Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 27, 2023

ILWU ‘sending message’ to West Coast terminals as contract talks drag on

Frustration is growing among West Coast port officials, shippers, and truckers over a string of recent job actions by dockworkers that are disrupting the flow of cargo, but longshoremen reportedly are limiting the level of disruption so as not to attract the attention of the media and the Biden administration.

Ten sources — including terminal operators, truckers, port executives, and importers — told the Journal of Commerce those actions, such as allegedly fabricating safety issues involving cargo-handling machines, have been underway for weeks and are clearly intended to pressure employers amid contract negotiations between International Longshore & Warehouse Union (ILWU) and terminal operators that are now in their ninth month. No significant progress has been made in the talks since the summer.

"They're sending a message," one port executive said. All sources spoke that to the Journal of Commerce this week did so on the condition they not be identified.

The ILWU and Pacific Maritime Association (PMA), which represents the terminal operators, did not respond to questions that were sent to them via email.

The job actions can be quite disruptive and costly for individual terminal operators and the shipping lines that call there. A terminal operator said dockworker claims of unsafe equipment at the ports of Los Angeles and Long Beach will often shut down an individual terminal for half a shift to an entire eight-hour work shift while the machines are being checked out. In Oakland, longshoremen have unilaterally stopped staggering their coffee and lunch breaks, which is intended to maintain eight consecutive hours of operation, and all dockworkers are now taking "unit breaks" together in order to disrupt cargo handling, sources say.

The terminal executive noted that back in the late 1990s and early 2000s, the ILWU would take job actions that would force the shutdown of a terminal or terminals for days until their demands were met at the coast level, but that tactic eventually resulted in federal intervention. Now, the union is careful to engage in such actions randomly and sporadically in an attempt to largely fly under the radar.

"There may be three or four hits one week, but only one the next week," the source said.

An importer told the Journal of Commerce he has experienced "minor disruptions" in Los Angeles-Long Beach while taking delivery of his containers. The source said he believes that because cargo volumes at West Coast ports have dropped so dramatically since last fall, there has been no snowball effect of the delays on cargo-handling at the ports.

Truckers, meanwhile, are feeling the pain of delays in container availability and ad hoc terminal shutdowns more so than most because drivers are arriving with delivery orders only to discover the terminal has been shut down for a shift. "The bogus equipment checks have really become a hurdle," a trucker in Southern California said.

Added a trucker in Northern California: "Unit breaks are definitely hurting container availability in Oakland."

West Coast cargo bleed

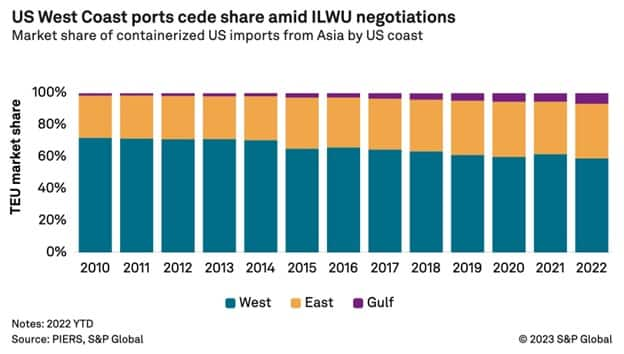

West Coast ports have been bleeding cargo since last September. The West Coast share of U.S. imports from Asia by year's end was 58.8 percent, down from 61.5 percent in 2021, according to PIERS, a Journal of Commerce sister product within S&P Global. The East Coast's share increased to 34.2 percent from 32.8 percent in 2021, while the Gulf Coast's share of Asian imports last year was 6.6 percent, up from 5.3 percent.

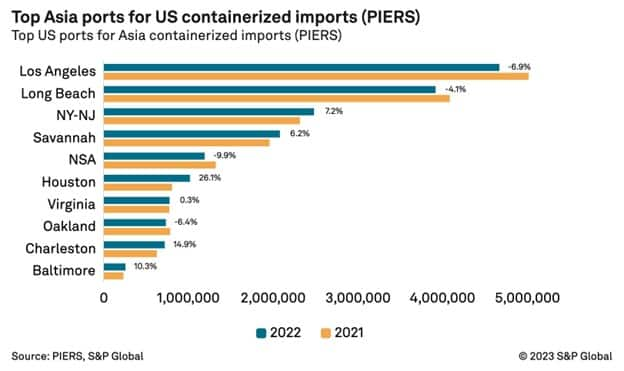

At the individual port level, U.S. imports from Asia last year declined 6.9 percent in Los Angeles, 4.1 percent in Long Beach, 9.9 percent at the Northwest Seaport Alliance of Seattle and Tacoma, and 6.4 percent in Oakland from 2021, according to PIERS. Meanwhile, Asian imports increased 7.2 percent in New York-New Jersey, 6.2 percent in Savannah, and 26.1 percent in Houston.

Retailers say they will continue to divert as much discretionary cargo as possible away from the West Coast until there is a new labor contract in place. "For the time being and foreseeable future, Southern California ports remain on an as-needed basis," said a mid-size retailer.

Pay guarantee protects dockworker earnings

The significant loss of cargo to the East and Gulf coasts caused ILWU man-hours paid to plummet last fall. According to the PMA, the decline in ILWU man-hours accelerated from 3.9 percent in September, 9.3 percent in October, 17 percent in November, to 18.2 percent in December year over year.

However, contract negotiators in San Francisco are apparently feeling no pressure from the ILWU rank-and-file because the drop in man-hours has not translated into reduced earnings for registered - meaning full-time -- longshoremen. That's because a decades-old program known as the Pay Guarantee Plan guarantees registered longshoremen 40 hours of pay each week - and 50 hours for marine clerks -- even if they show up for work each day and there is not enough cargo to call in a work shift. Several terminal executives told the Journal of Commerce that for the first time they can remember, dockworkers in Southern California are receiving PGP payments to ensure they are paid for 40 hours of work each week because they are sometimes working less than that amount.

Some West Coast terminal operators have been canceling shifts for several weeks now, and the number of canceled shifts is expected to increase significantly in the coming weeks while many factories in Asia are closed for the annual Lunar New Year celebrations. Carriers have announced blank sailings that will reduce capacity by 50 percent in the trans-Pacific in February.

Terminals pushing PMA negotiators

Terminal managers who were reticent to voice their concerns about the job actions and the total inertia in contract negotiations for fear of angering the ILWU are now speaking up to PMA negotiators, a terminal operator said. "There is a sense of frustration," the source said. "We are not moving forward. We have to get this done and get back to business."

The main issue that has been holding up negotiations at the coast level is a jurisdictional dispute between the ILWU and the International Association of Machinists and Aerospace Workers (IAM) over about 25 jobs that involve plugging in vessels to shore power at Terminal 5 in Seattle.

That matter is now under consideration by the National Labor Relations Board (NLRB) in Washington, which held hearings in Seattle in the fall. A source close to the jurisdictional dispute said the NLRB has given "zero hint" as to when it will announce its decision. "Will the NLRB issue its ruling in March? Possibly. But it's also possible it could come six months later," the source said.

But terminal operators say they can't endure six more months of job actions, loss of cargo, and falling revenues while waiting for the ILWU's reaction to however the NLRB rules. Several terminal managers said they are encouraging negotiators to seek the involvement of U.S. Secretary of Labor Marty Walsh at the negotiating table.

"I really think he can help, but if he comes out here, he'll have to stay for a while," one terminal operator said. The Department of Labor declined to comment.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Maritime, Trade & Supply Chain newsletter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2filwu-sending-message-to-west-coast-terminals-as-contract-talks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2filwu-sending-message-to-west-coast-terminals-as-contract-talks.html&text=ILWU+%e2%80%98sending+message%e2%80%99+to+West+Coast+terminals+as+contract+talks+drag+on+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2filwu-sending-message-to-west-coast-terminals-as-contract-talks.html","enabled":true},{"name":"email","url":"?subject=ILWU ‘sending message’ to West Coast terminals as contract talks drag on | S&P Global &body=http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2filwu-sending-message-to-west-coast-terminals-as-contract-talks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ILWU+%e2%80%98sending+message%e2%80%99+to+West+Coast+terminals+as+contract+talks+drag+on+%7c+S%26P+Global+ http%3a%2f%2fstage.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2filwu-sending-message-to-west-coast-terminals-as-contract-talks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}