Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Aug 23, 2022

Hong Kong SAR Real Estate Dividend Outlook

It was a tough beginning for Hong Kong listed real estate players in 2022. The fifth wave of the pandemic in Hong Kong SAR followed by approximately two months of complete lockdown in Shanghai imposed greater challenges for the mainland China economy. In early July, eight real estate participants were removed from the Hang Seng family index owing to the prolonged suspension of their shares on the Hong Kong Stock Exchange (HKEX) and failure to disclose 2021 financial results after the earning season closed for more than three months. However, we found the market leaders, especially the ones included in the Hang Seng Index, remained resilient in dividend payments. Under Beijing's statement for supporting the sustainable development of real estate industry and the 5.5% GDP target for 2022, we expect most market leader participants to keep the momentum and pay stable to rising dividends for the rest of FY2022.

Key implications:

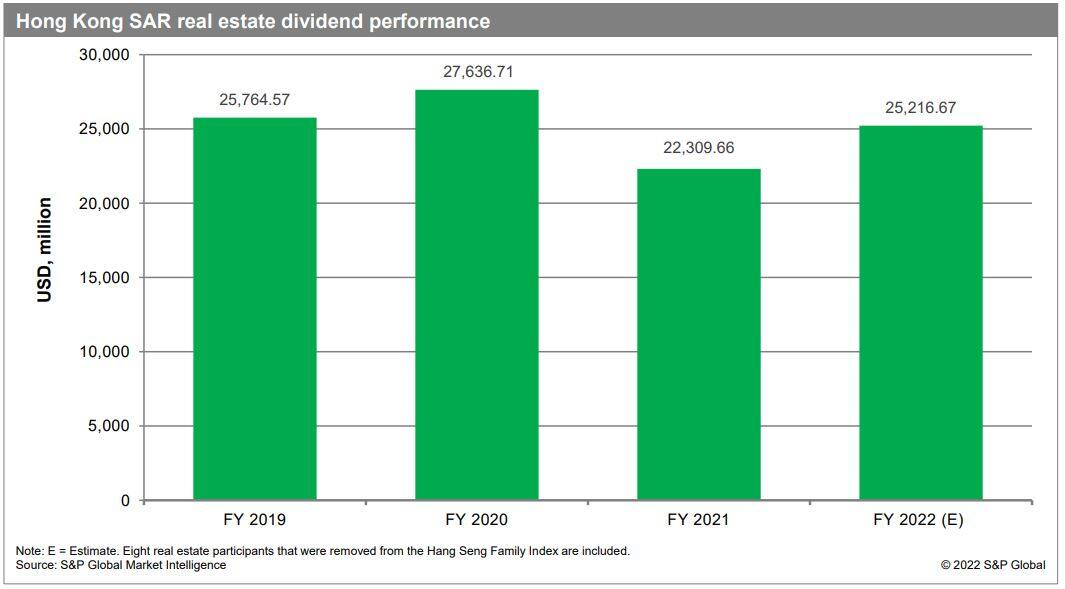

• Real estate companies listed in Hong Kong are expected to declare USD25.2 billion in FY 2022, representing a 13.3% increase from USD22.3 billion in FY 2021. The market leaders within Hang Seng Index, including Sun Hung Kai Properties and Henderson Land Development, are expected to remain resilient, paying stable to higher dividends for the rest of FY 2022.

• Compared with the players with assets that are mostly concentrated in mainland China, companies listed in Hong Kong SAR with diversified business projects both in Hong Kong SAR and mainland China appear to be more stable in dividend payments than the companies that only run projects in mainland China.

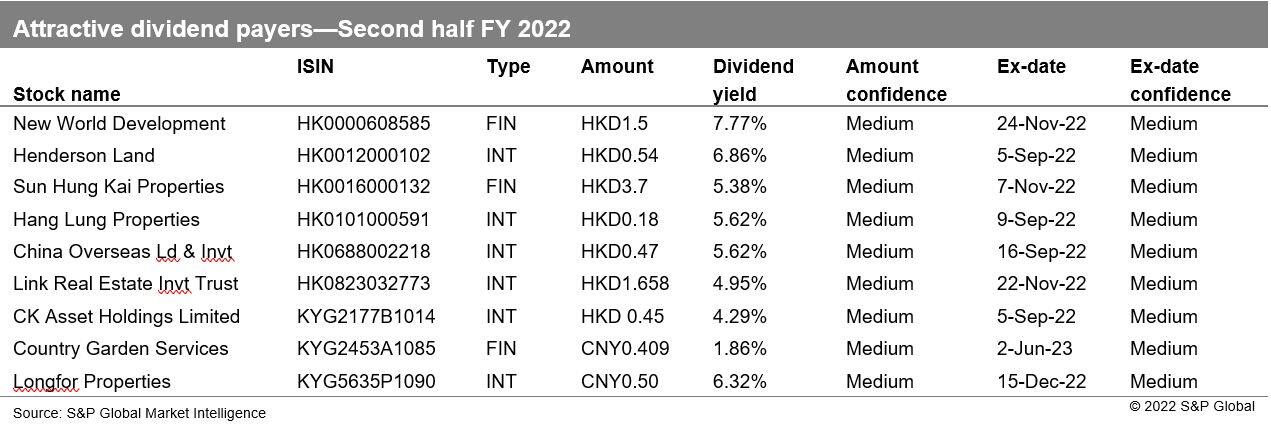

• While eight property developers (including services companies) were removed from the Hang Seng family index in early July, their impacts on the aggregate dividend amount are limited. Key contributors such as Longfor Properties and Country Garden Services Holdings strived to pay higher dividends to the shareholders.

• Debt control will be the priority for real estate players in the future. Under the government's "houses are built to be inhabited, not for speculation" policy statement, companies with healthy liquidity and cash flow will be more stable in paying dividends while the ones who do not will struggle to repay their debts.

For more information, please contact dividendsapac@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-real-estate-dividend-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-real-estate-dividend-outlook.html&text=Hong+Kong+SAR+Real+Estate+Dividend+Outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-real-estate-dividend-outlook.html","enabled":true},{"name":"email","url":"?subject=Hong Kong SAR Real Estate Dividend Outlook | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-real-estate-dividend-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hong+Kong+SAR+Real+Estate+Dividend+Outlook+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhong-kong-sar-real-estate-dividend-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}