the basket of this specific type of consumer, such as automobiles and restaurants.

- The passthrough from increased rates to net interest income may not be entirely consistent with household net wealth initially (over the next few months), as borrowing costs typically increase faster than interest receipts from savings.

- Households can still lose income indirectly, as the economy slows via the credit channel and ultimately generates less jobs and activity, a phenomenon we think is likely to be accentuated over the coming quarters.

Potential impact on taxes, wages

The gains stemming from higher rates for households are likely to be accompanied by increasing pressure on other actors through the debt channel, especially in some countries like Italy and Portugal, where the governments are carrying a significant amount of debt. Individuals might receive more income, then have to give some of it back via taxes as the public finance situation deteriorates.

Another possibility is that wage growth is restrained as companies suffer, muting the multiplier on private consumption. Although movement on that front has remained moderate thus far, we believe that the bulk of it is still ahead, as lending and credit costs have yet to fully integrate the impulse given by higher interest rates, potentially reaching levels far above the levels prevailing before the tightening of monetary policy.

By the time the shock is fully digested by the economy — probably around the middle of 2024 — we estimate that:

- Nonfinancial corporates' net rate payments in the euro area should jump from 0.2% of GDP in 2022 to 1.4% in 2024. The increase should be particularly noticeable in countries with high corporate indebtedness, such as France and a flurry of Northern European countries.

- General government payments should jump 2.1% in 2024. The government debt service will continue to increase beyond 2024 and not drop as rates are lowered in our baseline. This implies that the damage is likely to last longer for government finances — a headwind for medium-term growth that should not be overlooked.

- Households are the only "bright" spot in all this, with net interest receipts likely to increase by 0.9% of GDP.

We estimate that, for the eurozone's nonfinancial corporates — accounting for more than half of the investment in the region — the persistence of high rates to date will shave 7% off investment growth in 2023 and 4% in 2024. This likely prevents investment by the sector from reaching pre-pandemic levels in the foreseeable future, which represents a risk to our published activity forecast.

The same can be said for governments, although it is more difficult to isolate the impact of interest payments on spending. Historically, deficits and taxes have jumped up and down to plug holes in budgets everywhere in the eurozone, making it difficult to connect both concepts. Governments will need to find the funds somewhere, and we see limits to how much public deficits can widen once the downturn hits, given already high debt burdens and monetary policy that is overall less favorable to such endeavors.

Potential impact on industries

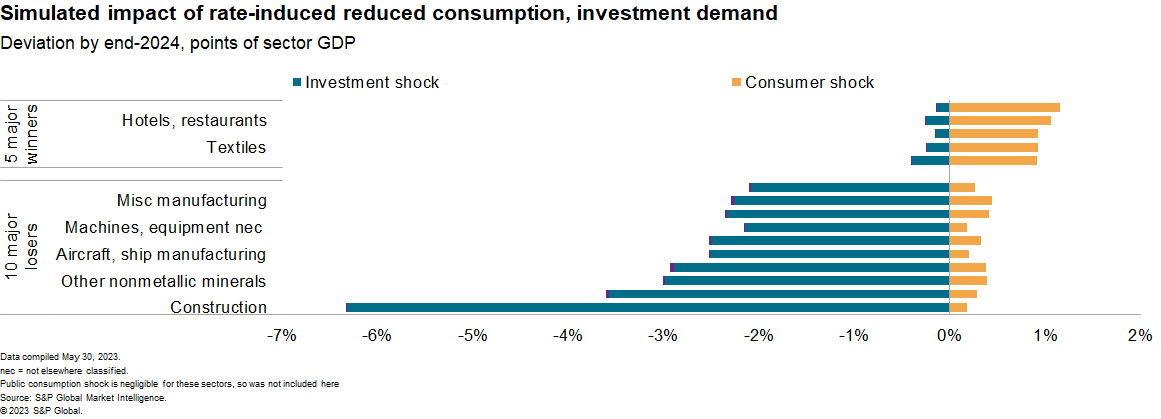

To get a more granular breakdown, we ran a simulation to estimate the impact on euro area industries of a mild increase of macro consumer spending more than offset by a contraction of investment and public spending regionally. A few segments largely dependent on consumer spending, such as hotels/restaurants, food and textiles are set to experience a modest boost in activity.

The negative impact is logically more pronounced in the investment and capital-intensive industries, with construction, aircraft/ship manufacturing, and machinery and equipment declining. The material-producing industry — metal mining, wood, fabricated metals — providing inputs to all these segments, also appears more exposed than average in the scenario. Most of these sectors in Europe were left fragile by the energy availability crisis that occurred in 2022, a problem that could recur as the euro area economy enters the winter period.

An important aspect to closely monitor in this unfolding scenario is the simultaneous increase in debt default talks and nonperforming loans, as businesses may face unbearable costs and the pressure on government finances and borrowing intensifies.

Learn more about our offerings

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-interest-rates-euro-area-economy-impact.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-interest-rates-euro-area-economy-impact.html&text=High+interest+rates+and+the+euro+area+economy+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-interest-rates-euro-area-economy-impact.html","enabled":true},{"name":"email","url":"?subject=High interest rates and the euro area economy | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-interest-rates-euro-area-economy-impact.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High+interest+rates+and+the+euro+area+economy+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigh-interest-rates-euro-area-economy-impact.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}