Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 15, 2018

Higher than expected inflation may give Swedish hawks the upper hand

- September's monetary policy meeting, whilst including no change to the forward guidance, did soften the language.

- The following week August's CPI and CPIF numbers came in fractionally lower than anticipated.

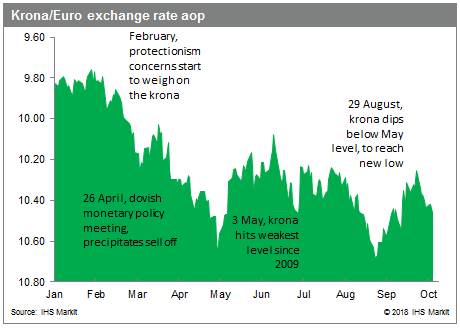

- The combination of these two events lead to a weakening of the krona in FX markets and increased market speculation that the Riksbank was going to delay the first rate rise since 2011 to February 2019.

- Now that September's CPI and CPIF numbers have shown a significant strengthening, what are the implications for October's meeting, and how likely is that December rate rise?

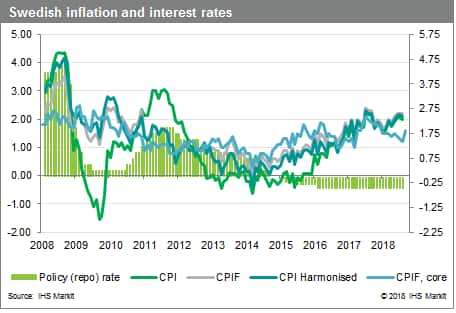

This set of data is stronger than we, or the market had anticipated. The FX market has already started to respond with a rapid strengthening of the krona against the euro and the dollar on Thursday morning, sending the exchange rate to its strongest level this month. Both key measures of Swedish inflation accelerated this month. CPI inflation, ticked up to 2.3% y/y, coming in fractionally stronger than our forecast of 2.2% y/y for September. CPIF inflation, the target measure of the Swedish central bank (Riksbank), which measures inflation at constant interest rates, bounced to 2.5% y/y, from 2.2% y/y in August. Crucially, whilst Statistics Sweden highlighted the sizeable contribution from stronger fuel prices to higher inflation, the CPIF excluding energy surged this month up to 1.6% y/y, from 1.2% y/y in August. Meaning that this month's revival for inflation is not just about energy.

At last month's monetary policy meeting, it appeared that the doves were in ascendency. The forward guidance became looser, the market interpretation of which was that the Riksbank was preparing a change to its forward guidance at the October meeting and was going to push back the first interest rate rise in seven-years to February 2019. The monetary policy report highlighted the Riksbank's concerns about domestic inflation, or inflation excluding energy prices. The report referred to underlying inflation remaining stable at around 1.5% in 2018. What is notable this month is that whilst there is no doubt that energy prices have made a significant contribution to growth, there is a strong domestic contribution as shown by the CPIF excluding energy prices. This will hopefully allay the fears of those board member who are on the fence, and bolster the rate rise argument of the hawkish members of the committee.

We said last month that this set of CPI and CPIF numbers would be hugely influential to the Riksbank's October meeting. If the board wishes to delay a rate rise to February, they will have to signal that to markets at the October meeting, to avoid causing excessive disruption. Smooth communication between the Riksbank and the market is essentially as the krona took a hammering last time the forward guidance was changed (April 2018). Political turbulence, and market concern about the Riksbank pushed the currency to a decade low in May, and again in August, meaning there is reduced capacity for the currency to bear further turbulence. Much more deterioration will have a serious negative effect on imports, which will put pressure on domestic consumption; but on the upside, it will likely bolster the current account.

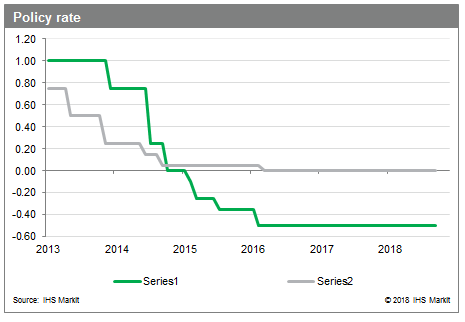

But, it is not a done deal yet. The Riksbank has shown itself to be extremely cautious in recent years. And the board maintained the repo rate at -0.5% throughout the third quarter of 2017, when inflation was on a similar path to the present. Our position on delaying the first rate rise has not changed since last month. We believe that it could be seriously detrimental to the Swedish economy and currency. Sweden has the second lowest interest rate globally - topped only by Switzerland - yet inflation is at target and it is expected to be amongst the strongest growing economies in Europe this year and next. IHS Markit believes that Swedish monetary policy is too loose, leading to mounting risks and asymmetries: volatility of the krona, rising house prices, very high household debt. Rather than supporting economic stability, current monetary policy is increasing the probability of a bumping landing for Swedish economy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-inflation-swedish-hawks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-inflation-swedish-hawks.html&text=Higher+than+expected+inflation+may+give+Swedish+hawks+the+upper+hand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-inflation-swedish-hawks.html","enabled":true},{"name":"email","url":"?subject=Higher than expected inflation may give Swedish hawks the upper hand | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-inflation-swedish-hawks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Higher+than+expected+inflation+may+give+Swedish+hawks+the+upper+hand+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhigher-inflation-swedish-hawks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}